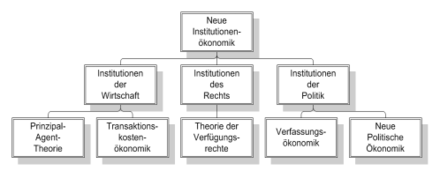

New Institutional Economics

The New Institutional Economics (NIÖ) has been an emerging field of research in economics since the 1970s , which examines the effect of institutions on economic units (private households, companies). A distinction must be made between the New Institutional Economics and the (“old”) Institutional Economics .

object

Institutions in the sense of the New Institutional Economics are formal and informal rules including the mechanisms of their enforcement, which restrict the behavior of individuals in transactions. They serve to reduce uncertainty and thus promote the possibility of interpersonal exchange.

history

A few classics have already dealt with what we understand by institutions today. Adam Smith already deals with restrictions on action in the form of informal institutions and David Hume addresses property rights . John Stuart Mill recognized the importance of habits in the formation of market prices . Yet both neoclassical theory and Keynesianism ultimately neglected institutions.

The New Institutional Economics can be traced back to the 1937 essay The Nature of the Firm by Ronald Coase . This work is commonly considered to be the "invention" of transaction costs . Transaction costs are a central subject of study in New Institutional Economics because their existence explains the importance of institutions for successful transactions. The term “New Institutional Economics” was first coined in 1975 by Oliver Williamson . The New Institutional Economics has been widely recognized in economics since the middle of the 20th century at the latest . The Nobel Prize winner Douglass North also played a major role in this . In Germany , the business ethicist Karl Homann in particular contributed to research in the field through the ethical foundation of the institutional concept, as did Josef Wieland with the development of the governance ethics .

Assumptions

A central assumption is that growth and investment, but also international development and wealth and poverty, depend on the respective institutional framework conditions, above all on property rights , legal regulations and restrictions (e.g. governance structures) and other factors such as persistent imbalances of the market, incomplete contracts , asymmetrical information , changes in knowledge, limited rationality , opportunism or moral hazard . The transaction costs arising from all these aspects are explicitly taken into account by institutional economics.

The new institutional economics thus differs in essential points from the neoclassical theory , in whose simple model of Homo oeconomicus there are no transaction costs and no non-economic behavioral incentives. The neo-institutional economists explain this assumption as unrealistic, because it significantly distorts the reality in which transaction costs and non-economically motivated behavior are very important.

example

When two individuals trade with one another, the exchange of goods is regulated by relevant norms, customs and practices (informal institutions) as well as by laws (formal institutions). In the event of a violation of these rules, a (monetary or non-monetary) sanction occurs, which is enforced either by society (internal institutions) or by the state (external institutions). Reliable compliance with rules increases individuals' willingness to trade. An institutional environment that promotes transactions between individuals by creating incentives for cooperation and reducing uncertainty has a strong welfare effect.

- The basis of institutional economics is interaction theory , on which the actual institutional theory is based.

- The main areas of application are the theory of state and society as well as the analysis of operational / organizational issues.

- Known sub-areas are: principal-agent problem , theory of property rights ( property rights theory ), transaction cost theory

Coordination of economic activities

The coordination between suppliers and buyers depends on the form of organization. “Organization” should be understood here as an institution and the people involved. The following forms of coordination can be distinguished:

market

advantages

- Contracts are concluded spontaneously

- the individuals are independent in their decision

- coordination takes place via prices

- high flexibility

- low administrative costs

- high innovation potential

- the person of the actor does not matter

- highest possible performance incentives

disadvantage

- Risk of opportunism (no voice option )

- only clearly specified services can be exchanged

- knowledge transfer is limited ( implicit knowledge )

- Search and information costs are very high

Hierarchy / company

advantages

- fixed contracts (e.g. employment contract )

- Coordination takes place via instructions (from the superior to the employee)

- the coordination effort is less than with the "market"

- Activities can be better planned

- confidential information and knowledge can be exchanged more openly

- Culture

- Openness of the (service) spectrum

- Voice option

disadvantage

- Bureaucracy costs

- no competitive incentives

- (limited) exit option

- Persistence of structures

network

Unification of the merits of market and hierarchy:

- predictability is better than on the market

- the flexibility is higher than with the hierarchy

- Examples are agreements ( cartels ), strategic alliances , virtual companies

The form of the network represents a suitable reaction to competitive dynamics, especially for small and medium-sized enterprises ( SMEs ).

