Silver price

| silver | |

|---|---|

| Country: | Global |

| Subdivision: | 1 troy ounce = 31.1034768 grams |

| ISO 4217 code : | XAG |

| Abbreviation: | no |

|

Exchange rate : (03 August 2020) |

1 troy ounce = 24.23 USD |

The silver price is the market price for the precious metal silver . It arises on commodity exchanges through the global interplay of supply and demand and is mainly quoted in US dollars .

Important influencing factors are the dollar exchange rate, interest rates and the oil price as well as the prices of other precious metals (e.g. gold , platinum and palladium ) and (semi-precious) metals (e.g. copper and rare earths ). Emotions also play a role on the commodity exchanges, e.g. B. Fears of inflation , political events, speculation and long-term expectations.

history

Antiquity

At around 4000 BC The first silver finds from Egyptian royal tombs are dated. In the law books of the Egyptian King Menes (around 3000 BC) it was stipulated that "one part of gold is worth as much as two and a half parts of silver".

The first coins were made in the Lydian Empire between 650 and 600 BC. Issued as means of payment ( see also: Croesus ). These were misshapen chunks of electron , a naturally occurring gold - silver alloy, initially without a picture. Pictorial representations on coins came around 600 BC. Chr. On. The first silver coins were made around 550 BC. In Asia Minor and on the Greek island of Aegina . Until about 400 BC BC the coin prevailed against barter throughout Greece.

In China, silver was part of the official currency during the Han Dynasty (206 BC to 220 AD) and its use was reserved for the royal family. The coin value largely corresponded to the metal value ( Kurant coin ).

Punic coins existed from around 410 BC. Some of them were made of silver, some of electron , some of gold.

The Roman Empire took 269 BC. Chr. Silver in the standard coinage. Around 211 BC BC began silver minting on a large scale with the denarius . Julius Caesar was the first living person to be depicted in full head profile as a god on a Roman coin (44 BC). During the time of the soldier emperors, the silver antoninian slowly asserted itself against the denarius.

As a result of further expansion - around 117 AD the Roman Empire reached its greatest extent - large amounts of silver flowed to Rome, so that a large part of the state expenditure was financed by the minting of silver coins, which in the following centuries initially led to currency devaluation and in the 3rd Century AD led to the complete collapse of the Roman silver currency . Increasingly, the Roman citizens no longer had any confidence in ever new forms of coin, which tended to have an ever-decreasing silver content. The result was that older coins in particular were hoarded or melted down. As a result, money lost much of its importance, so that, for example, the wages of the Roman soldiers were paid directly in grain. As a reaction, Emperor Constantine the Great (was Roman Emperor from 306 to 337; from 324 he ruled as sole ruler) replaced the silver currency with a stable gold currency called Solidus .

middle Ages

A period of dominance in silver-based currency was the early Middle Ages , when the silver denarius the still from the Roman period acquired gold solidus replaced and in the European area, a value ratio of both of 12: set first

Around 775 the kings of Saxony issued silver coins known as sterling silver . 240 coins were made from one pound of silver. Before 800, Charlemagne carried out a coin reform that led from the gold and silver currency to the uniform silver currency (see Schilling ). The denarius or pfennig was newly introduced as the almost exclusively minted coin. Between 750 and 1200 silver deposits were discovered in Central Europe, including in Schemnitz in Slovakia (today Banská Štiavnica ) and on Rammelsberg in the Harz Mountains , south of the city of Goslar . Silver mining began in the Ore Mountains and Bohemia around 800 .

In China, the Song Dynasty central government began monopolizing official state banknotes in 1024 . They were by imperial gold and silver covered and were able to establish itself in the 12th century as the main means of payment. The Mongolian Yuan dynasty abolished the precious metal backing and introduced the world's first fiat currency . The possession of gold and silver was forbidden, both metals had to be completely handed over to the government. Excessive banknote pressure repeatedly led to considerable inflation , which in 1287 and 1309 could only be countered with a currency reform .

From the 15th century onwards, silver poured into China from Japan and other overseas countries and soon gained considerable importance as a means of payment. In Guangdong the tax could be paid in silver early on; for 1423 the general usage for the Yangzi delta is documented. From 1465 the provinces paid their tributes to the central government in silver, from 1485 farmers and artisans bought their public works. The Empire of China owned one of the oldest silver currencies. The unit of currency was the tael , also called the liang in Chinese. From the Ming Dynasty to the end of the Qing Dynasty in 1911, silver bars were the most common currency in circulation.

Early modern age

After 1492 the Spaniards brought large quantities of gold and silver from America , including from the legendary Potosí mine , to Europe. More than 85 percent of the world's silver production came from the mines in Mexico, Bolivia and Peru. Japan was also a silver exporter in the 16th century. As the supply increased, the value of silver in the old world fell. The increase in the amount of gold and silver was not without consequences for the economies of the world. Prices began to rise worldwide. In Spain, inflation was 400 percent throughout the 16th century. That is 1.6 percent per year. The price revolution spread from there across Europe and as far as Asia. The phenomenon of constant inflation, which is considered normal today, did not exist in Europe before the 16th century.

