Corporation tax (Germany)

The corporation (abbreviation: CIT) is the tax on the income of resident legal entities such as corporations , cooperatives or associations . It amounts to 15% of the taxable income . Based on the tax balance sheet, the relevant income is determined through various corrections that are prescribed by the tax laws. It must be reported annually with the corporate income tax return to the responsible tax office. The corporation is not the only business tax . It is supplemented by trade tax and income tax on business income. Political parties, non-profit, charitable or church bodies as well as federal companies are exempt from corporate income tax.

Nature of corporate income tax and legal responsibilities

Taxes can be classified according to different aspects. For example, corporate income tax is a direct tax because the tax debtor bears the tax burden himself. There is an income tax (the tax is based on profit) and a personal tax (a person, not an object, is taxed). Since both the federal government and the federal states are entitled to half of the income, it is a community tax ( Article 106 (3 ) of the Basic Law ).

The Basic Law provides for competing legislation in accordance with Article 105 (2) of the Basic Law. Since the federal government has made use of its legislative right, corporation tax is a uniform federal tax. However, the Federal Council must approve changes to the law. The administrative sovereignty was assigned to the states via Article 108, Paragraph 2 of the Basic Law, that is, corporate income tax is levied by the tax offices. Insofar as the federal government is entitled to the share of corporation tax, the federal states act on behalf of the federal government in accordance with Article 108 (3) of the Basic Law.

German corporation tax is linked to income tax, and many rules for determining income are the same. The Corporate Income Tax Act (KStG) builds on the Income Tax Act and, together with the Corporate Income Tax Implementation Ordinance, forms the legal basis .

The income of the corporation is subject to trade tax if it is a corporation or generates income from business operations . There is no crediting of the trade tax on the corporation tax. The profit distributed by the corporation is again subject to income tax as income from capital assets in the case of domestic partners or shareholders, if it is not a participation in business assets , but at the maximum amount of the withholding tax .

history

| year | Revenue from corporation tax in € billion | Share of total volume | Tax revenue in € billion (total) |

|---|---|---|---|

| 2002 | 2.864 | 0.9% | 303.292 |

| 2003 | 8.275 | 2.8% | 299,562 |

| 2004 | 13,123 | 4.4% | 296,470 |

| 2005 | 16,332 | 5.4% | 301.672 |

| 2006 | 22.898 | 7.0% | 329,301 |

| 2007 | 22,929 | 6.1% | 374,334 |

| 2008 | 15.868 | 4.0% | 396,471 |

| 2009 | 7.173 | 1.9% | 370.675 |

| 2010 | 12,041 | 3.2% | 372.856 |

| 2011 | 15.634 | 3.9% | 403,568 |

| 2012 | 16,934 | 4.0% | 426.190 |

| 2013 | 19.508 | 4.4% | 442.752 |

| 2014 | 20.044 | 4.3% | 461.985 |

| 2015 | 19,583 | 4.1% | 483.178 |

| Source: BMF, tax estimate | |||

With the Erzberger tax and financial reform , a uniform corporate income tax was introduced for the first time in 1920. The tax rate for retained earnings was 10% and was continuously increased in the following years. After the end of the Second World War, in 1946, the tax rate reached a level of 65%, whereby distributions were also taken into account in the income tax. This was the highest corporate tax rate in the history of corporate income tax in the West. In the GDR , the top corporate income tax rate in the GDR was set at 95%, which means that corporations were almost completely abolished.

In 1953, for the first time, distributed profits were taxed at a lower rate than retained profits, as additional income tax was incurred on distributions. The tax rate for distributed profits was 30% and for undistributed profits 60%. In 1958 these rates were reduced to 15% and 51%.

In 1977 the crediting procedure was introduced. The corporation tax on distributed profits could be offset against the income tax, thus avoiding a double burden. Because of the complicated handling and the difficult handling of foreign matters, the crediting procedure was replaced in 2001 by the half-income procedure , in which the recipient only had to pay tax on half of the distribution. As a result of the system change, the income from corporate income tax 2001 was negative. The corporate income tax rate was a uniform 25%, with no difference between retained and distributed profits. In 2003, the Flood Victims Solidarity Act increased the tax rate to 26.5%. From 2004 a tax rate of 25% applied again.

