Input choice

The input choice represents one of the three sub- topics in company theory and is a prerequisite for profit maximization . In order to determine the company's optimal, cost-minimizing input combination , the other two areas of production technology and production costs must first be brought together. The goal when choosing the input is usually to maximize the output produced.

requirements

For the optimal input combination, two requirements must be met:

- It must be on the isocost line . In other words, it must be feasible based on the production budget.

- It must enable the producer to produce a maximum output quantity, i.e. lie on the highest possible isoquant (within a factor diagram).

Analogous to the indifference curves , isoquants describe which input combinations

produce the same output quantity.

The isocost line

The input factors (production factors ) are not freely available and the input quantities are limited by the costs for the inputs. It must now be determined whether the company can really afford the input factors that are required to produce the corresponding output quantities. The isocost line shows all combinations in a factor diagram that lead to the same total costs (according to the budget). With this straight line one can determine the minimum cost combination of the input. The prices of the input factors considered determine the position (slope) of the isocost line.

Analogy to the budget line from household theory

Graphical representation

- C = total cost

- r = interest

- w = price of labor

- L = amount of work

The cost function

This function relates the cost of production to the level of production and other variables that the company can control. Or: Indicates the minimum total costs for the production of the output quantity.

Assumption: 2 input factors (labor & capital):

- : Amount of work

- : Amount of capital

- : Price to work

- : Price of capital

- : Total cost of production

Total cost of production:

- or.

different isocost lines represent different total cost levels

The cost-minimized input choice

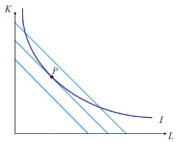

The optimal input combination is at the tangent point of the isocost line with the highest possible isoquant that just touches it. At this point the slopes of the isocost line and the isoquant are identical. The slope of the isoquant is described in terms of size by the marginal rate of technical substitution (GRTS). This marginal rate describes the amount by which the amount of an input can be reduced if an additional unit of another input is used so that the output remains constant.

The following applies:

Graphic of the minimum cost combination

- Isocost line

- Isoquant

Figure 2: Point P ( tangential point ) shows through the combination of technology

and prices of the inputs a minimum cost combination for the output level of

the isoquant. Minimum cost combination means the production of a

certain amount of output at the lowest possible cost.

The calculation

As already mentioned above, the slope of the isoquant for the minimum cost combination is identical to that of the isocost line (optimality conditions). The slope of the isoquant corresponds to the marginal rate of technical substitution (GRTS) and the slope of the isocost line corresponds to the factor price ratio.

Therefore, in the optimum:

Alternative interpretation of the cost-minimizing input choice:

corresponds to the additional output, per additional € for the labor factor

corresponds to the additional output, per additional € for the capital factor

In the cost minimum, the last added € of each input factor must achieve the same additional output!

Temporal dimension of production

A company cannot adapt to changed framework conditions in the short term; the minimum cost combination can only be achieved in the long term

Short-term: At least one input factor is fixed in the short term , i.e. not variable.

Long-term: All input factors used are variable.

Individual evidence

- ↑ see Silko Pfeil: VWL1 Abstract Microeconomics (2nd edition), 2007, Jena p. 37

- ↑ See Ulrich Fehl / Peter Oberender: Fundamentals of Microeconomics (6th edition), Munich 1994, Verlag Franz Vahlen GmbH, p. 71ff

- ↑ cf. Dietrich (2007): Die Produktion, Universität Erfurt, p. 12 ff. Http://economicscience.net/files/lec8-1x3.pdf , April 8, 2008

- ↑ cf. http://www.teialehrbuch.de/Kostenlose-Kurse/BWL/23276-Kostenfunktion.html , April 21, 2008

literature

- Ulrich Fehl / Peter Oberender: Fundamentals of Microeconomics , (6th edition), Munich 1994, Verlag Franz Vahlen GmbH