costs

Costs are the negative consequences of a profitable use of production factors . The exact definitions differ depending on the subject . In the business sense of cost accounting , it is usually understood to mean the consumption of production factors evaluated in monetary units . The valuation is based on payment transactions, for example the acquisition costs . In contrast, the quantitative consumption is referred to in production and cost theory as the input quantity or input. There are also opportunity costs , which describe lost profits . They also include the so-called pagatorial costs .

In business administration

Cost terms

From a business point of view, costs represent the assessed consumption of production factors in monetary units (MU), which are necessary for the production of the operational performance in a billing period. According to a business definition, costs are to be understood as the orderly, operationally related, valued consumption of goods and services in a period or, in other words, the use of value of goods and services for the provision of services. The valuation takes place in monetary units. Factor consumption can take the form of goods, services, labor, and rights. Even Tax Rate are part of the operational costs.

In addition to this value-based cost concept, business theory also differentiates between the pagatory (according to Helmut Koch and Erich Kosiol ) and the decision -oriented cost concept (according to Paul Riebel ). While the pagatorial concept of costs is based on (performance-related) payments, decision-oriented costs are used to evaluate alternative courses of action, the realization of which would trigger these costs. In contrast to the value-based cost concept, no opportunity costs are to be taken into account here, since these are included in the assessment as a suppressed contribution margin.

Opportunity costs are decision-oriented, but have nothing to do with the decision-oriented cost concept according to Paul Riebel. Opportunity costs are only a basis for assessing the amount of certain costs and can also be used within the value-based cost concept. In contrast, Paul Riebel defines his decision-oriented costs as "the additional - not compensated - expenses triggered by the decision on the object under consideration".

Differentiation from other invoice values

Costs and revenues are used as a pair of terms in internal accounting , i.e. H. used in particular in cost and performance accounting. It should be noted, however, that revenue should not be confused with performance . Costs and revenues are differentiated from similar pairs of terms as follows:

- Expense and income form the analogous pair of terms in external accounting and are used to create a periodic profit and loss account .

- Expenditure and income are key concepts in accounting . They arise when something has been bought or sold, regardless of whether it has already been paid for or not. Once effective payments are made, expenses and income become payouts and deposits . Payments and payments are the basic calculation parameters of dynamic investment calculation and treasury . The mentioned pairs of terms mostly overlap in terms of content. The use of the term is primarily based on the intended invoice purpose.

However, differences between costs and effort can arise, for example, if

- Operations are assessed differently, such as imputed depreciation and accounting depreciation (dar former represents costs, the latter effort)

- Costs are stated that have no equivalent in external accounting ( e.g. imputed interest or entrepreneurial wages)

The approach of imputed cost elements (e.g. of risk costs ) is, like the conceptual differentiation between costs and effort in general, a phenomenon of German cost theory and has no equivalent in other countries and languages. In English, for example, the terms cost and expense are largely used synonymously.

Cost categories

Within cost accounting , a distinction is made between the following pairs of cost terms:

- Step- fixed and fixed costs , variable costs , and mixed costs

- Direct costs and overheads

- primary cost and secondary cost

- Basic costs , other costs and additional costs

- Paid costs and imputed costs

- Decision-relevant costs and decision-irrelevant costs

- Full costs and partial costs

- Planned costs , normal costs and actual costs

- Total costs and unit costs

- Operating costs and maintenance costs for machines and systems

- Depreciation costs

- Opportunity costs (special kind of imputed costs)

- Target costs and actual costs

- According to the new institutional economics : transaction costs when carrying out day-to-day transactions , when carrying out one-off transactions, these can be ex ante (costs of the upfront) and ex post (costs for aftercare)

- related to costs: contribution margins to cover overhead costs

- Time costs and time cost rate

- Explicit costs (= absolute costs, actual expenses)

As a rule, the cost categories are not free of overlaps, but rather different perspectives on one and the same population, namely the cost block to be considered. For example, direct costs are often variable and can be actual costs or planned costs.

In economics

Microeconomics

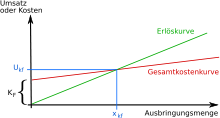

In economics , the concept of costs in microeconomics is discussed in connection with production and cost theory as a parameter in various production functions . Costs usually refer to the use of production factors in the production of goods and services, valued at market prices. The total costs (K) are divided into fixed (K fix ) and variable costs (K var ) within the cost function : K = K fix + K var . In relation to an individual production unit , the unit costs or average total costs (k) are made up of average fixed costs (k fix ) and average variable costs (k var ): k = k fix + k var .

Fixed costs exist if the period of observation is chosen so short that the corresponding factor input does not vary with the production volume. If the observation period is chosen long enough, all costs are variable. Stopping production, for example, would bring these costs to zero in the long term. The assignment is not always clearly possible. One then speaks of quasi-fixed costs (example labor input with variable and fixed cost components at the same time: wage costs, costs for canteens, sanitary facilities, etc.).

In microeconomics, the marginal costs (ie the costs related to an additional unit) are of fundamental importance .

Economical accounting

Economic accounting uses the concept of social costs as a special case of external effects . These are external side effects of products and consumption. This is always the case when not all costs are borne by the producer or consumer, but are passed on to third parties or society as a whole. This is the case, for example, with environmental pollution from traffic.

Web links

Individual evidence

- ↑ Olfert, K .: Kostenrechnung , 16th ed., Herne 2010, ISBN 978-3-470-49696-2