Bankruptcy forecasting process

As insolvency prediction methods are procedures referred to what the probabilities determine with those companies, individuals, states or other institutions within a specified time horizon, typically one year insolvent are. The following are procedures for forecasting corporate bankruptcies.

Development of corporate insolvencies in Germany

While there were around 10,000 corporate insolvencies per year in Germany at the beginning of the 1990s, their number rose to almost 40,000 by 2003/2004. With a company portfolio of around three million, this corresponds to an average insolvency rate of 1.3% per year. Depending on the company segment, significantly higher values were recorded. In the following years, the number of bankruptcies decreased again and amounted to around 30,000 between 2007 and 2011. At the beginning of the 1990s, the amount of the newly arisen insolvency claims was around 6 billion EUR per year, in the 2000s, however, mostly between 30 and 40 billion EUR, in individual years (2002 and 2009) even values of 62 and 85 billion respectively EUR reached. Experience has shown that 90 to 95% of insolvency claims are unrecoverable.

Motivation for development

The ability to create precise forecasts of corporate insolvencies, but also the ability to determine recommendations for action to avoid insolvencies, is of great importance both from an individual and from an economic perspective. At the individual level, in addition to owners, employees, customers, suppliers, auditors and other business partners of a company, banks in particular are interested in precise insolvency forecasts, as they regularly have to record considerable damage in the event of company insolvencies. The administrative expenses ( bankruptcy trustee ) and costs associated with liquidating the assets of the insolvent company alone consume on average between 15% and 20% of the gross liquidation proceeds.

From a banking perspective, insolvency forecasts are an essential prerequisite for being able to implement risk-based pricing and the structuring of non-financial credit terms (limits, required collateral ). Lending processes must be designed cost-effectively (by identifying critical cases that require more complex support from credit experts), increasing one's own liquidity through the creation of securitization options , and determining and managing the economic and regulatory capital requirements . From an economic point of view, insolvency forecasting procedures are seen as an important prerequisite for the stability of the banking system . Excessive credit risks have been the most frequent cause of the over 100 bank insolvencies in (West) Germany since the 1960s. Also, over 90% of regulatory capital requirements for banks relate to credit risk hedging. Furthermore, the availability of efficient insolvency forecasting procedures is a necessary prerequisite in order to motivate borrowers to behave in an incentive-compatible , risk-conscious manner. Market failure in the sense of a complete withdrawal of banks or other lenders from the financing of companies in above-average risky segments can also be avoided through more efficient insolvency forecasts .

classification

The current state of science in insolvency forecast research is characterized by a variety of methods. One reason for this diversity is likely to be the lack of a currently generally accepted, comprehensive theoretical foundation for explaining corporate insolvencies. The reason for the variety of insolvency forecasting techniques is also likely to be that numerous procedures, which have often already proven themselves in contexts other than insolvency forecasting, can be rejected as unsuitable or inferior. Furthermore, depending on the basic availability or the accepted costs of collecting information, a large number of different data sources and types of data can be used for the purposes of the insolvency forecast, the aggregation of which sometimes requires different procedures or makes them appear useful for statistical and technical reasons. The following figure provides an overview of the large number of insolvency forecasting methods used in science and practice.

Bankruptcy forecasting processes can be broken down into formal and informal bankruptcy forecasting processes. In the informal process, human loan decision makers make bankruptcy predictions based on their intuition and personal experience. Formal procedures, on the other hand, are based on explicitly set procedural rules. The formal procedures distinguish between inductive, (parametric and non-parametric) empirical-statistical and structural procedures. The inductive methods include, for example, scoring models and expert systems . In the parametric empirical-statistical methods, the multivariate linear discriminant analysis and the logistic regression analysis are important. Among the non-parametric empirical-statistical insolvency forecasting methods, the decision tree methods and artificial neural networks should be mentioned. The structural insolvency forecast models include bond spread-based and option price models as well as deterministic and stochastic simulation methods .

The first formal, multivariate corporate insolvency forecasting method was Altman's (1968) Z-factor model (Altman's Z-Score), a discriminant analysis model .