The 2008 corporate tax reform brought about significant changes in the taxation of corporations. The corporation tax rate was reduced from 25% to 15%, and an interest barrier of 30% was introduced with an exemption limit of currently € 3 million. In return, the previous provisions on shareholder external financing ( Section 8a ) KStG were repealed. In parallel to the corporate tax reform, the taxation of capital income for the shareholders was changed, the withholding tax and the partial income method replace the previous half-income method.

Corporate income tax revenue was around € 22.9 billion each in 2006 and 2007; it fell to € 15.9 billion in 2008 and was € 7.173 billion in 2009. Expressed as a percentage, the revenues fell from 4.7%, 4.3% and 2.8% to around 1.5% of the total tax revenue of Germany. This downward trend is due on the one hand to the lowering of the tax rate from 2009 and on the other hand to the financial and economic crisis . The biggest turning point came in 2001 when the half-income method was introduced and the tax rate was reduced from 40% (or 30% for distributions) to a uniform 25%.

Tax revenue is very unevenly distributed among the German federal states. In 2012, the state of Baden-Württemberg combined 22.5 percent of corporate income tax revenue, while the five new federal states together only achieved 9 percent.

spelling, orthography

According to Duden , both the spelling with Fugen-S (corporation tax) and the simple S (corporation tax) are possible. As with many tax laws, the legislature uses the version with an S.

Tax liability

As with income tax, corporate income tax must be distinguished between unlimited and limited tax liability.

Unlimited tax liability

According to Section 1 (1) KStG, certain corporations, associations of persons and assets are subject to unlimited corporation tax if they have their management ( Section 10 AO ) or their headquarters ( Section 11 AO) in Germany. This avoids double taxation of foreign companies. The companies subject to corporation tax are listed in Section 1 (1) No. 1–6 KStG, whereby the list in the addition to Section 1 (1) No. 1 KStG is no longer exhaustive since the amendment by Art. 3 No. 2 SEStEG . An extension of the unrestricted corporation tax liability by way of interpretation is not permitted in accordance with R 2 Paragraph 1 KStR 2004. Corporate income tax subjects are therefore:

| Section 1 Paragraph 1 | Legal forms covered by tax liability |

|---|---|

| number 1 | Corporations (in particular stock corporations , limited partnerships on shares , limited liability companies and European companies ) |

| No. 2 | Commercial and economic cooperatives |

| No. 3 | Mutual insurance and pension fund associations |

| No. 4 | Other legal entities under private law, e.g. registered associations , foundations, etc. |

| No. 5 | unincorporated associations, institutions, foundations and other special-purpose assets under private law |

| No. 6 | Businesses of a commercial nature from corporations under public law , for example municipal utilities, transport companies or the like owned by the municipalities / states. |

The unrestricted corporation tax liability extends to all income ( world income principle ) according to § 1 Abs. 2 KStG .

Limited tax liability

If neither the management nor the head office is in Germany, corporations, associations of persons and estates are subject to limited taxation with their domestic income ( Section 2 No. 1 KStG, Section 8 (1) KStG in conjunction with Section 49 EStG). However, double taxation agreements must be observed .

Furthermore, corporations under public law with their income subject to capital gains tax, such as interest income, are subject to limited taxation ( Section 2 No. 2 KStG). However, you do not have to submit a corporation tax return; the taxation procedure is completed once the final withholding tax has been deducted . For companies with limited tax liability, a reduced withholding tax rate of 15% applies, analogous to the tax rate for other legal entities.

Beginning and end of tax liability

In the absence of an express regulation in the KStG, the legal existence of the taxable person is fundamental for the start of tax liability. A pre-founding company in the form of a partnership under civil law or a general partnership is not subject to corporation tax. Although the legal person "as such" only arises with the entry in the commercial register (cf. § 11 para. 1 GmbHG , § 41 para. 1 sentence 1 AktG ), the tax liability begins with the notarial certification of the articles of association or the Articles of Association ( pre-company ) . This results from the fact that the previous company - regardless of the qualification as a company sui generis - is to be treated under civil law according to the law of the respective corporation. The immediate tax liability simplifies handling, as no separate tax return is submitted for the previous company. If, however, there is no later entry in the register (unreal parent company) , all corporation tax returns that have already been submitted will be reversed and the unreal parent company will be treated according to the law of partnerships . The tax liability ends with the legal termination of the liquidation of the company.

Tax exemptions

Companies of the federal government, political parties within the meaning of Section 2 PartG , professional associations as well as non-profit , charitable or church corporations are exempt from corporate income tax if no commercial business is carried out ( Section 5 (1) KStG, Sections 51 ff. AO ).

