Stability and Growth Pact

The term Stability and Growth Pact ( Euro Stability Pact for short ) refers to the agreements that are intended to ensure financial stability within the framework of the European Economic and Monetary Union , in particular for the euro and the countries of the euro zone . The essential legal basis of the Stability and Growth Pact is Art. 126 Treaty on the Functioning of the European Union (TFEU) and Protocol No. 12 annexed to the Treaty . The Stability and Growth Pact originally consisted of Council Regulation (EC) No. 1466/97 of 7 July 1997 on the development of budgetary surveillance and the surveillance and coordination of economic policies, Regulation (EC) No. 1467/97 of the Council of 7 July 1997 on speeding up and clarifying the excessive deficit procedure and the European Council resolution of 17 June 1997 on the Stability and Growth Pact .

The Stability and Growth Pact essentially requires that, in connection with the euro, a largely balanced state budget and a limitation of public debt be observed in normal economic times. This should also create or maintain leeway to enable increased debt-financed budget deficits if necessary on the one hand and to reduce debt through low budget deficits or even budget surpluses on the other.

target

The aim of the pact is to promote stability and growth in the euro zone. In particular, the set of rules is intended to prevent inflation from rising due to excessive indebtedness in the euro countries, reducing the euro countries' financial room for maneuver and overall uncertainty in the euro.

The primary goal of the European Central Bank (ECB) is to ensure monetary stability, as excessive inflation can have negative social and economic consequences. The pact is also intended to contribute to the political independence of the ECB by relieving possible political and economic pressure on the ECB. In particular, it should be ruled out that high budget deficits or national debts of individual member states put the ECB under pressure to buy up government bonds and pursue a low interest rate policy . Highly indebted countries have a natural interest in reducing their liabilities due to inflation and therefore tend to prefer a loose monetary policy.

In addition, the pact aims to promote the integration of Europe. Proponents of a political union also refer to it as the “minimal variant of a political union”.

content

General regulations

The Stability and Growth Pact requires EU member states that want to or have introduced the euro as the official currency to limit their budget deficits and debt. These requirements were already part of the convergence criteria .

The Stability and Growth Pact specifically stipulates that states must limit their annual budget deficit to 3% of their gross domestic product (GDP) and their public debt to 60% of their GDP.

According to the provisions of the Stability and Growth Pact, the euro-participating states are obliged to submit annual updated stability programs to the ECOFIN Council . In Germany, the respective update of the German stability program is forwarded by the federal government to the relevant specialist committees of the Bundestag and Bundesrat . The Federal Ministry of Finance publishes the stability programs. The last update of the German stability program was approved by the Federal Cabinet on April 17, 2013 .

Sanction regulations

If the budget deficit of a member state threatens to exceed three percent of GDP , the European Commission can issue an “early warning” (“blue letter”).

If the budget deficit actually exceeds three percent, the Council for Economic and Financial Affairs starts an "excessive deficit procedure". In a first step, the countries concerned must present a plan on how they intend to reduce the deficit. If they do not adhere to this plan, sanctions can be imposed:

- Fines ranging from 0.2 to 0.5 percent of the affected country's GDP can be imposed. (0.2 percent base amount and up to 0.3 percent, depending on the severity of the offense.)

- The EU Council of Ministers can require deficit states to make a “reasonable amount” of interest-free deposits in Brussels until the excessive deficit is corrected.

- A state may be required to publish additional information prior to issuing bonds and other securities .

- The European Investment Bank may be asked to review its lending policy to a country.

However, the sanctions cannot be imposed by the European Commission : the decision must ultimately be approved by the Council of Ministers with a qualified majority , whereby the country concerned has no voting rights .

Exceptions

The Stability Pact only provides for exceptions if an exceptional event such as B. a natural disaster occurs or the affected country is in a severe economic crisis. The Stability Pact defines this for a decline in GDP of at least 0.75%.

history

Contract creation

The idea of the deficit limit came from the French government in the 1980s; President François Mitterrand wanted a simple economic rule as a reason to reject budget requests from his ministers. The project manager at the French Ministry of Finance, Guy Abeille, one of the two inventors of the 3% budget deficit limit, later admitted that there was no scientific justification for the number, but was hastily suggested as an intuitive rule based on the Holy Trinity . During the deadlocked European negotiations shortly before the start of the Maastricht Conference, it was then introduced as a proposal by Jean-Claude Trichet at the end of 1991 .