Data sources

Overview

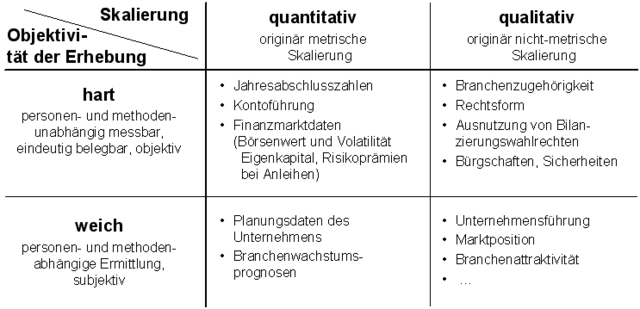

Numerous data sources can be used to forecast corporate bankruptcies. Depending on the objectivity of their survey (“hard” vs. “soft” data) and depending on whether the corresponding data are originally metrically scaled or not (“quantitative” vs. “qualitative” data), a total of four groups of input variables can be identified different for bankruptcy forecasting procedures, see the following figure.

Hard quantitative data

Hard quantitative data are data that are originally metrically scaled and can be collected independently of methods and people. Of particular relevance in the context of the corporate insolvency forecast are annual financial statements , information on account management behavior and financial market data (level and volatility of the company's market capitalization , level of the risk premium on the company's listed debt ). The advantages of account management and market data compared to accounting data are that they are much more up-to-date. They can be updated daily and there are practically no (additional) costs to collect them. They can also hardly be manipulated by companies. An important advantage of market data over account management and accounting data is seen in their "forward-looking nature". It is assumed that market data - via the rational expectations of market participants - are influenced by future developments in companies and not by their past - as is the case with account management and bookkeeping data . However, only very few companies have listed equity or borrowed funds. Information on account management behavior is exclusively available to the respective lending banks - and only after they have granted loans to the respective companies. The data situation is best for year-end data, which includes information on the balance sheets , the profit and loss accounts and the asset analysis . Annual financial statements data are characterized by a relatively low recording effort. Your survey does not require any special knowledge. Your survey is not subject to any subjective influences and does not offer any possibilities for targeted manipulation that could not easily be determined beyond doubt by subsequent controls. Input errors can be easily identified and corrected due to the redundant data structure. Systematic evaluations of the annual financial statement documents, "whereby in addition to the balance sheet and income statement, in particular the additional explanations in the notes and management report are to be used", reveal many of the possibilities - and, if necessary, neutralize them later - with which the company's earnings and assets are deliberately distorted should.

Hard qualitative data

Hard qualitative data are nominally or ordinally scaled data that can be measured regardless of person and method and can therefore be objectively collected. In the context of empirical-statistical procedures, factors are uncovered that have an empirical connection with the failure probability of the company (“statistical clan liability”). In this context, the legal form and the branch affiliation are of particular importance - because the various branch and legal form groups are characterized by considerable and long-lasting differences in terms of their insolvency rates. For example, it can be seen that corporations in the construction industry in Germany had about fifteen times as high insolvency rates as sole proprietorships in the service industry over long periods of time .

Soft quantitative data

Soft quantitative data are metrically scaled data, the collection of which is subject to personal, subjective assessments (on the part of the respondent or the interviewer). Typical soft quantitative information in the context of the insolvency forecast are industry growth forecasts, quantitative information on operational risks or individual information from the companies relating to the sales, costs or profits planned for future periods. However, our own studies with medium-sized companies have shown that the majority of companies do not create (consistent) multi-year financial plans. The plan information provided by the companies is, on average, significantly positively distorted. They can presumably only be interpreted in the sense of "desired target values" , but do not represent expected values in the statistical sense. Round values are often given. The probability of occurrence of losses threatening the existence of the company is completely underestimated. It is particularly problematic that the plan details show considerable contradictions depending on the type of survey. Another disadvantage is that the collection of detailed planning data is time-consuming and expensive, since a large amount of data has to be collected in a form that is unusual for the company and requires explanation in the context of on-site discussions.

