Credit Linked Note

The term Credit Linked Notes ( CLN for short ) refers to bonds , the repayment amount of which depends on certain contractually agreed credit events . They belong to the structured financial products . They enable the issuer to hedge credit risks with bonds and at the same time enable the investors to participate in the returns on the reference debt.

A credit linked note consists of a combination of a bond from the issuer of the CLN and a credit risk hedging transaction of the issuer in the form of a purchased credit default swap (CDS). From the bond, the issuer undertakes to repay the nominal amount of the bond in full on the redemption date . At the same time the issuer has in emission bought the bond a CDS on a specific reference debt and pays the seller of the CDS (investor) a premium (premium over the basic interest rate). The CLN's credit risk can encompass a single security (loan or bond) or a portfolio of risks (essentially loans).

If no credit event occurs during the term, the CLN pays interest for the entire term and is repaid in full at the end of the term.

If a credit event occurs, the issuer would be obliged to repay the face value in full due to the bond. On the other hand, the investor in the CLN (credit risk taker) would at the same time be obliged to make a compensation payment from the CDS. As part of the loan agreement , both payments are netted , which means that the issuer is only obliged to make the difference between the two payments.

A typical credit event is the default of a reference loan or a reference bond. If the reference loan defaults, the credit linked note will not be repaid (total failure) or only partially (recovery value) (see netting of the two payments). The credit risk of the reference debt (ies) can either be generated by the issuer via the market (sold CDS) or can relate to the issuer's own credit risks (one or more loans or bonds).

Credit linked notes thus offer the possibility of transferring credit risks from the seller to the buyer, whereby the credit risks can be combined in almost any way.

| Payment flows of a credit linked note | |

|---|---|

Scenario 1: The failure event does not occur

|

Scenario 2: The failure event occurs

|

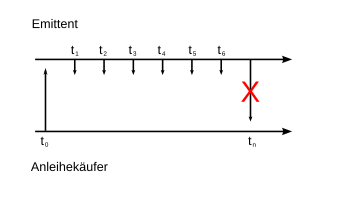

The two graphics show the payment flows of a credit linked note.

Scenario 1 describes the payment flows if the agreed default event does not materialize. At time t 0 , the bond buyer provides the issuer with capital in the amount of the nominal value. In return, the latter receives a mostly regular interest payment (t 1 to t 6 ) which ensures a market rate of interest on the capital and includes a risk premium for assuming the default risk. On the agreed due date (t n ), the bond buyer receives his invested capital back.

Scenario 2 differs from this in that the agreed credit event occurred. Accordingly, the issuer retains the capital invested by the bond purchaser at the end of the term (t n ).

In contrast to credit default swaps , in which the protection seller only pays the agreed amount to the protection buyer when the credit event occurs, the buyer of a credit linked note pays the purchase price at the time of purchase and receives the repayment at the end of the term if the credit event occurs did not occur. In the case of the credit linked note, the protection seller must therefore bear the issuer risk for the credit linked notes issued by the protection buyer in addition to the default risk of the reference credit.

Goals of CLN

a) Relief of the issuer's own funds

For the issuer, the proceeds from the issue serve as a cash hedge against the credit risk, which means that the original risks no longer have to be backed with own funds and can thus be used as an instrument for credit risk and own funds management.

b) Risk diversification and generation of income for the investor

CLNs offer an easy way for investors to diversify their credit risk at "fair prices" into markets to which they would not have access under normal business activity. At "fair prices" because the risk premium corresponds to the estimated credit risk (internal or external credit rating). In addition, CLN credit derivatives are also available to investors who cannot or are not allowed to enter into credit default swaps, such as private investors or insurance companies.

For credit bonds which plans Federal Financial Supervisory Authority (BaFin) for reasons of investor protection, a ban on retail sales to private customers. As of 2016, the affected market volume was around 6 billion euros. At the end of 2016, BaFin postponed the announced ban, as the certificates industry had committed itself to more transparency and investor protection in a voluntary commitment for the issue and sale of creditworthiness-dependent bonds.

Individual evidence

- ↑ BaFin press release of July 18, 2016, en

- ^ Daniel Mohr: Debate about financial products: Certificates industry seeks compromise with Bafin . In: Frankfurter Allgemeine Zeitung . September 2, 2016, ISSN 0174-4909 ( faz.net [accessed September 14, 2016]).

- ↑ Federal Financial Supervisory Authority: Credit bonds : Certificates industry reacts to the announced sales ban. December 16, 2016, accessed November 28, 2017 .