Protective put strategy

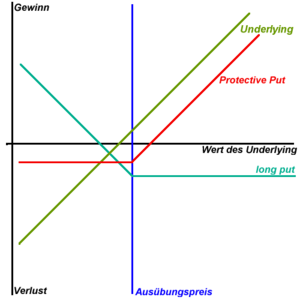

A protective put strategy is an option strategy that combines securities and options .

With a Protective Put strategy to acquire the underlying (z. B. a share) and a put option (including the put option called) to do so. The point is to use the put option to hedge against the risk of price decline, for example by means of delta hedging . It is therefore an important means of implementing a capital preservation strategy . The advantage of the protective put strategy is that the loss is limited. Certificates that implement a special protective put strategy are called guarantee certificates .

Comparison with the covered purchase option

The covered purchase option is a similar construct . The difference between the two strategies is: A protective put strategy secures a minimum sales price and pays a premium for it. The covered purchase option guarantees a maximum sales price and receives a discount for it.