It is also not to be expected that companies will truthfully and comprehensively disclose their plan and risk information to third parties, in particular to banks or credit agencies, if they have to expect that this could have negative economic consequences for them. Subsequent sanctioning of "wrong" planning and risk assumptions are tightly limited. In retrospect, plausible reasons can always be put forward for missing planned sales or earnings targets that are beyond the company's control. Except in trivial cases, stochastic planning assumptions can never be classified ex-post with certainty as true or false. The sanctioning of missed plans would also set (additional) incentives for economically useless to harmful behavior, for example by shifting sales and / or costs and income to neighboring periods.

Soft qualitative data

Soft qualitative data are data that are not originally metrically scaled and whose collection is subject to subjective, evaluative influences. This includes, for example, questions about the company's potential for success , such as the "quality of accounting ", the "professional suitability of management " or "supplier dependency". The benefit of soft, qualitative data in the context of corporate insolvency forecasting is seen primarily in the fact that it should allow negative corporate developments to be identified at an early stage, i.e. before they manifest themselves in "bad" annual financial statements.

However, soft qualitative factors can only be recorded with a very low level of reliability , which suggests that these data have only a small (additional) predictive benefit.

Conclusion on data sources

The rating procedures of banks are typically based to a large extent on the evaluation of hard quantitative information and in particular on the statistical analysis of key figures derived from annual financial statements. Many of the insolvency forecast models presented in scientific studies, as well as the forecast models of commercial providers that were developed for cost-effective credit assessment of medium-sized companies, are limited from the outset to the analysis of such financial indicators. In some rating models, hard qualitative variables such as industry, legal form or regional origin are also taken into account.

Even if they offer many advantages in theory, the practical use ("future-oriented") of soft quantitative and soft qualitative data for forecasting bankruptcies is small. Surveying them causes comparatively high costs and is subject to incentive problems on the part of the respondents.

Even if the rating agencies deny that the judgments they give are essentially based on key figure analyzes, empirical studies have at least shown that the rating judgments of well-known agencies can be reproduced or forecast relatively well on the basis of (few) financial figures. It is also interesting that the considerable personnel expenditure that the commercial rating agencies make in preparing their rating judgments (and the considerable fees they charge for this) are not adequately reflected in the quality of their forecasts. With simple key figure models - when applied to identical data sets from companies - insolvency forecasts can be created with a quality that corresponds to the forecast quality of the rating judgments of renowned agencies or even exceeds them.

Classification of appraisal measures

In the following, the estimation quality of an insolvency forecast procedure is to be understood as the degree of correspondence between the insolvency forecasts and the insolvency events that have actually occurred. Mathematically comprehensible clarifications of the term must take into account whether the insolvency forecasts to be assessed are categorical (= nominal ), ordinal or cardinal (= metric or quantitative ).

- Insolvency forecasts are referred to as categorical insolvency forecasts that only know two possible forms for assessing the rated companies: "Company A is likely to fail (within a period to be specified)" vs. "Company B is unlikely to fail (within a period to be specified)".

- In the case of ordinal insolvency forecasts , judgments are made about the relative default probabilities of the assessed companies: "Company B is more likely (within a period to be specified) than company A to fail, but less likely than company C". Ordinal insolvency prognoses could theoretically be differentiated as desired, but ordinal rating systems have prevailed in practice which communicate their results on discrete, 7- or 17-point scales in a notation adopted by Standard & Poor's .

- Cardinal insolvency forecasts assign each company a probability with which the company will default (within a period to be specified).

The individual procedures are downward compatible. Any, weakly monotonous transformations can be used to generate ordinally interpretable score values from failure probabilities , which can also be combined into a finite number of classes if required. Likewise, by combining score intervals or neighboring rating classes, until only two classes remain, ordinal insolvency forecasts can be converted into categorical insolvency forecasts. The way in which insolvency forecasts are available is, among other things, procedural. For example, discriminant analyzes or neural networks only generate categorical insolvency forecasts by default. In practice, however, your output is also interpreted ordinally and can also receive cardinal information content through calibration to failure data.

