APV approach

The adjusted present value or the APV method ( APV : English for A djusted P resent V alue or German net present value method-adjusted , short ABW ) is one of the discounted cash flow (DCF) method of the company - and project evaluation. The thoughts on the "Adjusted Present Value" were developed and published by Myers .

overview

The APV method, also the concept of the adjusted present value , is one of the entity methods of DCF valuation - like the WACC approach or the TCF approach . As part of this process, the value of a company's equity is determined by subtracting net financial liabilities from the company's total entity value.

The individual entity valuation approaches differ in the consideration of the proportionate external financing of the valuation object. In contrast to the WACC approach, the APV procedure determines the company value in its "classic" form, initially assuming full self-financing (market value of the (fictitious) non-indebted company - EVu). For this purpose, the free cash flows are discounted with the equity costs of the non-indebted company (r (EK) u). In a second step, the market value of the debt-free company is increased by the discounted tax savings from debt interest ( tax shields ) brought about by the debt . The sum of the market value of the non-indebted company (EVu) and the value contribution of the Tax Shields (WBTS) results in the market value of the total capital (EVv, Enterprise Value). After deducting the market value of the debt capital, the market value of the equity remains (equity value, EK).

The tax shields for the respective period are determined by the tax deductibility of the interest on borrowed capital. Therefore, the interest on borrowed capital has to be multiplied by the corporate tax rate (s) and subsequently taken into account to increase value. When determining the value contribution of the Tax Shields (WBTS), a risk-adjusted interest rate (rTS) is to be used to capitalize the tax advantages from the deductibility of the interest on debt capital (Tax Shields). In practice, borrowing costs (rFK) or the return demand of equity providers for the non-indebted company (rEKu) are mostly used for this. However, the assumptions on the risk content of the tax shields are not only relevant when applying the APV procedure. If consistent valuation results are to be achieved with the simultaneous application of all three DCF methods, the beta factor adjustment formula for the capital structure based on the same risk content of the tax shields must be used for the WACC and equity approaches.

The advantage of the APV approach consists in the precise (quantitative) determination of the tax benefit from a proportionate external financing, whereby a higher transparency of the valuation result is achieved. If it continues to be assumed that the company operates what is known as autonomous financing (in the case of autonomous financing, the future repayment or new borrowing is already specified for the entire future, deviations or other uncertainties are excluded), then the use of the APV approach as it circumvents the circularity problem . For further advantages and disadvantages, reference is made to Enzinger, Kofler .

Adaptation of the APV evaluation equation according to Enzinger / Pellet / Leitner

According to the “classic” APV procedure, the debt, i. H. the relation of the market value of the debt capital to the market value of the equity capital, only taken into account by the present value of the discounted tax savings from the debt capital costs (WBTS, value contribution of the tax shields). As the level of debt or borrowing costs increases, the market value of the total capital also increases. In company valuation, the uncertainty of future cash flows is usually mapped in the discount rate based on the risk premium on the risk-free base rate. The risk premium is regularly determined using the Capital Asset Pricing Model (CAPM). The risk premium is determined as the product of the multiplication of the beta factor (ß - as a measure of the systematic risk assumed by the investment) and the market risk premium (MRP). The return demand for the investor is determined by adding the risk-free base rate and the risk surcharge:

To determine the company value according to the APV method, it is necessary to differentiate between the sizes of the return demand of the lenders within the meaning of CAPM (rFK) and the interest on borrowed capital (iFK). The interest on borrowed capital is determined as the effective interest burden and corresponds to the expected payments from the company's perspective. The interest on debt not only includes surcharges to the risk-free interest rate (credit spread), which can be explained on the basis of systematic risks, but also those that are unsystematic in terms of CAPM and a surcharge to compensate for the costs and profit margin of the lender:

While the actual payment is relevant for the derivation of the cash flow, which is determined regardless of the systematic or unsystematic nature of individual surcharges, when determining the discount rate according to the CAPM, only the systematic component of the credit spread is relevant. Consequently, when deriving the beta factor for debt capital (Debt Beta), the debt capital providers' return requirement (rFK) must be used in order to subsequently determine a CAPM-compliant interest rate. In valuation practice, however, the borrowed capital rate (iFK including the unsystematic surcharges mentioned) is regularly used to determine the debt beta. This approach makes it possible to achieve consistent valuation results between the APV method in its "classic" form, the WACC approach and the equity approach, as the unsystematic components of borrowed capital interest are taken into account in all three calculation methods either in the cash flow or in the discount rate. Since there is no differentiation between borrowing costs and borrowing costs, strictly speaking it is only applicable if the borrowing costs correspond to the borrowing costs, i.e. H. if one abstracts from surcharges for the compensation of unsystematic risks as well as for other costs and from the profit margin in the debt capital interest. The prerequisite for application is therefore the implicit but unrealistic assumption that the credit spread is solely due to systematic risks.