As part of the Maastricht Treaty of 1992, the EC member states agreed on convergence criteria that countries must meet if they want to join the third stage of European monetary union and introduce the euro . At the initiative of the then German Finance Minister Theo Waigel , two of these criteria were laid down at the EC summit in Dublin in 1996, even after the entry into the euro. However, at this summit - after massive French pressure - Chancellor Helmut Kohl waived the originally intended stipulation of automatic penalties. With the Treaty of Amsterdam passed on June 17, 1997, the Stability and Growth Pact then became applicable EU law.

Infringements and Sanctions

Although Germany and France exceeded the deficit limits in 2002 and 2003, the ECOFIN Council temporarily suspended the proceedings, as both countries promised to keep their new debt below the 3 percent threshold in 2005.

In terms of domestic politics, there was massive pressure in Germany from Chancellor Gerhard Schröder on the Federal Ministry of Finance, headed by Hans Eichel . The Federal Finance Administration and the EU Commission, including the majority of the EU countries, favored a restrictive line with regard to compliance with the 3% limit, while Federal Chancellor Schröder, who was considering the upcoming Bundestag elections in 2005, with the support of his then Head of the Chancellery Frank-Walter Steinmeier and the then Europe department head Reinhard Silberberg avoided the unpopular reforms in the form of government spending cuts and austerity measures by putting the debt and government deficit ratio into perspective. In cooperation with France, Italy and Greece, Schröder managed to exceed the debt and deficit limit for Germany without sanctions.

In order to achieve permanent legal certainty about the mechanisms and procedures in excessive deficit procedures, the European Commission filed a complaint against the decision of the ECOFIN Council with the European Court of Justice . The then currency commissioner Pedro Solbes wanted in particular to clarify the question of whether the Council was authorized to reject the Commission's austerity measures and thus prevent sanctions against a deficit sinner in an ongoing procedure. On July 13, 2004, the court ruled that the Council did not necessarily have to follow the Commission's proposals and was in principle entitled to suspend an excessive deficit procedure for the time being. However, the specific decision of November 2003 was not compatible with EU law, as the recommendations formulated by the Council violated the Commission's right of initiative and also fell short of the conditions that had already been agreed.

In mid-December 2004, however, the European Commission suspended the proceedings against Germany for the time being, as the Federal Republic of Germany had forecast a new borrowing ratio of 2.9 percent for 2005 and this assumption was considered realistic by the Commission. On 14 March 2006, decided EU - Finance exacerbating the excessive deficit procedure against Germany. In 2006, contrary to original expectations , the Federal Republic was able to comply with the Stability Pact. On September 5, the law on the domestic allocation of non-interest-bearing deposits and fines in accordance with Article 104 of the Treaty establishing the European Community (Sanctions Payment Allocation Act - SZAG) was passed.

On June 5, 2007, the European Union ended its excessive deficit procedure against Germany, which had been running since 2003 . The EU finance ministers reacted to the fact that the German new debt in 2006 was again within the permissible range of the stability pact for the first time, as it was reduced to 1.7 percent of the gross domestic product. The proceedings against Malta and Greece have also been closed.

Because the debt ratio rose further to 132 percent in 2018, the European Commission recommended initiating an excessive deficit procedure against Italy on June 5, 2019 . The European Council now has two weeks to discuss this.

