Signa Holding

| Signa Holding GmbH

|

|

|---|---|

| legal form | GmbH |

| founding | 2000 |

| Seat |

Innsbruck and Vienna , Austria |

| management |

|

| Number of employees | 46,000 |

| sales | 25 billion euros balance sheet total, 7.5 billion euros trading turnover (750 million euros in online business), 14 billion euros real estate assets and 8 billion euros development volume |

| Branch | Real estate , trade, media |

| Website | www.signa.at |

The Signa Holding GmbH (proper spelling: SIGNA ) is an Austrian real estate and trading company in private hands with trade interests in Europe .

The company was founded in 2000 by René Benko , who retired from operational management in 2013. A two-man company that was initially focused on classic real estate development has now grown into a pan-European real estate and retail company with various office locations and total assets of 25 billion euros . Signa has also been active in the media business since the end of 2018 .

Since 2013 Signa has had two independent core business areas : Signa Real Estate (real estate) and Signa Retail (retail). In the same year, the Group acquired over the Signa retail the majority of the German sporting goods retailer Karstadt Sports and Karstadt Premium (now The KaDeWeGroup), and for the first time rose in the operational trading business one. In the summer of 2014, Signa also took over the entire Karstadt Warenhaus GmbH . Since then, further investments in the trading segment have followed. In 2018, after several unsuccessful attempts, the takeover of Galeria Kaufhof took place .

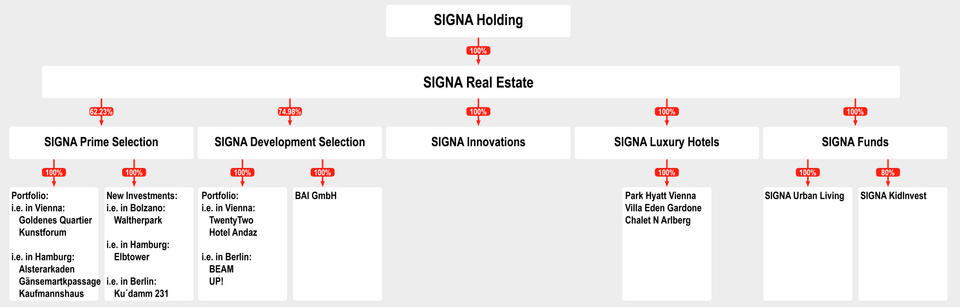

The Signa Real Estate division employs around 350 people at ten locations in Austria, Germany, Italy and Switzerland and manages real estate assets of around 14 billion euros. The real estate section is divided into five independent areas: Signa Prime Selection, Signa Development Selection, Signa Funds, Signa Innovations and Signa Luxury Hotels.

The entire retail sector - around a dozen German and European retail companies and the joint venture with Eataly - is bundled in the Signa Retail division . Signa Retail has 46,000 employees at 320 locations and a consolidated turnover of over 7 billion euros per year.

structure

The group of companies has grown continuously since 2000. In 2013 the group acquired the majority in the German sporting goods retailer Karstadt Sports and in the KaDeWeGroup (formerly Karstadt Premium) and thus entered the operative retail business for the first time. In the summer of 2014, Signa also took over the entire Karstadt Warenhaus GmbH. In October 2015 Signa Retail founded the joint venture Eataly Distribuzione GmbH with Eataly, one of the largest distributors of Italian consumer goods worldwide. In 2016, Signa Retail acquired a majority stake in Outfitter, a multi-channel provider in the sports sector, and expanded its online focus to include dress-for-less, an online outlet for designer fashion, internet stores , a bike and outdoor store -Commerce company and Tennis-Point, a multi-channel retailer in the tennis sector. In April Signa and its subsidiary internetstores took over the online bike retailer Probikeshop in France and southern Europe. In the early summer of 2017 Signa Retail took a 70% stake in hood.de - a German online marketplace. This was followed in June by the acquisition of 60% of the shares in the German fashion label Mybestbrands.

At the end of February 2018, Stylefile, an online shop for sports fashion, was taken over by Signa Retail.

In September 2018, after years of attempts, the takeover of Galeria Kaufhof was announced.

In December 2018, Signa announced that it was joining Kronen Zeitung and Kurier via a stake in WAZ Ausland Holding GmbH.

