Income tax (Germany)

The income tax in Germany (abbreviation: PIT ) is a Community tax based on the income of individuals will be charged.

The legal basis for the calculation and collection of income tax is - along with other laws - the Income Tax Act (EStG). The income tax rate regulates the calculation rules. The tax base is the taxable income .

In 2017, the German state received over 255 billion euros in income tax. This corresponds to almost a third of Germany's total tax revenue.

The also occurring term income s tax with joint-s is the official legal language not used.

General

Survey forms of income tax, the income tax , the capital gains tax that Bauabzugsteuer and Supervisory Control . They are also known as withholding taxes as they are deducted directly at source. The final withholding tax has served as a specific application of capital gains tax since 2009. According to the world income principle , taxpayers in Germany are taxable on their worldwide income.

Partnerships (e.g. the OHG, KG or GbR) are not subject to income tax, but the shareholders of a partnership are subject to income tax with their share of the profit ( Section 15 (1) sentence 1 no. 2 EStG). Corporations are not subject to income tax, but to corporation tax .

Income tax is a direct tax because the taxpayer and the taxpayer are identical. It is a community tax because it is federal , countries and communities are entitled to. In addition, it is a personal tax , a subject tax (unlike the trade tax that taxes the business object) and an income tax .

history

Income tax precursor

The ecclesiastical personal tithes (decimae personales) raised in the Middle Ages were the first approaches to personal taxation. In the 17th century the Prussian head shot was introduced. The first modern income tax was levied on German territory from 1811 to 1813 in East Prussia . It was originally recommended as a war tax as early as 1808 by Freiherr vom Stein based on the English income tax of 1799.

In 1820 Prussia introduced a class tax under Karl August Fürst von Hardenberg . The tax graduation was based on the grouping of the stands. This tax was replaced in 1851 by a classified income tax for higher incomes and replaced in 1891 under Finance Minister Johannes von Miquel by a uniform income tax with declaration obligation and progression , whereby the income tax rate of around 0.6% (for annual incomes of 900 to 1050 marks ) up to 4% (for an annual income of over 100,000 marks).

All German federal states followed this example until the First World War , after Bremen had already switched to a general income tax in 1848, Hesse in 1869 and Saxony in 1874. In the course of Matthias Erzberger's financial reform at the beginning of the Weimar Republic , the law of March 29, 1920 created a uniform Reich income tax, which was further developed in the tax reforms of 1925 and 1934. Among other things, the wage tax card was introduced in 1925, and wage tax classes I to IV in 1934 .

Development after 1945

In Control Council Act No. 3 of October 20, 1945 and Control Council Act No. 12 of February 11, 1946, the Allied occupying powers ordered large increases in tax rates, up to a top tax rate of 95%. As a result of the subsequent currency reform and several tax laws that provided for tariff reductions and tax concessions, these tariff increases were partially mitigated again or compensated for by increasing consumption tax rates.

The Basic Law of 1949 stipulated that the federal states were entitled to income from income tax, but that the federal government could participate in this. It was not until the Constitutional Amendment Act of 1955 that income tax was declared a joint tax by the federal and state governments in accordance with Article 106 (3) of the Basic Law.

Income tax in Germany underwent a significant change with the Income Tax Reform Act of August 5, 1974, which fundamentally reorganized the deduction of special expenses. The introduction of a linear progressive tariff in 1990, which abolished the " middle class belly" that had existed since the 1960s, was also of great importance . Further milestones were the increase in the basic tax credit to the subsistence level and the introduction of the lower-priced check between child tax credit and child benefit in 1996.

Development of the income tax rate since 1958

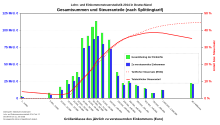

In recent times there has been a clear trend towards lowering income tax and the associated increase in consumption taxes.

The following table shows the historical development of the benchmarks as well as the entry and top tax rates in the German income tax rate. However, this information alone is not sufficient for a holistic understanding of the tax burden of the various income groups. For this purpose, in addition to the basic tax allowance , the rate profile of the marginal and average tax rates must also be considered, as shown in the graphics above for selected years.