The coin history of Germany shows a continual deterioration of coins . This devaluation usually took place gradually over decades or centuries. The minting authority enriched himself by deteriorating coins at the expense of his citizens. In northern Germany, for example, the price of a silver mark in Schilling (Kurant coin) rose by 694 percent from the 13th to the 16th century . All money owners had to bear the consequences of the coin valuation (inflation). The simple and uneducated classes of the people (see Schinderlinge , Kipper- und Wipperzeit , Ephraimiten ) were mostly hit harder than those who knew about commercial matters or who also had significant property from which they could earn regular income (e.g. through Rental or leasing).

|

|

In the Holy Roman Empire , the Reichstaler, as the successor to the Joachimsthaler , was the official currency coin from 1566 to 1750. In the 18th century, Austria coined the Maria Theresa thaler , also known as the "Levantine Thaler", which in oriental countries was an unofficial, but recognized, means of storing value that was not contested by changes in the price of silver until well into the 20th century.

In Great Britain, coinage was largely based on silver until the beginning of the 18th century. On September 21, 1717, Isaac Newton , head of the royal mint, set the price for a guinea in silver, fixing a ratio of 21 shillings to one guinea. The rate for exchanging pounds sterling for gold was £ 3.89 an ounce . Newton set a too low gold price for silver and thus the "cornerstone" of the gold standard , which was to last for around 200 years. Silver was now relatively more expensive than gold and was therefore pushed out of circulation over time.

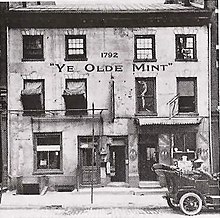

The United States of America, founded in 1776, chose the US dollar as a silver coin as their currency based on the thaler . In 1792, Alexander Hamilton was the first US Treasury Secretary to propose the creation of a currency system based on gold and silver. The price of silver was $ 1.293 per troy ounce (adjusted for inflation: $ 35.60). On April 2, 1792, the United States Congress decided to create a silver coin called the dollar. On October 15, 1794, the first official US silver dollar was supported by the Mint in Philadelphia coined. The number of coins produced was relatively small in the first few years due to the scarcity of silver. Only around 1750 coins were minted from the first US silver dollar.

19th century

In most countries there was a so-called bimetalism in the 18th and early 19th centuries ; the currency laws allowed the simultaneous minting and circulation of gold and silver coins. The basis of the actual bimetalism was the contractual or legal stipulation of a fixed value relationship between the coin metals used within a country or the financially strongest countries in a currency union .

Land speculation in the American West and a lack of confidence in paper currency were what caused the panic of 1837 on the New York Stock Exchange (NYSE). The bubble burst in New York on May 10, 1837, when all banks stopped converting paper money to gold and silver. It followed by six years of economic crisis ( depression ), a permanent insolvency of many banks and record-like unemployment. The price of silver reached a record high in 1837 at $ 1.419 per troy ounce. Adjusted for inflation, 39.06 US dollars had to be paid at that time.

The California gold rush between 1848 and 1854 led to a drop in the price of gold . This led to the (therefore undervalued) silver flowing from Western Europe to the Far East, where a silver currency predominated. A few years later, in 1858, silver ore was discovered in Nevada . This find, similar to the California gold rush, caused a huge rush.

During the Civil War (1861–1865), the military conflict between the southern states that left the USA - the Confederation - and the northern states that remained in the Union , the silver price rose to a high of 3.334 US dollars per troy ounce in 1864 (adjusted for inflation: 55.87 U.S. dollar).

In Germany until 1871 silver coins ( thalers ) were predominant; the currency was by silver covered ( Silver Standard ). After 1871 the silver standard was replaced by the gold standard . Silver lost its economic importance more and more. The value ratio fell from 1:14 to 1: 100 for a while, later it rose again a little. From 1873 the price of silver fell, partly due to the large German silver sales. Silver inflation in the 1880s prompted the Latin Monetary Union to introduce the gold standard in 1885.

On May 5, 1893, there were massive stock sales on the New York Stock Exchange (NYSE). The day went down in history as "Industrial Black Friday". In June of that year, the panic on the stock market spread to the silver market. Within four days the silver price collapsed 25 percent; many silver mines had to stop their production. By the end of the year, 15,000 companies were bankrupt, including 642 banks and 74 railroad companies. A four year depression followed the panic. The main causes were the increase in import tariffs for certain raw materials in the "McKinley Tariff Act", named after the later US President William McKinley , and the "Sherman Silver Purchase Act" of 1890, which opposed the purchase of silver by the US Treasury regulated treasury notes redeemable in gold .

At the end of the 19th century, the stagnation in the price of agricultural products in the United States gave birth to the free silver movement. This demanded unlimited minting of silver coins with a fixed value ratio to gold. The promotion of silver as legal tender has been particularly favored by farmers as a means of countering deflation in agricultural prices and facilitating the easier flow of credit in the rural banking system. Picked up by the Populist Party , the “Free Silver” became the central demand of the Democratic Party and its candidate William Jennings Bryan in the 1896 election campaign for the presidency . Its defeat and larger gold discoveries ended the free silver agitation. With the " Gold Standard Act " of March 14, 1900, the US broke with bimetallism and tied its currency to gold.

20th century

Because of the increasing importance of gold as a money reserve, the demand for the precious metal increased in the previous decades and caused silver prices to fall. In 1903, US $ 0.482 per troy ounce of silver had to be paid (adjusted for inflation, US $ 14.42).