Ordinal insolvency forecasts result, for example, from the application of subjectively parameterized scoring or key figure models, while logit models are used to create cardinal insolvency forecasts. The way in which insolvency forecasts must be available results from the intended use of the forecasts: the user only has two options for action - e.g. B. Acceptance or rejection of a customer, positive or negative determination of the " central bank eligibility " of claims - in principle, categorical insolvency forecasts are sufficient. The optimal design of categorical prognoses is based on a conflict of objectives between (prognosis) errors I. and errors II. Type (see estimated quality measures for categorical insolvency prognoses ). This in turn depends on subjectively influenceable secondary conditions, for example the specific design of credit conditions ( interest rates , collateral , guarantees , ...) and on subjectively non-influenceable, but variable over time, for example on the average default rate of the population considered.

This is where ordinal quality measures for assessing insolvency prognoses come in. They evaluate the classification performance of insolvency forecasting processes based on the totality of all possible error-I-II combinations that can be generated with the forecasting process. They enable a more differentiated assessment of customers, for example as a basis for deciding on the type and amount of collateral to be requested or the monitoring effort to be determined. Examples of ordinal measures of estimation are the accuracy ratio (also Gini index, Lorenz-Münzer concentration measure or power statistic).

On the other hand, cardinal insolvency forecasts are used as the basis for quantitative decisions, for example for the pricing of loans, bonds or derivatives or for determining the economic or regulatory risk capital. H. Failure probabilities, required. According to the new capital requirements of the Basel Committee on Banking Supervision, which will apply from the beginning of 2008, bank-internal rating systems must be based on cardinal insolvency forecasts (default probabilities). Estimates of the quality of cardinal insolvency prognoses are, for example, the Brier score , the conditional information entropy , the Rommelfanger index or the grouped Brier score .

A major disadvantage of cardinal appraisal measures is their dependence on the expected or realized portfolio default rates. They are therefore not suitable for cross-portfolio comparisons - and even with moderately correlated default probabilities, a meaningful validation of cardinal insolvency forecasts is no longer possible, even with portfolios of any size.

Overall, a good ability to separate insolvency prognoses, as measured by ordinal quality measures, is also important for the quality of cardinal insolvency prognoses - and even more important than correct calibration. When assessing the quality of insolvency prognoses, the following will therefore focus on ordinal quality measures for prognoses.

literature

- EI Altman: Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. (PDF file; 1.19 MB). In: Journal of Finance. Volume 23, No. 4, 1968, pp. 589-610.

- EI Altman, A. Saunders: Credit Risk Measurement: Developments over the last 20 years. In: Journal of Banking and Finance. Volume 21, 1998, pp. 1721-1742.

- EI Altman, HA Rijken: How rating agencies achieve rating stability. In: Journal of Banking and Finance. Volume 28, 2004, pp. 2679-2714.

- JD Amato, CH Furfine: Are credit ratings procyclical? (PDF file; 327 kB). In: Journal of Banking and Finance. Volume 28, 2004, pp. 2641-2677.

- S. Balcaen, H. Ooghe: 35 Years of Studies on Business Failure: An Overview of the Classic Statistical Methodologies and their Related Problems. Vlerick Leuven Gent Working Paper Series 2004/15, 2004. (also in British Accounting Review. Volume 38, No. 1, 2006, pp. 63-93).

- Basel Committee on Banking Supervision (Ed.): Range of Practice in Banks' Internal Ratings systems. (PDF file; 172 kB). Discussion paper, Bank for International Settlements (BIS), 01/2000.

- Basel Committee on Banking Supervision (Ed.): Credit Ratings and Complementary Sources of Credit Quality Information. (PDF file; 864 kB). Working Paper # 3, 2000.

- Basel Committee on Banking Supervision (Ed.): International Convergence of Capital Measurement and Capital Requirements, Revised Framework. Translation by the Deutsche Bundesbank, 06/2004.

- Basel Committee on Banking Supervision (Ed.): Studies on the Validation of Internal Rating Systems. (PDF file; 491 kB). Working Paper No. 14, revised version, 05/2005.

- M. Bemmann: Improvement of the comparability of estimation quality results of insolvency prognosis studies. In: Dresden Discussion Paper Series in Economics. 08/2005.

- M. Bemmann: Development and validation of a stochastic simulation model for the forecast of corporate insolvencies. Dissertation. Technical University of Dresden, TUDpress Verlag der Wissenschaften, Dresden 2007, ISBN 978-3-940046-38-3 .