However, these subjective tax exemptions do not apply to domestic income that is subject to withholding tax (i.e. capital income, see section on limited tax liability ). That is why the tax-exempt corporations are also referred to as "partially taxable" .

The exemptions also do not apply to persons with limited tax liability ( Section 2 (1) KStG, Section 5 (2) No. 2 KStG), with the exception of corporations with limited tax liability that serve charitable, charitable or church purposes ( Section 5 (1) No. 9 KStG), are companies founded in accordance with the legal provisions of an EU / EEA member ( Art. 54 TFEU / Art. 34 EEA Agreement) and have their headquarters and management in a member state with which an administrative assistance agreement exists.

tax rate

According to Section 23 (1) KStG, the tax rate is 15% of taxable income, the tax amount is rounded down to full euros. In addition, 5.5% of this tax amount is levied as a solidarity surcharge , so that the total tax component is a uniform 15.825% of the taxable income. Thus, the determination of the corporation tax amount to be paid corresponds to a proportional tariff , which is a significant difference to income tax with tax progression .

Determination of the taxable income

| Annual surplus according to the trade balance |

|---|

| +/- corrections, e.g. B. in the event of a different evaluation of fixed and current assets |

| Annual surplus according to the tax balance sheet |

|

+ hidden profit distributions |

| = Tax profit or income for the calculation of the donation deduction |

| - Deductible benefits (according to Section 9 (1) No. 2 KStG) |

| = Total amount of income ( according to § 10d EStG) |

| - Loss deduction (according to § 10d EStG) |

| = Income |

| - Exemptions for certain corporations ( § 24 , § 25 KStG) |

| = taxable income |

According to Section 7 (1) of the KStG, corporate income tax is based on the taxable income . The profit from the tax balance sheet serves as the basis for determining income. In principle, this takes place in accordance with the provisions of the EStG, but special regulations of the KStG take precedence as a lex specialis ( Section 7 (2) KStG in conjunction with Section 8 (1) KStG). A list of the relevant provisions from the Income Tax Act can be found in R 32 KStR 2004. The profit shown in the commercial balance sheet may need to be corrected (for example, in the event of deviating valuations of the fixed assets) and a reported net profit , which also includes profit or loss carryforwards from the previous year must be converted into the annual surplus. Profit distributions during the year are to be added and must of course also be taxed.

Special case of tax groups

In corporations - if certain conditions are met - the subsidiaries ( controlled company ) are taxed together with the parent company ( controlling company ). There must be a minimum of five years of ongoing profit transfer agreement concluded in which the subsidiary is obliged to transfer the entire profit to the parent company. In addition, the subsidiary must be financially integrated and the parent company must hold the majority of the shares. In contrast to commercial law, no joint consolidated balance sheet is prepared for corporation tax. The income of each company is determined separately and taxed jointly in the parent company. Nevertheless, a corporation tax return (with annex OG ) must be submitted for each individual company .

The advantage of the tax group is that profits and losses of the individual companies can be offset immediately and that fictitious business expenses are not treated as non-deductible as is the case with dividends 5%.

Covert profit distributions

Hidden profit distributions exist when the shareholder concludes contracts with the corporation that he could not conclude with a third party, for example if he demands excessive rent or an excessive salary. The same applies to close relatives of the partner. Hidden profit distributions (vGA) to the shareholder represent unnecessary expenses for the corporation and do not reduce the income according to § 8 Abs. 3 S. 2 KStG. In the case of an excessive salary, the difference to a reasonable salary is an expense under commercial law, but must be neutralized in the income calculation for corporation tax. Thus, the actual profit is taxed. For the recipient of the hidden profit distribution, this always belongs to the income from capital assets, even if it was a salary or rent. Only the appropriate part of the payments is taxed as income from employment (in the case of wages) or as rental and lease income (in the case of rent).

Concealed deposits

Concealed deposits exist when a shareholder gives a corporation an advantage, for example, waives his or her salary claim or sells an item from private assets to the corporation at below value. Not paying back a loan is also a hidden deposit. Hidden deposits are not allowed to influence taxable income and are therefore mathematically neutralized (see calculation scheme). Concealed deposits can be both an increase in assets for the corporation and a prevented asset decrease. The hidden contribution does not necessarily have to come from a partner, but can also come from a person closely related to the partner.