In the Republic of China , the National Monetary Council set up the silver dollar in 1914, which continued to exist into the 1930s despite several changes. The rise in the price of silver in the 1920s and 1930s resulted in a significant outflow of the precious metal from China and a collapse in the silver standard. In 1920, the price was $ 1.344 per troy ounce (adjusted for inflation: $ 17.12).

From May 8, 1923, the Deutsche Reichsbank was able to proclaim precious metals (gold, silver, platinum, platinum metals) from private property for the German Reich. With the ordinance of the Reich President Friedrich Ebert of August 25, an already existing compulsory loan to prevent the hoarding of precious metals was supplemented by an obligation to surrender gold and silver with a value of 10 gold marks or more (see gold ban ). This was followed by a further ordinance on September 7, whereby the persons entitled to dispose were obliged to surrender all precious metals to the Reich. At the height of inflation in November 1923, $ 0.65 - the price of 1 troy ounce of silver - was equivalent to 2.73 trillion paper marks. Towards the end of 1924, most of the emergency foreign exchange regulations of the inflationary period were repealed. On March 6, 1931, President Paul von Hindenburg also repealed the ordinance on the delivery of foreign assets of August 25, 1923. After an 8-year break, private ownership of gold and silver was allowed again.

During the Great Depression the price fell in 1932 to a low of 0,254 US dollars per troy ounce (inflation-adjusted 4.75 US dollars). On March 6, 1933, US President Franklin D. Roosevelt decreed a four-day bank holiday to curb the hoarding and export of gold and silver. The "Silver Purchase Act" of June 19, 1934, in conjunction with the Gold Reserve Act of January, made the United States central bank the world's largest silver buyer. He obliged the government to sell the precious metal only at a fixed price.

In the Federal Republic of Germany, the “silver eagle” ( 5-mark coin ) disappeared from circulation in 1975 because the price of silver had risen sharply. From then on they were minted in nickel. Commemorative coins with a nominal value of 5 German marks were minted until 1979 and from 1987 to 1997 with a nominal value of 10 German marks with a fineness of 625 per mil. From 1998 to 2001 there were commemorative coins with a nominal value of 10 DM with a fineness of 925 per mille. This ended the phase of silver money in circulation. In the GDR , commemorative coins appeared on various anniversaries or occasions. They were mostly made of silver , nickel silver (copper / nickel / zinc) or other alloys.

In the 1970s, which led silver speculation of the brothers Hunt to a record high in the silver price. Together with wealthy business people from Saudi Arabia, they bought huge amounts of silver and silver contracts on the commodity futures exchanges and tried to dominate the silver market. At the end of 1979 the price of silver in London closed at $ 32.20 an ounce, 435 percent higher than at the end of 1978. It was the highest annual profit in history. The marketing agency Minero Perú Comercial (Minpeco) got into trouble in December 1979 because its dealers had sold short four times as much silver as they owned and therefore could not deliver.

On January 18, 1980, the silver fixing at the London Bullion Market reached a record high of 49.45 US dollars per troy ounce (31.1 grams). Adjusted for inflation, then 153.17 US dollars per troy ounce had to be paid. On the New York Commodities Exchange (COMEX), a high of 50.35 US dollars was reached during trading (155.96 US dollars adjusted for inflation).

There are several highs for the silver price in January 1980, depending on which trading venue or which calculation basis is selected.

| price |

date |

Trading center |

description |

|---|---|---|---|

| 41.50 | Jan. 21, 1980 | New York Commodities Exchange | most traded futures contract (March future) |

| 48.70 | Jan. 17, 1980 | New York Commodities Exchange | Closing price on the futures market (January future) |

| 48.80 | Jan. 18, 1980 | New York Commodities Exchange | Trading history on the spot market |

| 49.45 | Jan. 18, 1980 | London Bullion Market | Silver fixing |

| 50.35 | Jan. 18, 1980 | New York Commodities Exchange | Trading history on the futures market (January future) |

| 52.50 | Jan. 18, 1980 | Chicago Board of Trade | Trading history on the futures market (January future) |

After delivery problems, the COMEX commodity futures exchange banned the purchase of silver on January 21, 1980; only sales were allowed. At the same time, the required security deposits on silver futures contracts were drastically increased. After the speculative bubble burst on the silver market in 1980, the price in New York fell by 90.4 percent to June 21, 1982, to a low of 4.81 US dollars per troy ounce (12.96 US dollars adjusted for inflation).

In 1988 the Hunt brothers, long position holders , had to file for bankruptcy. The market participants who were short in silver earned from the crash of the silver price. Among them were nine COMEX directors who knew about the introduction of the trading restrictions and who made high profits through short sales (see also insider trading ). In contrast to the Hunt brothers, who were convicted in August 1988 of “conspiracy to manipulate the market”, the COMEX directors remained unpunished.

Between July 25, 1997 and January 12, 1998, investor Warren Buffett purchased 129.71 million troy ounces (4034 tons) of silver. That corresponded to about 37 percent of the global supply of the precious metal. At $ 4.50 an ounce, the total investment was $ 585 million. It sold in 2005 at a rate of $ 7.50 an ounce. On May 6, 2006 announced Buffett to shareholders at the annual general meeting of Berkshire Hathaway that his company holds no more silver. The return on the silver investment was approximately $ 400 million.