Mark Granovetter provides another approach to network theory . This sees the relationships of individuals or companies in the market embedded in social networks. According to Granovetter, classical economics with its abstract image of the ideal market does not know these networks.

According to Ronald Coase , companies exist because the use of the market price mechanism is associated with costs, or more precisely with transaction costs . These can be avoided through coordination within a company. These costs include, for example, the costs of negotiating detailed contracts or the costs of uncertainty regarding the reliability of a supplier (e.g. the risk of the supplier becoming insolvent).

Markets exist because the integration of activities in a company also generates costs. These costs set limits to increasing integration ( see also X-efficiency ).

Cooperation is a hybrid form of market and hierarchy in the sense that the parties voluntarily submit to contractual rules on both sides. Although these limit the options for action on both sides, they nonetheless lead to a greater mutual benefit than under the rules of the market alone. Problems with the coordination according to these higher-level contractual rules can then be escalated - e.g. B. in court.

From a logistical point of view, supply chain management (SCM) deals with the question of the coordination of cross-company supply chains, which are to be viewed as a higher-level (virtual) organizational unit . Theoretical approaches of the SCM are based partly on the institutional economics.

literature

- Mathias Erlei, Martin Leschke, Dirk Sauerland: Institutional Economics. 3. Edition. Schäffer-Poeschel, Stuttgart 2016, ISBN 978-3-7910-3526-0 .

- Elisabeth Göbel: New Institutional Economics. Conception and business applications. Lucius & Lucius, Stuttgart 2002, ISBN 3-8252-2235-7 .

- Karl Homann , Andreas Suchanek: Economics - An Introduction. 2nd Edition. Mohr Siebeck, Tübingen 2005, ISBN 3-16-146516-4 .

- Douglass C. North : Institutions, institutional change and economic performance. CUP, Cambridge 2002, ISBN 0-521-39416-3 .

- Birger P. Priddat : Structured Individualism. Institutions as Economic Theory. Metropolis, Marburg 2004.

- Rudolf Richter , Eirik Furubotn: New Institutional Economics. An introduction and critical appreciation. 3. Edition. Mohr Siebeck, Tübingen 2003, ISBN 3-16-148060-0 .

- Stefan Voigt : Institutional Economics. 2nd Edition. Fink, Munich 2009, ISBN 978-3-8252-2339-7 .

- Oliver E. Williamson : The Economic Institutions of Capitalism. Mohr (Paul Siebeck), Tübingen 1990.

- Clemens Wischermann , Anne Nieberding: The institutional revolution (= basics of modern economic history. Volume 5). Steiner, Stuttgart 2004, ISBN 3-515-08477-0 .

Individual evidence

- ^ RH Coase: The Nature of the Firm . In: Economica . tape 4 , no. 16 , November 1, 1937, ISSN 1468-0335 , p. 386-405 , doi : 10.1111 / j.1468-0335.1937.tb00002.x ( wiley.com [accessed February 21, 2017]).

- ^ Stefan Voigt: Institutional Economics. 2nd edition Vienna a. a. 2002, p. 13 f.

- ^ OE Williamson: Comparative Economic Organization. The Analysis of Discrete Structural Alternatives. (PDF file; 560 kB) In: Administrative Science Quarterly. 36 (2), June 1991, pp. 269-296

- ^ Jörg Sydow: Strategic Networks. Evolution and organization. Gabler, 1992, ISBN 3-409-13947-8 .