Debt deflation

A debt deflation occurs when a drop in prices ( deflation ) to falling nominal income leads. Since the nominal amount of debt and the interest owed remain unchanged, debt deflation leads to an increase in the real debt burden. This can lead to a spiral of deflation: the increase in the real debt burden causes the bankruptcy of some debtors. This leads to a decrease in aggregate demand and thus to a further decrease in prices (worsening deflation). This in turn leads to an even further decline in nominal income and thus to an even greater increase in the real debt burden. This leads to further bankruptcies and so on.

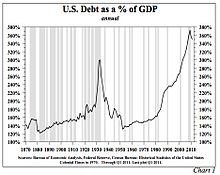

There is strong empirical validity that debt deflation was a major cause of the Great Depression.

Irving Fisher (1933)

Based on the now widely accepted quantity theory , Irving Fisher argued in his book The Debt-Deflation Theory of Great Depressions (1933) that the Great Depression was caused by the effects of deflation on credit debt. He emphasizes that a high amount of debt is not in itself harmful. But he mentions a chain of circumstances that lead to debt deflation and a recession:

- Debtors try to become solvent in the short term with distress sales (sales at very low prices).

- The repayment of debts leads to a reduction in the deposit money creation of the banks and thus to a reduction in the money supply.

- By reducing the money supply, the price level falls.

- As a result of the falling price level, the company values fall. The creditworthiness of companies is reduced, which makes it difficult to extend or reschedule loans.

- Corporate profits are falling.

- Companies are cutting production and laying off workers.

- There is a general loss of confidence in the economic situation.

- Instead of investing, money is hoarded.

- Although nominal interest rates are falling, the general decline in prices increases the real weight of the interest burden.

The result of debt deflation is apparently paradoxical: the more debts are repaid, the more the money supply falls (if the government and central bank do not intervene to reflation, as at the beginning of the Great Depression), the more the price level falls, and the more oppressive the real weight of the remaining ones becomes Debt burden.

Ben Bernanke (1983)

Ben Bernanke extended Irving Fisher's theory to include the “credit view”. If a borrower goes bankrupt, the bank will auction the collateral. Deflation also causes the prices of property, plant and equipment, real estate, etc. to fall. This leads to banks rethinking the risks of lending and consequently granting fewer loans. This leads to a credit crunch , which in turn leads to a decrease in aggregate demand and thus to a further decrease in prices (worsening deflation).

Empirical validity

There is strong empirical validity that debt deflation was a major cause of the Great Depression.

Countermeasure

Reflation policies are recommended as a solution to the debt deflation problem .

Individual evidence

- ↑ Randall E. Parker, Reflections on the Great Depression , Edward Elgar Publishing, 2003, ISBN 9781843765509 , p. 14

- ↑ Irving Fisher: The Debt-Deflation Theory of Great Depressions . In: The Econometric Society (Ed.): Econometrica . 1, No. 4, October 1933, pp. 337-357. JSTOR 1907327 . doi : 10.2307 / 1907327 .

- ↑ Randall E. Parker, Reflections on the Great Depression , Edward Elgar Publishing, 2003, ISBN 9781843765509 , pp. 14-15

- ↑ Randall E. Parker, Reflections on the Great Depression , Edward Elgar Publishing, 2003, ISBN 9781843765509 , p. 15