Gold as an investment

Gold as an investment is a sub- class of the commodities asset class . Gold is a precious metal and has also been used as a store of value for thousands of years .

According to Thomson Reuters GFMS , at the end of 2011 32,500 tons of gold were held as financial investments worldwide. At a gold price of 33 euros per gram (as of June 27, 2014), the market value of this gold corresponds to around 1 trillion euros. In addition to private and institutional investors , states and their central banks also hold large stocks of gold as reserves. At the end of February 2018, for example, the Federal Republic of Germany held currency reserves totaling 166 billion euros, around 70 percent or 117 billion euros in gold and gold claims .

history

From ancient times to the beginning of the 20th century, gold was used to make coins for payment transactions. The owners of gold were often granted the right by law to exchange their precious metal for marketable money at state mints or central banks. As a raw material for money, gold therefore served a store of value, as is the case today with banknotes and account balances. In the era of metal currencies, an investment in gold meant a secure investment in liquid funds. It was accordingly widespread among private individuals and merchants. Even after the progressive loss of importance of gold as a coin metal in the world wars, the traditional use of gold as an investment was preserved.

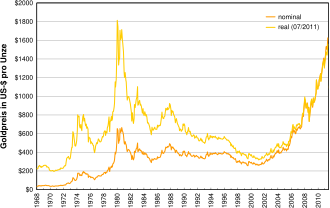

The termination of the international gold price fixing for private individuals in the amount of 35 US dollars per troy ounce in March 1968 changed the character of a gold investment. Since the prices of the precious metal have been able to fluctuate freely since then, speculative profits and losses are continuously possible with an investment in gold. Gold investments were particularly popular in the 1970s due to the high inflation rates at the time. Their loss of importance in the following two decades is explained by the greater attractiveness of other asset classes such as stocks. With the outbreak of the financial and economic crisis from around 2007, gold experienced a renaissance as an investment, especially in the Anglo-Saxon and German-speaking countries. The Arab states and Asia are also traditionally important markets for investment gold.

Motifs for the gold investment

Private and institutional investors invest in gold, typically because they are betting on a rising gold price and want to profit from it, or for the purpose of protecting and maintaining the value of their investments. Concerns about inflation and deflation play an important role here.

An investment in gold enables the investment funds to be diversified across another asset class . If the correlation of gold with other asset classes is not completely positive , adding gold to an investment portfolio as part of asset allocation or portfolio management can lead to a risk reduction and to a lower fluctuation range of the overall value of the investment portfolio ( risk diversification ).

Investors can also participate in rising, falling or sideways gold prices using investment instruments such as certificates and derivatives .

Investment forms

The various forms of investment in gold can be divided into three groups:

- Physical gold

- Exchange traded gold products

- Shares in gold mining companies

Physical gold

Investors who would like to purchase physical gold directly are generally entitled to purchase investment gold in the form of gold bars and investment coins, or purchase gold jewelry and collector coins . However, jewelery gold and collector coins usually have a considerable surcharge ( agio ) compared to the actual material value and are therefore usually not suitable for investors who only want to participate in the development of the gold price.

According to a representative study carried out in 2011 by the Steinbeis Research Center for Financial Services , 88% of German private individuals prefer gold bars or coins as a form of investment in gold, while only 12% would choose gold-related securities as an investment form.

Investors who want to purchase physical gold as a capital investment have various storage options: private storage, for example in a safe in the household, safekeeping in a safe deposit box or safekeeping in central high-security vaults of security companies or banks. In the case of central depository of investment gold is also called vaulted gold .

definition

According to the official summary of EU Directive 98/80 / EC, investment gold is defined as follows:

"Gold in bars or platelets with a weight accepted by the gold markets and a fineness of at least 995 thousandths (bars or platelets with a weight of no more than 1 g can be exempted from the regulation by the Member States) or gold coins with a fineness of at least 900 thousandths have, were minted after 1800, are or were legal tender in their country of origin and are usually sold at a price that does not exceed the open market value of their gold content by more than 80% "

Bullion gold

A “good delivery bar ” ( fineness 995 ‰) contains 12.441 kg (400 ounces ) of gold. Gold is also produced in bars of 1, 5, 10, 20, 50, 100, 250, 500 and 1000 g as well as 1 troy ounce (31.1034768 g) with a fineness of 999.9 ‰ and is mainly purchased by private investors - For bars smaller than 1 kg, the surcharge (difference between the selling and buying price of the banks, which is closely based on the current gold price) is higher and sometimes exceeds five percent. Small gold bars up to a troy ounce in weight have been increasingly ordered as kinebars by small investors since 1994, despite a further surcharge .