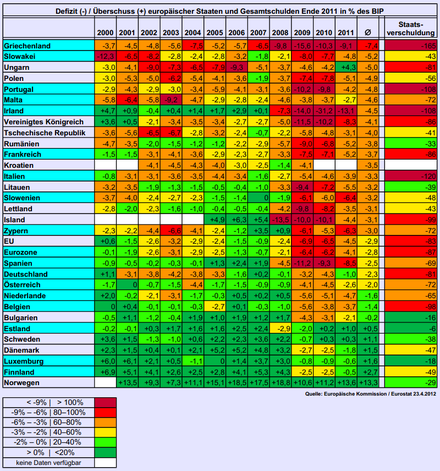

Excessive deficit procedure as a result of the financial crisis since 2007

As a result of the financial crisis from 2007 onwards , EU Member States violated or violated the Maastricht criteria in terms of annual budget deficit and total debt. In February 2009 the EU Commission announced the initiation of excessive deficit proceedings against the five euro countries France, Spain, Ireland, Greece and Malta as well as against the non-euro country Latvia. Even the non-euro country Great Britain did not meet the requirements of the Stability and Growth Pact. In summer 2009 further proceedings against Poland, Romania and Lithuania were initiated and the excessive deficit procedure against Hungary was extended. On October 7, 2009, further excessive deficit proceedings were initiated against Germany, Austria, Belgium, Italy, the Netherlands, Portugal, Slovakia, Slovenia and the Czech Republic. As a result of the global financial crisis, 20 of the then 28 EU member states no longer met the criteria of the Stability and Growth Pact. In spring 2010, corresponding proceedings against five other states were reported. In 2011, there were proceedings against 24 of the 28 EU countries.

On July 12, 2017, the EU Commission recommended that the Council terminate the excessive deficit procedure against Greece, the Council did so on September 19, 2017. On November 22, 2017, the Council terminated the proceedings against Great Britain.

On May 23, 2018, the EU Commission recommended that the Council discontinue the proceedings against France that were opened in 2009. The budget deficit was 2.6 percent of GDP in 2017, which is less than 3 percent for the first time since 2007. However, France's total debt is 97 percent; the EU rules actually set an upper limit of 60 percent. France had received three deadline extensions from the EU partners. On June 22, 2018, the Council of EU Finance Ministers decided to officially end the proceedings against France.

Spain became the last EU country against which an excessive deficit procedure is still pending. On June 5, 2019, the Commission recommended that the Council close the case against Spain as well. Should he agree to this, all excessive deficit procedures that followed the crisis would be closed.

"Sixpack"

On December 13, 2011 the so-called six-pack came into force, which includes a reform of the Stability and Growth Pact. Among other things, the sanctions for non-compliance with the deficit have been tightened and the pact has been supplemented by a procedure against macroeconomic imbalances that consists of an early warning system made up of ten indicators.

Reform proposals

There have been a number of reform proposals from both those in favor of the pact and those who oppose the pact in recent years.

Critics (in Germany, for example, Peter Bofinger and Heinz-J. Bontrup ) of the pact fear that it will lead to a procyclical fiscal policy that will exacerbate economic problems. In response to the pact, the state must reduce its spending in financial problems in order to avoid exceeding the 3 percent deficit limit. This in turn would worsen the economic situation, the 3 percent deficit limit would be exceeded again and the state would have to cut spending again. In the opinion of the critics, this can lead to a tightening and prolongation of a recession (while temporarily higher government spending to stabilize the economy can shorten the recession and thus also improve the longer-term financial / economic situation).

Proponents of a soft and flexible Stability and Growth Pact have various proposals. One line of reform aims to relax the three percent criterion (the former French President Chirac , for example, once called for a four percent criterion). A second strand of reform calls for a solution from an annual deficit criterion to a permitted level of debt depending on the level of debt. In their opinion, this would provide an incentive to reduce the debt level in order to have greater fiscal leeway in the event of a recession . A third group calls for the pact to be relaxed by removing individual budget items from the pact (for example capital expenditure or defense expenditure, as requested by former French defense minister Alliot-Marie ).

Representatives of a further direction are calling for the pact to be abolished completely, as some representatives believe that the common central bank management by the ECB would require a completely flexible national fiscal policy for the euro countries.

The proponents of a hard Stability and Growth Pact demand greater automatism in the sanction procedures so that they cannot be softened and circumvented. Among other things, this is intended to prevent individual member states from not agreeing to a sanction procedure in the event of a deficit violation for fear of their own, possibly high national debt in the future . Among other things, the German Prime Minister Angela Merkel suggested that the Commission withdraw the voting rights in the Ecofin Council (i.e. in the Council of Economic and Finance Ministers of the EU member states) from states that disregard the limits for new borrowing. Some proponents go a step further and argue in favor of completely removing competence from the Council and entrusting the European Commission alone with the excessive deficit procedures.