Since 2013 Signa has had two independent core business areas. The third division, Signa Media, was added in 2018 .

| Signa Real Estate | Signa Retail | Signa Media |

|---|---|---|

| The Signa Real Estate division employs around 350 people at ten locations in Austria, Germany, Italy and Switzerland and manages real estate assets of around 14 billion euros. The real estate section is divided into five independent areas: These include Signa Prime Selection AG, which focuses on the investment and long-term holding of real estate in European inner-city locations, Signa Development Selection AG, Signa Funds GmbH, Signa Innovations and Signa Luxury Hotels. | The entire retail sector is bundled in the Signa Retail division. Signa Retail has over 45,000 employees at 320 locations and generates annual sales of around 7 billion euros.

|

With the acquisition of 49% of the shares in the foreign subsidiary of the Funke Mediengruppe, Signa Holding has also entered the media sector and holds shares in two large Austrian daily newspapers. |

The group of companies has real estate assets of more than 14 billion euros and is one of the largest private real estate owners in the inner cities of Vienna, Bolzano and Innsbruck. The project development volume is currently around 8 billion euros with large developments and the like. a. in Vienna, Munich, Berlin, Hamburg and Bolzano. In an interview with René Benko in the Swiss business magazine BILANZ in February 2020, total assets of 25 billion were named.

The group is not only active in its core markets of Austria and Germany, but also in northern Italy, Switzerland, Luxembourg, the Netherlands and Belgium.

Corporate structure

The main shareholder of Signa-Holding is the Benko family private foundation with a controlling stake of 85 percent. Ernst Tanner , Chairman of the Board of Directors of Lindt & Sprüngli , holds 10 percent of the shares and Torsten Töller, the founder and majority shareholder of the Fressnapf retail chain, has held 5 percent of Signa Holding since 2017 . In 2016, the second largest shareholder, Falcon Private Bank, left, as did Signa’s long-term partner George Economou , the second largest owner of Panamax ships worldwide , in 2015 . Signa Prime Selection AG is the flagship company of Signa Real Estate and, with a portfolio worth around 4 billion euros, is a major owner, developer and operator of inner-city retail properties in German-speaking Europe.

Group Executive Board

The Signa Group has been operationally and strategically managed since the beginning of 2013 by the Executive Board (EB), which is led by Chairman Dieter Berninghaus , Christoph Stadlhuber, Wolfram Keil, Timo Herzberg and Jürgen Fenk. The EB deals not only with the business of the individual areas, but also with cross-company matters, such as group strategy and coordination, as well as fundraising.

Corporate advisory board

Since joining the Advisory Board in 2013, René Benko has been its chairman; Deputy Chairman is the former Austrian Chancellor Alfred Gusenbauer (he is also Chairman of the Supervisory Board of Strabag and Chairman of the Haselsteiner Private Foundation ). Also on the advisory board are: Roland Berger , Walid A. Chammah, Günter Koller, Eduardo Leemann (until 2016 CEO Falcon Private Bank Zurich), Karl Saturday (former CEO of Bank Austria UniCredit ), Susanne Riess , Karl Stoss , Rainer De Backere (formerly CIO Westfälische Provinzial Versicherung ), Peter Hasskamp (former CEO of Bremer Landesbank ), Karl Sevelda (former CEO RBI) and Ernst Tanner .

Extract from real estate assets

The new administration building of Deutsche Börse in Eschborn near Frankfurt (The Cube) , the luxury department stores KaDeWe in Berlin, Alsterhaus in Hamburg and Oberpollinger in the best downtown Munich location, as well as objects in the Viennese pedestrian zone near the Golden Quarter are part of the signa Portfolios; likewise other houses in the centers of Munich and Berlin. In Austria, the Kaufhaus Tyrol as well as the properties of the Golden Quarter in Vienna with the Park Hyatt or the building of the same name on the Freyung and one of the two houses in which Meinl am Graben is rented to the Constitutional Court and the Art Forum , to the Signa portfolio. In December 2013 it became known that Signa had bought the Wiener Postsparkasse , the headquarters of Bawag PSK , and leased it back to the bank on a long-term basis.

history

Signa Holding was founded in 2000 and emerged from the Immofina company . In its humble beginnings, the company focused on renovating unused attics. In 2001 Karl Kovarik joined as a private investor and the first office in Vienna was opened. In 2004, construction work began on the new Kaufhaus Tyrol , which today still houses the Innsbruck office of Signa Holding. In 2005, the company advisory board was established, which is still active today with changing members. In the years that followed, offices were opened in Munich, Zurich and Luxembourg, while other large properties, such as the Bank Austria headquarters “Länderbank” or the Deutsche Börse in Frankfurt am Main , were added to the portfolio.

