BCG matrix

The BCG matrix (also known as the Boston I portfolio ) is a portfolio for the strategic management of companies. Various products or services of a company are arranged in a matrix with the coordinates of relative market share and market growth and standard strategies are developed from this .

General

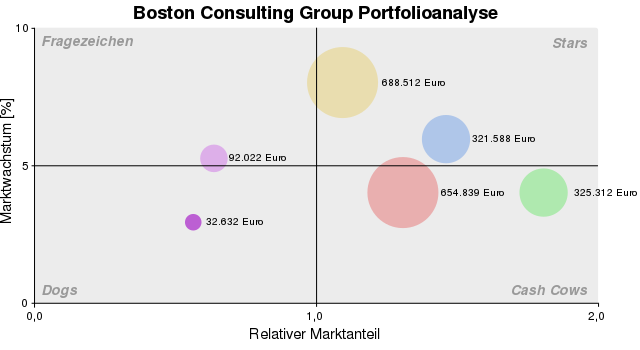

The BCG matrix is named after the Boston Consulting Group (BCG), whose founder Bruce Henderson developed this matrix in 1970. This concept should clarify the connection between the product life cycle and the cost experience curve. The matrix is often visualized as a scatter or bubble diagram ; the area of a circle then represents the sales of the respective product .

Norm strategies

The products or business units of a company are assigned to one of the four areas based on their values. Each area embodies a standard strategy. It should give a good recommendation on how to proceed. The life cycle of a typical product runs from the question mark to the star and cash cow to the poor dog. There are also products that do not follow this ideal path. Many flops do not even reach the star range. An imitating product, on the other hand, may skip the question mark area .

- The Question Marks (also question marks, newcomer products or babies) are the newcomers among the products. The market has growth potential, but the products only have a small relative market share . The management has to decide whether to invest or to abandon the product. In the case of an investment , the product requires liquid funds , which it cannot generate itself. A typical strategy recommendation is: selection and possibly an offensive penetration strategy to increase market share.

- The stars are the company's most promising products. You have a high relative market share in a growth market. The investment requirements resulting from market growth are already covered with their own cash flow . The strategy recommendation is: investment , and possibly a skimming strategy to increase contribution margins without jeopardizing market share.

- The cash cows ( milking cows ) have a high relative market share in an only slightly growing or static market. They produce stable, high cash flows and can be "milked" without further investment. A fixed price strategy or price competition strategy is appropriate.

- The Poor Dogs are the discontinued products in the company. They have low market growth, sometimes market contraction, and low relative market share. At the latest as soon as the contribution margin for these products is negative, the portfolio should be adjusted ( disinvestment strategy ).

In addition to assessing the individual products using the standard strategies, the entire portfolio should also be considered. Pay attention to the static financial equalization - the products in the portfolio should support and finance each other. A question mark can only expand if z. B. a cash cow finances this expansion. Future developments can also be seen. The products should be evenly represented in the individual areas - a company without question marks would have little chance in the future market.

matrix

The idea of the product life cycle is incorporated by mapping the real future market growth on the ordinate . That should represent the environmental dimension.

On the other hand, the relative market share based on the experience curve concept (ratio of one's own market share to that of the strongest competitor) is plotted on the abscissa . It embodies the corporate dimension and should take into account the idea that a company that has higher sales compared to the competition gains experience. This additional experience leads mainly to costs - of scale and to reduce market risk .

Dividing lines must be found to divide the portfolio. For the market growth, the dividing line results from the future average growth of the industry or the gross domestic product . A value of 1.0 is usually assumed for the relative market share, but another value is also possible.

example

The above example portfolio is unbalanced: although many products are in the liquidity-generating areas, there is a lack of newcomer products. The company will have problems with its position on the market in the medium to long term. This knowledge can be obtained very easily with a look at the visualization of product sales using the so-called bubbles . This is a major advantage of the model - the overview of static variables (in this case absolute sales figures) within the framework of the dynamic market dimensions.

From the point of view of product policy in marketing , it is advisable in this example to either quickly eliminate the existing offers in the Poor Dogs area or to bring them onto the market so strongly that they can be prepared for the upcoming market with suitable market communication .

Such a situation also has an impact on the company rating according to Basel II . Although the company is currently generating high profit margins , this does not mean that the company's capitalization will also be invested in product innovation in good time. Since the company valuation by the bank according to Basel II only asks for the static performance indicators without considering a dynamic segmentation of the product portfolio, the company uses both the EBIT analysis (EBIT: earnings before interest and tax ) and the Being able to present key figures for added value excellently.

The problem with debt financing , however, is the intrinsic value of the commitment for the future and thus securing the loan with future successes to be expected. Banks that have adjusted to a Basel II-compliant performance appraisal will not recognize the strategic risk of their customers in this case. The company may receive high loans on favorable terms without expecting any follow-up income in the current portfolio in the medium to long term. Should a company use this advantage directly to finance new products, further success could in turn be relatively easily financed with outside capital. The advantage of the BCG matrix lies in the mapping of current and future potential of the company.

criticism

The relation between market share and profitability is questionable as the development of the market share can require high investments. The PIMS study , however, confirmed a connection. In addition, the approach places a questionably high weight on market growth and ignores the potential of declining markets. The matrix could therefore down, so for shrinking markets, are supplemented by two fields: Underdog (Under Dogs, sinking growth with low market share) and losers (buckets, sinking growth with high market share).

Another point of criticism relates to the growth rate of the market, which is taken for granted in the BCG model. In reality, however, a company can positively influence market growth through appropriate marketing measures.

The usual dividing line between a relatively low and a relatively high market share is 1.0. This means that only the market leader can have stars and cash cows in their portfolio . The setting of the values for the dividing lines (e.g. 1.0 for the relative market share and 5 percent for the real market growth) is purely subjective. It must be carried out with the awareness that other values (e.g. 0.7 for the relative market share or 8 percent for the real market growth) can lead to a shift of the business areas to another quadrant of the portfolio. This would ultimately lead to different norm strategies.

The matrix is only a snapshot and does not provide a forecast , but forms a basis for further considerations.

See also

- Eisenhower Principle , a 2 × 2 decision matrix

- List of controlling instruments

literature

- Baum, Heinz-Georg / Coenenberg, Adolf G. / Günther, Thomas: Strategisches Controlling , 4th edition, Schäffer-Poeschel Verlag, Stuttgart 2006, ISBN 3-7910-2545-7 (explanation of various portfolios with examples)

- Geml, Richard / Lauer, Hermann: Marketing and Sales Lexicon , 4th edition, Poeschel-Verlag, Stuttgart 2008, ISBN 978-3-7910-2798-2

- Hahn, Dietger / Taylor, Bernhard (eds.): Strategic corporate planning - strategic corporate management: status and development tendencies, 7th edition, Physica-Verlag, Heidelberg 1997, ISBN 3-540-23575-2 , pp. 342-353, p 372-435

- Olbrich, Rainer: Marketing, An Introduction to Market-Oriented Management , 2., neubearb. Ed., Berlin et al. 2006, ISBN 3-540-23577-9

- Schneider, Dietram: Corporate Management and Strategic Controlling - Superior Instruments and Methods . 4th edition, Hanser Verlag, Munich 2005, ISBN 3-446-40428-7