Forward (economy)

Forwards are unconditional forward transactions that are not traded on the stock exchange and as such belong to the group of derivatives .

A forward is an agreement to buy or sell an asset at a specific price and at a specific time in the future. This makes forwards the over-the-counter counterpart to futures . Typical values that are traded via forward are financials and metals.

Description of the business type and terminology

A forward is a contract to buy or sell

- a certain amount (nominal) of a certain good ( base value )

- at a certain price (exercise price)

- at a certain point in time in the future ( due date , fulfillment time ).

An example: Lots A and B agree today that A will sell 100 units of a certain federal bond to B in 3 months from today at a price of EUR 105. It is therefore a forward securities transaction. If it is due in 3 months, the futures contract will be fulfilled by A delivering 100 bonds to B and B paying A EUR 10,500 for them. The forward transaction is pending until it is fulfilled.

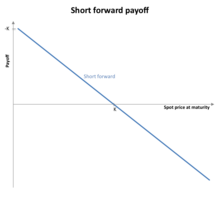

A is the futures seller. Its exposure is also known as a short position . Accordingly, B is the forward buyer and accordingly has a long position .

Forwards can be differentiated according to the type of good traded and the type of fulfillment. According to the base value, a distinction can be made between forwards on goods (e.g. agricultural products) and on financial instruments (e.g. shares , foreign exchange ). On the other hand, the underlying assets can be divided into storable (including financial instruments) and non-storable (e.g. electricity).

With regard to fulfillment, a distinction is made between payment and delivery on the one hand and cash settlement on the other . In the case of payment and delivery (physical delivery), the base value is actually delivered to the buyer against payment of the agreed forward price. In particular in the case of currencies that are not freely tradable, for example, there may be restrictions that limit the possibilities of such a transaction.

In the case of cash settlement, a payment is made when the due date corresponds to the difference between the agreed forward price and the current spot price of the basic goods at the due date .

In the above example, the fulfillment type payment and delivery was assumed. For the settlement type cash settlement, the example can be continued as follows: In the event of settlement, the market price of the federal bond is EUR 107. Since the market price is higher than the agreed price, seller A pays buyer B the difference of EUR 2 per bond (EUR 107 market price minus EUR 105 agreed price), i.e. a compensation payment of EUR 200 for 100 bonds. B can now buy the bonds on the cash market at a total price of EUR 10,700 if required. After deducting the equalization payment of EUR 200, he paid EUR 10,500 net, i.e. the net price of EUR 105 agreed in the forward for each bond.

The non-standardized forwards offer the parties greater flexibility compared to futures, but generally also lower market liquidity .

rating

A forward concluded at the fair forward rate has a value of zero at the time of conclusion. In reality, a forward is not necessarily concluded at the fair forward rate (e.g. because of excess supply or demand on the futures market or because of the bid-ask spreads ), and the fair forward rate changes over time.

From the perspective of the forward seller, the value of a forward with a due date T and exercise price K is determined using the following formula:

,

where F is the fair forward price. The value is therefore the difference, discounted to the current point in time, between the agreed exercise price K and the current fair forward price F.

literature

- John C. Hull : Options, Futures and Other Derivatives . 3rd edition, Prentice Hall 1997. ISBN 0-13-264367-7