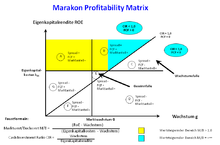

Marakon Profitability Matrix

Marakon Profitability Matrix is a controlling instrument and is also used in other areas of business administration . The instrument developed by Marakon Associates for the representation and analysis of the company portfolio is based on the Gordon model and the associated boundary conditions. The Marakon Profitability Matrix serves as an explanatory grid for the financial positioning of strategic business units within strategic management .

Gordon model

The Gordon model is a value-based controlling tool that has been developed from the dividend discounting model (DDM) developed by Williams. The Gordon model follows the approach of shareholder value and is used to evaluate future corporate success. It is assumed that potential company growth leads to higher dividend payments. In order to incorporate this assumption into the valuation scheme of shareholders, the dividend and growth are increased at a constant rate annually. From the assumptions made, the following calculation of the market / book value ratio for a company can be derived:

- Return on Equity (RoE)

- Growth (g)

- Own capital costs (K EK )

From this calculated market / book value ratio, the following decision rules can be made:

| M / B> 1 | RoE> K EK | Growth is increased | Business / value enhancement for owners |

| M / B = 1 | RoE = K EK | Growth is neutral | Preservation of value for owners |

| M / B <1 | RoE <K EK | Growth reduces company value | Destruction of value for owners |

Marakon Profitability Matrix

The Marakon Profitability Matrix is a graphic representation in a two-dimensional coordinate system based on the M / B ration determined in the Gordon model. The growth g is plotted on the abscissa and the return on equity RoE of the strategic business units is plotted on the ordinate .

Cash Investment Ratio (CIR)

The CIR represents the relationship between the equity invested and the resulting return flows of capital. The CIR is defined as follows:

Since Marakon's equity approach is based on profit-oriented parameters, the free cash flow is to be understood as so-called equity- free cash flow and is defined as follows:

This results in the following relationship:

| Cash Investment Ratio | Equity free cash flow | Explanation from the equity provider perspective |

|---|---|---|

| CIR <1 | Equity free cash flow> 0 | Investments in the business are smaller than the returns from the business |

| CIR = 1 | Equity free cash flow = 0 | All funds released are reinvested |

| CIR> 1 | Equity free cash flow <0 | Business investment needs exceed business returns |

The return on equity , the growth and the cash investment ratio result in a three-fold grid with seven fields. These can be viewed from different perspectives:

The spread perspective

This shows the difference between the return on equity and the cost of equity . A positive spread generates returns, while business units with a negative spread cannot cover the cost of equity.

Positive spread: A, B and C

Negative spread: D, E, F and G.

The free cash flow perspective

Business units that are above the bisector release liquid funds; business units below consume them.

Free cash flow> 0: A, B, E and G

Free cash flow <0: C, D and F

The market share perspective

Business units that are growing faster than the market average gain market share while others lose market share.

Market share winners: B, C, E and D

Losing market share: A, G and F

Growth trap

The situation of business units in Area C is of particular importance. The business unit gains market share and generates the cost of capital , but the above-average growth has to be financed, which means that the business unit does not achieve a positive free cash flow . In the Boston I portfolio (also known as the BCG matrix ), such business units can be compared with the stars. This means that the business unit will most likely generate a positive cash flow in the future , as this will develop into a cash cow after the product life cycle .

Profit trap

The business unit generates positive cash flow, but the spread is negative. That is, the reported profit cannot cover the cost of capital. If the profitability cannot be increased, divestment is advised in this case .

Marakon Portfolio Profitability Matrix

Marakon Portfolio Profitability Matrix is an advanced model of the Marakon Profitability Matrix. This makes it possible to compare business units in different markets. Up until now, it was difficult to compare business units as they are dependent on market-related factors that cannot be influenced.

The Marakon Portfolio Profitability takes these influencing factors into account. Instead of the growth of the business unit, the relationship between growth and market growth (g / G) is used. The RoE can only be used to a limited extent to compare different business units, since the cost of equity varies depending on the risk of the market. The RoE spread (RoE - K EK ) is selected to enable a comparison, i.e. to take into account the various market risks .

The third dividing line (cash investment ratio) can no longer be drawn. However, the CIR can be calculated and indicated next to the circular areas.

The circular area is shown proportionally to the invested capital, so the importance of the strategic business units within the portfolio is shown.

evaluation

The Marakon Profitability Matrix, based on the Gordon model, provides an overview of the value contributions of individual strategic business units of a company. With the help of this simplified visualization, it is possible for the company to derive strategic decisions for the continued success of the various business units. The matrix also reaches the limits of its effectiveness, which are based on the assumptions of the Gordon model. This is because this is a static model (various constancy assumptions such as return on equity / cost of equity ) with many restrictive assumptions about relationships between various factors, which is rarely found in practice.

literature

- Burger, Anton; Ulbrich, Philipp: R.Oldenbourg Verlag (Ed.): Beteiligungscontrolling 2005, ISBN 3-486-57870-7 , pp. 571-572.

- Gleißner, Werner: Gabler Verlag (ed.): Value-oriented risk management for industry and trade , 1st edition 2001, ISBN 3-409-11699-0 , pp. 83-85.

- Günther, Thomas: Verlag Franz Vahlen (ed.): Unternehmenswertoriented Controlling , 1st edition 1997, ISBN 3-8006-2106-1 , pp. 222-224, 348-357.

- Baum, Heinz-Georg; Coenenberg, Adolf G .; Günther, Thomas: Schäffer-Poeschel Verlag (Hrsg.): Strategisches Controlling , 1st edition 2007, ISBN 3-7910-2545-7 .