The steepest rise in the marginal tax rate has occurred since 2004 in the lower income bracket. Therefore it is often complained that small and medium income groups are particularly affected by the cold progression . The progression range, i.e. the ratio between the uppermost basic income value and the basic tax-free allowance, has steadily decreased in recent years. The progressive range of the marginal tax rate is now less than a tenth of its width from 1958. However, the basic tax allowance was more than doubled in 1996 and the top marginal tax rate was then gradually reduced. In 2007 an additional tiered top tax rate was introduced ( tax on the rich ), which, however, leaves the linear progression zones unchanged. The continuous linear progression introduced in 1990 has now been replaced by a tariff with different steep zones and jumps (see also the graphics above).

| Period | Basic allowance | Input tax rate | Start of the last tariff zone |

Top tax rate |

Progression width |

progression height |

|---|---|---|---|---|---|---|

| 1958-1964 | 1,680 DM (859 €) | 20% | 110,040 DM (56,263 €) | 53% | 65.50 | 2.65 |

| 1988-1989 | 4,752 DM (2,430 €) | 22% | 130,032 DM (66,484 €) | 56% | 27.36 | 2.55 |

| 1990-1995 | 5,616 DM (2,871 €) | 19% | 120,042 DM (61,376 €) | 53% | 21.38 | 2.79 |

| 1996-1997 | 12,095 DM (6,184 €) | 25.9% | 120,042 DM (61,376 €) | 53% | 9.92 | 2.05 |

| 2000 | 13,499 DM (6,902 €) | 22.9% | 114,696 DM (58,643 €) | 51% | 8.50 | 2.23 |

| 2001 | 14,093 DM (7,206 €) | 19.9% | 107,568 DM (54,998 €) | 48.5% | 7.63 | 2.44 |

| 2002-2003 | € 7,235 | 19.9% | € 55,008 | 48.5% | 7.60 | 2.44 |

| 2004 | € 7,664 | 16% | € 52,152 | 45% | 6.80 | 2.81 |

| 2005-2006 | € 7,664 | 15% | € 52,152 | 42% | 6.80 | 2.80 3.00 |

| 2007-2008 | € 7,664 | 15% | € 52,152 from € 250,001 |

42% 45% |

6.80 32.6 |

3.00 3.21 |

| 2009 | € 7,834 | 14% | € 52,552 from € 250,401 |

42% 45% |

6.71 32.0 |

3.00 3.21 |

| 2010–2012 | € 8,004 | 14% | € 52,882 from € 250,731 |

42% 45% |

6.61 31.3 |

3.00 3.21 |

| 2018 | € 9,000 | 14% | 54,950 € from 260,533 € |

42% 45% |

6.11 28.9 |

3.00 3.21 |

| 2019 | € 9,168 | 14% | € 55,961 from € 265,327 |

42% 45% |

6.10 28.94 |

3.00 3.21 |

| 2020 | € 9,408 | 14% | € 57,051 from € 270,500 |

42% 45% |

6.06 28.75 |

3.00 3.21 |

| 2021 (planned) |

€ 9,696 | 14% | 57,919 € from 274,613 € |

42% 45% |

6.06 28.75 |

3.00 3.21 |

| Source: bmf-steuerrechner.de (website of the BMF ). Source 2018: Federal Law Gazette 2016 Part I No. 63 . Source 2019 and 2020: Family Relief Act - FamEntlastG 2021 has not yet been legally passed. Source 2021: Focus | ||||||