Bar

Since 2012 it has also been possible to purchase so-called "table bars" from some providers. Larger embossed bars are subdivided by a perforation with precise predetermined breaking points . Bars of 50 or 100 grams are available, each divided into 100 small bars. This makes it possible to only partially resell the entire bar. The price of a table bar is currently (2020) higher than the price of a non-subdivided item.

Gold coins

In addition to bullion gold, gold coins are also traded as an investment product around the world. Some of the coins have a face value; the Krugerrand, one of the world's most famous investment coins, has no face value. The advantages of coins are that their authenticity is guaranteed by the state through the minting and that they are easier to handle than gold bullion. According to the EU directive, former circulation coins that consist of at least 900/1000 gold and were minted after 1800 can also be traded as tax-free investment gold.

Possibilities of investing in investment gold

The most common form of investment in investment gold is the physical acquisition of gold bars or gold coins; H. of so-called investment coins .

The direct acquisition of investment gold is also possible through the purchase of safe gold . Vault gold is physical gold stored in high-security vaults that investors acquire legal ownership of.

In addition to the options described for the direct purchase of investment gold, investors can also purchase gold products that are traded on the stock exchange , such as gold ETCs. In this case, however, investors do not acquire direct ownership of physical gold, but instead, depending on the product, a covered or unsecured contractual claim against the issuer of the product or a share in a fund that contains gold.

Exchange traded gold products

In exchange-traded gold products is gold price-related securities, which are usually on one or more stock exchanges are traded. Investment vehicles such as mutual funds or exchange-traded funds their investment funds may invest (in whole or in part) in physical gold. Funds approved for public sale in Germany may only hold a maximum of 30% of their investment volume in physical gold. This is why gold ETFs - unlike in Switzerland or the USA, for example - are generally not available on the German market. So-called gold exchange-traded commodities (ETC), such as Xetra-Gold , can be invested in gold up to 100%. However, these are bearer bonds .

In addition to these forms of exchange-traded gold products that are (partially) covered by physical gold, there are also numerous instruments that are not covered by physical gold, such as certificates on the gold price or other derivatives .

Stocks of gold mining companies

Shares of gold mining companies , also sometimes referred to as gold stocks, allowing an indirect participation in rising gold prices. Investors buy shares in the mining companies with shares in gold mining companies. The mining companies usually have production facilities and / or mining rights for gold production .

Some specific stock indices - for example the NYSE Arca Gold BUGS Index - bundle the stock prices of large gold mining companies. Exchange-traded funds that track these indices allow investors to diversify risk.

Comparison of different forms of gold investment

| Investment form | Participation in the performance of gold | Gold ownership | Taxation in Germany | Risks in addition to the price risk |

|---|---|---|---|---|

| Physical gold | Direct participation in the gold price | Direct ownership | Income tax only for a holding period of up to 1 year | Custody risk |

| Exchange traded gold : | ||||

| - Funds (including ETF ) | Participation in the gold price | Joint ownership of the fund | Withholding tax | Replication error (minor) |

| - ETC | Participation in the gold price | Obligatory claim , possibly secured | Withholding tax | Counterparty risk |

| - Gold certificate | Depending on the product, e.g. B. positively or negatively correlated or leveraged | No | Withholding tax | Counterparty risk |

| - derivatives on gold | Depending on the product, e.g. B. positively or negatively correlated or leveraged | No | Withholding tax | Counterparty risk |

| Gold mining company stocks | Indirect participation in the gold price, but also in company-specific developments | no, only ownership of company | Withholding tax | Corporate risks |

In the physical gold investment type, the following types of custody can be distinguished:

- Private safekeeping - safekeeping risk can be covered by private household contents insurance

- Storage in a locker - usually limited insurance coverage is available

- Vault gold

taxation

Income tax

In principle, realized income from gold-related securities and exchange-traded gold products in Germany is subject to the withholding tax . In contrast, direct investments in physical gold and thus direct investments in investment gold are not subject to the withholding tax. In the event of a sale within one year of purchase, however , capital gains are taxable at the personal income tax rate. In contrast, income realized after this one-year period is tax-free. This also applies to vaulted gold stored in central high-security vaults .

value added tax

In implementation of Directive 98/80 / EC of October 12, 1998 to supplement the common VAT system, investment gold was exempt from VAT in the European Union with the aim of promoting gold as a financial instrument .

Return

The rules of profitability calculation apply to the calculation of the return on an investment in gold . The risks of such an investment must be taken into account, especially fluctuations in the price of gold , purchasing power parities and fluctuations in exchange rates . Anyone who bought gold on December 31, 1970 and sold it again on December 31, 2010, achieved an inflation-adjusted annual return (on a US dollar basis) of 4.8 percent . Comparisons with other investments allow an estimation of the opportunity costs .

The collector's value of rare gold coins can rise faster than the gold fixing ( spot price on the cash market in London ). This applies to investment coins as well as to (recent, ancient or historical) collector coins. The legal definition of an investment coin under tax law does not exclude its numismatic quality as a collector's coin ; often there is overlap. The rarity of a gold coin can increase returns. In addition to the number of copies , the degree of preservation and the packaging, coin collectors pay attention to the year , the mint , the motif and sometimes a Privy Mark .

When selling coin gold, complete sets or series can increase the achievable price and thus the return. The value of a gold coin cannot fall below its face value ; the value of gold medals and gold jewelry cannot fall below their melting value .

Risks of investing in gold

Investors who invest in gold generally bear the market risk , i.e. the risk of a loss in value in the event of a falling gold price. The market risk lies in a higher supply or a lower demand . Since the production of gold is subject to only relatively minor fluctuations in the short term, there is a risk of a surprising increase in supply, especially in sales by large (central banks) or many (mass panic) investors. The demand for gold is mainly distributed among jewelry manufacturers, industry and investors. There is a risk of falling demand if gold becomes less important as jewelry, if industry finds cheaper substitute materials or if investors switch to other asset classes (e.g. shares, real estate, other raw materials).

Depending on the type of investment, investors can also bear other risks of different levels, for example a risk of ownership due to custody or a counterparty risk with regard to a product provider.

Since the gold price is quoted in dollars, there is also a currency risk for investors who live outside the US dollar currency area . A falling euro exchange rate is synonymous with an increase in the value of gold holdings (on a euro basis); conversely, a falling dollar rate lowers the gold value in the euro area .

In the case of acquiring shares in gold mining companies, investors also bear various strategic and operational corporate risks, which can result, for example, from poor corporate governance or inadequate risk management.

criticism

Investments in gold are subject to various criticisms. Some investors like Warren Buffett criticize investing in gold because gold does not generate any income and is therefore a dead investment.

Other voices criticize the price or exchange rate risk of a gold investment, especially as a result of a possible speculative bubble . A counter-argument to a gold investment is also cited that the gold price is often more positively correlated with other asset classes than expected and thus the diversification of a portfolio through the addition of gold is less than hoped for.

Presumably as a result of the historically relatively high price of gold and the resulting strong interest of large groups of investors in gold, reports of fraud and overpriced investments in gold are also increasing. The fact that physical gold is not treated as a financial product in Germany and is therefore not subject to strict regulation should also play a role. This fact often makes use of so-called multi-level marketing salespeople , who sell physical gold products and savings plans in pyramid systems without having to show a license or special qualification for the sale of financial products.

literature

- World Gold Council : Gold Investment Guide , European edition, December 2011, available on the Internet.

- Jens Kleine, Martin Hüfner, Matthias Krautbauer: Motives and origin of the gold possession of private individuals in Germany . Steinbeis Research Center For Financial Services, Steinbeis University Berlin , October 2011, PDF.

