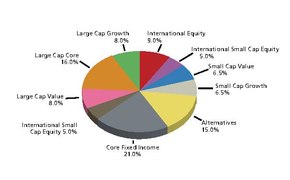

Asset allocation

The asset allocation , including asset allocation , investment allocation , asset allocation or portfolio structuring ( English asset allocation ) is the division ( diversification ) of assets to different asset classes such as bonds , stocks , real estate , currencies and precious metals .

Both the process of dividing the assets and the result, the diversified portfolio, are referred to as asset allocation.

Procedures

A classic question for asset allocation arises from considering the needs of a private investor who needs a certain amount of money in retirement to secure their standard of living.

The Markowitz paradigm (based on Harry Markowitz ) is considered the classic approach to asset allocation. A required return is calculated from the investor's financial position and his / her life data (time until retirement). In addition, the risk-return profile of the asset classes is determined based on historical data and an attempt is made to structure the assets in such a way that the expected return on the investment portfolio corresponds to the required return. The higher the required return, the higher the proportion of risky asset classes required. For the risky part of the investment, an additional attempt is made to eliminate avoidable risks through the greatest possible diversification using models such as portfolio selection and the Black-Litterman method . Since the returns of different asset classes and individual stocks can develop more or less independently of one another, it is possible to achieve a positive performance of the entire portfolio, although there is a negative development in individual parts of the portfolio. In this way, the risk can be minimized for a given expected return or the return can be maximized for a given risk.

The Merton paradigm (after Robert C. Merton ) forms a competing view. It considers historical estimates to be flawed and instead determines the expected capital market risk and the expected future returns from the prices on the capital market using financial models. A given risk aversion of the investor is assumed, which is weighed against the expected return and the expected risk using stochastic optimization procedures (see consumer-investment problem ), so that a consumption strategy and asset allocation result.

See also

Web links

- Portfoliotheorie.com describes three practical variants of asset allocation: by people, by income and by capital.