Development of tax revenue since 1987

| year | Income tax and assessed income tax | of which assessed income tax | ||

|---|---|---|---|---|

| in billion € (rounded) | as a percentage of total tax revenue |

in billion € (rounded) | as a percentage of total tax revenue |

|

| 1987 | 100 | 41.58% | 15.7 | 6.53% |

| 1991 | 131 | 39.48% | 21.2 | 6.39% |

| 1995 | 152 | 36.44% | 7.2 | 1.73% |

| 2000 | 148 | 35.70% | 12.2 | 2.94% |

| 2001 | 141 | 35.85% | 8.8 | 2.24% |

| 2002 | 140 | 36.36% | 7.5 | 1.95% |

| 2003 | 138 | 35.87% | 4.6 | 1.20% |

| 2004 | 129 | 29.18% | 5.4 | 1.22% |

| 2005 | 129 | 28.54% | 9.8 | 2.17% |

| 2006 | 140 | 28.68% | 17.6 | 3.61% |

| 2007 | 157 | 29.18% | 25.0 | 4.65% |

| 2008 | 176 | 31.37% | 32.7 | 5.83% |

| 2009 | 162 | 30.91% | 26.4 | 5.04% |

| 2010 | 159 | 29.94% | 31.1 | 5.86% |

| 2011 | 172 | 30.02% | 32.0 | 5.59% |

| 2012 | 186 | 30.95% | 37.3 | 6.21% |

| 2013 | 200 | 32.35% | 42.3 | 6.84% |

| 2014 | 214 | 33.19% | 45.6 | 7.07% |

| 2015 | 227 | 33.78% | 48.6 | 7.22% |

| 2016 | 238 | 33.81% | 53.8 | 7.63% |

| 2017 | 255 | 34.71% | 59.4 | 8.10% |

Current legal situation

Principles

The following principles shape income tax law:

- Performance principle

- World income principle for tax residents

- Net principle

- Principle of tiered tax rates

- Periodicity principle

Legal bases

The legal basis is the Income Tax Act (EStG) of October 16, 1934 and the Income Tax Implementation Ordinance (EStDV) that came into force on December 21, 1955. But also other tax laws such as the Foreign Tax Act (AStG) of September 8, 1972 or the Transformation Tax Act (UmwStG) of October 28, 1994 contain substantive regulations for income taxation. In order to ensure uniform application of income tax law by the tax authorities, the federal government issued income tax guidelines on December 16, 2005, which, however, only bind the tax authorities and not the tax courts or taxpayers. In addition, decrees are regularly published by the Federal Ministry of Finance (BMF) in which specific questions about the application of the law are clarified.

Federal distribution

According to Article 106 (3) and (5) of the Basic Law , income from income tax is shared by the federal government , the federal states and the municipalities . The Decomposition Act regulates which regional authority can claim the taxes collected . The municipalities have received a share of income tax since 1970. Originally it was 14, currently it is 15 percent of the revenue (§ 1 Municipal Finance Reform Act). The remaining 85 percent are then divided equally (42.5% each) between the federal government and the states according to Article 107 (1) of the Basic Law. The tax revenue sovereignty lies with the municipality and the country in which the taxpayer is domiciled.

When calculating the distribution key between the municipalities, however, only taxable income up to a maximum of 35,000 euros per person is taken into account. The municipalities therefore do not benefit from the high incomes of their citizens. This ensures that, on a national average, around 60 percent of the local revenue is included in the determination of the distribution key and the tax power differential between large and small municipalities is preserved.

The municipality's share of income tax in 2014 was EUR 30.3 billion. The municipalities cover around 14% of their adjusted expenditure on a national average in 2014. The importance is greater for the federal and state governments. They each cover almost a third of their expenses through this tax. The income of the municipalities results directly from the local income from wages and salaries. That depends on the wage level and unemployment. The differences in volume per inhabitant are correspondingly large nationwide. In 2014 the poorest district of Mansfeld-Südharz received 176 euros and the richest district of Starnberg 721 euros per inhabitant.

Tax liability

Income tax is levied both on the world income of natural persons with their place of residence or habitual abode in Germany ( unlimited income tax liability in accordance with Section 1 Paragraph 1 Clause 1 EStG ) as well as on the domestic income (within the meaning of Section 49 EStG ) of persons who are neither domiciled still have their habitual residence in Germany ( limited income tax liability according to § 1 Abs. 4 EStG ).