Surrender of use and free management do not lead to a hidden deposit, as they do not represent a depositable asset. The subject of the hidden deposit must always be accountable. This is where the hidden deposit differs from the hidden profit distribution.

For the depositor, the hidden deposit leads to acquisition costs for the participation. For the legal entity, the tax deposit account increases . The amount of the tax deposit account is determined separately each year by the tax office in a notification; it does not appear in the balance sheet, but is rather an ancillary tax calculation. It is developed independently of the capital reserve , into which hidden deposits can but do not have to flow. If the shareholder later sells his share, the hidden deposits are added to the historical acquisition costs so that the capital gain is lower or the capital loss is higher.

Non-deductible expenses

Non-deductible expenses are partly regulated in the Corporate Income Tax Act and partly in the Income Tax Act.

In terms of commercial law, all expenses of the corporation can be booked as expenses, so the profit determined in the commercial and tax balance sheets also includes expenses that may not be deducted for tax purposes. Therefore, the profit in the corporate income tax return must be increased accordingly (see calculation scheme). The corrections must not be made in the balance sheet itself, as the commercial law profit, for example, forms the basis for distributions .

The additions in the corporation tax law are regulated in § 10 KStG. The most important are:

- No. 2: Taxes on income (such as your own corporation tax and the solidarity surcharge ), other personal taxes (such as inheritance tax ) and sales tax on withdrawals or hidden profit distributions

- No. 3: Fines set in criminal proceedings and other legal consequences of a property law nature. Since the German Criminal Code does not provide for any penalties for legal persons, only penalties from other countries fall under this provision. Possible fines against legal persons, however, are according to § 8 Abs. 1 KStG i. V. m. Section 4 (5) no. 8 EStG excluded from deduction.

- No. 4: Half of the remuneration for members of the supervisory board and similar supervisory bodies . The reimbursement of expenses is excluded (if it was not paid in a lump sum).

The most important non-deductible expenses according to § 4 EStG are the following:

- Para. 5 S. 1 No. 1: Gifts over 35 euros per year per recipient

- Paragraph 5 sentence 1 no. 2: 30% of the reasonable and proven entertainment costs, unreasonable costs are fully non-deductible

- Paragraph 5 S. 1 No. 3: Guest houses

- Para. 5 S. 1 No. 4: Expenses for hunting, fishing and sailing or motor yachts

- Paragraph 5 Sentence 1 No. 8: Fines, administrative fines and warning fines

- Paragraph 5 Sentence 1 No. 8a: Interest on evaded taxes

- Paragraph 5 Sentence 1 No. 10: Bribes

- Paragraph 5b: trade tax

- Paragraph 6: Donations to political parties

Donations

Donations and membership fees for the promotion of tax-privileged purposes ( §§ 52–54 AO ) are already deductible as business expenses when calculating profits and are neutralized as non-deductible business expenses (see there) in the income calculation. They can then be deducted as gifts, albeit within the maximum tax limits. A deduction is only possible for voluntary and unpaid donations, i.e. if the service is provided without a legal obligation and without the expectation of a special benefit. Voluntary and also purely moral or moral obligations do not exclude voluntariness.

In the Corporate Income Tax Act ( Section 9 (1) no. 2 sentence 1 lit. a and b KStG) two maximum limits are provided, whichever is more favorable. The first limit is 20% of income, the second limit is 4 ‰ of the sum of total sales, wages and salaries. However, this second limit is usually lower and is therefore rarely used. This is particularly important for companies that have made a loss in the current financial year. Otherwise, these companies would be effectively excluded from the deduction of donations. Donations that exceed the maximum amount can be deducted the following year.

According to § 9 Paragraph 1 No. 2 Sentence 8 KStG, membership fees to certain corporations are not deductible. This applies to those corporations that promote sport ( Section 52 (2) No. 21 AO), cultural affairs and local history ( Section 52 (2) No. 22 AO), cultural activities that primarily serve to organize leisure time, or purposes within the meaning of Section 52, Paragraph 2, No. 23 AO (promotion of animal breeding, plant breeding, allotment gardening, traditional customs including Carnival, Mardi Gras and Mardi Gras, soldier and reservist care, amateur radio, model flying and dog sports ) promote. Donations, however, are deductible to the named bodies.

Donations must be proven with a certificate.