21st century

From 2001 to April 2011 the silver price rose continuously. This increase had a clear correlation with the growth of US national debt and the weakening of the dollar against world currencies. On March 17, 2008, the price of the precious metal on the COMEX in New York rose to USD 21.40 per troy ounce, the highest level since 1980.

In the course of the international financial crisis , which started in the US real estate crisis in the summer of 2007, the price of silver began to decline. From autumn 2008 the crisis increasingly affected the real economy. As a result, stocks, raw materials and precious metals collapsed worldwide. On October 28, 2008, the price of silver in New York fell to a low of $ 8.40 an ounce. The decline since March 17 of the year is 60.7 percent. The volatility of silver increased in the wake of the crisis . On October 2, 2008, the trading loss was 13.4 percent and on October 29, the profit was temporarily at 15.5 percent.

On March 25, 2011, the US state of Utah introduced gold and silver coins as the official currency alongside the US dollar. With the signing of the "Utah Legal Tender Act" by Governor Gary Herbert, the law became final. The House of Representatives in Utah approved the bill on March 4, 2011, and the Senate followed on March 15. Similar legislative initiatives have been submitted for consideration in a further 12 US states.

On April 8, 2011, the iShares Silver Trust holdings reached an all-time high of 11,242.89 tons. The ETF launched by iShares in April 2006 was the world's largest silver-based exchange-traded fund. Barclays Global Investors International is the fund management company . JPMorgan Chase & Co. NA, London Branch is the depositary . The trustee / administrator is the Bank of New York Mellon .

On April 25, 2011, the price of silver on the New York Mercantile Exchange (NYMEX) rose to 49.83 US dollars per troy ounce, the highest level since January 18, 1980. On the same day , the price of 34.20 Euro per troy ounce reached a 31-year high. The all-time high of 1980 is 86.78 Deutsche Mark (equivalent to 44.37 euros). The euro crisis , doubts about the US credit rating , the protests in the Arab world and the Tōhoku earthquake in Japan, which led to global production stoppages and delivery problems, were mainly responsible for the increase . Investors were concerned about global public finances and rising inflation.

On May 2, 2011, when electronic trading opened at 12:00 a.m. CET , the price of silver fell by 11.9 percent within a few minutes. The slump began on the futures market and spread to the spot market. Automatic sell orders, which are triggered when certain prices fall below ( stop-loss levels), accelerated the fall . On May 5, the silver price collapsed by 13.1 percent in the course of trading. It was the biggest daily loss since autumn 2008. The trigger for the crash was the increase in the deposit sums when trading silver futures on the COMEX commodity futures exchange. Within two weeks, the margins rose by 84 percent. The Chinese trading platform Shanghai Gold Exchange also increased the requirements. For investors, this meant that they had to put more capital than collateral into buying silver contracts. The increases resulted in many short-term oriented speculators withdrawing from the silver market.

Between May 2011 and June 2012 the silver price development remained characterized by high volatility . On September 22, 2011, the price of the COMEX silver future fell by 10.4 percent over the course of the day. A day later, on September 23, the silver price collapsed 16.5 percent. It was the biggest daily loss since 1984. On September 26th, the price fell 16.1 percent. Three months later, on December 29, the price was quoted at $ 26.14, an annual low. The loss since April 25, 2011 is 47.5 percent. On February 29, 2012, the price of the silver future on the COMEX commodity futures exchange rose to an annual high of US $ 37.56. The profit since December 29, 2011 is 43.7 percent. On June 28, 2012, the price fell to $ 26.13, its lowest level since November 28, 2010. The loss since February 29, 2012 is 30.4 percent. One reason for the price decline was investors' fear of a global recession . Silver is cyclical because of its use in industry. Investors also sold the precious metal to offset losses in other areas. Hedge funds in particular reduced their net long positions in futures contracts. There was no sell-off in the bars and coins business.

Silver market

Market mechanisms

Silver demand and supply change frequently. That is why the price of silver is very volatile . That is, it fluctuates considerably even within a short period of time. The price of silver is traded in US dollars and is inversely proportional to the dollar price. So if the dollar rate falls, the silver rate usually rises. The most stable purchase area for the precious metal is industry. This is where most of the world's silver mining is used. A quarter of production is processed in the jewelry and silverware segment. The supply of silver depends on the development of consumption and production of other metals.

The silver market, valued in US dollars, is much smaller than the gold market. The silver production is, according to the United States Geological Survey (USGS) at an annual 22,000 tons or 707.3 million troy ounces . This corresponds to a theoretical market value of currently 17.1 billion US dollars. This was based on a price of US $ 24.23 per troy ounce (silver price as of August 3, 2020). Around 2,500 tons or 80.4 million troy ounces are mined in gold mines worldwide every year. At a price of 1,958.55 US dollars per troy ounce ( gold price as of August 3, 2020), the annual gold production comes to a value of 160 billion US dollars.

For comparison: the market value of all bonds worldwide is 91,000 billion US dollars, the value of all derivatives 700,000 billion US dollars. The global gross domestic product in 2010 was, according to the International Monetary Fund at 63.000 billion US dollars. If a lot of international investment capital flows into such a small market, the price jumps quickly.