From 2012: Takeover of Karstadt

The takeover of Karstadt Premium GmbH (since March 1, 2015 The KaDeWe Group GmbH ), Karstadt Sports GmbH and Karstadt Warenhaus GmbH including Karstadt Feinkost GmbH & Co. KG and LeBuffet Restaurant & Café GmbH was completed in several steps .

At the end of December 2012, Signa Prime Selection AG bought a portfolio of 17 Karstadt department stores, including the Kaufhaus des Westens (KaDeWe) in Berlin, for a purchase price of over 1.1 billion at the time. In 2012, this transaction was by far the largest investment in retail real estate in Germany.

On September 16, 2013 it was announced that Signa, together with the BSG Group, had acquired 75.1% of the operational Karstadt Premium GmbH and 75.1% of the operational Karstadt Sports GmbH from Berggruen Holdings owned by the German-American entrepreneur Nicolas Berggruen for 300 million euros take over. These funds were used to strengthen the Karstadt Group and are intended to modernize the individual locations in order to keep Karstadt competitive in the long term.

The The KaDeWe Group (formerly. Karstadt Premium GmbH) operates three luxury department stores KaDeWe in Berlin, Alsterhaus in Hamburg and Oberpollinger in Munich. With its 28 sports stores, Karstadt Sports is one of the leading providers of stationary sporting goods retail in Germany.

On August 15, 2014, Signa Holding acquired 100% of the ownership shares in Karstadt Warenhaus GmbH as well as the remaining shares in Karstadt Premium GmbH (The KaDeWe Group GmbH) and Karstadt Sports GmbH. Berggruen Holdings thus withdrew completely from the operative business of the Karstadt Group, as well as from the holdings in individual Karstadt properties.

In January 2015, the Beny Steinmetz Group (BSG RE) completely took over around 20 Karstadt properties (e.g. Nuremberg, Cologne, Konstanz, etc.). The houses come from the package that BSG-RE took over from the Highstreet consortium together with Signa in December 2012. This means that the BSG-RE Group is now the landlord of numerous branches of the department store group. The operative trading business of Karstadt Warenhaus GmbH remained unaffected, because it had been 100% with Signa since 2014. In return, Signa took over the three properties of the KaDeWe Group with the KaDeWe in Berlin, the Oberpollinger in Munich and the Alsterhaus in Hamburg. BSG-RE surrendered its previous shares to Signa. This also applies to the Karstadt Ku'damm Berlin and Karstadt Stuttgart stores. They too now belong to Signa alone. The Cartel Office approved this transaction in December 2014.

In June 2015, La Rinascente acquired 50.1% of the operating company from The KaDeWe Group GmbH as part of a long-term partnership, with 49.9% remaining in the long-term ownership of Signa Retail.

For the 2015/16 financial year, Karstadt was able to achieve a positive operating result of 50 million euros for the first time in years. In the subsequent 2016/17 financial year, Karstadt again generated an annual surplus of 1.4 million euros - for the first time in twelve years. In the next three financial years, the company intends to increase the share of online sales to around 10 percent.

In January 2019 Signa announced that it would restore the historic architecture of the department store on Hermannplatz as part of a renovation.

2015: Joint venture with Eataly

In October 2015, Signa Retail founded the joint venture Eataly Distribuzione GmbH with Eataly , the largest distributor of Italian consumer goods worldwide and one of the fastest growing and most successful gastronomy and fast food food concepts . The different competencies of the companies involved flow into the newly established partnership between Signa Retail and Eataly: Eataly supplies the goods, marketing concept and specialist training, Signa Retail provides the gastronomic system competence on the German market through Le Buffet, the organization and systems through Karstadt Department store and real estate expertise from the Signa Group. The first location to be opened in November 2015 was an Eataly flagship store in Munich in the Schrannenhalle directly on Viktualienmarkt .