- S. Blochwitz, T. Liebig, M. Nyberg: Benchmarking Deutsche Bundesbank's Default Risk Model, the KMV® Private Firm Model® and Common Financial Ratios for German Corporations. (PDF file; 587 kB). Workshop on Applied Banking Research, Basel Committee on Banking Supervision, 2000.

- U. Blum, W. Gleißner, F Leibbrand: Stochastic company models as the core of innovative rating systems. IWH Discussion Paper No. 6, 11/2005.

- ME Blume, F. Lim, AC Mackinlay: The Declining Credit Quality of US Corporate Debt: Myth or Reality. In: Journal of Finance. Volume 53, No. 4, 1998, pp. 1389-1413.

- R. Cantor, C. Mann: Measuring the Performance of Corporate Bond Ratings. (PDF file; 278 kB). Special Comment, Report # 77916, Moody's Investor's Service, 04/2003.

- MS Carey, M. Hrycay: Parameterizing Credit Risk Models with Rating Data. In: Journal of Banking and Finance. Volume 25, No. 1, 2001, pp. 197-270.

- LKC Chan, J. Karceski, J. Lakonishok: The Level and Persistence of Growth Rates. (PDF file; 181 kB). In: Journal of Finance. Volume 58, No. 2, 2003, pp. 643-684.

- Deutsche Bundesbank (Ed.): For assessing the creditworthiness of commercial enterprises by the Deutsche Bundesbank. In: Monthly Report January 1999. 01/1999, pp. 51–64.

- Deutsche Bundesbank (Ed.): Validation Approaches for Internal Rating Systems. In: Monthly Report September 2003. 09/2003, pp. 61–74.

- Deutsche Bundesbank (Ed.): Financial Stability Report 2005. 11/2005.

- AI Dimitras, SH Zanakis, C. Zoponidis: A survey of business failures with an emphasis on prediction methods and industrial applications, theory and methodology. In: European Journal of Operational Research. Volume 90, 1996, pp. 487-513.

- J. Eigermann: Quantitative credit rating procedures in practice. In: Finanzbetrieb. 10/2001, pp. 521-529.

- B. Engelmann, E. Hayden, D. Taschen: Measuring the Discriminative Power of Rating Systems. Deutsche Bundesbank, Discussion Paper, Series 2: Banking and Financial supervision, 01/2003.

- WB English, WR Nelson: Bank Risk Rating of Business Loan. Board of Governors of the Federal Reserve System FEDS Paper No. 98-51, 12/1998

- P. Escott, F. Glormann, AE Kocagil: RiskCalcTM for Private Companies: The German Model. Moody's KMV, Modeling Methodology, 11/2001.

- E. Falkenstein, A. Boral, AE Kocagil: RiskCalc ™ for Private Companies II: More Results and the Australian Model In: Moody's Investors Service . Rating Methodology, Report # 62265, 12/2000

- A. Fischer: Qualitative characteristics in internal bank rating systems: an empirical analysis for assessing the creditworthiness of corporate customers. Dissertation, University of Münster. Uhlenbruch Verlag, Bad Soden am Taunus 2004, ISBN 3-933207-47-9 .

- JS Fons, J. Viswanathan: A User's Guide to Moody's Default Predictor Model: an Accounting Ratio Approach. (PDF file; 209 kB). In: Moody's Investors Service . Report # 90127, 12/2004.

- J. Franks, A. de Servigny, S. Davydenko: A Comparative Analysis of the Recovery Process and Recovery Rates for Private Companies in the UK, France, and Germany. In: Standard and Poor's Risk Solution . 06/2004.

- S. Fritz, D. Hosemann: Restructuring the Credit Process: Behavior Scoring for German Corporates. In: International Journal of Intelligent Systems in Accounting, Finance and Management. Volume 9, 2000, pp. 9-21.

- H. Frydman, EI Altman, DL Kao: Introducing Recursive Partitioning for Financial Classification: The Case of Financial Distress. In: Journal of Finance. Volume 40, No. 1, 1985, pp. 269-291.