Today, financial derivatives ( futures , forwards , options , swaps ) have an increasing influence on the silver price . Due to arbitrage transactions, in which traders use price differences at different financial centers to generate profits, these futures transactions have a direct influence on the price of silver for immediate delivery ( spot market ). In the USA in 2010/11 there was a strong concentration of commercial contracts (contracts) on the books of a few major American banks on the commodity futures market. In October 2010, a lawsuit was brought against JPMorgan Chase & Co. and the US branch of the British bank HSBC on the silver market for alleged manipulation of the silver price.

The Commodity Futures Trading Commission (CFTC), an independent agency in the United States that regulates the futures and options markets in the United States, has confirmed that there has been manipulation of the silver market. In 2010, CFTC Commissioner Bart Chilton said: "There have been fraudulent attempts to move the price and control it in insincere ways."

Trading venues

For standardized silver trading on commodity exchanges , “ XAG ” was assigned as a separate currency code according to ISO 4217 . It denotes the price of one troy ounce of silver in US dollars. XAG is the currency abbreviation published by the International Organization for Standardization , which should be used for unique identification in international payment transactions . The "X" indicates that this is not a currency issued by a state or confederation of states.

The International Securities Identification Number (ISIN) is XC0009653103. The Bloomberg ticker symbol for the spot market price for silver reads "SILV <CMDTY>".

Silver is traded on the New York Commodities Exchange (COMEX), a division of the New York Mercantile Exchange (NYMEX), the Chicago Board of Trade (CBOT) and the Tokyo Commodity Exchange (TOCOM) , among others . The silver future, which began trading on the COMEX on July 29, 1971, is quoted in US cents per troy ounce.

In the physical market (silver in bar form ), the off-exchange trading (English: Over-the-counter, OTC) is called, is the London Bullion Market Association (LBMA), the largest trading platform in the world. Only bars from refineries and mints that meet certain quality requirements are permitted for trading . The international seal of approval "good delivery" (German: "in good delivery") guarantees the embossed or stamped features such as fineness and weight. Silver bars with good delivery status are accepted and traded worldwide.

Other marketplaces for the physical trading of silver are New York and Zurich.

On the spot market prices are traded for immediate physical delivery, while fixed to the futures and options markets prices for deliveries in the future. The spot price and the price of the future usually run in parallel.

The Philadelphia Gold and Silver Index (XAU) comprises both hedged and unhedged gold and silver producers .

Trading hours

There are two sessions at the Tokyo Commodity Exchange (TOCOM):

Day session: Monday to Friday 9:00 am to 3:30 pm JST (1:00 am to 7:30 am CET )

Night session: Monday to Friday 5:00 pm to 11:00 pm JST (9:00 a.m. to 3:00 p.m. CET)

The following trading hours apply at the London Bullion Market :

Monday to Friday 8:50 a.m. to 3:00 p.m. UTC (9:50 a.m. to 4:00 p.m. CET) A price is determined

once a day for the silver fixing : 12:00 p.m. UTC (1:00 p.m. Clock CET)

Trading on the New York Mercantile Exchange (NYMEX) takes place at the following times:

Floor: Monday to Friday 8:20 a.m. to 1:30 p.m. EST (2:20 p.m. to 7:30 p.m. CET)

Electronic (CME Globex): Sunday through Friday 6:00 p.m. to 5:15 p.m. EST (12:00 a.m. to 11:15 p.m. CET)

Silver fixing

In London, the trade in silver bars can be traced back to the 17th century. In 1684, the bank and precious metal broker “Mocatta” (since the end of the 18th century “ Mocatta & Goldsmid ”) started operations, the original member of the market. The introduction of the silver fixing in London in 1897 marked the beginning of the market structure. The founding members were Sharps & Wilkins , Mocatta & Goldsmid, Pixley & Abell and Samuel Montagu. For this event, dealers met once a day at 12:00 noon local time (1:00 p.m. CET) on Great Winchester Street at Sharps & Wilkins to assess supply and demand. When the two were in balance, the contestants lowered their British flags and the day's silver price could be locked.

After the outbreak of World War II on September 3, 1939, the silver market came under the sole control of the Bank of England . In 1946 there was a partial resumption of the silver trade and in 1953 the silver market was fully opened. The increase in companies trading gold and silver, along with the introduction of the Financial Services Act of 1986, led to the establishment of the London Bullion Market Association (LBMA) a year later. Since 1999 the silver price has been fixed there by telephone. On every working day three LBMA members took part in the silver fixing chaired by “ ScotiaMocatta ” (subsidiary of Scotiabank ). Other members of the silver fixing were Deutsche Bank AG London and HSBC Bank USA NA London Branch. In May 2014 it was announced that the silver fixing would be discontinued on August 14, 2014. In July 2014, a class action lawsuit was filed against the three banks in New York on suspicion of price manipulation during the silver fixing.

Silver plant

Investing in silver can be done through physical purchases and securities trading. Silver bars and investment coins can be purchased from banks, precious metal and coin dealers. There are rental and insurance costs for storage in a bank safe. In the scope of some household contents insurance, however, valuables stored in (bank) lockers are included up to a certain maximum amount. The purchase of bars and coins made of silver, platinum and palladium is subject to sales tax . In contrast, the purchase of gold bars and gold coins is exempt from sales tax, provided that the gold bars and gold coins qualify as investment gold in accordance with Section 25c (2) of the Sales Tax Act (UStG). In contrast to those from securities investments, profits from physical silver (e.g. coins and bars) are exempt from withholding tax in Germany if at least one year has passed between purchase and sale.

