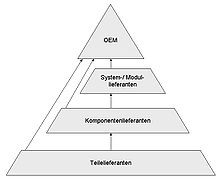

Supplier pyramid

As supply pyramid ( English supply pyramid , also supply network or supply chain ), the structure of the suppliers referred up to the producer of the final product. The latter is also briefly referred to as OEM (from English Original Equipment Manufacturer for German "Original Equipment Manufacturer " , i.e. original equipment manufacturer ). The OEM is at the top of the pyramid, the rest of which is formed by the supply chain .

In the automotive industry in particular, a pyramid structure emerged, at the top of which was the local company, the automobile manufacturer. This procures products from a few system suppliers, who in turn procure products from module suppliers themselves. The pyramid continues with the component suppliers and parts supplier types. Suppliers at the lower levels of the pyramid can also skip levels and supply "higher" suppliers or the OEM directly.

The suppliers are referred to as Tier-1 , Tier-2 etc. within the pyramid depending on the distance to the OEM (from English tier for German “level” or “rank” ). The terms first tier ( German “first level” ), ie direct supplier to an OEM, second tier ( German “second level” ), etc. are also common. This characterizes the sub-supplier structure.

The emergence of supplier pyramids have also led to the development of quality management procedures such as B. the auditing and of codes of conduct between suppliers and buyers is stimulated, because due to the just-in-time delivery, continuous incoming controls are no longer possible.

Dynamics and risks of supplier pyramids

Due to the complexity of the increasingly tightly coupled international logistics chains and their susceptibility to failure, an intensive analysis of the risks in supplier networks is required today, which can easily escalate when several errors and failures occur.

As a result of the digital transformation , the weights and added value shares in the supplier pyramids have been shifting in favor of the software manufacturers, whose products flow into the value chain at various points. As early as 2006, electrics and electronics accounted for up to 40% of the manufacturing costs of cars. With a steadily increasing proportion of software, z. In part, a technology leadership and a market capitalization that can lead to the reconfiguration of the entire value chain by large IT companies. It is conceivable that parts of the automotive industry and its electronics suppliers will transform into suppliers (or at least equal cooperation partners) of the software industry as a result of the development towards autonomous driving through the forward integration of the value chain. The relationships between the partners in the value chain are therefore likely to become more and more complicated in legal terms because of the licensing problems that result from the use of software from different original equipment manufacturers.

literature

- SM Wagner: Strategic supplier management in industrial companies: an empirical study of design concepts . Lang, Frankfurt am Main et al. 2001, ISBN 3-631-36225-0 . (Zugl. St. Gallen, Univ., Diss., 2000)

Individual evidence

- ↑ On the concept and the risks of the close coupling C. Perrow : Normale Katastrophen. The inevitable risks of large-scale engineering . Campus, Frankfurt 1987/1992, ISBN 3-593-34125-5 .

- ↑ D. Reh: Development of a method for logistic risk analysis in production and supplier networks. Fraunhofer-Verlag, Stuttgart 2009, ISBN 978-3-8396-0049-8 .

- ↑ Ricardo Büttner: Software in the automotive industry: an economic consideration of the competitive forces acting in the value chain. In: Journal for the entire automotive value chain (ZfAW), 9 (2006) 4. Pp. 69-71.