Lowest value principle

The lowest value principle is a principle of proper bookkeeping that must be observed when preparing a company balance sheet as an evaluation procedure. The lowest value principle results from the principle of prudence and relates exclusively to the subsequent valuation of assets and debts, which upon addition according to § 253 HGB were valued with the acquisition or production costs or with the settlement amount.

This general principle of prudence results in two opposing valuation principles for both sides of the balance sheet: While liabilities (debts) are recorded at the highest possible value ( maximum value principle ), assets (assets) according to Section 253 (1) sentence 1 HGB must be of the two possible valuations ( market value or amortized cost ), the lower one can be selected.

The company's assets are accordingly written down to the value at which they could be sold on the balance sheet date . The meaning of the lowest value principle is to show unrealized losses and thus protect creditors .

species

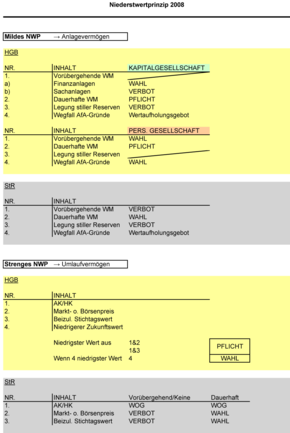

The lowest value principle exists in two forms:

- The strict lowest value principle applies to current assets . The principle is to be applied to all assets of the current assets, for which the amortized acquisition or production costs exceed the actual value. No distinction is made between permanent and temporary impairment , i.e. H. an interpretation of the durability of an impairment by the accounting party is not permitted. According to this, an asset is to be recognized by an unscheduled depreciation with a lower value, which results from a stock exchange or market price on the balance sheet date ( § 253 Abs. 4 HGB).

- The moderated lower value principle applies to fixed assets . Here, the person making the balance sheet is given a margin of discretion in which he himself has to decide on the durability of an impairment under the conditions of a reasonable commercial assessment . If the person making the balance sheet has determined a permanent decrease in value, then all items of the fixed assets concerned are to be written down to the amount that is less than the amortized acquisition or production costs. If, instead, one assumes a non-permanent decrease in value, a prohibition of depreciation applies to the intangible assets of the fixed assets and to the tangible assets. In the case of financial assets, however, there is an option to choose whether to reduce the value.

The extended lower-of-cost-or-market principle meant the regulation applicable until 2009, according to which current assets can be depreciated due to future fluctuations in value. This variant no longer applies due to the Accounting Law Modernization Act of May 25, 2009.

If the value of non-depreciable parts of the fixed assets increases again in later financial years or if the reasons for the depreciation no longer apply, a write-up must be made, whereby the new valuation must not exceed the amortized cost ( Section 253 (5) HGB). The previously existing right to write-up for partnerships no longer exists since the Accounting Modernization Act came into force.

Tax implications

In the tax balance sheet , depreciation to the lower partial value can only be made in the event of an expected permanent decrease in value , Section 6 (1) No. 1 and No. 2 EStG . Since the revision of Section 5, Paragraph 1, Sentence 1, last Hs. EStG, tax options - such as the use of the lower current market value - can be exercised independently of the use in the commercial balance sheet. The obligation to depreciate to the lower value up to the BilMoG due to the relevance according to § 5 Abs. 1 S. 1 EStG therefore only applies in old cases.

literature

- Adolf G. Coenenberg , Axel Haller, Gerhard Mattner, Wolfgang Schultze: Introduction to accounting: Fundamentals of bookkeeping and accounting , 4th edition. Schäffer-Poeschel Verlag, Stuttgart 2012, ISBN 978-3791030852

- Siegfried Schmolke, Manfred Deitermann, a. a .: Industrial accounting ICR. Financial accounting - analysis and criticism of the annual financial statements - cost and performance accounting , 38th edition, Winklers Verlag 2009, ISBN 978-3804566521

- Gerhard Scherrer: Accounting according to the new HGB , 3rd edition, Vahlen Verlag, Munich 2010, ISBN 978-3800637874