Taxation procedure

Assessment period

Income tax is based on the principle of section taxation ( Section 2 (7) sentence 2 EStG ). The assessment period is the calendar year ( Section 25 (1) EStG ). In the case of commercial enterprises, the business year can differ from the calendar year. The profit is deemed to have been drawn in the assessment period in which the financial year ends. There are also deviations for farmers and foresters due to the different harvest times and yields ( Section 4a EStG ). Here, the profit is divided proportionally to the respective assessment periods.

tax declaration

The assessment of income tax is usually based on the income tax return submitted by the taxpayer . The obligation to submit a tax return results from the tax regulations ( Section 56 EStDV and Section 46 (2) EStG ). Furthermore, the tax authorities can request the taxpayer to submit a tax return ( Section 149 (1) AO ).

An income tax return - if there is an obligation to submit it - must be submitted to the tax office by July 31 (2017 by May 31, 2017 at the latest) of the calendar year following the assessment period ( Section 149 (2) sentence 1 AO ). This period can be extended upon request. A four-year period after the end of the respective assessment period applies to assessments upon request for income from non-self-employed work ( Section 46 (2) No. 8 EStG ). The application for assessment is made by submitting an income tax return , which can be useful to claim additional tax reductions . Colloquially, this is often referred to as " annual income tax adjustment ", but this is not legally applicable.

Income tax assessment

According to Section 19 of the Tax Code, the tax office in whose district the taxpayer is domiciled is responsible for setting and collecting income tax .

The taxpayer is informed of the tax set for the assessment period by means of the income tax assessment ( administrative act ). With the determination of the income tax, the determination of the church tax (if the taxpayer belongs to a denomination with the right to revoke, in Bavaria differently determined by the church tax offices), the solidarity surcharge and, if applicable, the employee savings allowance also take place regularly .

The tax assessment can be challenged with the objection within one month of the notification of the decision . The tax bases themselves cannot be challenged ( § 157 Paragraph 2 Clause 1 Tax Code ). Whether it's a result of the tax assessment refunds or additional payment - also vulnerable - is for the taxpayer, the accounting part of the assessment, in addition to the tax assessment an independent regulates administrative act represents.

Prepayments

Since income tax only arises at the end of a calendar year and is only due after it has been determined, the legislature has prescribed the payment of advance payments ( Section 37 (1) sentence 2 EStG ). The advance payments are determined by the tax office by means of an advance payment notice, which is usually issued together with the income tax assessment.

Determination of the individual tax burden

Income tax law distinguishes between revenue , income , income and taxable income . Income is the income minus business expenses or business expenses. The calculation of income and taxable income is shown below.

Tax base / taxable income

Calculation scheme

The income tax to be paid is determined by applying the income tax rate to the taxable income as the assessment base, which is determined as follows:

The income is determined for the assessment period separately according to the types of income ( Section 2 (1) EStG). Advertising costs and business expenses are already deducted from the income .

+ Income from agriculture and forestry ( Sections 13–14a EStG )

+ Income from commercial operations ( Sections 15–17 EStG )

+ Income from self-employed work ( Section 18 EStG )

+ Income from non-self-employed work ( Sections 19–19a EStG )

+ Income from capital assets ( Section 20 EStG )

+ Income from renting and leasing ( Section 21 EStG )

+ Other income ( Sections 22–23 EStG )

=Sum of the income (in the case of joint assessment : each individual spouse)

- Age relief amount for persons in the calendar year after reaching the age of 64 (Section 24a EStG)

- Relief amount for single parents , 1908 €

- Tax allowance for farmers and foresters , 900 € / 1800 €

=Total amount of income (GdE, if both spouses are assessed together )

- Loss deduction (note the maximum amount!)

