Debit and credit (accounting)

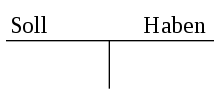

Debit and credit are the names for the left ( debit ) or right ( credit ) side of an account in commercial accounting . These are purely accounting- technical terms that have given up their actual meanings.

Origin of the term

The origin of debit and credit is explained by Balduin Penndorf in the translation of a work by Luca Pacioli as follows:

“The account title was followed by debit and credit, deve dare - deve avere (should give - should have). Later the deve (debit) was dropped on both sides , so that in Italy only dare and avere (give and have) remained; while in Germany there was no giving on the left and debit on the right, so that today in Germany we use debit and credit. "

meaning

For each account, the double- entry booking logic determines when debits or credits are posted:

| Account type | Should | To have |

|---|---|---|

| Expense account | effort | Effort reduction |

| Income account | Decrease in yield | Yield |

| active inventory account | Access | Exit |

| passive inventory account | Exit | Access |

Receipts are always on the same page on which the account posted is on the balance sheet .

Examples:

- Sales proceeds are income and are therefore posted to profit or loss accounts in credit. In contrast, operating expenses are in target there.

- The sale of a vehicle is posted in credit (outflow), the purchase in debit (addition) on an active fleet account.

- On a passive stock account liabilities increasing a liability on the credit (access) and their payment is posted to the debit (decrease).

In principle, each account can be posted to on both sides, but the balance must be on the correct side when the account is closed. A credit balance (excess of credit postings) is only permitted on income accounts and on passive inventory accounts. An active inventory account with a credit balance is not possible (for example, you cannot own vehicles with a value of less than zero euros).

literature

- Jörn Littkemann, Michael Holtrup, Klaus Schulte: Bookkeeping: Basics - Exercises - Exam preparation . 4th edition. Gabler, Wiesbaden 2009, ISBN 978-3-8349-1914-4 .

- Siegfried Schmolke, Manfred Deitermann u. a .: Industrial accounting ICR. Financial accounting - analysis and criticism of the annual financial statements - cost and performance accounting . 38th edition. Winklers Verlag, Düsseldorf 2009, ISBN 978-3-8045-6652-1 .

- Günter Wöhe, Heinz Kußmaul: Basics of bookkeeping and accounting technology . 7th edition. Vahlen, Munich 2010, ISBN 978-3-8006-3683-9 .

Web links

Individual evidence

- ↑ Luca Pacioli: Treatise on bookkeeping 1494 . Translated into German from the Italian original from 1494. Poeschel, Stuttgart 1933 (Italian: Summa de arithmetica, geometria, proportioni et proportionalita . Venice 1494. Translated by Balduin Penndorf).