Most of the political forces in Europe are now discussing a reform of the pact, because it has not been and will not be observed in its current form, regardless of its intended effects. The principle of unanimity among the member states makes reform difficult. The EU Commission is also not averse to reforming the pact. It is important to her, however, that a reform of the pact must not lead to fundamentally higher new borrowing in the euro area.

In the course of the introduction of the euro and the financial crisis from 2007 and the subsequent euro crisis , the Stability and Growth Pact was discussed more and more again. In the opinion of Jean Pisani-Ferry and André Sapir , it is wrong to claim that Art. 125 and Art. 143 TFEU strictly forbid support to an EU member state. Joachim Starbatty announced a complaint to the Federal Constitutional Court in the event of the disbursement of a Greek loan ; German research institutes also raised legal concerns.

The tightening of the Stability Pact was criticized for several reasons. First, because there is no scientific justification for the 3% and 60% debt criteria. Second, it increases the bureaucratic effort. Thirdly because it does not provide for any restrictions for countries with large budget surpluses and fourthly because government spending cuts associated with the savings plan can have a negative impact on economic development.

There is no scientific justification for the 3% and 60% debt criteria, but a simple mathematical one. When the deficit limits were set at the beginning of the 1990s, the EU states expected annual nominal GDP growth of 5%. Under these conditions, a nominal budget deficit of 3% would stabilize the national debt at the EU average of around 60% of GDP at the time ((100%: 5) * 3 = 60%).

European Fiscal Compact

The European Fiscal Compact (“EU debt brake”) came into force on January 1, 2013 for 17 EU countries (in full for 13 euro countries).

European stability mechanism

"European stabilization mechanism" (eng. European Stabilization Mechanism , ESM) is on 9/10. Loan financing instrument decided on by the Council of the European Union in Brussels on May 28th 2010 to guarantee the financial stability of the euro zone and all of Europe. After the turmoil on the financial markets in connection with the Greek debt crisis exposed the stability of the euro currency and the economies of the member states of the European Union to high risks, the countries of the euro zone agreed to support individual member states with 440 billion euros in loans in an emergency . The European Commission is making an additional 60 billion euros available for this. The International Monetary Fund is expected to contribute additional loan guarantees of around 250 billion euros. The relevant German law was signed by Federal President Köhler on May 22, 2010. In France, the corresponding legislative project ( loi de finances rectificative - PLFR ) was presented to parliament on May 31, 2010 and adopted by it on June 3, 2010. The European Commission is committed to making the mechanism permanent. A special purpose vehicle will be set up under Luxembourg law to process the transaction.

When the Financial Stability Review was published in June 2010, representatives of the ECB warned of medium-term dangers for the European banking system. In view of the Greek crisis, economist and political advisor Alessandro Leipholz describes a timely, uniformly coordinated and institutionally secure approach by the eurozone countries as indispensable. A group of economists from the Brussels think tank BRUEGEL believes that a central crisis management architecture is required due to current developments.

See also

literature

- Felix Bark: The deficit procedure under Community law. Reform approaches and their legal implementation options . Dissertation. Peter Lang, Frankfurt am Main, 2004.

- Matthias Belafi, Roman Maruhn: C • A • P-Position: A new stability pact? Balance of the summit compromise . (PDF; 293 kB), Center for Applied Policy Research, 2005

- Anne Brunila, Marco Buti, Daniele Franco: The Stability and Growth Pact . Palgrave, 2001

- Peter Bofinger : The Stability and Growth Pact neglects the policy mix between fiscal and monetary policy . (PDF; 121 kB) In: Intereconomics , Review of European Economic Policy, Volume 38, No. 1, 2003, pp. 4–7.

- Stability and Growth Pact decisively weakened . Deutsche Bundesbank, press release, March 21, 2005.

- Daniel Gros: Reforming the Stability Pact . (PDF; 224 kB), pp. 14-17. In: Boonstra, Eijffinger, Gros, Hefeker: Forum: The Stability and Growth Pact in Need of Reform . In: Intereconomics , Volume 40, No. 1, 2005, pp. 4-21.

