social plan

According to the legal definition of Section 112 (1) sentence 2 BetrVG , a social plan is an agreement between the works council and the employer to compensate for or mitigate the economic disadvantages that employees suffer as a result of planned changes to the company . A social plan also comes into being if the decision of the arbitration board replaces the social plan, Section 112 (4) BetrVG .

The social wage agreement that makes comparable regulations without being bound by the provisions of works constitution law is not a social plan .

requirements

Changes in operations of a certain magnitude trigger the employer's obligation to inform the works council, § 111 BetrVG , to seek a balance of interests with him and to set up a social plan, § 112 BetrVG .

The minimum requirement is that more than 20 employees who are entitled to vote are employed in the company and that changes to the company are planned that could result in significant disadvantages for considerable parts of the workforce, Section 111 sentence 1 BetrVG .

If an agreement on the reconciliation of interests and the social plan cannot be reached through negotiation, the employer or the works council can call the arbitration board.

The arbitration board can only decide on the social plan by means of a verdict. The ruling of the arbitration board then replaces the agreement of the parties to the company, Section 112 (3) BetrVG. The employer can thus be forced to finance the social plan.

When making its decision, the arbitration board must take into account the social concerns of the employees concerned and the economic viability of the company. When compensating or mitigating the economic disadvantages, in particular a reduction in income, the elimination of special benefits or the loss of entitlements to a company pension, moving costs or increased travel costs are to be recorded; the circumstances of the individual case must be taken into account. The prospects of the employees concerned on the labor market must be taken into account, Section 111 (5) BetrVG .

The Federal Labor Court initially saw the purpose of the social plan in older decisions as both compensation and the future-related bridging function. In recent case law, however, it emphasizes the future-oriented compensation and bridging function. The main content of social plans are severance payments in the event of job loss. The envisaged services do not represent remuneration for the services provided in the past, but are intended to compensate for the future disadvantages that the employees may experience as a result of the change in the company.

Despite this clear legal regulation on the social plan, in practice the length of service is also regularly used as a criterion for determining the severance payment.

Procedure for determining the social plan volume

The negotiation process is to be designed in such a way that the negotiating parties must in particular endeavor to compensate for the ascertainable or expected material losses suffered by the employee in individual cases. An "arbitration board ... must compensate for the disadvantages for the employees resulting from the change of company as specifically as possible." The prospects of job seekers on the labor market according to age, education, skills, special qualifications, special features such as severe disability and to be considered differently. However, flat-rate compensation payments for disadvantages can also be appropriate if the specific disadvantages of the employees cannot be predicted.

Only when the specific disadvantages for the employees caused by the change in the company have been determined, taking into account factors that reduce the social plan, it can be determined whether the determined social plan volume is to be regarded as economically justifiable for the company or not.

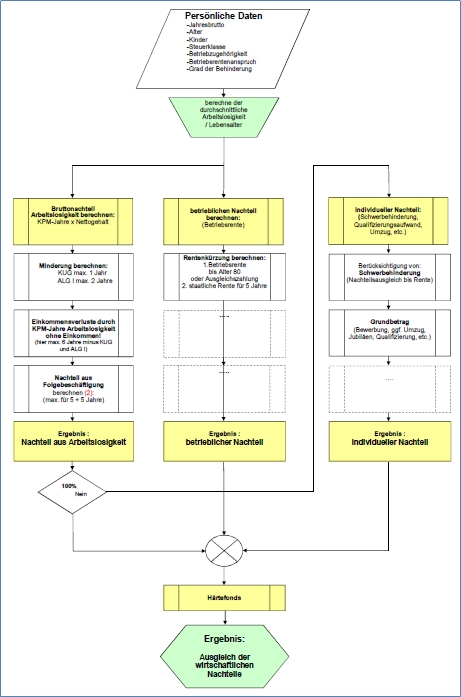

Calculation scheme for determining the disadvantage for a social plan

Building blocks for specifying the disadvantages

A social plan is made up of the following social plan modules:

- Module 1: Probable duration of unemployment

- Module 2: Loss of income from subsequent activities

- Module 3: Loss of statutory pension

- Module 4: Losses in the company pension

- Module 5: Basic amount of the severance payment

- (For example for individually expected application costs, reduced existing and dismissal protection in the case of new hires, the possible reduction in vacation days, as well as financial benefits for relocation of the place of employment)

- Module 6: Consideration of resignations

- Module 7: Particular disadvantages for the severely disabled

If the disadvantages are not fully offset, other socio-economic factors must be taken into account, for example:

- children

- immaterial damage

- Maintenance obligations (spouse etc.)

Economic justifiability of a social plan - drawing of boundaries

In § 112 , para. 5, line 2 no. 3 WCA is already contain a demarcation. According to this, in an economically inefficient company, in the event that a large part of the workforce is laid off, drastic burdens up to the edge of the continued existence of the company can be justifiable.

The Federal Labor Court provides for assessing the economic viability of a social plan z. B. the cost savings of two years or the long-term savings effects, which are associated with the change of company, as a possible measure of economic viability. Thus, investment calculation methods can also be used to check whether an investment is economically justifiable, as they are also used to assess the profitability of an investment; z. B. Amortization calculation, internal rate of return method or cost and profit comparison calculation . What does the operational change cost compared to not doing it?

Basically, economic justifiability is only a corrective to determine the upper limit of a social plan. A limit is reached when the company's liquidity at the time the social plan is paid out would no longer be sufficient or future jobs would be jeopardized. Therefore, the insolvency criteria (over-indebtedness and insolvency) may determine the economic reasonableness of a social plan.

Group companies A different assessment may be made for group companies. If there is a domination and profit and loss transfer agreement and the controlling company has not given adequate consideration to the own interests of the dependent company, an assessment procedure can be considered.

Investment company An investment company is also liable as joint and several debtors for the claims of the employees of the operating company, which are justified within five years after the demerger takes effect on the basis of Sections 111 to 113 of the Works Constitution Act. This also applies if the assets remain with the transferring legal entity and are made available for use by the accepting or new legal entity or the accepting or new legal entities. However, the assessment penetration according to Section 134 (1) UmwG on the economic performance of the investment company when determining the social plan volume for the operating company is not unlimited. The amount is limited to the assets withdrawn during the demerger.

Further areas of regulation are regulations on transfer companies according to § 110 f. SGB III or regulations on transfers and transfers as well as qualification.

A social plan has the normative effect of a works agreement . The blocking effect of Section 77 (3) BetrVG does not apply to him. This means that a social plan can also be effectively agreed if a collective agreement , for example in the form of a social collective agreement , already contains provisions on the compensation of economic disadvantages in the event of operational changes.

In contrast to the reconciliation of interests, the social plan can generally be enforced via the conciliation body. Exceptions apply, however, to start-ups (the company has not yet existed for four years) and changes to operations that are limited to a mere reduction in staff if the required minimum number of terminations ( Section 112a BetrVG) is not reached.

literature

- Bertold Göritz, Detlef Hase, Rudi Rupp: Handbook of reconciliation of interests and social plan. 6th edition. Bund-Verlag, Frankfurt 2012, ISBN 978-3-7663-6148-6 .

Web links

Individual evidence

- ^ Fitting, Engels, Schmidt, Trebinger, Linsenmaier, Works Constitution Act, Hand Commentary, 26th edition, 2012, RN121, page 1803

- ↑ BAG, dated September 14, 1994 - 10 ABR 7/94, RN 26

- ↑ [1]

- ↑ a b BAG, dated May 6, 2003 - 1 ABR 11/02, guiding principle

- ^ Göritz / Hase / Rupp, Handbook for reconciliation of interests and social plan, 5th edition, page 349.

- ↑ BAG, of March 15, 2011, 1 ABR 97/09, RN 32 e)