Investors can invest in certificates or funds - including exchange-traded funds (ETF) - directly via the stock exchange or broker . Physical delivery is no longer required. Certificates are dependent on the solvency of the issuer and influence the demand situation on the commodity exchanges indirectly via the banks' hedge transactions (Certificate → Future → Spot ).

In addition, the purchase of shares in the silver mining companies offers the prospect of a higher return in the form of price increases and dividends than when investing in the physical precious metal. Shares in the silver mining companies are also useful in the event of an impending inflation , as they certify a share of the company's real capital, that is, the shareholder owns a share of the silver still in the ground. The silver investment in the form of derivatives , which are based on the silver price or the share price of the respective mining company, offers even higher returns and risks . Like certificates, derivatives are dependent on the solvency of the issuer.

In economically calm times, paper money is exchanged for a tangible asset , for example gold or silver, with the expectation that at an indefinite point in time in the future a larger amount of paper money will be available for the same amount of precious metal. In times of galloping inflation or hyperinflation , on the other hand, paper money is finally exchanged for tangible assets in order to preserve accumulated assets over and above a currency reform . Gold and silver investments can also be lucrative in times with negative real interest rates , since here the inflation is greater than the interest income that can be achieved through a short-term investment in interest-bearing securities.

Gold-silver price ratio

The gold-silver price ratio has fluctuated between 1:10 and 1: 100 since 1700. It is based on the mass and indicates how many units of silver are needed to buy one unit of gold. It shows the value relationship between the two precious metals. The long-term historical mean was most of the time between 1:10 and 1:20, but also fluctuated within this range for a short time depending on the market situation. These relative price fluctuations played an important role in the history of modern currencies, for example in the development of the classic gold standard as an international currency regime. From the late 19th century the ratio changed permanently to the disadvantage of silver. One reason for the change is that gold and silver have increasingly been seen as commodities since the abolition of bimetallism and the gold standard. When gold and silver still functioned as a means of payment, an exchange rate was usually chosen that made sense due to the natural resources and the ratio of the annual production volumes.

The gold-silver price ratio reached its first peak in the 1930s, when for a short time one troy ounce of gold was worth significantly more than 100 troy ounces of silver. In the late 1960s and early 1980s, values below 1:20 were recorded again. At the beginning of the 1990s there was another high at around 1: 100. In 2009 and 2010 the price of silver rose faster than the price of gold. While 80 troy ounces of silver had to be paid for one troy ounce of gold at the end of 2008, at the end of 2010 it was 46 troy ounces. In April 2011 the gold-silver price ratio was 1:30. The gold-silver ratio thus again approached the ratio of natural raw material deposits of 1:10. For 2011, the United States Geological Survey estimated the gold reserves in the earth's crust that can be extracted at current prices and with today's production technologies at 51,000 tons and the silver reserves at 530,000 tons. At the end of 2011, 56 troy ounces of silver had to be paid for one troy ounce of gold.

Below are the annual high, low and closing prices of silver in US dollars per troy ounce and the annual percentage performance on the London Bullion Market since 1965. In addition, the annual closing prices and the annual performance of gold as well as the gold-silver ratio for the same period are listed.