- W. Gleißner: Rating forecast, solvency test and rating impact analysis. In: KRP Credit & Rating Practice. Edition 03/2009, pp. 38–40. (werner-gleissner.de)

- J. Grunert, L. Norden, M. Weber: The role of non-financial factors in internal credit ratings. In: Journal of Banking and Finance. Volume 29, 2005, pp. 509-531.

- T. Günther, M. Grüning: Use of insolvency forecasting procedures for creditworthiness checks in corporate customers. In: Business Administration. Issue 1/2000, pp. 39-59.

- T. Günther, G. Hübl, M. Niepel: Insolvency prognosis based on data during the year. In: German tax law. (DStR), Vol. 2000, No. 8, 2000, pp. 346-352.

- GM Gupton, RM Stein: LossCalc V2: Dynamic Prediction of LGD Modeling Methodology. Moody's KMV, Working Paper, 01/2005.

- A. Hamerle, R. Rauhmeier, D. Rösch: Uses and Misuses of Measures for Credit Rating Accuracy. Version 04/2003, Working Paper, University of Regensburg, 2003.

- T. Hartmann-Wendels, A. Lieberoth-Leden, T. Mählmann, I. Zunder: Development of a rating system for medium-sized companies and its use in practice. (PDF file; 485 kB). In: Journal for Business Administration. ZfB, special issue 52, 2005, pp. 1–29.

- S. Huschens, S. Höse: Can internal rating systems be evaluated within the framework of Basel II? - To estimate the probability of default by means of default rates. In: Journal for Business Administration. (ZfB), Volume 73, No. 2, 2003, pp. 139-168.

- K. Keasey, R. Watson: Financial Distress Prediction Models: A Review of their Usefulness. In: British Journal of Management. Volume 2, 1991, pp. 89-102.

- KfW Bankengruppe (Hrsg.) : Corporate financing: Still difficult, but first signs of improvement. Study by the KfW banking group, 2005.

- W. Krämer : The evaluation and comparison of credit default forecasts. In: Credit and Capital . Volume 36, No. 3, 2003, pp. 395-410.

- K. Küting, C.-P. Weber: The balance sheet analysis, textbook for assessing individual and consolidated financial statements. 7th edition. Schäffer-Pöschel, Stuttgart 2004, ISBN 3-7910-2260-1 .

- WC. Lee: Probabilistic Analysis of Global Performances of Diagnostic Tests: Interpreting the Lorenz Curve-Based Summary Measures. In: Statistics in Medicine. Volume 18, 1999, pp. 455-471.

- B. Lehmann: Is It Worth the While? The Relevance of Qualitative Information in Credit Rating. EFMA 2003 Helsinki Meetings, 04/2003.

- JA McQuown: A Comment on Market vs. Accounting-Based Measures of Default Risk. KMV Working Paper, KMV Corporation, 1993.

- Moody’s (ed.): Default & Recovery Rates of Corporate Bond Issuers, A Statistical Review of Moody's Ratings Performance, 1920–2003. (PDF file; 1.51 MB). Moody's Investors Service , Special Comment, 01/2004.

- Austrian National Bank (Ed.): Rating models and validation. (PDF; 2.3 MB). Guide series on credit risk, Vienna 2004.

- Austrian National Bank (Ed.): Lending Process and Credit Risk Management. (PDF; 3.5 MB). Guide series on credit risk, Vienna 2004.

- F. Romeike, U. Wehrspohn: Market study of rating software for companies. Excerpts published in RATINGaktuell 06/2004, pp. 10–19.

- H. Scheule: Forecast of credit default risks. Dissertation, University of Regensburg. Uhlenbruch Verlag, Bad Soden / Ts. 2003, ISBN 3-933207-41-X .

- JR Sobehart, RM Stein, V. Mikityanska, L. Li: Moody's Public Firm Risk Model: A Hybrid Approach to Modeling Short Term Default Risk. Moody's Investors Service , Rating Methodology, Report # 53853, 03/2000.

- RH Somers: A new asymmetric measure of association for ordinal variables. In: American Sociological Review. Volume 27, No. 6, 1962, pp. 799-811.

- Standard and Poor's (Ed.): Corporate Ratings Criteria. The McGraw Hills Companies, 2003.

