Investment funds

An investment fund is a fund that manages the investment assets or special assets that an investment company has invested for investors in accordance with its contractual conditions .

General

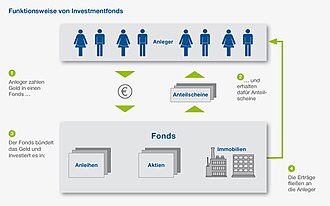

An investor has the choice of shares or bonds directly through banks or brokers to buy or mutual fund purchase by an investment company, the different again for their investment or fund a mix stocks, bonds or other financial instruments compiles. The main advantage of the investment fund is its risk diversification . This is best for mixed funds because investments can be made in all financial instruments; In the case of equity funds, on the other hand, risk diversification is limited to shares.

Legal issues

The legal basis for investment funds is the Capital Investment Code (KAGB), which does not speak of investment funds, but in Section 1 of the KAGB of investment funds or special assets. It only uses the term investment fund in connection with alternative investment funds (AIF) and protection of names. Designations such as " capital management company ", "investment fund", "investment fund" or "investment company" or a designation containing these terms may be used in the company , as an addition to the company, to designate the business purpose or in accordance with Section 3 (1) KAGB for advertising purposes only by management companies within the meaning of the KAGB. According to Section 1 (11) KAGB, the legal form of investment companies must be a stock corporation or a limited partnership .

Belonging to the fund assets may in accordance with the investment conditions of ownership of capital management company or joint ownership of investors are ( § 92 para. 1 KAGB). The first form is the fiduciary solution , the second form establishes co-ownership shares of the investors. Although the management company is the legal owner of the fund in the former form , the fund is not liable for the liabilities of the management company in accordance with Section 93 (2) KAGB . This exclusion of liability is completed by Section 99 (3) KAGB, according to which the right of the capital management company to manage the investment fund expires when insolvency proceedings are opened against the capital management company's assets. The fiduciary solution is mandatory for real estate special assets ( Section 245 KAGB).

If the right of the capital management company to manage an investment fund expires, then in accordance with Section 100 (1) KAGB - if the investment fund is owned by the capital management company - the investment fund is transferred to the depositary or - if it is jointly owned by the investors - the management and right of disposal over the fund is transferred to the depositary. The depositary has the fund handle and distribute to investors (§ 100. 2 KAGB). In addition, there is a prohibition of separation, obligation, debit and set-off under investment law (section 92 (1) sentence 2, section 93 (2) sentence 2 and sections 3 to 6 of the KAGB). Because of this investor protection under investment law, deposit protection is not required for investment funds.

In Section 2 of the Investment Tax Act , the investment fund is elevated to a legal term , but without being legally defined. Domestic mutual funds are considered according to § 6 para. 1 InvStG as purpose fund to § 1 para. 1 no. 5 Corporation Tax Act (CITA). Special-purpose assets are trust assets that the investment company holds for investors. Their domestic investment income , domestic real estate income and other domestic income are subject to corporation tax (Section 6 (2) InvStG). Equity funds or real estate funds must invest more than 50% of their assets in shares or real estate (Section 2 (6) and (9) of the Investment Tax Act).

species

Depending on the focus of the fund, there are particular stock funds , alternative investment funds , fund of funds , ethical funds , film funds , guarantee funds , money market funds , hedge funds , real estate funds , open-ended property funds , property funds , index funds , infrastructure funds , fixed-term funds , media funds , balanced funds , private equity funds , bond funds , Ship funds , special funds or forest funds . While special funds only for certain institutional investors launched or investor groups, are mutual funds open to all investors.

For many of these types, a distinction must be made between open-ended investment funds and closed-end funds . The distinction between open-ended and closed-end funds is particularly important for the authorization as a capital management company, for the permissible legal form of the fund, the approval of the investment conditions, assets that can be acquired and the investment strategy. Investment funds with securities (UCITS) are always open-ended investment funds because there is a right of return (Art. 1 Para. 2b UCITS Directive ). Pursuant to Section 98 (1) of the KAGB, every investor can request at least twice a month that their share in the investment fund be paid out to them in return for their share. However, the investment conditions can stipulate that the management company may suspend the redemption of units if there are exceptional circumstances that make suspension appear necessary, taking into account the interests of the investors. There are special regulations for real estate funds according to Section 255 KAGB. In contrast to open funds, with closed funds the return of investment certificates is not possible or only possible to a limited extent.

economic aspects

Investment or special assets of the investment fund are congruently refinanced through the investment certificates issued . The fund managers carry out the portfolio management of investment or special assets . They perform the tasks of market observation, in particular of the financial markets , market analysis and asset allocation , which leads to buying, selling or holding individual financial instruments ( underlyings such as securities) using a benchmark . With asset allocation, care must be taken to ensure that there is good risk diversification with an acceptable risk mix due to high granularity with an acceptable concentration of risk . When diversifying risk into the various asset classes, they take into account the existing investment strategy , analyze the leverage effect of the investment assets and the extent to which this leverage is secured ( Section 29 (4) KAGB). The fund managers are obliged to monitor the overall performance in order to ensure sustainable performance of the investment fund.

Web links / literature

- Börsenlexikon FAZ: Investment funds

- Literature on investment funds in the catalog of the German National Library