capital accumulation benefits

Asset-forming benefits ( VL ) are a form of savings in Germany that is subsidized by the state through the granting of a savings allowance : As a rule, employers grant a cash benefit on the basis of a collective agreement , a works agreement or an employment contract ; In order to obtain the (full) state subsidy in the form of the employee savings allowance, this can also be provided through personal contribution as a deduction from wages , even on several different contracts. Persons in a public office ( civil servants , soldiers , judges ) receive capital-building benefits from their employer on the basis of the law on capital-building benefits .

The legal basis for employees under private law is the Fifth Asset Creation Act (5th VermBG) of 1990: according to this, the VL is promoted with the employee savings allowance (ANSpZ). The types of investment that are eligible for funding differ in terms of blocking periods (minimum investment period to obtain state funding), the amount of investment subsidized, the savings allowance rate and the income limits.

State support for the creation of assets in the hands of employees began with the "312 Mark Law" (1st VermBG), which later became the "624 Mark Law" (2nd VermBG) and from 1983 the "936 Mark Law" (4th VermBG) was renewed. The aim is to promote the accumulation of wealth among employees .

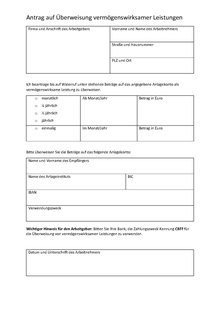

application

The VL must be transferred directly from the employer to the company or institute named by the employee where it is to be applied. To do this, the employee must submit a corresponding application in writing to his employer (sample: graphic on the right). Depending on the form of the contract, the employee can top up the employer's payment through his own work or provide the full amount himself; In principle, both regular transfers and one-off payments are possible. If, for example, capital-forming savings are started during the course of the year, a one-off payment can be made for the months that have already passed in consultation with the employer in order to achieve the maximum amount supported.

Forms of investment, state funding, embargo periods

VL can be created in the following ways:

- Bausparen : The blocking period for obtaining government funding is seven years. A VL of a maximum of EUR 470 per year is funded with 9%, provided that the investor has a taxable income of no more than EUR 17,900 (sole assessment) or EUR 35,800 (with joint assessment) in that savings year .

- Corporate forms of savings (e.g. equity funds or employee equity participation ): The blocking period for obtaining government funding is also seven years. However, it begins on January 1st of the year in which the first payment is made. A VL of a maximum of EUR 400 per year is funded at 20%, provided that the investor has a taxable income of no more than EUR 20,000 (sole assessment ) or EUR 40,000 (for jointly assessed) in the savings year .

Forms of investment can coexist if the income limits are observed:

With a taxable annual income i. H. v. € 16,500 with a VL-capable equity fund and a VL-capable home loan and savings contract and a payment into both contracts of € 500 per year, the equity fund will be increased in the first year with 20% of max. 400 € = 80 € and the building society loan contract with 9% of max. € 470 = € 43 funded. The savings allowance is paid out after the blocking period has expired.

- Use for residential purposes (acquisition of building land, residential buildings or condominiums) as well as for the repayment of corresponding loans or mortgages i. H. v. A maximum of EUR 470 per year with 9%, there is no blocking period with regard to the investment period, the ANSpZ is paid out immediately (Section 7 (1) No. 1 VermbDV).

- Bank savings contracts or retirement benefits such as B. Endowment insurance contracts with a life insurance policy : These forms of savings are not subject to any restrictions with regard to a lock-up period or a maximum income, but are not subsidized by the state.

Tax and social security classification

VL are part of the wages under labor law. They are part of the income from non-self-employed work and are remuneration within the meaning of social insurance and the Third Book of the Social Security Code and are fully taxable.

For capital-forming payments created after December 31, 2016, paper certificates (Annex VL) are no longer issued for the tax return; instead, an electronic wealth creation certificate is reported to the tax authorities; Exceptions must be confirmed in writing by the responsible tax office .

The employee savings allowance does not count as taxable income within the meaning of the Income Tax Act or as income, earnings or remuneration (remuneration) within the meaning of social insurance and the Third Book of the Social Security Code and it is not considered part of the wage or salary under labor law. The entitlement to employee savings allowance is not transferable.

See also

Web links

- Text of the Fifth Capital Formation Act

- Text of the law on capital formation payments for civil servants, judges, professional and temporary soldiers

Individual evidence

- ↑ a b c d § 13 5. VermBG - single standard. Retrieved July 7, 2018 .

- ↑ 5. VermBG, § 13 Entitlement to Employee Savings Allowance Website of the Federal Ministry of Justice and Consumer Protection, accessed on February 10, 2017

- ↑ 5. VermBG, § 11 Asset-Effective Investment of Parts of Wages Website of the Federal Ministry of Justice and Consumer Protection, accessed on February 10, 2017

- ↑ 5. VermBG, § 2 Asset-generating services, investment forms Website of the Federal Ministry of Justice and Consumer Protection, accessed on February 10, 2017

- ↑ a b Capital-building benefits: secure employee savings allowance. Website of the United Wage Tax Aid eV of April 12, 2018 (accessed June 3, 2019).

- ^ Fifth Asset Creation Act (5th VermBG); First-time application of the electronic wealth formation certificate procedure. (PDF) Federal Ministry of Finance, December 16, 2016, accessed on February 12, 2017 (BMF letter; GZ IV C 5 - S 2439/16/10001, DOK 2016/1157725).