- Federal Statistical Office (ed.): Insolvencies in Germany 2003, structures and developments. Federal Statistical Office, Wiesbaden 2004.

- RM Stein: Benchmarking Default Prediction Models, Pitfalls and Remedies in Model Validation. Moody's KMV, Report # 030124, 2002. (also published in Journal of Risk Model Validation, Volume 1 (1), 2007, pp. 77–113.)

- JA Swets: Measuring the Accuracy of Diagnostic Systems. In: Science. Volume 240, 1988, pp. 1285-1293.

- WF Treacy, MS Carey: Credit Risk Rating at Large US Banks. (PDF file; 138 kB). In: Journal of Banking and Finance. Volume 24, No. 1-2, 2000, pp. 167-201.

- Independent State Center for Data Protection Schleswig-Holstein (Ed.): Scoring systems for assessing creditworthiness - opportunities and risks for consumers. (PDF; 7.2 MB). Study on behalf of the Federal Ministry for Consumer Protection, Food and Agriculture and the Federal Agency for Agriculture and Food, 2006.

- LJ White: The Credit Rating Industry: An Industrial Organization Analysis. New York University, Center for Law and Business, Research Paper No. 01-001, 04/2001.

Individual evidence

- ↑ This article is based on Bemmann (2005) and Bemmann (2007)

- ↑ See the Federal Statistical Office (2004, p. 31 and p. 44) for the development of the number and rates of insolvency, as well as the number and collectability of insolvency claims; for current data on insolvency events, see https://www.destatis.de/DE/ZahlenFakten /Indikatoren/LangeReihen/Insolvenzen/lrins01.html and https://www.destatis.de/DE/ZahlenFakten/Indikatoren/Konjendungindikatoren/Insolvenzen/ins110.html (September 20, 2012)

- ↑ See Dimitras, Zanakis, Zoponidis (1996, p. 488) and Balcaen, Ooghe (2004, p. 4) or Hartmann-Wendels et al. (2005, p. 4f.) For an analysis of those interested in insolvency forecasting procedures for companies.

- ↑ see Franks, Servigny, Davydenko (2004, p. 4), Basler Committee (2000b, p. 27f.), Basler Committee (2000b, p. 7f.), Moody's (2004, p. 13) and Gupton, Stein ( 2005).

- ↑ see Franks, Servigny, Davydenko (2004, p. 13)

- ↑ see English, Nelson (1998, p. 11f.), Treacy, Carey (2000, p. 897), Basler Committee (2000a, p. 33), Escott, Glormann, Kocagil (2001a, p. 3) and Scheule ( 2003, p. 96ff.)

- ↑ see Fischer (2004, p. 13 and the literature cited there)

- ↑ see Deutsche Bundesbank (2005, p. 44)

- ↑ see Basler Committee (2004, §4), OeNB (2004b, p. 33)

- ↑ See KfW (2005, p. 6): “This indicates the widespread use of bank-internal rating tools, which are now also used by small companies. [...] In the past, the largely uniform interest rates for all customers of a bank meant that smaller companies in particular had difficulties in obtaining loans at all. Today, banks and savings banks use rating tools to design credit conditions increasingly risk-oriented. This will make it easier for small businesses in particular to access bank loans. "

- ↑ see Basler Committee (2000b, p. 109ff.), Altman, Saunders (1998, p. 1724), Keasey, Watson (1991, p. 90) or Günther, Hübl, Niepel (2000, p. 347).

- ↑ see Frydman, Altman, Kao (1985, p. 270)

- ↑ see Bemmann (2007, p. 6)

- ↑ The terminology used in the following was taken from Fischer (2004, p. 83), the hard vs. soft and quantitative vs. delimits qualitative data. In the literature on bankruptcy forecasting, these terms are mostly used synonymously and are therefore often used inconsistently. For example, the OeNB (2004a, p. 65) states: “Qualitative questions are always subject to a subjective scope for assessment”, but also describes the undoubtedly objectively identifiable “home country of the debtor” as a “qualitative rating criterion”, see OeNB (2004a, p. 66).

- ↑ For key figures for quantifying account management behavior, see Fritz, Hosemann (2000, p. 13ff.).

