Landesbank

Landesbanken are credit institutions in Germany that carry out banking transactions for individual federal states and support the state in promoting the economy .

history

The provincial relief funds were the forerunners of today's Landesbanken . The first was the Provinzial-Hülfskasse Westfalen , which started its business operations in Münster on January 5, 1832 . Their statutes provided for lending to repay debt and to improve the budget of municipalities as well as for infrastructure measures. On June 23, 1832, the Landeskreditkasse was established in Kassel, which, unlike the Hülfskasse, was also allowed to accept state deposits and private savings and issue bonds . Further Provincial Aid Funds subsequently came into being in Saxony and Pomerania in 1847. On February 7, 1854, the Rheinische Provinzial-Hülfskasse in Cologne started its activities. This moved its headquarters to Düsseldorf on July 10, 1877, received a new statute on February 17, 1888 and was now called "Landesbank der Rheinprovinz". The importance of the payment transaction function for Landesbanken has increased since 1910 , as they became the central clearing house for the acceleration of cashless payments. Since February 1911, the Stadtsparkasse Köln took over the function of the Girozentrale for the Rhine Province. On June 20, 1914, the Rheinisch-Westfälische Sparkassentag in Cologne decided to use the Landesbank der Rheinprovinz instead of the Stadtsparkasse Köln as a giro center.

The German currency and banking system was hit hard by the German banking crisis from 1931. The largest of the Landesbanken, the Landesbank der Rheinprovinz, was on the verge of collapse. The latter had refinanced long-term municipal loans through short-term investments by the savings banks and in July 1931 had got into a liquidity crisis. She had to stop her payments on August 7, 1931. In August 1931, a branch of the Deutsche Girozentrale in Cologne took over the coordination of the savings bank giro traffic. Support from the Reichsbank with a line of RM 200 million eliminated the Landesbank's liquidity problems.

After 1935, Landesbanken were founded or continued as an institution under public law . Landesbanken in the modern sense emerged after the Second World War , when the states of their first state bonds with the help of state banks as Haubank and lead underwriter issued the underwriting syndicate. Since most of the federal states acted as regular issuers, Landesbanken rose to become the largest foreign issuers in Germany. In the development phase, Landesbanken were an important instrument for the financial implementation of the infrastructure and economic policy of the federal states.

In 1972 WestLB began building up its branch network abroad in order to be able to organize its international business. All Landesbanken followed this example, but suffered in some cases considerable losses, especially in the financial crisis from 2007 onwards . The Financial Market Stabilization Development Act, which came into force in July 2009, was intended to prevent major corporate crises at banks by opening up the possibility of setting up resolution agencies, i.e. a bad bank to be set up for each institute to outsource business areas to be processed. The crisis ultimately led to the first split of a Landesbank, WestLB AG, on July 1, 2012.

Legal forms and carriers

The classic legal form of the Landesbanken is the public-law institution (exceptions: HSH Nordbank AG and Landesbank Berlin AG ). In public law this is automatically linked to institutional liability and guarantor liability . Their shareholders - known as carriers because of the mostly public legal form - are not uniform nationwide. The sponsorship extends from the respective State ( Bayerische Landesbank ), regional savings banks ( Helaba ) to mixed forms with regional associations and regional savings banks associations ( WestLB ). As a result of the state's legal form-related subsidiary guarantor liability, the problem of state aid arose for the first time at WestLB , as the EU Competition Commission classified the capital increases at Landesbanken from 1993 onwards as distorting competition. With the Brussels Concordance of July 2001, guarantor liability and institutional liability were abolished or modified at all Landesbanken (and also at Sparkassen). The Landesbanken are subject to state supervision in that the highest representatives of the guarantors are born members of the administrative or supervisory board. The organs of the Landesbanken are the board of directors , the supervisory board / administrative board and the board of guarantors . All Landesbanken are members of the Federal Association of Public Banks in Germany (VÖB).

tasks

Landesbanken are state and municipal banks in the respective federal state, for which they carry out all banking transactions, advise it financially and thus perform a house bank function. Landesbanken are also authorized to conduct all banking business permitted under their statutes. In this respect, these institutions have been appearing on the market for years as general commercial banks or universal banks. They are particularly active in the municipal loan and mortgage lending business, which they refinance through Pfandbriefe or municipal bonds. In particular, the savings banks conduct business with small and medium-sized companies as well as retail business, while the Landesbanken concentrate on business with large companies , wealthy private customers and institutional investors . This results in a strict market segmentation between the two groups of institutes. As part of the so-called vertical division of labor , the savings banks should, in accordance with the principle of subsidiarity , assume all tasks that they can perform depending on their size; the Landesbanken should only intervene on a subsidiary basis where they are technically and / or in terms of size superior. There is a size-related cooperation between Landesbanken and savings banks in the case of joint loans for medium-sized companies and in real estate financing (“one-stop building financing”). In the past, retail banking was not a task of the Landesbanken, but is now offered by Landesbank Baden-Württemberg, Norddeutscher Landesbank, Landesbank Hessen-Thüringen and Bayerischer Landesbank, in some cases through subsidiaries.