- Special expenses that are not pension expenses ( §§ 10c – 10i EStG ), including church tax

- Pension expenses , including old-age provision ( §§ 10-10a EStG )

- Extraordinary burdens of a general nature, if over the reasonable burden

- Maintenance to needy persons (extraordinary burdens)

- Training allowance (extraordinary burdens)

- Employment of help in the household (extraordinary burdens)

- Lump sum for the disabled (extraordinary burdens)

- Flat rate for surviving dependents (extraordinary burdens)

- Lump-sum care amount (extraordinary burdens)

- Childcare costs (special expenses) -

Deduction amount for the promotion of home ownership

+ additional income according to the Foreign Tax Act

=Income

- allowances for children , if more favorable than child benefit

- hardship compensation

=Taxable income (zvE)

annual tax according to the basic / splitting table - see also income tax rate

= collective income tax

+ annual tax according to special calculation - see z. B. Progression proviso

- tax reductions

+ additions (e.g. child benefit, if child allowances are used; old-age provision allowance , if more favorable than special

expenses ) = annual tax to be determined

- advance payments made

- capital gains tax to be offset (if withholding tax less favorable)

- income tax offset = additional income tax payment

/ refund

Allocation of income

The seven types of income are not of equal importance.

- Income from a commercial enterprise can only be present if the activity in question is not to be considered at the same time as exercising agriculture and forestry, a liberal profession or another independent activity.

- If income is to be allocated to surplus income as well as to profit income, the allocation to profit income takes precedence.

- According to Section 20 (8) of the Income Tax Act, income is only to be attributed to income from capital assets, unless it is attributable to income from commercial operations, self-employment or from renting and leasing. Income from capital assets is therefore subordinate to the other types of income mentioned (principle of subsidiarity). From the 2009 assessment period, this capital income is mainly subject to the withholding tax (as a form of capital gains tax ), for which there is a fixed tax rate in contrast to the other types of income.

Calculation of the individual tax amount

How much tax has to be paid on the annual taxable income (ZVE) is determined by the income tax rate . Thereafter, the tariff zones shown below apply .

First, the applicable legal formula for the ZvE is selected. The individual tax amount is calculated on the basis of the selected formula, in which the entire income (i.e. without deducting the basic tax allowance) is rounded down to full euros. This calculates the entire tax amount and also rounds it down to full euros ( Section 32a (1 )).

Spouse splitting applies to married people . In order to be able to use the formulas for married taxpayers , the joint taxable income is halved, the result is inserted into the applicable formula as zvE and the tax amount calculated afterwards is doubled.

In principle, these formulas also apply to wage tax (StKl 1 to 4) , whereby the zvE is obtained by deducting the lump-sum exemptions from the gross income.

Tariff 2019

Legal formulas for calculating income tax, where S = tax amount and zvE = annual taxable income (always rounded down to full euros). This means that for single taxpayers :

As will be explained below, these formulas can be converted into a mathematically equivalent form:

The formulas given in the legal text with the factors y and z are explained in more detail below.

First zone (basic allowance)

Up to a zvE of 9168 € there is no tax.

Second zone: zvE from € 9,169 to € 14,254

Where y is a ten-thousandth of (zvE - 9168):

As a result, the basic value at which the zone begins is subtracted from the zvE, because the calculation only affects the zvE part that goes beyond this. The division by 10,000 is only used to avoid too many decimal places in the factors.

The number 1400 divided by 10,000 corresponds to the input tax rate of 14%.

The number 980.14 determines the linear progression factor. It has the effect that the marginal tax rate increases linearly and so abrupt transitions between the tariff zones are avoided (see linear progressive tariff ).

A maximum of € 965.58 income tax is due in this zone.

Third zone: zvE from € 14,255 to € 55,960

Z is one ten thousandth of (zvE - € 14,254):

Here, too, the basic value at which the zone begins is subtracted from the zvE.

The number 2397 divided by 10,000 corresponds to the entry tax rate for this zone of 23.97%. The number 216.16 determines the linear progression factor here.

The number 965.58 corresponds to the tax amount of the second zone, which is added to the debit of this zone.

At the end of this zone, together with the lower zones, a maximum of € 14,722.30 income tax is due (calculated using the formula from the fourth zone without rounding off).

Fourth zone: zvE from € 55,961 to € 265,326

The zvE is multiplied by the marginal tax rate of 42% and 8,780.90 is subtracted.