- Christian Haese: Capital investment: safe gold as a banking product . In: die bank - magazine for banking policy and practice, No. 10, October 2011, pp. 22–24, ISSN 0342-3182 .

- Thorsten Proettel: The most important things about gold investments, investment advice . Sparkassen Verlag, Stuttgart 2012.

- Rae Weston: Gold: A World Survey , 1983 (2013 reprint , ISBN 978-0415630603 )

Individual evidence

- ^ Paul Walker: Gold Survey 2012. April 30, 2012, archived from the original ; Retrieved April 12, 2018 (English, presentation, Thomson Reuters GFMS). Here p. 2.

- ^ Deutsche Bundesbank: Currency reserves and foreign currency liquidity of the Federal Republic of Germany. Retrieved April 12, 2018 (as of February 2018).

- ↑ Thorsten Proettel: The most important thing about gold investments, investment advice. Sparkassen Verlag, Stuttgart 2012, pages 6 and 32.

- ↑ In the German Empire: Section 14 of the Banking Act of 1875, in Austria-Hungary: Article 87 of the statutes of the Austro-Hungarian Bank.

- ↑ Thorsten Proettel: The most important thing about gold investments, investment advice. Sparkassen Verlag, Stuttgart 2012, pages 7 and 32–33.

- ↑ Commodity Yearbook 2010, LBBW (editor), page 37.

- ↑ Thorsten Proettel: The most important thing about gold investments, investment advice. Sparkassen Verlag, Stuttgart 2012, page 4.

- ↑ Commodity Yearbook 2008, LBBW (editor), page 46.

- ↑ Jens Kleine, Martin Hüfner, Matthias Krautbauer: Motives and Origin of Gold Ownership by Private Individuals in Germany, p. 5, Steinbeis Research Center for Financial Services, Steinbeis University Berlin, October 2011, on the Internet at: http: // steinbeis-research. de / pdf / Motives_and_origin_of_goldown_of_private_persons_in_Germany.pdf .

- ↑ Council Directive 98/80 / EC to supplement the common VAT system and to amend Directive 77/388 / EEC - special regime for gold

- ↑ Tobias Bürger: Gold im Sondergeld, Part II. In: portfolio institutionell of February 14, 2012.

- ↑ Gold-Derivat - Stuttgart Stock Exchange competes with Xetra-Gold - Handelsblatt from June 4, 2012, available on the Internet at: http://www.handelsblatt.com/finanzen/zertifikate/nachrichten/gold-derivat-boerse-stuttgart-macht -xetra-gold-competition / 6707780.html .

- ↑ Federal Ministry of Justice, Income Tax Act, Section 23 ESG

- ↑ Official Journal of the European Communities Council Directive 98/80 / EC of October 12, 1998 supplementing the common VAT system and amending Directive 77/388 / EEC - Special rules for investment gold (PDF) . In: Official Journal of the European Communities .

- ↑ VAT: Special regulation for gold , summary of the changes to Directive (EC) No. 1998/80 / EC.

- ↑ Warren Buffett: Why stocks beat gold and bonds, in: Fortune Magazine, February 9, 2012, on the Internet at: Archivlink ( Memento from May 21, 2012 in the Internet Archive ).

- ↑ Arne Gottschalk: Dangerous Gold Bull Market - The Dark Side of Splendor, in: Manager Magazin online, on the Internet at: http://www.manager-magazin.de/finanzen/alternativegeldanlage/0,2828,775987,00.html .

- ↑ Gertrud Hussla: Column recalculated - The expensive pitfalls of a gold savings plan. In: Handelsblatt print edition of August 26, 2011.

- ↑ Directive 2002/92 / EC on insurance mediation

- ^ ARD BR - Thomas Kießling, Marie Mallinckrodt, Eva Achinger: Report Munich of August 8, 2011; Germany in a gold rush. The million dollar business with the euro fear, on the Internet at: http://www.br.de/fernsehen/das-erste/sendung/report-muenchen/dossiers-und-mehr/report-muenchen-gold100.html ( Memento from November 1, 2011 in the Internet Archive ) .