- Friedrich Heinemann: The strategic cleverness of stupidity - no flexibilization of the stability pact without depoliticization , pp. 62–71. In: Hefeker, Heinemann, Zimmermann: Economic Policy Forum: Does the EU Need a More Flexible Stability Pact? In: Journal for Economic Policy , Volume 53, Issue 1, 2004, pp. 53–80.

- Martin Heipertz : The European Stability and Growth Pact. Institutional design in the self-commitment dilemma . Dissertation, 2005, kups.ub.uni-koeln.de

- Martin Heipertz, Amy Verdun : Ruling Europe - The Politics of the Stability and Growth Pact . Cambridge University Press, 2010

- Kai Hentschelmann: The Stability and Growth Pact . Nomos, Baden-Baden 2009.

- Kai Hentschelmann: The Stability and Growth Pact as a regulatory framework in times of crisis . (PDF; 488 kB), Europa-Kolleg Hamburg, Institute for European Integration, Discussion Paper No. 1/10, 2010.

- Helmut Schmidt : When stability becomes a fetish . In: Die Zeit , No. 12/2005.

- Björn Hacker, Till van Treeck (): How influential will European governance become? Reformed Stability and Growth Pact, Europe 2020 Strategy and “European Semester” . (PDF; 172 kB) Friedrich Ebert Foundation, 2010

Web links

- Official EU website on the topic of the Stability Pact

- European Commission. Economic and Financial Affairs. Current.

- No growth on credit? How Merkel & Co. do not ask crucial questions

Individual evidence

- ^ Official Journal of the EC . C, No. 83, 2010, pp. 201-328.

- ^ Official Journal of the EC. L, No. 209, August 2, 1997, p. 1.

- ^ Official Journal of the EC. L, No. 209, August 2, 1997, p. 6.

- ^ Official Journal of the EC. C, No. 236, August 2, 1997, p. 1.

- ↑ Horst Siebert: Why the European Monetary Union needs the Stability Pact . Kiel Working Paper No. 1134, 2002, p. 2

- ^ Christian Konow: The stability and growth pact . 1st edition. Nomos Verlagsgesellschaft, Baden-Baden, 2002, p. 19

- ↑ bundesfinanzministerium.de ( Memento of the original from March 5, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ European Union Portal, Corrective Component: Excessive Deficit Procedure, ( Online )

- ^ Bill Mitchell: Options for Europe - Part 40 . Economic outlook, March 6, 2014

- ↑ How the Maastricht Criterion came about in the Louvre . FAZ, September 26, 2013

- ^ The secret of 3% finally revealed . Presseurop, Le Parisien, September 28, 2012

- ↑ a b The foundations of the Stability and Growth Pact: O Holy Trinity! , Reverse pages, July 4, 2014

- ^ Hans-Peter Schwarz : Helmut Kohl. A political biography . Deutsche Verlagsanstalt, Munich 2012, ISBN 978-3-421-04458-7 , 1052 S, Part V, section “Euro-Fighter”.

- ^ Christian Reiermann, Klaus Wiegrefe: Herr und Helfer . In: Der Spiegel . No. 29 , 2012, p. 32-34 ( online ).

- ↑ Sven Afhüppe, Konrad Handschuch: Wrong strategy . In: Wirtschaftswoche , No. 41/2002, pp. 40–41

- ↑ Court of Justice strengthens Stability Pact . faz.net

- ↑ EU ends deficit proceedings against Germany ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. . Reuters

- ↑ EU Commission recommends criminal proceedings against highly indebted Italy. In: focus.de. June 5, 2019, accessed June 5, 2019 .

- ↑ EU Commission recommends excessive deficit proceedings against Italy. In: spiegel.de. June 5, 2019, accessed June 5, 2019 .

- ↑ The Bad Guy in the Right . ( Memento of the original of December 13, 2008 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. Southgerman newspaper

- ↑ Four EU countries have to reckon with excessive deficit procedures . Spiegel Online , March 24, 2009; Retrieved October 7, 2009.

- ↑ European Union takes action against deficit sinners . Spiegel Online , July 7, 2009; Retrieved October 7, 2009.

- ^ National debt: Brussels punishes Austria . Die Presse , October 7, 2009; Retrieved October 7, 2009.