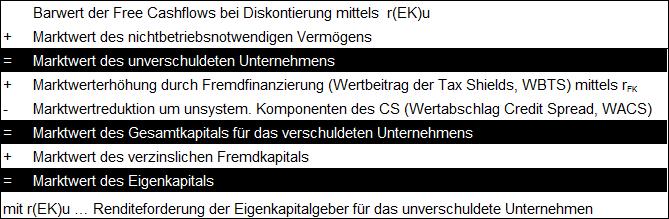

If the borrowing costs (iFK) - as is usual in practice - are higher than the borrowing costs (rFK), the APV valuation equation must be adjusted to avoid overvaluations. The difference between the agreed borrowing costs (iFK) and the borrowing costs (rFK) represents payments that cannot be explained by the CAPM and are therefore not included in the cost of capital, but rather by deducting the cash flows. This difference is therefore systematically assigned to the service area and not to the financing area. From the total of the market value of the non-indebted company (EVU) and the value contribution of the Tax Shields (WBTS), a value deduction for components in the credit spread that cannot be explained by the CAPM (value deduction credit spread, WACS) must be deducted. This deduction is determined as the capitalized difference between the agreed borrowing costs and the borrowing costs, taking into account the tax deductibility of this difference (1-s). The adapted APV calculation scheme shows the following picture:

The increase in market value due to debt financing, which can be attributed solely to the tax deductibility of debt capital costs (WBTS, value contribution Tax Shields), represents a market value reduction in the adapted APV valuation equation due to components in the credit spread that cannot be explained by the CAPM (WACS, value reduction credit spread ) across from. The assumption of systematic risk by the lenders and thus the reduction of the (capital structure) risk of the equity investors can be mapped appropriately so that overvaluations are avoided.

In order to continue to achieve consistent and therefore correct valuation results according to the WACC and equity approach, the debt beta must be determined using the return requirement of the lenders (rFK). Which guarantees the CAPM-compliant determination of the beta factor.

literature

- Sasson Bar-Yosef: Interactions of corporate financing and investment decisions: Implications for capital budgeting. Comment. In: The Journal of Finance. Vol. 32, No. 1, March 1977, ISSN 0022-1082 , pp. 211-217.

- Tom Copeland, Tim Koller, Jack Murrin: Company Value . Methods and strategies for value-oriented corporate management. 3rd, completely revised and expanded edition. Campus-Verlag, Frankfurt am Main et al. 2002, ISBN 3-593-36895-1 .

- Aswath Damodaran: The Adjusted Present Value Approach .

- Jochen Drukarczyk, Andreas Schüler: Company Valuation . 6th, revised and expanded edition. Verlag Franz Vahlen GmbH, Munich 2009, ISBN 978-3-8006-3636-5 .

- Alexander Enzinger, Peter Kofler: The Adjusted Present Value procedure in practice. In: Heinz Königsmaier, Klaus Rabel (ed.): Company valuation. Theoretical basics - practical application. Festschrift for Gerwald Mandl on his 70th birthday. Linde, Vienna 2010, ISBN 978-3-7073-1606-3 , pp. 185-217, (PDF; 1.11 MB) .

- Joachim Krag, Rainer Kasperzak: Basics of company valuation. Verlag Franz Vahlen GmbH, Munich 2000, ISBN 3-8006-2416-8 .

- Frank J. Matzen: Company valuation of housing construction companies. With special consideration of taxation and financing (= writings on real estate economics. Vol. 32). Rudolf Müller Verlag, Cologne 2005, ISBN 3-89984-138-7 (also: Oestrich-Winkel, European Business School, dissertation, 2005).

- Stewart C. Myers: Interactions of corporate financing and investment decisions: Implications for capital budgeting. Reply. In: The Journal of Finance. Vol. 32, No. 1, March 1977, pp. 218-220.

Individual evidence

- ↑ a b [1] , Alexander Enzinger, Peter Kofler, The Adjusted-Present-Value-Procedure in Practice: At the same time a contribution about Debt Beta and safe or unsafe tax shields , in: Heinz Königsmaier, Klaus Rabel (Eds.) : Company valuation. Theoretical basics - practical application. Festschrift for Gerwald Mandl on his 70th birthday. Linde, Vienna 2010, ISBN 978-3-7073-1606-3 .

- ↑ [2] , KFS / BW1 - Expert opinion of the Expert Senate for Business Administration and Organization of the Chamber of Public Accountants for Company Valuation, margin no. 44.

- ↑ [3] , Alexander Enzinger, Peter Kofler, DCF method: Adjustment of the beta factors to achieve consistent evaluation results .

- ↑ [4] , Alexander Enzinger, Markus Pellet, Martin Leitner, Debt Beta and Consistency of Valuation Results, RWZ 7-8 / 2014 .

- ↑ a b c [5] , Alexander Enzinger, Markus Pellet, Martin Leitner, Der Wertabschlag Credit Spread in the APV procedure, Assessment Practitioner 4/2014 .