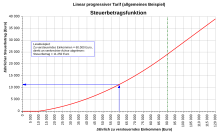

Tax amount function

A tax amount function is the clear assignment of a tax amount to a tax base . For example, the tax amount function for income tax determines which tax amount (in euros ) is to be paid on a given taxable income (assessment base).

A mathematical function is usually defined for this

There are several options for defining the functional sequence, whereby the term tax rate is common in tax law :

- Proportional tariff with constant tax rate ( flat tax )

- Progressive tariff with increasing tax rate (picture above right)

- Degressive tariff with falling tax rate

- Flat rate with constant tax amount ( head tax )

each depending on the assessment basis. The picture at the bottom right shows the four courses, with the tax amount on the vertical axis and the tax base on the horizontal axis.

This function does not have to be continuous and differentiable at every point . Tax scales need not have the same characteristic to the same extent for each section of the tax base. For example, income tax can only start when a certain minimum income is reached (basic allowance) or increase more rapidly from a certain income. In public finance, a distinction is made between the following tax amount functions:

The tax amount function can be analyzed using two quantities: the average tax rate and the marginal tax rate , where applies

The average tax rate indicates how high the proportion of the tax amount is in relation to the total tax base, while the marginal tax rate shows how much tax (in percent) is to be paid on an additional unit of the underlying tax base (for example: "How much wage tax do I have to pay extra if I earn one euro more? ").