- ^ Commission presents excessive deficit reports for five countries. European Commission, Economic and Financial Affairs, May 12, 2010.

- ↑ Press release of July 12, 2017 . europa.eu

- ↑ Closed procedure (2004–2017)

- ↑ Closed procedure (2008-2017)

- ↑ ec.europa.eu

- ↑ France incurs little enough debt . FAZ.net, May 23, 2018

- ↑ a b Excessive deficit procedures - overview . ec.europa.eu (with a link list Overview of closed excessive deficit procedures )

- ↑ see also Ongoing procedure , accessed on June 5, 2019.

- ↑ EUROPA press releases, Brussels, December 12, 2012: "EU" Six-Pack "on economic governance comes into force"

- ↑ Alternatively, tax increases would also be conceivable, but these are seen as unlikely compared to cuts: Mechthild Schrooten: European debt brake (PDF) FES, May 2012

- ↑ a b Hearing in the German Bundestag BT on June 6, 2012 - Statement by Prof. Dr. rer. pole. Heinz-J. Bontrup, printed matter 17/9040 and 17/9649. Video and nachdenkseiten.de (PDF) pp. 9–14

- ↑ Horst Siebert: Why the European Monetary Union needs the Stability Pact . Kiel Working Paper No. 1134, 2002, p. 15

- ↑ Questions and answers on the euro crisis. Konrad-Adenauer-Stiftung , May 15, 2012 (original version, updated)

- ^ Jean Pisani-Ferry, André Sapir, Benedicta Marzinotto: Two crises, two responses. ( Memento of the original from March 31, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. BRUEGEL Policy Brief, March 22, 2010.

- ↑ Declaration on support for Greece by the member states of the euro area. (PDF; 16 kB) Communication to the Finance Committee of the German Bundestag, April 13, 2010.

- ↑ Criticism in Germany of the Greece package is growing. Reuters, April 16, 2010.

- ↑ Klaus Busch: Will the Euro fail? Structural problems and political failures bring Europe to the brink . (PDF; 800 kB) IPA of the FES, 2012

- ↑ The European Stabilization Mechanism. ( Memento of the original from May 19, 2010 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. Federal Government, May 11, 2010.

- ^ IMF Welcomes European Actions to Stabilize Euro Area. Press Release No. 10/188, May 9, 2010.

- ↑ Declaration by the heads of state and government of the euro area, Brussels, May 7, 2010. ( Memento of the original of December 4, 2011 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. / Revised version of the conclusions of the Council (Economic and Financial Affairs) of 9 May 2010 adopted on 9 May 2010. ( Memento of the original of 4 December 2011 on the Internet Archive ) Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Transcript of a Press Briefing by International Monetary Fund First Deputy Managing Director John Lipsky on the Euro Countries Stabilization Measures. IMF, Washington, May 10, 2010.

- ↑ 9596/10 (Presse 108) (PDF; 64 kB) Preliminary press release for the meeting in Brussels on 9/10. May 2010.

- ^ Köhler signs law for euro stabilization. Reuters Germany, May 2, 2010.

- ↑ Plan d'aide européen: la quote part française soumise aux députés. Le Monde , May 31, 2010.

- ↑ Le Parlement français adopte le plan de sauvetage de l'euro. Le Monde, June 3, 2010.

- ↑ Reinforcing economic policy coordination in the EU and the euro area. European Commission, Economic and Financial Affairs, May 12, 2010.

- ↑ (hen / apn / dpa), finance ministers seal the euro rescue mechanism. Handelsblatt , June 7, 2010.

- ↑ Special purpose vehicle for failing states. ( Memento of the original from June 11, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Luxemburger Wort , June 8, 2010.

- ↑ 3 1 May 2010 - Financial Stability Review June 2010

- ^ Jack Ewing: European Central Bank's Report Issues Warning. The New York Times , May 31, 2010.

- ↑ Alessandro Leipholz: Preventing Greek Tragedy from Becoming Disaster. Lisbon Council e-letter. Issue 06/2010.

- ^ André Sapir , Mathias Dewatripont, Gregory Nguyen, Peter Praet: The role of state aid control in improving bank resolution in Europe. ( Memento of the original from December 4, 2011 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. BRUEGEL Policy Contribution, May 17, 2010.