| year | High silver |

Low silver |

Closing silver |

Change in% |

Closing gold |

Change in% |

Gold-silver ratio |

|---|---|---|---|---|---|---|---|

| 1965 | 1.29 | 1.29 | 1.29 | 0.00 | 35.12 | 0.00 | 27.22 |

| 1966 | 1.29 | 1.29 | 1.29 | 0.00 | 35.19 | 0.20 | 27.28 |

| 1967 | 2.06 | 1.29 | 2.06 | 59.69 | 35.20 | 0.03 | 17.09 |

| 1968 | 2.58 | 1.84 | 1.95 | −5.34 | 41.90 | 19.03 | 21.49 |

| 1969 | 2.04 | 1.56 | 1.79 | −8.21 | 35.20 | −15.99 | 19.66 |

| 1970 | 1.93 | 1.57 | 1.63 | −8.94 | 37.38 | 6.19 | 22.93 |

| 1971 | 1.75 | 1.27 | 1.37 | −15.95 | 43.63 | 16.72 | 31.85 |

| 1972 | 2.03 | 1.37 | 2.03 | 48.18 | 64.90 | 48.75 | 31.97 |

| 1973 | 3.26 | 1.96 | 3.26 | 60.59 | 112.25 | 72.96 | 34.43 |

| 1974 | 6.76 | 3.27 | 4.47 | 37.12 | 186.50 | 66.15 | 41.72 |

| 1975 | 5.21 | 3.93 | 4.18 | −6.49 | 140.25 | −24.80 | 33.55 |

| 1976 | 5.08 | 3.83 | 4.36 | 4.31 | 134.50 | −4.10 | 30.85 |

| 1977 | 4.98 | 4.31 | 4.76 | 9.17 | 164.95 | 18.36 | 34.65 |

| 1978 | 6.26 | 4.82 | 6.02 | 26.47 | 226.00 | 37.01 | 37.54 |

| 1979 | 32.20 | 5.94 | 32.20 | 434.88 | 524.00 | 131.86 | 16.27 |

| 1980 | 49.45 | 10.89 | 15.50 | −51.86 | 589.50 | 12.50 | 38.03 |

| 1981 | 16.30 | 8.03 | 8.15 | −7.05 | 400.00 | −32.15 | 49.08 |

| 1982 | 11.11 | 4.90 | 10.87 | 33.37 | 448.00 | 12.00 | 41.21 |

| 1983 | 14.67 | 8.37 | 8.91 | −18.03 | 381.50 | −14.84 | 42.82 |

| 1984 | 10.11 | 6.22 | 6.29 | −29.41 | 308.30 | −19.19 | 49.01 |

| 1985 | 6.75 | 5.45 | 5.80 | −7.79 | 327.00 | 6.07 | 56.38 |

| 1986 | 6.31 | 4.85 | 5.28 | −8.97 | 390.90 | 19.54 | 74.03 |

| 1987 | 10.93 | 5.36 | 6.70 | 26.89 | 486.50 | 24.46 | 72.61 |

| 1988 | 7.82 | 6.05 | 6.05 | −9.70 | 410.15 | −15.69 | 67.79 |

| 1989 | 6.21 | 5.05 | 5.22 | −13.72 | 401.00 | −2.23 | 76.82 |

| 1990 | 5.36 | 3.95 | 4.19 | −19.73 | 391.00 | −2.49 | 93.32 |

| 1991 | 4.57 | 3.55 | 3.86 | −7.88 | 353.40 | −9.62 | 91.55 |

| 1992 | 4.34 | 3.65 | 3.67 | −4.92 | 332.90 | −5.80 | 90.71 |

| 1993 | 5.42 | 3.56 | 5.12 | 39.51 | 390.65 | 17.35 | 76.30 |

| 1994 | 5.75 | 4.64 | 5.19 | 1.37 | 382.50 | −2.09 | 73.70 |

| 1995 | 6.04 | 4.42 | 5.14 | −0.96 | 386.70 | 1.10 | 75.23 |

| 1996 | 5.83 | 4.71 | 4.80 | −6.61 | 369.55 | −4.64 | 76.99 |

| 1997 | 6.27 | 4.22 | 6.00 | 25.00 | 289.20 | −21.74 | 48.20 |

| 1998 | 7.81 | 4.69 | 5.01 | −16.50 | 287.45 | −0.61 | 57.38 |

| 1999 | 5.48 | 5.03 | 5.33 | 6.39 | 290.25 | 0.97 | 54.46 |

| 2000 | 5.45 | 4.57 | 4.58 | −14.07 | 272.65 | −6.06 | 59.53 |

| 2001 | 4.82 | 4.07 | 4.52 | −1.31 | 276.50 | 1.41 | 61.17 |

| 2002 | 5.10 | 4.24 | 4.67 | 3.32 | 342.75 | 23.95 | 73.39 |

| 2003 | 5.97 | 4.24 | 4.97 | 6.42 | 417.25 | 21.74 | 83.95 |

| 2004 | 8.29 | 5.50 | 6.82 | 37.22 | 438.00 | 4.97 | 64.22 |

| 2005 | 9.23 | 6.39 | 8.83 | 29.47 | 513.00 | 17.12 | 58.10 |

| 2006 | 14.94 | 8.83 | 12.90 | 46.09 | 635.70 | 23.92 | 49.28 |

| 2007 | 15.82 | 11.67 | 14.76 | 14.42 | 836.50 | 31.59 | 56.67 |

| 2008 | 20.92 | 8.88 | 10.79 | −26.90 | 865.00 | 3.41 | 80.17 |

| 2009 | 19.18 | 10.51 | 16.99 | 57.46 | 1104.00 | 27.63 | 64.98 |

| 2010 | 30.70 | 15.14 | 30.63 | 80.28 | 1410.25 | 27.74 | 46.04 |

| 2011 | 48.70 | 26.16 | 28.18 | −8.00 | 1574.50 | 11.65 | 55.87 |

| 2012 | 37.23 | 26.67 | 29.95 | 6.28 | 1664.00 | 5.68 | 55.56 |

| 2013 | 32.21 | 18.77 | 19.59 | −35.43 | 1196.80 | −28.08 | 61.09 |

| 2014 | 21.97 | 15.34 | 16.24 | −16.59 | 1200.33 | 0.29 | 73.91 |

| 2015 | 18.34 | 13.68 | 13.89 | −11.58 | 1061.75 | −11.55 | 76.44 |

| 2016 | 20.71 | 13.58 | 16.24 | 16.91 | 1159.10 | 9.17 | 71.37 |

| 2017 | 18.56 | 15.71 | 16.87 | 3.88 | 1296.50 | 11.85 | 76.85 |

| 2018 | 17.52 | 13.97 | 15.47 | −8.30 | 1281.65 | −1.15 | 82.85 |

| 2019 | 19.31 | 14.38 | 18.05 | 16.68 | 1523.00 | 18.83 | 84.38 |

See also

Web links

- Silver fixing in London ( memento of March 8, 2012 in the Internet Archive ) current and historical (in USD and GBP: from 1968, in EUR: from 1999)

- Historical prices (silver future) in dollars (from 1963)

- Historical prices (silver future) in euros (from 1971)

- Historical prices (silver future) in Swiss francs (from 1971)

