Last in - first out

Last In - First Out ( LIFO , English for last in - first out ) describes the way in which

- Goods are stored in a warehouse (see also storage )

- Consumables are valued and taxed - LIFO as a consumption sequence method names the assumption that the most recent stocks are or have been used first. In LIFO valuation in accounting, this assumption is only made fictitiously for valuation purposes. However, a different warehouse management (e.g. FIFO) can also have been selected effectively or physically.

- Data are stored in a stack or storage area and can be called up again. The same term is "Last Come, First Served" (LCFS).

principle

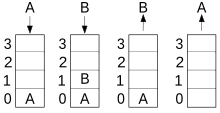

The LIFO principle is similar to a vertical stack of books. Elements are retrieved in exactly the opposite order in which they were previously placed, that is, the first ("bottom") element is retrieved last. Accordingly, the last ("top") element is called up first.

The operation in which a new object is put on the stack is called "push". With the "Pop" operation, the top object (top of stack) is read and deleted at the same time. If the top object is only to be read and not deleted, an operation called "Top" or "Peek" is used.

The terms push and pop arose from the similarity to a stack of trays in a cafeteria: If a tray is placed on top of the stack, the stack is pushed down ( to push ); if a tray is removed from the stack, the stack “pops” up.

All programming languages use LiFo memory ( stack memory ) for internal purposes, the stack- oriented languages also for operations with data.

Types of the LiFo procedure (in tax law)

The assessment according to the Lifo method can be carried out both by permanent LiFo and by period LiFo (see also R 6.9, Paragraph 4 EStR ) .

Permanent LiFo process

With the permanent LiFo method, the inflows and outflows are continuously (permanently) recorded in terms of quantity and value, so that the stocks are constantly updated.

Period LiFo method

The period LiFo method represents a simplification in the relationship that the inventory changes only have to be determined within certain time periods (e.g. the financial year). If there are no changes in stocks at the end of the period, the values of the opening stocks are to be used. If the inventory has increased, the excess inventory is to be set at the acquisition or manufacturing costs of the first inventory additions in the financial year or the average acquisition or manufacturing costs of all additions in the financial year. This creates a new layer to be assessed separately in the amount of these costs. If the stock has become smaller, the shortfall is to be deducted from the layer (or layers) that were last formed to their (their) evaluation (s) of the initial stock.

See also

- First Expired - First Out (FEFO)

- First In - First Out (FIFO)

- Highest In - First Out (HIFO)

- Lowest In - First Out (LOFO)