2016: further expansion

Participation in Outfitter

In April 2016 Signa Retail took a majority stake in Outfitter, one of the leading multi-channel providers in the sports sector. As part of this stake, Signa Retail acquired 60% of Outfitter - the remaining 40% remained with Ron Berger. The founder and previous sole shareholder will thus continue to have a significant share and will continue to manage the business operationally together with his co-managing director Maximilian Albert.

Both partners invested "a substantial amount of millions" in the company in order to expand existing business areas. The plan is to create the prerequisites for the desired market leadership in Germany by coupling Karstadt Sports and Outfitter.

Takeover of dress-for-less

In August 2016, Signa Retail took over 100 percent of the online outlet for designer fashion dress-for-less. Dress-for-less was founded in 1999 and is present in thirteen countries. The core business takes place in the DA-CH region and in the Netherlands. In 2011 the Spanish-based shopping club Privalia acquired the German company. In November 2015, Privalia withdrew and the management team, chaired by Managing Director Antonio Gonzalo, took over the company. In the meantime, Mirco Schultis - founder of dress-for-less in 1998 - has returned to the role of CEO in order to re-establish the successful course of the early 2000s. Holger Hengstler will also support the company as an active advisory board member. Sandra Rehm has been managing director since July 2017. The common goal with the new owner SIGNA Retail is to return the company to its old strength. The company employs around 260 people at its headquarters in Kelsterbach, Hesse. The goods are also dispatched centrally from there to over 60 countries.

Takeover of internet stores

At the beginning of November 2016, Signa Retail took an 87% stake in the special mail order company for bicycle and outdoor products Internet stores . The entire management of Internet stores stayed on board: René Köhler continues to support the company as Chairman of the Advisory Board. On October 1, 2016, Markus Winter took over the role of CEO. The previous managing directors Bernd Humke (finance) and Ralf Kindermann (purchasing) also stayed with the company. Internetstores is active as of 2017 with online shops in 14 European countries. The outdoor portfolio includes the German online retailer Campz and the Swedish internet company Addnature. In the bicycle segment, Internetstores with Fahrrad.de and Brügelmann are mainly active in Germany, with bikers all over Europe.

Takeover of Tennis-Point

At the end of 2016, Signa Retail took a majority stake of 78% in the multichannel retailer Tennis-Point and expanded its portfolio in the area of sporting goods retail. The company founders Christian Miele and Thomas Welle continue to manage the company and retain 22% of the shares. Sascha Beyer has also joined the management team. With its range of over 12,000 tennis and running items from over 100 different sports brands, own brands and exclusive brands, Tennis-Point has a wide range of products that are sold in 19 online shops and 12 branches at various locations in the DA-CH region. The first online shop was launched on the occasion of the Australian Open in 2008; these are now available in ten different languages.

Joint venture for Karstadt Munich Bahnhofplatz

In a central location in Munich, between the main train station and Stachus, Signa Real Estate entered into a joint venture with its partner RFR Holding GmbH in October 2016 and acquired a stake in the well-known Karstadt Munich Bahnhofplatz department store ensemble .

2018: Takeover of Galeria Kaufhof

On September 11, 2018, it became public that Signa Holding would take over the majority of the department store chain Galeria Kaufhof from Hudson's Bay Company . For this purpose, Signa and HBC founded a joint venture in which Signa held 50.01% of the shares. Market watchers expect synergies for the new German department store giant. The German cartel office approved the merger of the former competitors Karstadt and Galeria Kaufhof under the leadership of Signa Holding in November 2018. On June 10, 2019, HBC announced that it would sell its stake in the joint venture for $ 1.5 billion to Signa Holding, which will become the sole owner. The transaction was completed by autumn 2019.

Business segments

Signa Real Estate

SIGNA Real Estate offices 2019 |

Takeover of BAI

At the beginning of January 2017, Signa Real Estate announced that it would take over the renowned Viennese property developer BAI Bauträger Austria Immobilien GmbH. BAI Bauträger Austria Immobilien GmbH is a property developer with a current investment volume of around 1.7 billion euros, a portfolio of currently 18 projects and a project development volume of over 440,000 m². As part of the BAI Group, the company's own service companies for project development and property developers (BAI), brokers (BAReal) and property management (Donath) are acquired and continued by the new owners. The declared future goal for BAI under the new ownership is to become an independent “housing developer for affordable living in Vienna”.

