Competence strategy portfolio

Competence strategy portfolios (also called competence portfolios) are used to analyze and control the core competencies of companies. They generally describe the dimensions of a company's relative strength in terms of competence (internal analysis) and the strategic importance of competence (external analysis).

Structure and dimensioning

Competence strategy portfolio according to Thiele

The dimension “relative strength of competence” is placed on the abscissa axis, the dimension “strategic importance” is shown on the ordinate. Figure 1 is used for visualization.

The competence strategy portfolio consists of four quadrants, each with a different relevance. The first quadrant represents a skills gap that does not reveal any strategic importance for the company.

In the second quadrant , a strategically relevant skill gap is characterized, which can or must be reduced. The strategic importance is seen as high, but the company is less successful with this competence because it does not have the necessary strength.

The third quadrant is characterized by high strategic importance and the company's high strength. In this area, strategically important core competencies for the company are characterized, which need to be promoted and further developed. They form the company's "trademark" and embody the competitive advantage over competitors.

A selection strategy is targeted in the fourth quadrant . Here the company shows a high level of strength in terms of competence, which, however, has little strategic relevance. It is to be evaluated how a strategic advantage can be generated from this competence.

Customer value-oriented competence portfolio approach

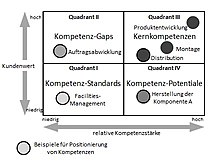

Hinterhuber changes the competence strategy portfolio according to Thiele. Figure 2 shows such a portfolio in which the abscissa axis embodies the competence strength, but the ordinate no longer represents the strategic importance of the competence, but rather its customer value.

The first quadrant represents competence standards. These are characterized by a low relative competence strength and a low customer value. They have little relevance from the customer's point of view and are dominated in a similar way by competitors. This type of competence can mostly be found in support functions with little relevance to the core business. No competitive advantages can be achieved through them.

In the second quadrant . Competency gaps are so-called classified. Compared to competitors, there is a relatively low level of competence in an area to which the customer attaches great importance. There are consequently competence gaps between market requirements and the company's capabilities.

If the company has a relatively high level of competence compared to the competition with regard to a high current and future customer value, it has core competencies ( third quadrant ). A company's core competence is understood to be an activity or ability that enables the company potential access to a large number of markets, provides the customer with a recognizable product benefit and is difficult to imitate by competitors. In this respect, core competencies bundle strengths that generate competitive advantages over competitors.

The fourth quadrant characterizes the competence potential. This is understood to mean competencies in which the company takes a leading position, but the customer value is assessed as low. This often results from the fact that potential benefits are not adequately communicated by the company.

A modification of the customer value-oriented approach is also conceivable. Here, a blurring area is integrated between the quadrants, as shown in Figure 3.

The integration of a fuzzy area limits the clear classification of a competence to a smaller field. This is a concession to the methodological inexactness, which is due to the equal weighting of the individual evaluation criteria and the neglect of the dependencies of the dimensioned criteria.

Market-related competence portfolio according to Krüger / Homp

This approach is characterized by a multi-stage procedure in which the market and resource perspectives are linked to one another and a development forecast of the respective portfolio dimensions is also made.

To determine the strength of competence, development prospects and expenditure are compared to the current competence in an internal analysis (competence matrix). In the external analysis, market attractiveness is determined by comparing the competence position with the expected market development in a market matrix (see Figure 4).

The market attractiveness and competence strength are brought together in the market competence matrix. The conclusions and strategic implications are generally congruent with the perspectives and norm strategies of the competence strategy portfolio. The approach possibilities of competence strategy portfolios shown lead, even with different delimitation of the dimensions or integration of a fuzzy area, in corresponding strategic implications or norm strategies, which are presented in the fourth section.

method

As part of the internal analysis to determine the strength of a company with regard to a competence, a profile matrix is first generated using a scoring approach. The company defines certain competence criteria, the assessment of which leads to a weighted point value. For this purpose, the company's own success story is recorded by identifying and questioning key people. Decisive characteristics of the key persons are their interdisciplinary view, in-depth knowledge of the company and connection to strategic tasks.

By including external perspectives, for example by management consultants , a subsequent comparison can be made to reduce subjective distortions. The evaluation of the surveys leads to a consolidation of the competencies relevant to the competition and the future in a company- specific cluster of individual competencies, which may have to be transferred into competency bundles.

