Direct costing

Direct costing (also called proportional costing ) is a single-level contribution margin calculation . It is carried out as a partial cost calculation and is based on a separation into fixed costs and variable costs . Since employment is seen as the only reference variable , the results are interpreted on the basis of the contribution margin determined.

As with all cost accounting methods, the retrospective analysis of proportional cost accounting is unsuitable because it is not linked to the process that has already run, in order to enable a controlling intervention in an ongoing operational process.

method

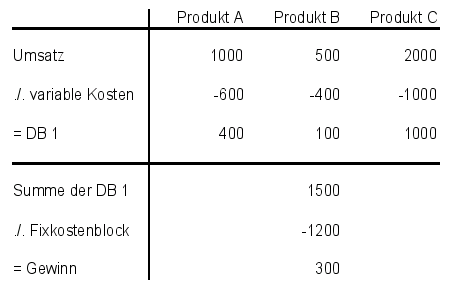

The variable costs are deducted from the product-specific revenues . The result is the contribution margin. The fixed costs are not distributed among the cost units, but allocated to the entire company as a block.

Another possibility of direct costing is profit center accounting . All departments of a company that generate income become profit centers with personal responsibility. The costs incurred are assigned to the respective departments. The operating result (GOP = Gross Operating Profit) is a responsibility. Indirect costs are assigned to the profit centers using distribution keys. Based on the result, you can see what proportion the respective department has in the overall result of the company (→ character of representation).

interpretation

Few conclusions can be drawn due to the simplicity of this procedure. In the event of a negative contribution margin, the product should either be discontinued, the sales price increased or variable costs must be saved (in special cases, strategic marketing will continue to manufacture products with a negative contribution margin that are sufficiently important in terms of product range). If the contribution margin is positive, no precise statement can be made about the product.

Criticism and shortcomings of direct costing

Cost influencing factors other than employment (e.g. set-up times ) are neglected. In addition, only an imprecise interpretation is possible.

Furthermore, direct costing has a number of inherent deficiencies, some of which it also has in common with full cost accounting :

- Contrary to the assumption of direct costing, the total costs usually do not increase linearly with the production volume. It is therefore not justified to equate variable costs with proportional costs. In the direct costing system, calculations are usually not made with real proportional, but with average variable (artificially proportionalized) costs.

- Contrary to the assumption of direct costing, sales do not always increase linearly with the amount sold. It is therefore often not justified to expect proportional sales proceeds (prices).

- In the direct costing system - as in full cost accounting when determining the profit amount of a product type - the variable overhead costs are assigned to the individual product types and service units. This reduces the informative value of the coverage margin.

- In the direct costing system - just like in full cost accounting when determining the net profit for the period - the periods - overhead costs (e.g. time-dependent depreciation) are assigned to the individual accounting periods, but not to the cost units causing them. This reduces the informative value of the reported profit for the period. The coding of the period overhead costs can also lead to fallacies in the breakeven point analysis.

example

In the invoice below, only the individual contribution margins can be evaluated. All products have a positive contribution margin. The elimination of a product is not necessary based on this information.

Profit denotes the net profit here . The contribution margin denotes the gross profit .