Sustainability factor

The sustainability factor is part of the pension adjustment formula and influences the annual pension adjustment according to the change in the ratio of contributors to pension recipients. Both demographic and economic changes are taken into account. It was inserted into Section 68, Paragraph 4 of the Sixth Book of the Social Code (SGB VI) in 2004 by the Act to Secure the Sustainable Funding Basis of the Statutory Pension Insurance ( BGBl. 2004 I, p. 1791 ) and is intended to reduce the contribution rate by up to limit to a maximum of 22 percent by 2030.

The mathematical form of the sustainability factor

The sustainability factor (NHF) reflects the development of the pensioner quotient (RQ). To do this, it determines the change in the pensioner quotient (RQ) of the previous calendar year (t-1) compared to the previous year (t-2). The factor determines to what extent the change in the pensioner quotient affects the pension adjustment:

The pensioner quotient of a year (tx) relates the number of equivalent pensioners in the year to the equivalent contribution payers in the same year.

- Note: Until uniform income relationships between East and West have been established, the number of equivalent pension recipients and contributors for the old and new federal states will be calculated separately and added up (cf. §255a SGB VI).

The number of equivalent pensioners shows how many standard pensions (so-called corner pensioners) of the year tx would cause the pension volume (the expenditure of the pension insurance for pensions without, for example, the expenditure on rehabilitation) of the same year. The annual pension volume (west) is divided by the annual standard pension (west) and the annual pension volume (east) by the annual standard pension (east). The two numbers are then added. The number must be rounded to the nearest 1,000 equivalent pension recipients.

The number of equivalent contribution payers in year tx shows how many average earners would have to pay contributions in year tx in order to generate the contribution income of the GRV for the same year. In the west, the annual premium income (west) is divided by the annual premium on the provisional average earnings (according to Annex 1 of SGB VI) of the same year. The annual premium income (east) is divided by the premium due on the average income of the same year (according to Annex 1 SGB VI) divided by the provisional factor in accordance with Annex 10 of SGB VI. The number must be rounded to the nearest 1,000 equivalence contributors.

The complete formula looks like this:

| is 0.25. The change in the pensioner quotient therefore only adjusts the pension to a quarter. | ||

| Pension volume | Total volume of pensions paid | |

| Basic pension / standard pension | Amount of a deductible old-age pension with 45 earnings points | |

| Contribution volume | Total volume of the contributions of all employees subject to pension insurance, marginal part-time employees and those receiving unemployment benefits | |

| Contribution to vDE | Contribution to the GRV attributable to the provisional average pay according to Annex 1 SGB VI | |

Sample calculation for 2012

The change in the pensioner ratio of 2011 to the pensioner ratio of 2010 is decisive for the pension adjustment in 2012.

This then corresponds to:

Now the equivalent pension recipients and contributors for east and west are added:

Finally, the respective pensioner quotients are divided and the effect of the NHF is determined:

In 2012, the sustainability factor increased the pension by a factor of 1.0209. This corresponds to an increasing effect of 2.09 percent.

Political goal setting

The goal of the sustainability factor is essentially to change the pension adjustment in accordance with demographic and economic developments in such a way that the contribution rate ceilings set out in Section 154, Book Six of the Social Code (SGB VI) are observed. The factor in particular is an expression of this objective . "The α parameter is used to control [...] the achievement of a contribution rate target of 22 percent in 2030. [The value is] set at 0.25, taking into account the current forecasts [...]". "This guarantees an appropriate distribution of the financial burdens of the pension insurance, also taking into account the development of the decline in births and employment among contributors and pensioners [...]". As a result, the contribution rate target has become dominant over the performance target in the statutory pension insurance.

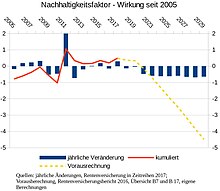

Effect of the sustainability factor

In the long term (up to 2030), the sustainability factor will ensure that pensions are around 20 percent (compared to 2002) behind wage developments (compared to 2012, around 14 percent). In the short term, as the sample calculation for 2012 shows, the sustainability factor can even have a pension-increasing effect, especially if the economy is developing very well. This effect is desirable. Because with the sustainability factor, the pension insurance was converted from a performance-oriented (defined-benefits) to a contribution-rate-oriented (defined-contribution) insurance system. The pension insurance no longer promises a certain pension level (percentage of the individual earnings position), on which the contribution rate is based, but the pensions may only increase if the contribution rate does not have to be increased. If the number of contributors increases more than the number of pension recipients, then the pensions are allowed to increase accordingly.

Criticism of the sustainability factor

The sustainability factor is much criticized as one of the dampening factors in the pension adjustment formula. Since it causes pensions to lag significantly behind wage developments, pensions will lag behind inflation if real wages are stagnating or rising slightly. In any case, the insured must provide additional private or company provisions in order to achieve the previous level of benefits. However, these costs are largely borne by the insured persons alone, which considerably relieves the burden on employers and the burden on the insured. That is why many social associations, the trade unions and parts of the opposition are calling for the sustainability factor to be removed.

See also

Web links

- Annual report 2004/2005 of the council of experts for the assessment of the macroeconomic development. (.pdf 17 MB)

Individual evidence

- ↑ Draft of the RV Sustainability Act (PDF; 203 kB)

- ↑ Pension Value Determination Ordinance 2012 ( Memento of the original from July 23, 2012 in the Internet Archive ) Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Draft of an RV Sustainability Act (PDF; 668 kB), p. 23, reasons for paragraph 4

- ↑ Draft of an RV Sustainability Act (PDF; 668 kB), p. 22, reason for paragraph 1

- ↑ Statement on pension adjustment 2013 (PDF; 143 kB), Sozialverband Deutschland, Berlin, 2013

- ↑ Speech by Gregor Gysi ( Memento of the original from May 8, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. on March 1, 2013 in the German Bundestag ; Retrieved April 10, 2013