Sale of large office projects in Austria

In the summer of 2017, the Signa project The Icon Vienna at the new Vienna Central Station was sold to Allianz as part of a forward deal. At the beginning of October, the first three parts of the Austria Campus office project were sold to PGIM Real Estate. With a volume of over 500 million euros, the deal was the largest real estate transaction of 2017 and the largest office property transaction in Austria to date.

Signa Prime Selection AG capital increase

Also at the beginning of October 2017, the shareholder capital of Signa Prime Selection AG, which has properties in good inner-city locations in Germany, Austria and Northern Italy, was increased by 1 billion euros. Existing Signa investors, the private foundation of Hans Peter Haselsteiner and Niki Lauda's Family Office, as well as new investors subscribed for the shares.

Acquisition of RFR portfolio in Germany

In November Signa Prime Selection AG acquired a portfolio consisting of five properties: the Upper West in Berlin, the Kaufmannshaus and the Alsterarkaden in Hamburg , the Upper Zeil project development in Frankfurt and a 50% RFR stake in the Karstadt project at Munich train station. The other 50% were already in the possession of Signa Prime. The volume of the transaction was around 1.5 billion euros and was the largest real estate deal in Germany in 2017.

At the beginning of December, the Deloitte headquarters previously held by Signa Funds became BNP Paribas Real Estate . The Schickler Haus, an office complex in Berlin-Mitte, was purchased in mid-December.

Participation in S Immo AG

In December 2017 it was announced that the S-Immo shareholder Ronny Pecik had concluded an agreement with Signa Holding that entitles it to take over his entire 21.86 percent stake.

At the beginning of April 2018, the Vienna Insurance Group (VIG) sold its 10.22 percent stake in S Immo AG, which it held in the real estate group through its subsidiary s Versicherung (Sparkassen Versicherung AG).

In the course of this, the Benko family private foundation took over 7.28 percent of the VIG share package and at that time, including the right of first refusal, held a 29.14 percent stake in S Immo AG to 21.86 percent.

In mid-April 2018, Ronny Pecik and the Signa Group sold the entire S Immo share package of 29.14 percent to the real estate group Immofinanz.

Takeover of APA tower

In October 2018 it became known that BAI Bauträger Austria Immobilien GmbH had bought the former home of the Austria Press Agency (APA), the APA tower , as part of Signa Holding . The old 82-meter high-rise is to make room for residential construction projects so that the proportion of residential units in the area is increased.

Purchase of the Chrysler Building

In March 2019, Signa Holding announced the joint purchase of the world-famous Chrysler Building in New York. The purchase price was given as 133 million euros.

New development of the north head in Wolfsburg

On March 26, 2019, Signa Holding and Wolfsburg AG presented a project to redesign the Nordkopf in Wolfsburg. The construction project is intended to create a new city center within the next seven years.

Sale of Austria Campus 2

In the first half of the year Signa Financial Services AG launched a real estate fund for the Bavarian Supply Chamber. Signa Prime Selection AG has now sold the Austria Campus 2 property in this real estate fund .

Investment by the Peugeot family

In June 2019, Signa confirmed that the French investment company Société Foncière, Financière et de Participations , which is majority owned by the Peugeot family holding company, had acquired a 5% stake in Signa Prime Selection for 186 million euros.

Participation of Madison International Realty

The New York investment company also acquired a 5 percent stake in Signa Prime Selection AG on July 2019. This makes the American investor one of the five largest shareholders, like the Peugeot family, in this real estate group within Signa Holding. Signa Prime Selection's investments focus on special inner-city locations, such as the KaDeWe in Berlin or the Golden Quarter in Vienna.

Structure and participations Signa Real Estate

Signa Retail

2017

In April, the Signa Sports Group and its subsidiary internetstores took over 100% of the shares in Probikeshop - an online bike retailer in France and southern Europe founded in St. Etienne in 2005 .

In mid-June 2017, the company acquired the majority (70%) of the Hood.de online marketplace and 60% of the Mybestbrands online platform.

2018

At the end of February 2018, Stylefile, an online shop for sports fashion, was taken over.