Such an interdependent network of competencies provides information about possible interrelationships, in particular multiplier effects or incompatibilities between individual bundles of competencies.

Hafeez, Malak and Zhang, for example, present a detailed analytical hierarchical process for the identification of corporate competencies according to the criteria of uniqueness and transferability between products, functions and business areas.

Then, in an external analysis to determine the strategic importance of the competence, the environment developments, industry trends as well as requirements of potential customer groups and thus future competencies required by the market are evaluated. The required competencies are assessed in a so-called identification matrix analogous to the profile matrix using the same competency criteria.

Finally, the weighted sums of points in the profile and identification matrix are transferred to the competence strategy portfolio. As already made clear, this consists of a four-quadrant scheme with the values "low" and "high". Based on their position in the portfolio , standard strategies for dealing with the individual competence fields can then be formulated from the competence strategy portfolio . Figure 5 illustrates the procedure using an example.

Key messages and strategic implications

Standard competencies (Quadrant I) Standard competencies characterize skills which round off the range of services customary in the industry and which have little potential for differentiation. Therefore, further investments in standard competencies should not be made or outsourcing should be sought.

Competency Gaps (Quadrant II) When determining the competency requirements of a company, the competency gaps must be examined to determine how the gap between customer requirements and the company's own skills can be closed. This opens up alternatives that range from joint ventures to strategic alliances. Outsourcing in this context represents the possibility of outsourcing a relatively weak competence to streamline the organizational structure or for reasons of efficiency and cost. In addition, it offers the opportunity to integrate missing know-how from outside into the company in order to fill one's own competence gap conclude.

Core competencies (Quadrant III) Core competencies, which are highly developed in both dimensions, are key skills to be kept in your own hands for competitive success. With regard to the core competencies, the success-critical " insourcing " is to be focused by the company. The company must concentrate on these skills, continuously maintain and develop them. The research and development capacities, resource and investment allocations are to be prioritized accordingly.

Competence potentials (Quadrant IV) If the existing competence potentials can be converted into future competitive advantages, either the investment intensity should be increased or outsourcing should be considered. The latter alternative presents itself in the situation of a future decreasing differentiation advantage due to standardization or decreasing protection against imitation. Furthermore, diversification into other markets or products is conceivable in order to increase the customer value of the competence.

application areas

The competence strategy portfolio and its modifications are used in the strategic management of a company. The classification of competencies and the derivation of standard strategies support the company management in investment decisions, as well as in the strategic alignment of business areas or the entire company. It should be noted that the sole consideration in the context of the competence strategy portfolio is not to be favored. Ultimately, strategic decisions are dependent on many factors and interdependencies.

The basic idea of the competence strategy portfolio can also be transferred to individual competencies and used in the context of human resource management .

Differentiation from other portfolio concepts

Product portfolio

The term product portfolio denotes a collection of the various products of a company and is a subset of the company portfolio . The market share market growth portfolio (Boston-I) of the Boston Consulting Group and the market attractiveness and competitive strength portfolio of McKinsey are the most prominent representatives from the field of product portfolios.

In comparison to the competence-strategy-portfolio approach, it should be noted that product portfolios only carry out a current-related analysis with regard to certain products or strategic business units . In times of shortening product life cycles, this short-term perspective is generally sufficient. d. Usually not enough to survive in the market in the long term.

In the Boston I portfolio, the strategic business units or products are evaluated on the basis of quantitative values (sales, cash flow) and standard strategies are derived. Qualitative influencing factors are also taken into account in both the McKinsey portfolio and the competence strategy portfolio. In the competence strategy portfolio, market expectations and trends regarding the development of the sector are also taken into account, which make it possible to take a differentiated view of the factors influencing the company's success.

Technology portfolio

The technology portfolio maps the technologies used in the company in a matrix with the dimensions “technology attractiveness” and “resource strength” and allows differentiated strategies to be derived as recommendations for future development activities.

The technology portfolio analysis is particularly suitable for observing the development cycle of a technology and shows long-term technological development trends. A separate delimitation of product and process technologies as well as an explicit derivation of research and development priorities is possible. The isolated consideration of the technology dimensions has a disadvantage in that no market planning is integrated and the delimitation of technologies is difficult to implement.

The competence strategy portfolio is a strategic addition to the product and technology portfolio as part of the concept of core competencies. The three portfolio approaches are interdependent. These interactions result from the technology implied with a product, the success factors of which are one or more competencies of a company. Therefore, comprehensive perspectives are indispensable for strategic management decisions.