The function of a giro center , which is usually also performed by the Landesbank, must be strictly separated from the tasks of the Landesbank .

Realignment

There is a horizontal integration through mergers of Landesbanken with one another, as in January 1969 between the "Rheinische Girozentrale and Provinzialbank" and the "Landesbank für Westfalen Girozentrale" to form the "Westdeutsche Landesbank Girozentrale" or between the "Hamburgische Landesbank" and the "Landesbank Schleswig-Holstein" Girozentrale ”to HSH Nordbank in June 2003. Vertical integrations took place between the Landesbank Baden-Württemberg and the Landesgirokasse Stuttgart in January 1999 or the Landesbank Hessen-Thüringen and the Frankfurter Sparkasse in February 2005.

The Landesbanken business model was increasingly faced with a dilemma - on the one hand, a declining house bank function can be observed, on the other hand, they are largely staying away from the savings bank markets. The discontinuation of guarantor liability and limited business models are forcing the remaining Landesbanks to merge within the Landesbank sector, even if political obstacles have to be overcome. Mergers can synergies lift of scale increase, costs decrease and thus more favorable economies of scale lead. Their privatization was called for as early as 1993 ( Otto Graf Lambsdorff ); it would eliminate the systemic problem at Landesbanken criticized by the EU Competition Commission because of their public ownership of equity increases.

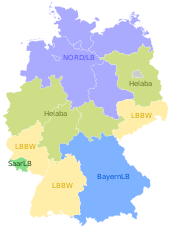

Existing Landesbanken in Germany

- Bayerische Landesbank (BayernLB)

- Landesbank Baden-Württemberg (LBBW)

- Landesbank Hessen-Thüringen Girozentrale (Helaba)

- Norddeutsche Landesbank - Girozentrale - (Nord / LB)

- Landesbank Saar (SaarLB)

The Oldenburgische Landesbank (OLB) is not one of the state banks under public law . The majority of OLB belongs to Bremer Kreditbank and is called Landesbank for historical reasons.

Former Landesbanks in Germany

-

HSH Nordbank and its predecessor institutions (privatized in 2018):

- Hamburgische Landesbank (until 2003)

- Landesbank Schleswig-Holstein Girozentrale / LB Kiel (until 2003)

- Predecessor institutions of today's Landesbank Baden-Württemberg :

-

Südwestdeutsche Landesbank Girozentrale (SüdwestLB; merged in 1999 with Landesgirokasse Stuttgart and the market section of Landeskreditbank Baden-Württemberg to form Landesbank Baden-Württemberg)

- Landesbank Stuttgart (merged with Südwestdeutsche Landesbank Girozentrale in 1988)

- Badische Kommunale Landesbank (merged into the Südwestdeutsche Landesbank Girozentrale in 1988)

- LRP Landesbank Rheinland-Pfalz (merged with Landesbank Baden-Württemberg in 2008)

- Landesbank Sachsen (merged with Landesbank Baden-Württemberg in 2008)

-

Südwestdeutsche Landesbank Girozentrale (SüdwestLB; merged in 1999 with Landesgirokasse Stuttgart and the market section of Landeskreditbank Baden-Württemberg to form Landesbank Baden-Württemberg)

- Landesbank Berlin (LBB) (no longer owned by a federal state since it was sold by the state of Berlin to the Sparkassen-Finanzgruppe )

- WestLB (has been processed since July 1, 2012; large areas of the bank were transferred to Erste Abwicklungsanstalt for processing , the network banking business for North Rhine-Westphalia and Brandenburg went to Helaba, legal successor is Portigon , a service company for financial service providers).

- Bremer Landesbank Kreditanstalt Oldenburg : merged with Nord / LB in 2017

International

The counterpart of the Landesbanken in Switzerland are the cantonal banks . They, too, are institutions under public law and - since Switzerland does not belong to the European Union - they are still endowed with guarantor liability or cantonal guarantees. It is planned to abolish these cantonal guarantees in the medium term.

In Austria the role of the Landesbanken was played by the mortgage sector .

Web links

Individual evidence

- ^ Hans Pohl: Economy, business, credit system, social problems. Volume 1, 2005, p. 967

- ^ Hans Pohl: Economy, business, credit system, social problems. Volume 1, 2005, p. 972

- ↑ Hans Pohl: The Rhenish savings banks. 2001, p. 112

- ↑ Michael North: A Little History of Money. 2009, p. 199

- ↑ Hans Pohl: The Rhenish savings banks. 2001, p. 137

- ↑ Hans Pohl: The Rhenish savings banks. 2001, p. 154

- ^ Jochen Klein: The savings bank system in Germany and France. 2003, p. 165

- ^ Johannes Völling : Girozentralen and subsidiarity principle. In: Concise dictionary of the savings banks. Volume 2, 1982, p. 314

- ↑ Olaf Preuß: "The money is there": The sale of HSH Nordbank is complete . In: THE WORLD . November 28, 2018 ( welt.de [accessed December 1, 2018]).

- ↑ Carinthia's rating falls because of Hypo - Hypo Alpe Adria - derStandard.at ›Economy. In: derstandard.at. Retrieved November 6, 2017 .