Risk neutrality

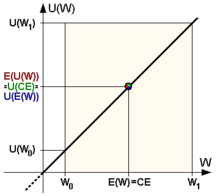

CE - security equivalent ; E (U (W)) - expected value of utility (expected utility) of the uncertain payout; E (W) - expected value of the uncertain payout; U (CE) - utility of the safety equivalent; U (E (W)) - utility of the expected value of the uncertain payoff; U (W 0 ) - use of the minimum payout; U (W 1 ) - use of the maximum payout; W 0 - minimum payout; W 1 - maximum payout; RP - risk premium

In decision theory, risk neutrality is the risk attitude of a market participant (e.g. investor ) to prefer neither safe nor unsafe alternatives when choosing between different alternatives of the same expected value , but to orientate themselves solely on their mathematical expected value. Risk neutrality lies between risk aversion and risk appetite .

Formal definition

Risk neutrality visually corresponds to the fact that the function graph of the individual utility function of the market participant is linear (see figure), i.e. it is a function with constant marginal utility : the risk of possible asset losses and the prospect of possible asset gains weigh equally in the decision-making process.

Accordingly, a market participant is called risk-neutral if the following relationships always apply to a payout in an uncertain amount :

- .

The expected benefit from the payout is just as high as the benefit from the expected payout .

The degree of risk aversion or risk appetite of a market participant can be measured using the Arrow / Pratt measure of absolute risk aversion

be quantified, which is always zero in the case of risk neutrality of the market participant. As already mentioned, the same applies to the difference between the expected uncertain payout and its security equivalent , the so-called risk premium : In the case of a risk-neutral market participant, this is also always zero. The following also applies accordingly:

- .

Further forms of risk attitude are:

- and

- .

Examples

- A market participant has the choice between the secure payment of a sum of 100 euros and a lottery , with a probability of paying 50% income of 0 euros and with a probability of 50% is also a profit of 200 euros. While the risk-neutral market participant is indifferent to this lottery and the safe amount of money, the risk-averse market participant prefers the safe amount of money and the risk-taking market participant prefers the lottery.

- A consumer has the choice between a "tried and true" and a new product, with a probability of more of 50% and a probability of 50% is worse than the previous product. While the risk-neutral consumer is indifferent to the old and the new product, the risk-averse consumer prefers the tried and tested and the risk-taker the new product.

economic aspects

This means in particular that the certainty equivalent (CE, English certainty equivalent ) of the operator, so the one safe amount that has equal value to the market participants as the statistically expected uncertain payoff always is as high as this withdrawal itself, as the difference so-called defined between insecure and secure payout. Risk premium (RP, English risk premium ) so in this case regularly disappears.

The risk premium is directly related to the risk attitude of a decision maker . The following risk settings can therefore be assigned to the risk premium :

- risk neutral,

- risk averse,

- risk taker.

A risk-free investment has a standard deviation of zero, a zero correlation with all other risky forms of investment, and offers a risk-free return. Risk-neutral investors expect a return in the amount of the risk-free interest rate, because they do not demand a risk premium and assign a disuse to the risk . Risk-averse investors, on the other hand, prefer investments that pay a risk premium. In turn, risky investors even receive a risk premium from the counterparty . There is a risk premium for the systematic risk because the investor cannot avoid this risk through risk diversification . In the case of unsystematic risk, market participants can optimize their portfolio through skillful risk diversification , so no risk premium is paid here.

See also

Individual evidence

- ↑ Florian Bartholomae / Marcus Wiens, Game Theory: An application-oriented textbook , 2016, p. 11

- ↑ Matthias Kräkel, Organization and Management , 2007, p. 70

- ↑ Thomas Schuster / Margarita Uskova, Financing: Bonds, Shares, Options , 2015, p. 154

- ↑ Florian Bartholomae / Marcus Wiens, Game Theory: An application-oriented textbook , 2016, p. 11