In April 2018, the Signa Sports Group - one of the four Signa Retail trading platforms - announced that it would appoint new top management. Stephan Zoll, former managing director of ebay in Germany and member of the management of ebay in Europe, took over the function of CEO of the Signa Sports Group on July 1, 2018.

In June 2018 the foundation stone was laid for a new shopping center in Berlin-Tegel , where Karstadt plans to open a new branch. Another new Karstadt branch - the first in three decades - was inaugurated in October 2018 in the Gropius Passagen in Berlin. A location that Kaufhof closed last year is being continued here. It is the largest shopping center in the German capital, with Karstadt as the anchor tenant having an area of approx. 7,900 m² on three floors.

On June 1, 2018, Christian Bubenheim was hired as the new CEO of the online retailer for outdoor and bicycle products internetstores. The manager of Autoscout24 switched to Signa Retail.

On June 15, 2018, it was announced that Benkos Signa would be joining the financially troubled furniture chain Kika / Leiner . The participation was able to save the traditional Austrian furniture store from the crisis. Reinhold Gütebier took over the management of the furniture store chains after the purchase.

2019

In June 2019 the sports retail division of Signa Holding took over the French online retailer for tennis products called Tennis-Pro.

In November 2019 it became known that the retail division of Signa Holding was taking over the travel agencies and the online platform of Thomas Cook Germany and thus securing the jobs of the insolvent tour operator for the time being. The travel business is not completely alien to the new Galeria Karstadt Kaufhof association , but this step will significantly expand it.

In December 2019 it was announced that Galeria Karstadt Kaufhof is taking over the sports retailer Sportscheck from the Otto Group. This will expand the Signa Retail division by a further 1,300 employees and an annual turnover of 300 million. The head of Sportscheck, Markus Rech, welcomed the end of the uncertain times in a first statement.

2020

At the beginning of February 2020 it was announced that the Signa Group, in cooperation with the Central Group , would take over Magazines zum Globus from Migros .

Signa Retail was ranked 124th largest retail company in the world in February 2020 with annual sales of $ 8.5 billion.

Structure and holdings Signa Retail

Signa Media

In November 2018, Signa Holding announced the takeover of 49% of the shares in the German Funke Mediengruppe in the Austrian daily newspapers “ Kronen Zeitung ” and “ Kurier ”. This is the first investment in media.

Signa Innovations

This branch of Signa Holding deals with the identification of promising projects in the field of digitization with real estate reference. After identification, Signa Innovations equips the corresponding start-up company with capital, know-how and industry- relevant contacts. In this context, a cooperation with the Vienna Chamber of Commerce has already been entered into.

Storebox

In September 2018, the Viennese start-up Storebox secured a seven-digit investment from Signa Innovations. The company's concept is aimed at a close-knit warehouse network, which could become more important in times of increasing mail order business .

Realxdata

This start-up relies on methods of digital transformation to value real estate objects. In December, Signa Innovations announced an investment in the new company. Here, too, a seven-digit amount is said to have been invested.

Tax avoidance

As a result of the Luxembourg leaks , it became known that Signa had channeled money through Luxembourg on the basis of a tax- saving model created by the auditing firm PricewaterhouseCoopers . Tax agreements between the Luxembourg authorities and Signa can be viewed on the Internet.

Web links

- Official website of Signa Holding

Individual evidence

- ↑ We believe in the City Interview with René Benko in Schweizer BILANZ on February 27, 2020

- ↑ Signa Holding's own report on sales after the department store merger , accessed on January 22, 2019.

- ↑ http://www.signa.at/de/kontakt/#presse ( Memento from April 15, 2016 in the Internet Archive )

- ↑ Signa Holding company profile Values as stated by the company

- ^ Eataly - Success story of a delicatessen retailer Süddeutsche Zeitung on November 25, 2015

- ↑ Benkos Signa takes over online bike dealer “Probikeshop” Tiroler Tageszeitung on April 4, 2018

- ↑ Signa structure ( memento of September 12, 2014 in the Internet Archive ), accessed on November 9, 2015

- ↑ Signa takes over the Mybestbrands online marketplace

- ^ Wirtschaftsblatt ( memento of October 10, 2014 in the Internet Archive ) of October 2, 2014

- ↑ Why the Fressnapf founder always stays hungry Handelsblatt dated March 12, 2018

- ↑ Signa: Karstadt owner Benko separates from Falcon Private Bank - manager magazin . In: manager magazin . ( manager-magazin.de [accessed December 5, 2016]).

