Short deadline

The short-term ( English short-run ) is a perspective in macroeconomics , one at the annual developments in economic activity economy can be studied. According to Olivier Blanchard , the short term describes how the macroeconomy develops from year to year. In macroeconomics, one differentiates between three perspectives: short, medium and long term . The separation of the intervals is fuzzy and can only be given approximately. Blanchard and Illing give a period from year to year for the short term, 10 years for the medium term and 50 years for the long term. Whereby the time specification for the long term is to be understood more as a model assumption in which it is possible to consider the economy based on flexible prices under market clearing conditions. In the long run, an economy will achieve equilibrium in all markets, since prices have enough time to adjust and thus ensure an alignment of supply and demand. In the short term, one focuses on the interactions between demand, production and income at constant prices.

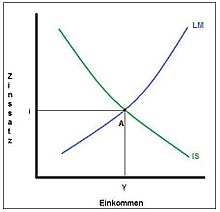

Short-term equilibrium in the IS-LM model

The IS-LM model , the basic model for analyzing the short term, is developed from the equilibrium on the goods, money and financial markets .

For the short-term equilibrium in the IS-LM model, only overall economic demand is decisive; the supply curve is elastic. This means that the prices are completely rigid. The price level is therefore constant during the entire observation. Furthermore, the model is a static macroeconomic standard model that has a number of other limitations:

Assumptions

- All external economic influences are not taken into account.

- The effects of the government budget restriction are not taken into account.

- All effects resulting from price and wage adjustments are hidden.

- Expectations about future events and processes are also not recorded.

- Medium and long-term effects are not taken into account. This primarily affects all effects that come from savings and investment decisions

The goods supply must correspond to the goods demand ( goods market equilibrium , IS equation) and the money supply to the money demand ( money market equilibrium) . At the intersection of these two equations, at point A, there is a simultaneous equilibrium on the goods, money and financial markets.

Interpretation of the result

One finding of this model is that there is an equilibrium at point A. The IS and LM equations contain information about consumption, investment, money demand and equilibrium conditions. This information can be helpful in solving problems. For example, monetary or fiscal policy instruments can be analyzed, such as how income and interest rates react when the central bank increases the money supply or the state increases taxes.

The severe limitations imposed with the above assumptions make the IS-LM model too simple for economic and economic policy analysis. However, the rigidity of the model enables a targeted observation of the effects of changing a single variable. It forms the starting point for a more complex economic analysis.

Short-term equilibrium in the AS-AD model

The AS-AD model is formed from the AS function, the total economic supply aggregated supply and the AD function, the total economic demand aggregated demand .

Assumptions

- The price expectations P e of the parties involved in wage setting are fixed.

- Predefined values of monetary and fiscal policy (real money supply M / P , government spending G and taxes T )

The short-term equilibrium lies at the intersection of the AS and AD curves (point A). At point A all markets are in equilibrium. The value of P e determines the position of the aggregated supply curve. In Figure 2, the production Y is above the natural level Yn. This is possible because Y depends both on the price expectation P e and on all variables of the aggregated demand curve ( M , G , T ). In the medium term, however, production Y will return to its original level Y n by adjusting wage setting - and thus price expectation P e . Changes in production in the short term can therefore be traced back to shifts in aggregate demand or supply.

AS function:

AD function:

Interpretation of the result

In the short term, i.e. given price expectations, production usually deviates from its natural level. Price expectations and the variables that influence the position of the AD curve are the determinants on which production depends. In the short term, for example, an expansive monetary policy will result in both production and the price level rising. The available monetary and fiscal policy measures can help in the short term to overcome a recession, even if such actions can be neutral in the medium term and even harmful in the long term.

See also

Footnotes

- ↑ Cf. Blanchard, Olivier; Illing, Gerhard: Macroeconomics, 3rd, updated edition, Pearson Education Deutschland GmbH, Munich, 2003, page 836

- ↑ Cf. Blanchard, Olivier; Illing, Gerhard: Macroeconomics, 3rd, updated edition, Pearson Education Deutschland GmbH, Munich, 2003, page 836

- ↑ Cf. Blanchard, Olivier; Illing, Gerhard: Macroeconomics, 3rd, updated edition, Pearson Education Deutschland GmbH, Munich, 2003, page 213

- ↑ Cf. Blanchard, Olivier; Illing, Gerhard: Macroeconomics, 3rd, updated edition, Pearson Education Deutschland GmbH, Munich, 2003, page 214

literature

- Blanchard, Olivier; Illing, Gerhard: Macroeconomics , 4th, updated edition. Pearson Education Deutschland GmbH, Munich 2006, ISBN 978-3-8273-7209-3

- Branson, William H .: Macroeconomics , 3rd edition, R. Oldenbourg Verlag, Munich, 1992, ISBN 3-486-21772-0

- Cezanne, Wolfgang: Grundzüge der Makroökonomie , 5th, unchanged edition, R. Oldenbourg Verlag, Munich 1991, ISBN 3-486-21842-5

- Krugman, Paul R .; Obstfeld, Maurice: International economy , theory and politics of foreign trade. 7th, updated edition. Pearson Education Deutschland GmbH, Munich 2006, ISBN 3-8273-7199-6

- Mussel, Gerhard: Introduction to Macroeconomics , 6th, revised and updated edition. Verlag Franz Vahlen GmbH, Munich 2000, ISBN 3-8006-2544-X