account

The account (from ital. Conto , "invoice", from Latin computus , "calculation") is the central data structure in bookkeeping as well as in payment transactions .

Structure and use

In principle, an account is a table with any number of rows and two columns (called debit and credit ) that hold amounts of money. In practical applications, these two columns are almost always supplemented by additional auxiliary columns that contain information such as the posting date, a consecutive number of the posting line, explanatory text, etc.

The account itself is identified by a (mostly numeric, less often alphanumeric) account number and almost always has a concise name. In many cases, information is like the type of account (see below) encoded in its number, which one as a chart of accounts or as accounting plan referred scheme requires for number assignment.

For teaching purposes and as an aid to account assignment , an account is usually shown as a so-called T account : Above a horizontal line is the account number and name, and below it is a space for debit postings (left) and credit postings (right), divided by a vertical line.

A monetary amount can be posted to an account : One or more lines are added to the account. For active inventory accounts and expense accounts, an amount is credited by entering it in the debit column of the account. If an amount is to be deducted from the account, it is placed in the credit column. The reverse is true for passive inventory and income accounts. The difference between the sums of debit and credit postings is the effective account balance known as the balance .

Chart of accounts and classes

Accounts for financial accounting are structured according to the decimal system and are regularly divided into 10 account classes, regardless of the economic sector.

Example for account classes according to SKR04:

| Account class | Account area | Account name | description |

|---|---|---|---|

| 0 | 0001-0999 | Capital assets | Accounts for the company's long-term funding needs |

| 1 | 1000-1999 | Current assets | Accounts for movement of goods, for short and medium-term finances and active accruals and deferrals |

| 2 | 2000-2999 | Equity | Accounts for equity, for capital and revenue reserves as well as profit carryforwards |

| 3 | 3000-3999 | Borrowed capital | Accounts for all liabilities and deferred income |

| 4th | 4000-4999 | Operating income | Accounts for income from sales, services, inventory changes, bonuses and discounts granted |

| 5 | 5000-5999 | Operating expenses | Accounts for material costs, incoming goods, bonuses and discounts received |

| 6th | 6000-6999 | Operating expenses | Accounts for business-related expenses such as B. wages & salaries, depreciation, rent |

| 7th | 7000-7999 | Other income and expenses | Accounts for income from investments, interest expenses and income, depreciation as well as trade and property tax expenses |

| 8th | 8000-8999 | free | |

| 9 | 9000-9999 | Lecture accounts, statistical accounts | Accounts for private deposits and withdrawals, opening and closing balance accounts, adjustment accounts and statistical accounts |

Account groups for double entry bookkeeping

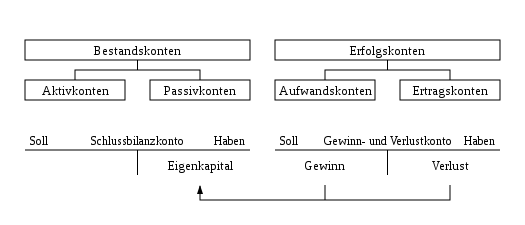

In double-entry bookkeeping, a distinction is made between two groups of accounts: the stock accounts and the profit accounts.

Inventory accounts are derived from the balance sheet . They contain the stocks of assets ( assets ) and capital ( liabilities ) and record their changes. Your balances are continued: The opening balances at the beginning of the financial year correspond to the closing balances of the previous period. Even bank accounts are this definition, according to balance sheet accounts.

Success accounts capture expenses and income , so winning or performance-effective operations. They are "empty" at the beginning of the year, ie without opening balances, and closed at the end of the year via the profit and loss account . Its balance then flows into the balance sheet item of the same name via the equity account . The equity account connects the two groups of accounts .

Two auxiliary accounts are required to transfer the values from the balance sheet to the accounts and back again. At the beginning of the financial year , the items in the opening balance are transferred to the stock accounts via the opening balance account (EBK). The following principle applies: The opening balance account is the exact mirror image of the opening balance. In the annual financial statements , the closing balance account (SBK) is used to transfer the new balances back to the closing balance after coordination with the inventory .

Current account

The current account bookkeeping processes the (cashless) business relationships of a company with its customers and suppliers . In order to be able to show the receivables and liabilities towards each individual business partner, the general ledger accounts “Receivables a. LL "(read: from deliveries and services) and" Liabilities a. LL "is broken down into personal or business friend accounts. A distinction is made between customer accounts for customers and accounts payable for suppliers. The current account is primarily used to monitor payments . Each personal account contains information about the respective business partner in the master data record (for example address, bank details , payment targets or billing plans ). For one-off and rarely occurring business contacts, CpD or collective accounts are kept in the current account .

Billing account

Companies can use a billing account to process specific, cashless transactions, be it from debtors or creditors, separately. These accounts can be provided by third parties. Examples of these billing accounts are central billing accounts for business travel management (English travel management). Typical travel expenses and business travel transactions such as hotel, flight or rental car bookings are processed via an account managed by a third party. The main advantage of such a billing account is that it can be easily integrated into the company's existing processes, but later on offers valuable evaluation and individual analysis options for billing.

literature

- Manfred Deitermann / Siegfried Schmolke: Industrial accounting IKR. Winklers Verlag Darmstadt, 34th edition 2006. ISBN 3-8045-6652-9

- Falterbaum / Bolk / Reiss / Kirchner: Bookkeeping and Balance Sheet Erich Fleischer Verlag, Achim, 21st edition 2010. ISBN 978-3-8168-1101-5

Web links

Individual evidence

- ↑ Account classes for the posting records , accessed on July 12, 2013.