- ^ André Exner: Cards at Signa Holding are being reshuffled. In: Wirtschaftsblatt . September 21, 2015, archived from the original on September 29, 2015 ; accessed on September 28, 2015 .

- ↑ Abu Dhabi new major shareholder in Benko. In: Solid. September 21, 2015, accessed October 21, 2015 .

- ↑ Berninghaus will be head of retail for Karstadt parent company Signa - manager magazin. Retrieved August 19, 2016 .

- ↑ Signa Executive Board ( memento of October 21, 2015 in the Internet Archive ), accessed on October 19, 2015

- ↑ Wendelin Wiedeking is a new member of the Signa Holding Advisory Board and Supervisory Board of Signa Prime Selection AG . Signa Holding GmbH press release on ots.at, November 30, 2011. Accessed on September 16, 2013.

- ↑ Current Advisory Board , accessed on October 6, 2015

- ↑ https://www.signa.at/de/realestate/immobilien/. Signa Holding GmbH, accessed on March 9, 2019 .

- ↑ Signa buys Bawag headquarters . ( Memento from December 14, 2013 in the Internet Archive ) In: Wirtschaftsblatt , December 13, 2013. Accessed on December 16, 2013.

- ↑ Chronicle according to the company newsletter

- ↑ Tyrolean investor strikes in Germany . ORF .at, December 22, 2012. Accessed December 22, 2012.

- ↑ Melanie Agne, Christoph von Schwanenflug: The biggest retail deals 2012 . In: Immobilien-Zeitung , January 2, 2013. Accessed February 4, 2013.

- ↑ Berggruen silver-plated Karstadt pearls . n-tv .de, September 16, 2013. Retrieved September 16, 2013.

- ↑ Report on the Tagesschau website

- ↑ Benko divides Karstadt . In: Format , No. 4/2015, accessed on October 6, 2015.

- ↑ Signa sells the majority of the KaDeWe Group to La Rinascente . ( Memento from June 11, 2015 in the Internet Archive ) In: Wirtschaftsblatt , October 6, 2015, accessed on October 6, 2015.

- ↑ Karstadt achieves planned operating result on October 26, 2016

- ↑ Karstadt creates the Wende Süddeutsche Zeitung on October 22, 2015

- ↑ Karstadt writes Profit Zeit again on March 21, 2018

- ↑ New old shine for Karstadt in Berlin Kurier on January 21, 2019

- ↑ Signa Retail acquires 60 percent of the shares in Outfitter ( Memento from June 7, 2016 in the Internet Archive ) Etailment in April 2016

- ↑ Signa Retail takes over dress-for-less: Karstadt owner strengthens online business. In: www.handelsblatt.com. Retrieved August 19, 2016 .

- ↑ Angelika Fleischl: Signa Retail takes over 87 percent of internetstores. In: www.immoversum.com. Archived from the original on March 30, 2017 ; Retrieved April 10, 2017 .

- ↑ Benko also buys internet stores. In: www.sport-fachhandel.com. Retrieved April 10, 2017 .

- ↑ Mega deal: Benkos Signa Retail takes over internet stores. In: www.sazsport.de. Retrieved April 10, 2017 .

- ↑ Signa takes over the majority of Tennis-Point. In: derstandard.at. Retrieved April 10, 2017 .

- ↑ Signa Retail grabs Tennis Point. In: w ww.internetworld.de. Retrieved April 10, 2017 .

- ↑ Benko's Signa group has projects worth billions. In: orf.at. Retrieved April 10, 2017 .

- ↑ Kaufhof-Karstadt Alliance: Two department store giants merge . Salzburger Nachrichten on September 11, 2018

- ↑ Karstadt and Kaufhof are allowed to merge . Tagesschau on November 9, 2018

- ↑ investor.hbc.com/news-releases/news-release-details/hbc-agrees-sell-remaining-european-real-estate-and-divest

- ↑ SIGNA Real Estate Locations . Signa Holding. Retrieved February 28, 2019.

