Delay effect

The term delay effect (or English time lag ) indicates the time delay that can be observed between two events .

In economic policy

In economic policy it is about time delays between the need of any action, then action taken and the final effect of this. In it it stands for "the period between the occurrence of a disruption in the economic process and its correction".

It can be differentiated into inside lag (delay within the sphere of economic policy; i.e. the time that passes before action is taken) and outside lag (delay outside of this sphere; i.e. the time that passes before the action takes effect) according to its cause, u. a. as recognition lag (delay in knowledge), decision lag ( delay in decision- making), instrumental lag (delay in implementation) and operational lag (delay in effect).

The most important time-lags, particularly in monetary policy, are:

- Time delay until the actor (usually the central bank ) acts: " Inside Lag "

- Information " information lag " (information gathering takes longer; e.g. surveys, analysis of figures, etc.)

- Knowledge " Recognition Lag " (the knowledge about which phase - e.g. recession or upswing - you are in and what causes it is based)

- Decision " decision lag " (decision about which measures should be taken; here, bureaucracy and a lengthy parliamentary decision-making process lead to delays)

- (Action " Action Lag " (time from decision to implementation - mostly negligible))

- Time delay until the measure (e.g. the changed key interest rate ) has an effect: " Efficiency Lag "

- Passing on " Intermediate Lag " (delay in the transfer of the interest rate level by the credit institutions to the consumers)

- Reaction " Outside Lag " (the time until the non-banks react to the measures and the macroeconomic variables are affected)

| Actor (e.g. central bank) |

Transmitter (e.g. commercial banks) |

Addressee (e.g. non-banking sector) |

||

|---|---|---|---|---|

| ← Inside Lag → | ← Efficiency Lag → | |||

| ← Information lag → | ← Recognition Lag → | ← Decision Lag → | ← Intermediate Lag → | ← Outside Lag → |

| ← total time lag → | ||||

National economy

The Robertson lag describes a delay between the development of income and the consumer demand that is dependent on it and reacts with a delay .

Another example in the economy is the reaction of exports to the appreciation of the domestic currency . If the currency appreciates, exports only decrease after about 6 or 12 months, as the export contracts are concluded in the future and buyers of the exports first have to find a replacement in their domestic market, which would take time (see J-curves Effect ).

Delay effects or time-lags play an important role in the multiplier-accelerator model , i.e. in business cycle theory ( business cycle indicator ), in the cobweb theorem and the pig cycle described with it .

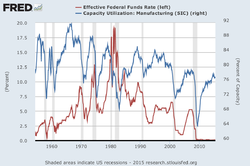

Capacity utilization , employment rate and, conversely, the unemployment rate in the US. The unemployment rate is considered to be a late economic indicator that follows the economic cycle with a time lag.

The wage share (blue) follows with time lag the employment rate (red) in the USA.

The capacity utilization in Germany follows that of the United States with time lag

Individual evidence

- ↑ Piekenbrock, Dirk: GABLER COMPACT LEXICON OF VOLKSWIRTSCHAFTSLEHRE . Look up, understand and use 4,200 terms. 3rd completely revised and expanded edition. Gabler Verlag, Wiesbaden 2009, ISBN 978-3-8349-8774-7 ( springer.com ). P. 257.

- ^ Ulrich Mehrer: Economy and Law . Edition Upper secondary school Bavaria 12th grade. Ed .: Simone Voit. 1st edition. Klett, Stuttgart; Leipzig 2010, ISBN 978-3-12-006121-2 . P. 54 f.