Idle costs

As idle capacity costs ( english idle cost , non-Necessary cost ) is known in the business administration that part of the fixed costs , by underemployment of production factors created.

General

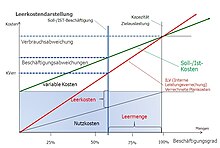

The term belongs to partial cost accounting . In theory, these are fixed costs that arise due to unused capacities . Correspondingly , the utility costs are the part of the fixed costs that leads to a benefit and at which the production factors are utilized. The basis of the subdivision of fixed costs into useful and empty costs is the utilization principle .

Since the idle costs are part of the fixed costs that are already incurred in full, they cannot be “saved”, but only converted into utility costs.

Temporary idle costs can arise due to internal factors (e.g. due to the illness of employees) but also external factors (no need for the product produced). In industries with high asset intensive , i. H. a high proportion of fixed assets in total assets, idle costs are permanently included in profitability calculations due to global plant overcapacity (e.g. for commodities in the chemical industry).

However, idle costs can also be structurally necessary: The high demands placed on the flexibility of a company result in a permanent, structurally unavoidable change between capacity bottlenecks and excess capacities (= idle costs). In the case of fixed personnel costs, attempts are made to minimize idle costs by making working hours more flexible. In the case of service companies in which the fixed production costs essentially consist of personnel costs, it should be noted that the provision of resources (= idle costs in the classic sense) is perceived by the customer as a quality feature, especially if the service is provided in cooperation with the customer. One way of depicting this in an idle cost analysis is to differentiate the utility costs into usage benefits / actual utility costs and availability benefits / standby costs.

calculation

Calculation of the idle costs with the help of the employment rate :

With

- : Empty costs

- : Actual employment

- : Capacity

- : (total) fixed costs

At a level of employment of 100 (so-called capacity ), all fixed costs are utility costs and the idle costs are zero. In the IT industry, one speaks of an optimal degree of employment (degree of utilization), which is usually 80–85%.

Empty costs in the event of underemployment

- Basically: If a company is underemployed, the idle costs must be deducted from the fixed overheads when determining the production costs (full costs) in the context of the valuation of capital goods produced in-house or in the accounting valuation of intermediate and finished products.

- The amount of the manufacturing costs depends on the capacity utilization, since underemployment results in higher unit costs than full employment. This may not always be plausible for existing customers, since the value of a product does not depend on the capacity utilization of a company. Nevertheless, the idle costs must also be covered by revenues. Otherwise the company will not be profitable.

- There are different metrics and measurement methods for determining full or underemployment. Idle costs are to be eliminated if there is a "permanent and apparent" underutilization. This is a "flexible" rule; For this reason, the law only requires the elimination of idle costs in the case of evaluations in the context of accounting if there is a "permanent and evident" under-utilization of capacities. Otherwise the simplification is based on full employment - although this term cannot be clearly defined in practice either.

Empty cost types

- Predictable idle costs

- Ramp-up costs: Or start-up costs. Delta between costs from planned / actual quantity and costs of a target quantity. Ramp-up costs are based on a specific output volume, which is based on a real roll-out plan.

- Structural idle costs: Delta between a technically required capacity and a planned utilization. The structural idle costs are "permanent and evident". There is no specific customer order or plan for the use of the existing empty capacity. Structural idle costs are not seasonal underemployment.

- Unplanned idle costs (temporary idle costs)

- Operational idle costs: Delta between the fixed costs of a planned quantity and the fixed costs of an actual quantity. The costs are to be optimized through sustainable resource shifting.

- Definition of the ramp up

Ramp up / down costs is the expected delta of the unit costs between the planned quantities (in the planning) or actual quantities (in the actual) and the target quantity stored in the business plan in the start-up and final phase. The delta essentially results from the economic of density and the synergy effects of changes in volume. Target quantities are agreed. These are included in the tariff calculation. Differences (production variances) between target quantities and planned quantities (planning) or actual quantities are evaluated and shown.

- Mathematical definition:

- Plan: (target quantity * SAP tariff * ramp up effect) - (planned quantity * SAP tariff * ramp up effect)

- ACTUAL: (target quantity * SAP tariff * ramp up effect) - (ACTUAL quantity * SAP tariff * ramp up effect)

- Rules for the documentation of ramp up / down costs

- Ramp up phase: This phase may only be considered until the end of the 2nd period (year) (manufacturing cost allocation principle). The planned quantity at this point is then the target quantity for this ramp up. If the target quantity is reached before the agreed phase has expired, the ramp up phase is deemed to have ended. An extension to a second ramp up / down phase is possible, all calculations must be updated and re-evaluated.

- The tariff effect per unit of measure evaluated in euros between the planned / actual and target amount from the economic scale of density and the synergy effect should exceed a firmly defined value, e.g. 30% (assuming a linear consideration in the ramp-up phase). (Evidence: business case / plan SDE calculation).

- The starting quantity / planned quantity is determined from:

- : Target sets

- : Actual amount

- : Plan amount

- : Plan tariff / SAP tariff

- : Ramp up effect in%

-

: Ramp up costs in euros

-

Structural idle costs

requirements

- The structural idle costs, which are based on strategic company decisions, are to be approved in advance by the decision-making bodies as part of a business case.

- Structural idle costs that arise through permanent and obvious underemployment (e.g. infrastructure costs due to the loss of a customer order) must be documented in a cost review. These structural idle costs must be taken into account in the corresponding cost planning.

- Permanent remanence costs that are not customer- indexed and can not be assigned in a dedicated customer situation are structural idle costs. The remanence costs determined in the business case are to be used for structural idle cost planning.

Recording of structural idle costs

The fixed costs are differentiated according to usage costs (that is the fixed cost share that is used for production) and idle costs (idle capacity). The determination of the usage costs is based on the percentage utilization of the respective cost driver, taking into account all optimization measures (resource shifting, etc.)

Operational idle costs

requirements

- Operational idle costs that result from permanent and obvious underemployment (deviation between the planned utilization and the actual utilization) must be documented in a cost review. The costs are to be optimized through sustainable resource shifting.

Calculation methodology

- The fixed costs are differentiated according to usage costs (that is the fixed cost share that is used for production) and idle costs (idle capacity). The operational idle costs are determined according to the percentage utilization of the respective cost driver, taking into account all optimization measures (resource shifting, etc.).