- ↑ BAI sold to Signa and investor group. In: immobilien.diepresse.com. Retrieved April 10, 2017 .

- ↑ Signa wants to get into residential construction on a large scale. In: kurier.at. Retrieved April 10, 2014 .

- ↑ Allianz acquires Signa project "Icon Vienna" Standard on July 6, 2017

- ↑ SIGNA Prime increases equity by 1 billion euros ots.at on October 10, 2017

- ↑ Largest real estate deal in Germany in 2017: RFR Holding sells outstanding real estate portfolio to SIGNA Prime ots.at on November 10, 2017

- ↑ Karstadt owner Signa also buys the Upper West Berliner Morgenpost on November 9, 2011

- ^ Berlin: Schickler Haus sells real estate manager on December 19, 2017

- ↑ Benko has a foothold at s Immo Orf on December 29, 2017

- ↑ Why not a "threesome" with Immofinanz, CA Immo and s Immo? The press on April 16, 2018

- ↑ Immofinanz takes over s Immo shares from Pecik and Benko Trend on April 18, 2018

- ↑ Benko's Signa subsidiary BAI bought "APA-Turm" in Vienna Salzburger Nachrichten on October 15th

- ↑ René Benko buys the Chrysler Building Today, March 9, 2019

- ↑ Wolfsburg's new heart will soon be beating here, Wolfsburger Allgemeine on March 27, 2019

- ↑ Benko: Signa sells Austria Campus 2 to Immobilienfonds Kurier on June 19, 2019

- ↑ The Peugeot brothers get 5 percent at Benkos Signa Kleine Zeitung, June 19, 2019

- ↑ Madison International Realty rises five percent at Signa Prime a press on July 23, 2019

- ↑ Signa Retail: Seven online subsidiaries in 14 months. In: www.textilwirtschaft.de. Retrieved July 10, 2017 .

- ↑ Karstadt owner Signa buys sports internet retailer. Handelsblatt, February 28, 2018.

- ↑ Stephan Zoll becomes head of Signa Sports. The press, April 17, 2018.

- ↑ Karstadt owner Benko hires e-commerce professional for the sports shop. Handelsblatt, April 17, 2018.

- ↑ Karstadt sets the first stone for the Tegel Center. In: tagesspiegel.de , May 30, 2018.

- ↑ Karstadt opens two new stores in Berlin. Berliner Morgenpost, May 17, 2018.

- ↑ Christian Bubenheim becomes the new CEO of Internetstores. Fashionunited, June 7, 2018.

- ↑ René Benko and his lucky hand. Wiener Zeitung, June 15, 2018.

- ↑ René Benko buys Kika / Leiner. Die Presse, June 15, 2018.

- ↑ Everything new at Kika / Leiner. Wiener Zeitung. October 16, 2018.

- ↑ Handelsblatt on the Tennis-Pro takeover

- ↑ Galeria Karstadt Kaufhof takes over travel agencies from Thomas Cook Handelsplatt on November 19, 2019

- ↑ Galeria Karstadt Kaufhof takes over Sport Scheck from Otto Handelsblatt on December 11, 2019

- ↑ New owners - Migros sells Globus. In: srf.ch . February 4, 2020, accessed February 4, 2020 .

- ↑ Worldwide ranking: Benkos Signa just behind the top 100 retailers Tiroler Tageszeitung on February 11, 2020

- ↑ Karstadt owner Benko buys into Austrian newspapers (November 12, 2018)

- ↑ Real estate investor Benko buys in "Krone" and "Kurier" (November 12, 2018)

- ↑ Signa Innovations about itself, accessed December 8, 2019

- ↑ René Benkos Signa and OMV are looking for startups incubators on June 4, 2019

- ↑ Storebox: Medium seven-digit investment by Signa Innovations AG Brutkasten on September 28, 2018

- ↑ Business Week on December 4, 2019

- ^ Karl Gaulhofer: The tax haven Luxembourg and its co-architect. In: The press . November 6, 2014, accessed November 27, 2014 .

- ↑ Luxleaks - Also Stronach in the tax haven?

- ↑ ICIJ, Luxemburg Leaks , to be found under category 'finance'

Coordinates: 47 ° 15 '55.3 " N , 11 ° 23' 40.5" E