Carousel business

As missing trader fraud , or carousel fraud (English Missing Trader Intra-Community (MTIC) fraud ) is defined as one in the European Union widespread (EU) form of tax evasion . Several companies in different EU member states work together, whereby one of the dealers in the supply chain does not pay the sales tax paid by its customers to the tax office. The customers, on the other hand, claim input tax and receive it from the tax office. Since delivery takes place across internal borders in other parts of the chain and, according to the country of destination principle, sales tax is not incurred in the country of origin ( the seller's country of residence ), but in the country of destination (the buyer's country of residence), there is no offsetting of the input or sales tax from other parts of the supply chain ; in addition, detection is made more difficult.

procedure

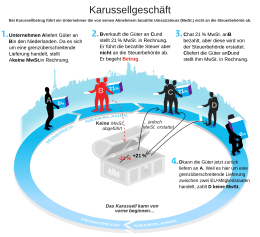

The carousel business works via (at least) three steps:

- A company S sells goods to an intermediary Z in other EU countries. For this purpose, according to the country of destination principle, no sales tax is to be paid by S, but by Z (in Germany: § 4 No. 1b in conjunction with § 6a of the Sales Tax Act (UStG)). However, Z is regularly entitled to the full input tax deduction ( Section 15 (1) No. 3 UStG). As a result, the export delivery on the first stage of the carousel remains tax-neutral for both S and Z.

- Z sells the goods to an entrepreneur U in the same country. For this delivery, Z has to pay sales tax to his tax office ( § 1 UStG) because he cannot deduct the input tax a second time. However, Z does not meet this payment obligation.

- U now sells the goods back to S. This delivery back to the first EU country is again exempt from sales tax for U according to the country of destination principle. However, U can still claim input tax deduction from his tax office if he has an invoice ( Section 15 (1) sentence 1 number 1 UStG). As a result, U gets the sales tax invoiced by Z reimbursed by the tax office.

The profit of the carousel (and at the same time the fiscal damage to the tax coffers) stems from the fact that U constantly has sales tax reimbursed by the tax office and the sole sales tax debtor Z does not meet his payment obligations. As a rule, Z disappears from the market without a trace before the sales tax is due and is therefore referred to in English as the "missing trader".

As soon as the goods have returned to the original seller S, the process can begin anew. The goods are pushed in a circle over the borders again and again. This rotating transaction principle has led to the name sales tax carousel . It assumes that all three parties cooperate. However, other intermediaries can also be involved who do not necessarily need to know about the fraud. In order to achieve the highest possible yield, physically small but very expensive goods are usually used (e.g. mobile phones or computer chips). A carousel business with services is conceivable, but so far not very widespread.

According to official estimates, this type of tax fraud causes the tax authorities of the EU countries to lose around 50 billion euros per year, including an estimated 5 to 14 billion euros in taxpayers' money in Germany alone.

In a study published at the end of 2019, researchers found a deviation of more than 300 billion euros in the trade data recorded between 28 EU member states since 1999. The estimated amount of damage is therefore up to 64 billion euros per year.

Countermeasures

In the United Kingdom , which was heavily affected by carousel fraud, at the end of 2006 the input tax deduction for certain goods (e.g. mobile phones) was suspended and the so-called reverse charge system was introduced. As a result, the cross-border trade in mobile phones decreased extremely.

July 1, 2011 was in Germany for certain goods (mobile phones, individual chips, i. E. Also processors) exposed to the deduction and the reverse charge introduced method (purchase tax). However, a value limit of 5000 EUR applies. Only when this limit is exceeded for a related transaction does the reverse charge procedure apply ( Section 13b (2) No. 10 UStG).

Since October 1, 2013, the entry certificate or other alternative evidence has been required to prove that tax-free intra - community deliveries from companies within the scope of the German VAT Act have actually arrived in other EU countries.

Similar measures were also used to prevent fraud in EU emissions trading ( see also fraud through carousel deals ).

The EU Economic Commissioner Pierre Moscovici is in favor of preventing carousel transactions by deciding that companies in the EU will in future have to pay VAT where they actually sell their services ( destination principle ).

On November 30, 2017, the EU Commission presented the current deficiencies in VAT collection (including fraud). In order to remedy these deficiencies, the EU member states are particularly supporting options such as Transaction Network Analysis (TNA) programs. All Member States, with the exception of Great Britain and Germany, are now actively participating in TNA.

See also

literature

- Demut / Billau: The sales tax abuse liability - new developments and outlook. BB 2011, 2653.

- Dorothee Nöhren: The evasion of sales tax. Hamburg 2007, ISBN 978-3-8300-2104-9 .

- André Dathe: VAT evasion. Bremen 2006, ISBN 978-3-937686-38-7 .

- Jens Pahne: Measure to curb sales tax fraud . Lohmar 2006, ISBN 978-3-89936-436-1 .

- Ulf Gibhardt: Evasion of sales tax in the European internal market: the crux of the unjustified input tax refund. Baden-Baden 2001, ISBN 3-7890-7522-1 .

Individual evidence

- ^ Tiedtke, VAT fraud in theory and practice, UR 2004,6, 8 with a description of the model of carousel fraud

- ↑ Annual damage of 50 billion - New scam with green electricity certificates , ZDF from May 7, 2019

- ↑ The EU Self-Surplus Puzzle: An Indication of VAT Fraud? Retrieved January 14, 2020 .

- ↑ DER SPIEGEL: VAT fraud: researchers attest EU trade surplus - with themselves - DER SPIEGEL - economy. Retrieved January 14, 2020 .

- ↑ Business Brief 14/06 of the HM Revenue & Customs

- ↑ Alexander Mühlauer: Value Added Tax: Brussels wants to stop fraud billions. In: Süddeutsche Zeitung. October 3, 2017. Retrieved October 3, 2017 .

- ↑ On the way to a uniform European VAT area - Time to act , EU Commission of November 30, 2017

- ↑ Annual damage of 50 billion - New scam with green electricity certificates , ZDF from May 7, 2019