Fundamental analysis

The fundamental analysis ( English fundamental analysis ) is a financial analysis , from enterprise data management ratios derived and tested to the appropriate market price of securities ( intrinsic value ) to identify. Chart analysis is a complementary term .

General

Fundamental analysis evaluates company data, business figures and market analyzes , which are referred to as fundamental data. Fundamental analysis assumes that the development of a company's profitability ultimately determines the market development of share prices . It is generally based on the earnings value . However, this is not always the case temporarily. Rumors , moods and herd behavior are part of the noise that is exploited by noise trading . The market participants following this trading strategy ( arbitrageurs , speculators , traders , noise traders ) do not act on the basis of the rational principle and ignore fundamental data, so that there are also short-term stock market trends that are not based exclusively on the intrinsic value of the trading objects .

economic aspects

Fundamental analysis can be found particularly in the stock market . (From the intrinsic value English intrinsic value ) can be for a particular stock trading price derived, the "appropriate market price" is called. If this reasonable market price exceeds the current market price, the share is “cheap” or “fundamentally undervalued” ( English underperformer ) and should be bought. Conversely, if the fair market price below the current market price, so the stock is "expensive" and "fundamentally overvalued" ( English over performer ) and should be sold. So if the two prices differ, the current share price is also influenced by noise.

The fundamental analysis process is based on methods of balance sheet analysis as well as on a number of share price-related parameters, such as the dividend yield or the price / earnings ratio . The result of the fundamental analysis is, for example, a price target that provides indications of undervalued and overvalued stocks or companies and thus impulses for an action strategy on the stock market called value investing .

The effectiveness of fundamental analysis, like that of chart analysis, contradicts the market efficiency hypothesis . According to her, it is not possible with either of the two processes to systematically achieve higher returns than the respective market.

Important key figures of fundamental analysis

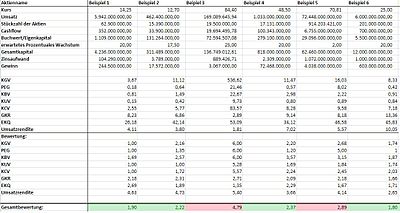

Fundamental analysis begins with an analysis of the overall economy and then conducts a market analysis . Only then does the company analysis follow. So that the company data and key figures of different companies in the same branch of industry can be compared, the annual financial statements of the companies must be prepared according to uniform accounting standards . Fundamental analysis uses the following key figures in particular.

Price / earnings ratio

The price-earnings ratio (PER) (ger .: Price-earnings ratio (PER)) is the best known measure of fundamental analysis. The P / E ratio is obtained by dividing the current price by the expected company earnings per share. A share with a P / E ratio below the long-term industry-specific average is therefore considered cheap. A P / E of 10 means the company is making 10% profit on the company's value (the value of all its shares combined), a P / E of 20 means that profit is only 5%.

Price-to-book ratio

The price-to-book value ratio (KBV) is obtained by dividing the current market value of a share by the book value per share. The traditional theory of value investing states that the lower its P / B, the cheaper a share is, and that its fair value is roughly equivalent to its book value (see also: market value to book value ratio ).

Price-to-sales ratio

The price-to-sales ratio (KUV) is determined by setting the current market capitalization of a company in relation to its (annual) sales . The KUV does not take into account the profitability of a company. The KUV is used to assess stock corporations that write losses and for cyclical stocks . The P / E ratio cannot be applied for these companies because there are still no profits. A company with a price-to-sales ratio that is low compared to the industry tends to be cheap.

Price-to-cash flow ratio

The price-cash-flow ratio (KCV) is obtained by dividing the current price of a share by the cash flow per share. A company's income statement contains many different factors, such as provisions or depreciation, which falsify the results of the real cash flow. The cash flow of a company shows the actual cash flows in a certain period of time. Compared to the KGV, the KCV is less susceptible to the measures companies take to improve their balance sheets. It makes a statement about how the price of a company relates to its liquidity. The price-cash flow ratio can be used to evaluate the development of the profitability of a stock corporation, so to speak. The benchmark for the KCV is seven as a guideline for a fair evaluation, since the KCV is below the P / E. In the annual report of the company under review, the cash flow reported is € 700 million. If you divide this value by the number of shares (201 million) you get the cash flow per share: € 3.48. Consequently, in our example, we have a KCV of 7.18 assuming a share price of € 24.99.

Total return on investment

The return on capital employed (GKR) is a key figure that helps the analyst to estimate the profitability of a company. It indicates how a company uses its existing capital to generate profit. You add the profit and the interest expense to get the actually earned profit. Now you divide the result by the total capital and multiply the quotient by a hundred and get a percentage for the total return on capital that shows the efficiency of the company in the calculation period. For the analyst, this key figure says a lot about the management of the stock corporation examined. It is also difficult to set a benchmark for the return on investment, as it is highly industry-dependent and can therefore vary enormously from industry to industry. But to make everything a little more concrete, we set a universal standard: A GKR greater than 12% is considered good. If the GKR is lower, the assessment becomes more negative. The example company has an interest expense of € 1,000 million and total capital of € 12,000 million. With the known values (profit: 603 million €) a GKR of 13.36% is calculated.

Equity ratio

The equity ratio (EKQ) shows the equity of a company in relation to its total capital in percent. To do this, you divide the equity by the total capital and multiply the result by 100. You want to use this figure to examine the company's financial stability and dependency on external capital. The higher the EKQ, the higher the stability and independence from borrowed funds. In addition, the creditworthiness of the stock corporation improves with a higher EKQ and thus also increases the possibility of raising more debt. A lower share of borrowed funds also reduces the interest burden that reduces profit / increases loss (so-called "finance leverage"). This is particularly important in times of the subprime crisis , in which banks are becoming more cautious in lending, as companies with a high EKQ do not easily run into problems with rising interest rates or a lack of investment capital. Many investors consider an EKQ of 40% good. This value speaks for the independence and stability of the analyzed company. All data from the example are already available for calculating the EKQ (equity or book value: € 5,500 million; total capital: € 12,000 million). The calculated EKQ is 45.83%.

Market-to-revenue

The key figure of the market-to-revenue indicates how often the sales of a stock corporation are included in its market capitalization . The lower this ratio, the cheaper this stock is valued.

Evaluation of the key figures

If the individual key figures are available, each key figure must be weighted because not all key figures have the same meaning with regard to the goal of the analysis. The aim of the analysis is to determine an appropriate stock market price in the future ( price target ). There are no general guidelines as to how strongly the individual key figures should be weighted or how strongly they influence the overall rating of the share. Priority is given to the weighting of business indicators on the company's performance , with its success factors making up the profitability . Once the appropriate stock exchange price based on the intrinsic value has been determined, market participants can make purchase , sale or hold decisions by comparing it with the current stock exchange price , or the investment services company can provide appropriate investment advice .

Individual evidence

- ↑ Wolfgang Gerke, Gerke Börsen Lexikon , 2002, p. 335 ff.

- ↑ a b Marc Oliver Opresnik / Carsten Rennhak, General Business Administration: Fundamentals of Entrepreneurial Functions , 2015, p. 149

- ↑ Thomas Schuster / Margarita Uskova, Financing: Bonds, Shares, Options , 2015, p. 45 ff.

- ↑ Hans E. Büschgen, Das kleine Börsen-Lexikon , 2012, p. 677