The number 8,780.90 cannot be assigned directly to a tax parameter because it results from changing the original formula:

You can see the basic value of 55,960 euros and the sum of the tax amounts from zone two and three with 14,721.95 euros.

At the end of this zone, together with the lower zones, a maximum of € 102,656.02 income tax is due.

Fifth zone: zvE from € 265,327

The zvE is multiplied by the marginal tax rate of 45% and € 16,740.68 is subtracted.

The equivalent formula is:

The explanations for the fourth zone apply here accordingly.

2020 tariff

Legal formulas for calculating income tax:

Mathematically equivalent formulas:

The detailed explanations for 2019 apply accordingly here.

Mathematical properties of the control function

The linear progression is used to determine the income tax rate . This means that the marginal tax rate rises linearly as income rises . However, this only applies in the progression zones. The marginal tax rate is constant in the proportional zone and corresponds to the top tax rate in the highest zone. In the course of the average tax rate, there is an asymptotic approximation to this top tax rate.

Mathematically, this can be expressed as follows:

If S is the tax amount and B is the tax base, the tax amount is a function of B :

where p n , s gn , C n are parameters defined by law. The factor s gn is the initial marginal tax rate at the lower tariff limit (benchmark value E n ) and the factor p n defines the linear progression factor within zone n . It is calculated from the difference between the initial marginal tax rate of the tariff zone in question and that of the next zone and the difference between the relevant benchmarks. The factor 2 in the denominator is necessary for the correct determination of the marginal tax rate function (derivation rule) .

In the progression zones the parameter p is greater than zero, in the proportional zone it is equal to zero, then the straight line equation results

In the German EStG, the constant C n is defined differently. In the progression zone is C n , the control part amount S n-1 , the results from the previous tariff zone. Therefore the following applies here for B = zvE - basic value . In the proportional zones, however , the amount of C n is the tax sub- amount S n-1 , which is overcharged in all previous tariff zones by first applying the marginal tax rate s g with B = zvE to the entire zvE. This is then corrected by subtracting the amount from C n . The law defines a total of 5 tariff zones:

The parameters correspond to the values shown in the following table (on the left the values according to the law and on the right mathematically equivalent with C n = S n-1 as the tax amount of the respective lower tariff zone). This makes it clear that the marginal tax rate in the two upper zones only applies to the portion of income that exceeds the respective benchmark.

| Zone | ZvE area (benchmarks) |

Legal stipulation | Type of zone |

Mathematically equivalent definition (changed parameters highlighted in dark gray) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| parameter | |||||||||||

| n | from [€] |

to [€] |

p n | s gn |

C n [€] |

B [€] |

p n | s gn |

S n-1 [€] |

B [€] |

|

| 0 | 0 | 9408 | 0 | 0 | 0 | zvE | Zero zone | 0 | 0 | 0 | zvE - 0 |

| 1 | 9409 | 14532 | 972.87 10 −8 | 0.14 | 0 | zvE - 9408 | Progression zone | 972.87 10 −8 | 0.14 | 0 | zvE - 9408 |

| 2 | 14533 | 57051 | 212.02 10 −8 | 0.2397 | 972.79 | zvE - 14532 | Progression zone | 212.02 10 −8 | 0.2397 | 972.79 | zvE - 14532 |

| 3 | 57052 | 270500 | 0 | 0.42 | −8963.74 | zvE | Proportionality zone | 0 | 0.42 | 14997.68 | zvE - 57051 |

| 4th | 270500 | ∞ | 0 | 0.45 | −17078.74 | zvE | Proportionality zone | 0 | 0.45 | 104646.26 | zvE - 270500 |

The development of the parameters over time is presented in detail in the main article, Tariff History of Income Tax in Germany .

The ratio of tax amount S to taxable income zvE results in the average tax rate :

The marginal tax rate is the instantaneous increase in the tax amount; H. the derivative ( differential quotient ) of the tax amount according to the taxable income. The following therefore applies to the marginal tax rate in the progression zones:

as well as in the proportional zone simplified because of

with the corresponding values of the parameters p and s g as above.