Critical appraisal

The competence strategy portfolio enables the classification of competencies and their classification in a four-field matrix with the accompanying derivation of standard strategies. This portfolio concept also allows a combination of market and resource-oriented perspectives. A complex company situation can be mapped in a simple manner in a two-dimensional representation. In particular, the possibility of integrating future expectations (cf. Krüger / Homp) should be noted positively.

Due to its multi-level structure (competence view, market view, integrative view), the market competence portfolio according to Krüger and Homp has the advantage that strategies are not derived exclusively from internal competency considerations, but also with regard to external market conditions. In this way, bad investments are avoided, resources are not tied up unnecessarily and innovation potential is recognized at an early stage. It should be noted critically that the compression from nine to four fields can lead to a loss of information. The output matrices each represent both an internal and an external dimension, but in the second step they are treated as a single variable (market attractiveness or competence) and thus a dimension. In addition, the delimitation of the two dimensions of the final portfolio is problematic. E.g. If the current competitive position and the strength of competence in the original matrices overlap and are partly mutually dependent.

It should also be noted that the determination and delimitation of future competencies is difficult to predict and the interaction between the individual competencies in the portfolio is neglected. This has a particular effect on standard strategies such as outsourcing. It is not always possible to break down a competence, as it may be interdependent with others.

In addition, the selection of the evaluation criteria and their weighting are not standardized. Therefore, there is a risk of a subjective assessment, usually a better assessment. In addition, the acquisition and integration of external qualitative data is difficult. If, for example, external perspectives from management consultants, experts, etc. are integrated into the analysis, then these too can be influenced by different interests. The quality and meaningfulness of the portfolio therefore depends on the quality of the identification process.

literature

- Harmsen, H .; Jensen, B. (2004). Identifying the determinants of value creation in the market: A competence-based approach, in: Journal of Business Research, 57 (5), pp. 533-547. Harmsen and Jensen carried out a wide-ranging study on the “translation” of market requirements into corporate competencies and their strategic importance. Here, central market characteristics were determined and in a workshop with experienced managers the relevant skills required to meet the requirements were derived.

- Schmieder, M. (2004), Diss., Investigation of the transferability of the competence cell-based networking theory to the multi-variant series production.

- Quian, Y. (2002), Diss., Strategic Technology Management in Mechanical Engineering (Success Factors of Chinese Mechanical Engineering Companies in Competence-Based Competition)

Individual evidence

- ↑ See Baum, H.-G. et al. (2007), Strategisches Controlling, 4th edition, p. 263

- ↑ See Demirelli, N. (2007), The strategic implications of an outsourcing decision using the example of DaimlerChrysler AG, p. 13.

- ↑ See Prahalad, CK; Hamel, G. (1999). The Core Competence of the Corporation, in: Harvard Business Review, 68 (3), pp. 79-91.

- ↑ See Hinterhuber, H. (2004), Strategische Unternehmensführung, 7th fundamentally revised edition, p. 128 ff.

- ↑ See Steinle, C. et al. (1997), p. 17.

- ↑ See Thiele, M. (1997), p. 85.

- ↑ 7 Cf. Boos, F. / Jarmai, H. (1994), p. 22.

- ↑ Demirelli, N. (2007), The strategic implications of an outsourcing decision using the example of DaimlerChrysler AG, p. 15.

- ↑ See Hafeez, K .; Malak, N .; Zhang, YB (2007). Outsourcing non-core assets and competences of a firm using analytic hierarchy process, in: Computers & Operations Research, 34 (12), pages 3592-3608.

- ↑ See Schlüter, T. (2000), Strategisches Marketing für Werkstoffe, p. 134.

- ↑ See Thiele, M. (1997), p. 85.

- ↑ See Demirelli, N. (2007), The strategic implications of an outsourcing decision using the example of DaimlerChrysler AG, p. 17.

- ↑ See Quian, Y. (2002), Diss., Strategic Technology Management in Mechanical Engineering (Success Factors of Chinese Mechanical Engineering Companies in Competence-Based Competition) p. 108.

- ↑ Cf. Brade, J. (2005) Strategic Management in Extra-University Research: Development of a Concept Using the Example of the Helmholtz Association, DUV, p. 245 f.