Individual evidence

- ^ Hans Peter Latscha, Martin Mutz: Chemistry of the elements: Chemistry basic knowledge IV. Springer Verlag, Berlin 2011, ISBN 3-642-16914-7

- ↑ Heinz-Wilhelm Kempgen: Early Chinese Coin History - On the Chronology of Spade Coins (7th to 3rd Century BC) , Stuttgart 1993

- ^ Günther Ludwig, Günther Wermusch: Silver, from the history of precious metal , Verlag Die Wirtschaft, Berlin 1988, ISBN 3-349-00387-7

- ^ Wilhelm Patalas: Chinese coins. From its origins to 1912. An identification book. Klinkhardt & Biermann, Braunschweig 1965

- ^ Friedrich-Wilhelm Henning: Das vorindustrielle Deutschland 800 to 1800. Uni-Taschenbücher, Stuttgart 1994, p. 184, ISBN 3-8252-0398-0

- ^ Adolf Soetbeer: Articles and materials for assessing money and banking issues: with special consideration for Hamburg. Herold Verlag, Hamburg 1855

- ↑ Ulrich van Suntum : The invisible hand. Economic thinking yesterday and today . Springer-Verlag, Berlin 2005, ISBN 3-540-25235-5

- ↑ Global Financial Data: US Silver Prices, 1792-1998 ( Memento June 9, 2000 in the Internet Archive )

- ^ Robert Sobel: Panic on Wall Street: A History of America's Financial Disasters. Beard Group, Cleveland Heights OH 1999, ISBN 978-1-893122-46-8

- ↑ Austrian National Library: RGBl. I 1923, p. 275

- ↑ Austrian National Library: RGBl. I 1923, p. 833

- ↑ Austrian National Library: RGBl. I 1923, p. 865

- ↑ Austrian National Library: RGBl. I 1931, p. 32

- ^ The 1980 Hunt Speculation on Silver , accessed May 20, 2020

- ↑ The Silver Institute: Silver News Archives ( Memento from December 28, 2008 in the Internet Archive )

- ^ The Silver Institute: Historical Prices - COMEX Spot & London Fix ( Memento of July 7, 2010 in the Internet Archive )

- ↑ The Silver Institute: For Future Reference Silver Prices 1979-2008 ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. (PDF; 759 kB)

- ↑ Knight Coin and Collectibles: Metals Closes

- ↑ About.Ag: Record High Silver Spot Price in 1980

- ↑ Wikiposit: Historical Time Series - COMEX futures

- ↑ Börse Express: Silver just before a 30-year high - the Hunt brothers send their regards - Part 1 ( Memento from March 4, 2016 in the Internet Archive ), from September 18, 2010

- ↑ Börse Express: Silver just before reaching a 30-year high - greetings from the Hunt brothers - Part 2 ( memento of March 4, 2016 in the Internet Archive ), September 19, 2010

- ↑ Berkshire Hathaway: Investment in Silver , February 3, 1998

- ^ Silver Monthly: Analyzing Warren Buffett's Investment in Silver , June 27, 2007

- ↑ WirtschaftsWoche: America's Flight into Gold and Silver , March 31, 2011

- ^ IShares: iShares Silver Trust

- ↑ a b Stooq: Historical prices in US dollars

- ↑ Stooq: Historical prices in euros

- ↑ Oanda: Historical exchange rates (each previous day)

- ↑ Die Welt: Silver Price Rises to 31-Year High , April 21, 2011

- ↑ Financial Times Deutschland: The Totally Crazy Silver Crash ( Memento from May 4, 2011 in the Internet Archive ), May 2, 2011

- ↑ LocalGoldSales.com: Silver Flash Crash Chart ( Memento from November 3, 2013 in the Internet Archive ), from May 2, 2011

- ↑ Handelsblatt: Silver price crashes, gold in the red , May 5, 2011

- ↑ Börse Express: Debt crisis and falling industrial demand for silver in China are sending the silver price down ( memento from December 29, 2015 in the Internet Archive ), from December 29, 2011

- ↑ Die Welt: Fear of recession sends the silver price downhill , May 17, 2012

- ↑ Wirtschaftswoche: The New Gold Rush , August 5, 2010

- ↑ Wirtschaftswoche: Suspected price manipulation of the silver price: JP Morgan and HSBC indicted , October 28, 2010

- ↑ Börse.ARD.de: Silver between fear and fraud ( memento from January 9, 2011 in the Internet Archive ), from November 5, 2010

- ↑ Deutsche Bank: Precious Metals - Markets & Products ( Memento from January 30, 2012 in the Internet Archive )

- ↑ London Bullion Market Association: The London Gold and Silver Fixings ( Memento of March 8, 2012 in the Internet Archive )

- ↑ GoldSeiten: London silver fixing will be discontinued in August!

- ↑ Wall Street: Online: Deutsche Bank, HSBC and Bank of Nova Scotia are said to have manipulated the silver price

- ↑ Federal Administrative Court: Value Added Tax Act (UStG) - § 25c Taxation of sales with investment gold

- ↑ United States Geological Survey: World Gold Mine Production and Reserves (PDF; 28 kB)

- ↑ United States Geological Survey: World Silver Mine Production and Reserves (PDF; 28 kB)

- ^ London Bullion Market Association: Silver Fixings

- ↑ London Bullion Market Association: Gold Fixings ( Memento of March 8, 2012 in the Internet Archive )