Distribution according to volume

The most accurate statistical data is provided by the wage and income tax statistics of the Federal Statistical Office (Fachserie 14 Reihe 7.1) as a full survey. The last edition contains the data from 2014 and was published on June 21, 2018. Since in Germany an assessment is based on the basic or split tariff, two separate evaluations are available in these statistics (Tables 2.1 and 2.2).

The two upper graphics on the right-hand side illustrate the breakdown of the sums of all income or the sums of all taxable income (zvE) in relation to the size class of the zvE. In addition, the average tax rates that are actually shown (red line, solid) and the average tax rates to be expected from 2014 according to Section 32a EStG (red line, dashed) are entered. It can be seen that even if the basic tax-free amount is not reached, cases are reported for which income tax is due. Reasons for this can be:

- Cases have also been proven that have waived an assessment. In these cases, only the withheld income tax is proven.

- When calculating income tax, extraordinary income (Section 34 EStG) is added to the ZvE.

- According to § 32b EStG, a special tax rate is to be applied to the zvE for existing income that is subject to the progression proviso.

It can also be seen that with higher incomes, the actual tax shares are significantly below the average tax rates to be expected according to Section 32a of the Income Tax Act. The reason for this is the application of the calculation scheme to determine the income tax amount (earlier in this article). There are still a few additional and deductible items ( tax reductions ) that explain this effect.

The distribution of the number of taxable individuals and married couples according to the size class of the ZVE is shown in the two images below.

Here, too, there is a significantly high proportion of taxpayers with ZVE below the basic tax allowance (green and blue bars), especially among those taxed according to the basic rate. However, as is to be expected, most of them pay no taxes at all (red bars).

Most taxpayers are in the zvE range of around 15,000 to 35,000 euros (basic tariff) or 30,000 to 70,000 euros (splitting tariff) annually.

International comparison

In an international comparison, the top tax rate for German income tax is in the upper half and the basic tax rate in the lower quarter. A detailed table can be found in the article income tax rate . However, the information on the entry and top tax rates alone does not say anything about the tariff progression, the benchmarks and the burden on the individual income groups.

criticism

German income tax law has been the subject of criticism for years: Numerous exceptions and special regulations have led to a lack of transparency. An important cornerstone of all tax reform concepts is tax simplification. Exceptions and special regulations are to be restricted or abolished in order to lower the tax rates with the resources released as a result, but this does not necessarily mean that income tax has to fall in general.

The creeping increase in the tax burden due to the cold progression is also criticized . The Taxpayers' Association has calculated that in 1958 the top tax rate of 53% was based on 20 times the average income at the time and in 2019 it was 1.9 times the average income. However, this does not take into account that the marginal tax rate used for comparison was reduced to 42% here. From 1995 to 2017, the number of taxpayers who reached the end of the progression zone (around 55,000 euros with 42%) rose from around 0.5 million to around 3.7 million. But commentators point out that in the past, when inflation is taken into account, high earners were taxed significantly higher than they are today. For example B. in 1986 earnings equivalent to 75,000 euros were taxed at 51.8 percent.

The key points of the tariff have been increased regularly since 2007, which counteracts the cold progression.

In a report for the Finance Committee of the Bundestag on January 17, 2012, the Federal Audit Office came to the conclusion that the legal enforcement of the tax laws in the assessment of employees is still not guaranteed.

Social impact

According to Joachim Wieland , lowering income and corporation tax changes the ratio of revenue from direct taxes to indirect taxes to the disadvantage of underperforming taxpayers. Since direct taxes such as income tax (especially through tax progression) are based on the efficiency principle and indirect taxes are the same for everyone, when income tax is reduced, tax revenues shift to indirect taxes, which do not take into account the financial strength of taxpayers. With the lower tax burden on economically more efficient taxpayers, tax fairness will decrease. As a result, the gap between rich and poor increases accordingly .