- ↑ See, for example, McQuown (1993, pp. 1f.). However, it is precisely the advantage of the "forward-looking" nature of market prices compared to (historical) accounting data that is questioned in a study by Chan, Karceski, Lakonishok (2003, p. 671). The sometimes considerable differences in the observable price-earnings ratios (P / E) of stock corporations can be easily explained by the company's historical profit development - a forecast benefit, however, can hardly be proven.

- ↑ see Fischer (2004, p. 91)

- ↑ See Deutsche Bundesbank (1999, p. 54), Eigermann (2001, p. 523) and Küting, Weber (2004, p. 423ff). However, the aim of the aforementioned authors is not to correct the annual financial statement data, but to evaluate the company's “accounting behavior”, which is then used as an independent input in the context of the insolvency forecasting process used.

- ↑ see ULD (2006, p. 50)

- ↑ See Bemmann (2005, p. 57). The average annual insolvency rates of the two groups of companies mentioned in the period 1999-2003 were 3.6% and 0.23%.

- ↑ See Blum, Gleißner, Leibbrand (2005b). See Fischer (2004, p. 97) for a selection of 150 examples from 18 groups of soft qualitative factors.

- ↑ see Fischer (2004, p. 89)

- ↑ see Basler Committee (2000a, p. 17ff.) And Romeike, Wehrspohn (2004, p. 9)

- ↑ see Bemmann (2005, p. 51ff.)

- ^ S&P (2003, p. 53). “Ratios are helpful in broadly defining a company's position relative to rating categories. They are not intended to be hurdles or prerequisites that should be achieved to attain a specific debt rating. [...]. " and S&P (2003, p. 17) “There are no formulas for combining scores to arrive at a rating conclusion. Bear in mind that ratings represent an art as much as a science. "

- ↑ see Blume, Lim, Mackinlay (1998) and Amato, Furfine (2004)

- ↑ See the 100-page description of the elements of rating processes at Standard and Poors's in S&P (2003).

- ↑ According to White (2001, p. 14), the " list prices " to be borne by the company being valued for the creation of a rating by Moody's or S&P are 3.25 basis points for bond amounts of up to US $ 500 million - with a minimum fee of US $ 25,000 and a maximum of US $ 125,000 ( S&P ) or US $ 130,000 ( Moody's ). For bond amounts exceeding US $ 500 million, both agencies charge 2 basis points. S&P caps the total at US $ 200,000, but charges an additional fee of US $ 25,000 when creating a rating for the first time.

- ↑ see Carey, Hrycay (2001), Altman, Rijken (2004) and Fons, Viswanathan (2004)

- ↑ see Bemmann (2005, p. 6f.)

- ↑ see Altman, Saunders (1998, p. 1737)

- ↑ The calibration of a rating system based on empirical failure data is, for example, described in Sobehart et al. (2000, p. 23f.) And Stein (2002, p. 8ff.).

- ↑ see Deutsche Bundesbank (1999)

- ↑ see Bemmann (2005, p. 9ff. And the literature cited there)

- ^ “There are no bad loans, only bad prices.”, See Falkenstein, Boral, Kocagil (2000, p. 5).

- ↑ see Basel Committee (2004, in particular Item 461f.)

- ↑ see in detail Bemmann (2005, p. 32ff.)

- ↑ see Bemmann (2005, p. 32ff.)

- ↑ see Huschens, Höse (2003, p. 152f.) And Basler Committee (2005, p. 31f.)

- ↑ The actual relevance of this theoretical objection is still disputed. There are empirical indications that the corresponding segment-specific correlation parameters assumed within the framework of Basel II are set too high by a factor of 15 to 120 (on average around 50), see Scheule (2003).

- ↑ Blochwitz, Liebig, Nyberg (2000, p. 3): “It is usually much easier to recalibrate a more powerful model than to add statistical power to a calibrated model. For this reason, tests of power are more important in evaluating credit models than tests of calibration. This does not imply that calibration is not important, only that it is easier to carry out. ”, Analogous to Stein (2002, p. 9)

- ↑ For further explanations and arguments for the use of ordinal parameters for determining the quality of insolvency prognoses, see Bemmann (2005, p. 12ff.).