Rioforte

| Rioforte Investments SA

|

|

|---|---|

| legal form |

Société anonyme (public limited company) |

| founding | September 2009 |

| Seat |

Luxembourg Luxembourg |

| management | Manuel Fernando Moniz Galvão Espírito Santo Silva |

| Number of employees | 9,900 (2013) |

| Branch | Investment |

| Website |

|

Rioforte Investments SA is a company based in Luxembourg . It belongs to the international group Espírito Santo (GES) , which has its origin in Portugal . In July 2014, Rioforte was embroiled in a financial crisis and was unable to repay debt securities to its creditors, which led to the liquidation of the Portuguese commercial bank Banco Espírito Santo and left a financial gap of 4,900 million euros.

history

In September 2009, the year of the financial crisis, the Espírito Santo Group (GES) decided to create Rioforte as an investment company based in Luxembourg: a company that would manage non-financial assets (such as agricultural and industrial companies) for the group. With the separation of the companies from the Espírito Santo Resources group, which previously worked for this purpose, and the change of the company headquarters, the aim was to achieve internationalization of the business and, through the company headquarters in Luxembourg, to achieve a reduction in taxes and duties and escape Portuguese fiscal control. By issuing bonds, new investment capital was to be raised on the international capital market in order to further advance the new projects in Portugal, Brazil and Africa. The ESCOM group was to be replaced as the previous investment platform by its own company, Rioforte Investments.

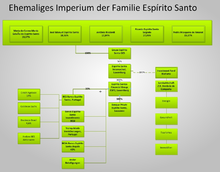

The Espírito Santo Group

The Espírito Santo Group operated a corporate network in more than 20 countries and the holding companies were based in Switzerland and Luxembourg ( Espírito Santo Financial Group , ESFG). With this constellation, the group escaped the operational and fiscal control of the Portuguese state, which led to open criticism in Portugal during the 2008 financial crisis. So z. B. by the Portuguese Institute for Corporate Governance (IPCG), which saw this as a violation of the Code of Good Corporate Governance. The capital requirement was financed by issuing bonds and certificates.

Crisis in 2014 and liquidation

At the end of July 2014, the RioForte got into trouble, as maturing bonds could not be repaid. It was bankruptcy protection sought under Luxembourg law and granted. Since then, Rioforte has been in liquidation and was one of the reasons for the decline of Banco Espírito Santo . Portugal Telecom alone has invested 895 million euros in this company through bonds that are now lost and cannot be repaid.

The Mexican company Angeles was interested in Rioforte's 51% stake in ES Saúde (health). Angeles had made a takeover offer and offered 4.30 euros per share, which ES Saúde valued at 410 million euros. The offer was later increased to EUR 4.50 per share. Other bidders were the Portuguese insurance company Fidelidade , which belongs to the Chinese Fosun group, and the US group United Healthcare . In the end, Fidelidade prevailed with a bid of EUR 5.01 per share.

The tourism subsidiary ES Viagens was sold to the Swiss-Luxembourg company Springwater Capital.

After the rejection of Rioforte's request for bankruptcy protection, the company is now being liquidated.

The liquidators are currently (May 2015) offering the property subsidiaries Herdade de Comporta and Property Brasil for sale. However, the sales offer was withdrawn again in July 2015.

Rioforte companies and their fate

Espírito Santo Property (land)

- Area: 2,508,000 m²

Herdade de Comporta (Agriculture and Tourism)

- Turnover: 45,071,000 euros

- Fixed assets: 139,661,000 euros

for sale

ES Property Brasil

- Building land: 2.1 million m²

for sale

Tivoli Hotels & Resorts

- Hotels: 14 (12 in Portugal and two in Brazil)

- Bed nights per year: 1,072,848

In January 2015, six hotels (four in Portugal and two in Brazil) were sold to the Thai hotel chain Minor International for around 168 million euros .

In October 2015, Minor International also bought the Tivoli Oriente Hotel in Lisbon for 38.5 million euros. By February 2016, Minor also acquired the remaining hotels; the total investment was 294 million euros.

ES Viagens (tourism)

- Turnover: 61,825,000 euros

- Tickets issued: 310,503

sold to Springwater Capital

Cobrape (farm)

- Rice: 6,938 t

- Soybeans: 5,182 t

- Cattle: 5,725

Companhia Agrícola Botucatu (citrus cultivation)

- Land: 2,000 ha

- Oranges: 1,240 boxes

- otherwise. Citrus fruits: 187,000 boxes

Agriways (agriculture and forestry)

- Land: 5,000 ha

- Eucalyptus production: 69,368 m³

- Sugar cane production: 73,000 m³

Sociedad Agrícola Golondrina (Agriculture and Forestry)

- Land: 7,000 ha

- Pasture land: 5,000 ha

- Forest land: 12,000 ha

Ganadera Corina Campos Y Haciendas SA (cattle breeding)

- Pasture land: 68,000 ha

- Cattle: 52,487

ES Saúde (Health Sector)

- Health centers: 18

- Beds: 1,311

- Inquiries and emergency calls annually: 1,825,000

- 'Treatments: 45,000

sold to Fidelidade

Energias Renováveis do Brasil (renewable energies)

- Total asset value: 174,247,000 Brazilian reais

Georadar

- 2D seismics: 6.409

- 3D seismic: 992

See also

Web links

- Official website ( Memento of December 21, 2014 in the Internet Archive )

- Bankruptcy website

- Minor International Hotel Group

Footnotes

- ↑ rioforte.pt ( Memento of the original from August 10, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ The decline of the Banco Espírto Santo. In: NZZ. 4th August 2014.

- ↑ Investors are rediscovering Portugal. In: FAZ. August 21, 2014.

- ↑ a b Mexicanos avaliam Espírito Santo Saúde em 410 milhões de euros. In: Observador.

- ^ A duel between the bidders for hospitals in Portugal. In: NZZ. September 28, 2014.

- ^ The Espírito Santo Group can hardly be saved. In: NZZ. 5th October 2014.

- ↑ Rioforte Agrees to Sell 51% of Espirito Santo Saude to Fosun. In: Business Week. October 10, 2014.

- ↑ Swiss investors secure the Espírito Santo estate. In: Handelszeitung. 2nd October 2014.

- ^ Espirito Santo Units to Be Liquidated as Protection Denied. In: Businessweek. 17th October 2014.

- ↑ ESPIRITO SANTO INSOLVENCIES / RIO FORTE INVESTMENTS SA , May 1, 2015

- ^ [1] Suspension of the sale of the Herdade de Comporta

- ↑ ESPIRITO SANTO INSOLVENCIES / RIO FORTE INVESTMENTS SA , May 1, 2015

- ↑ ESPIRITO SANTO INSOLVENCIES / RIO FORTE INVESTMENTS SA , May 1, 2015

- ↑ Thai company buys six Tivoli hotels for € 168.2 million - , Portugal Resident, January 28, 2015

- ↑ Thai hotel group buys its fifth Tivoli hotel in Portugal. Macauhub English, accessed October 10, 2015 (American English).

- ↑ Minor Hotel Group completes Tivoli takeover. Retrieved January 13, 2019 .

- ↑ Swiss investors secure the Espírito Santo estate. In: Handelszeitung. 2nd October 2014.

- ↑ Rioforte Agrees to Sell 51% of Espirito Santo Saude to Fosun. In: Business Week. October 10, 2014.