Specialty

For reasons of equity, the residents of the community of Büsingen am Hochrhein are granted an additional tax exemption to cover the higher Swiss cost of living. This amounts to 30% of the taxable income, but not more than 30% of € 15,338 annually for single people and € 30,675 for married people. This assessment basis increases by € 7,670 for each child.

See also

- Income tax return

- Income tax (Germany)

- Income tax rate

- Linear progressive tariff

- Tiered tariff

- Cold progression

- Child benefit (Germany)

- Negative income tax

- tax evasion

- Exit taxation

Web links

- Text of the Income Tax Act (Germany)

- Income tax calculator of the Federal Ministry of Finance with information

- ELSTER - The Electronic Tax Return (Germany)

- Graphic: Distribution of the tax burden , from: Facts and figures: The social situation in Germany , online offer of the bpb (2008)

- Income tax calculator with annual comparison taking inflation into account , historical tax formulas from 1958

- Graphically interactive rate editor , create, change and compare income tax rates

Individual evidence

- ↑ a b c d Tax revenue by type of tax in the years 2014 - 2017. (PDF; 81 kb) In: https://www.bundesfinanzministerium.de . Federal Ministry of Finance, August 28, 2018, p. 2 , accessed October 8, 2018 .

- ↑ Bernhard Fuisting: The Prussian Income Tax Act of June 24, 1891 and the implementation instruction of August 5, 1891, with explanations and an introduction: The historical development of the Prussian tax system and systematic presentation of income tax . Second increased and improved edition. Heymann Berlin 1892. p. 190 ff. P. 190 ff. Digital.staatsbibliothek-berlin.de

- ↑ a b c Gierschmann, Gunsenheimer, Schneider: textbook income tax. 15th edition. P. 65, margin no. 1

- ↑ Control Council Act No. 3 , source: http://www.verfassungen.de/de/de45-49/kr-gesetz3.htm

- ^ Willi Albers: The burden of the German income tax in relation to foreign countries

- ^ Klaus Tipke : "An end to the income tax confusion !?", Cologne 2006, page 36

- ↑ a b c Increase in the basic allowance due to unconstitutional taxation of the subsistence level, cf. BVerfGE 87, 153 - basic allowance

- ↑ cf. also uniformity of taxation according to performance , reduction of the " middle class belly "

- ↑ Progression width = start of the last progression zone (euro) divided by the basic tax allowance (euro)

- ↑ Progression level = top tax rate (highest marginal tax rate) divided by the initial tax rate (lowest marginal tax rate)

- ↑ Figures 2010 to 2014: Statistics on tax revenue. Federal Statistical Office, 2014, archived from the original on April 25, 2016 ; accessed on September 7, 2014 (or older archive versions).

- ↑ Federal Ministry of Finance: "The municipal share of income tax in the municipal finance reform" ( Memento from June 2, 2016 in the Internet Archive ) Berlin 2015, p. 18

- ↑ Federal Statistical Office: “Quarterly cash results of the general public budget 2014” , series 14th series 2. Wiesbaden 2015, p. 16.

- ↑ Taxes. The south is pulling away. The east remains behind. ( Memento from June 2, 2016 in the Internet Archive ) Website of the Bertelsmann Foundation. Retrieved June 2, 2016.

- ↑ § 32a Paragraph 1 EStG according to Article 3 - Family Relief Act (FamEntlastG)

- ↑ Wage and Income Tax 2014 (Fachserie 14 Reihe 7.1) , PDF accessed on October 3, 2018

- ^ Individual information from the Federal Statistical Office of April 29, 2009

- ↑ a b The state spares the rich. In: zeit.de. Retrieved June 2, 2020 .

- ↑ Die Welt, December 5, 2017, p. 9.

- ↑ 2012 special report “Enforcement of tax laws, especially in the area of employees”. In: www.bundesrechnungshof.de. Federal Audit Office, January 17, 2012, accessed on March 3, 2018 .

- ↑ Joachim Wieland: fair taxation instead of national debt | APuZ. Retrieved June 18, 2020 .