Participation in other corporations

Distributions of profits from other corporations and capital gains from the sale of shares in other corporations are not taxed according to § 8b KStG in order to largely avoid the cumulative effects of corporation tax in multi-level groups . Taxation only takes place in the event of a distribution to natural persons. The downside is that profit reductions from the depreciation of a participation at the level of a parent corporation do not have to be taken into account. After the income is tax-free, the related expenses may not reduce the profit. For these expenses, a flat rate of 5% of the investment income is added back to the profit, regardless of the actual expense. For the taxed investment income of 5%, the accumulation is unavoidable, corporation tax is doubled: for the distributing company as well as for the participating company. The federal government is currently examining whether the receiving corporation will have to hold at least 5% of the distributing company in order for the tax exemption of the profit distribution to apply. In some cases, the tax exemption regulations do not apply to banks and insurance companies .

Loss deduction

The provisions of Section 10d EStG apply to the deduction of losses via Section 8 (1) KStG . If a loss is incurred, it is generally carried back to the previous year up to an amount of € 1,000,000 (if there was positive income in the previous year), otherwise it is carried forward to the next year. Upon request, the loss will only be partially carried back to the previous year or not at all. This makes sense, for example, if the tax rate increases in the following year: In this case, the loss deduction brings a higher tax advantage in the following year than in the previous year.

In the following year, the loss carried forward will be deducted from the total amount of income (see calculation scheme above). It is not possible to waive the application of the regulation and to carry forward the loss as long as it can be offset. If the loss carryforward was higher than the total amount of income, the loss carryforward that was not taken into account is carried forward for another year. If the total amount of income is negative, the existing loss carryforward will be increased accordingly for the next year.

A maximum of one loss carryforward of one million euros per year can be offset without restriction. In addition, only 60% of the total amount of income can be reduced by the loss carryforward. This means that over one million euros will be taxed on 40% of the income in any case.

Loss carryforwards when transferring shares

If more than 25% of the shares are transferred directly or indirectly to an acquirer within five years, the existing loss carry-forwards are no longer deductible on a pro-rata basis ( Section 8c KStG). According to the decision of the Federal Constitutional Court , this regulation is unconstitutional from January 1, 2008 to December 31, 2015 . If more than 50% of the shares are transferred, the loss carryforwards expire completely. For shares acquired after 2007, a restructuring clause was provided by law, according to which the loss carryforwards would not expire if the transfer of shares served to prevent the company from becoming insolvent . This clause was overturned by the EU Commission in January 2011, and the regulation was no longer allowed to be applied since February 2010. However, in its judgment of June 28, 2018, the ECJ declared this decision of the EU Commission null and void. For transfers of shares from January 1, 2016, the continued loss carryforward can be determined on application under the conditions of the new Section 8d KStG, in which case the carryforward can be retained .

Allowances

For certain agricultural cooperatives and certain agriculturally active associations, an allowance of 15,000 euros ( § 25 KStG) applies, for other corporations, associations of persons and assets that do not distribute profit, such as associations, this tax allowance is 5,000 euros ( § 24 KStG). . The tax exemption is deducted from income, the difference being the taxable income. The allowance must never be higher than the income, so its application must not lead to a loss.

Tax return and tax assessment

The corporation's tax return on its income situation serves as the basis for determining the corporation tax to be assessed. The cover sheet KSt 1 of the corporation tax return essentially contains the master data and other basic information of the corporation and is supplemented by various attachments. These are z. B .:

- Annex GK to determine the income from business operations (includes the former Annexes A and B)

- Annex AEV for foreign income

- Annex AESt for foreign creditable or deductible taxes

- Annex GR for cooperatives and associations

- Appendices OG and OT for tax groups

- Annex WA for further information (share capital, relationships with related parties, ...)

- Appendix Z for determining donations

- Annex ZVE for determining the taxable income (based on the income from commercial operations in Annex GK)

In addition, other forms may have to be filled out.

The corporation tax return for the past assessment period must be submitted by July 31 of the following year ( Section 149 (2) AO). It is carried out by the legal representative of the corporation, e.g. B. the managing director of a GmbH according to. Section 6 (2) GmbHG or its authorized representative (usually a tax advisor ) to the tax office . There it is checked and the corporation tax to be paid and the solidarity surcharge are determined by means of a tax assessment . The tax office can set quarterly advance tax payments by means of an advance payment notice (based on the corporation tax at the last assessment) ( Section 31 KStG in conjunction with Section 37 EStG).

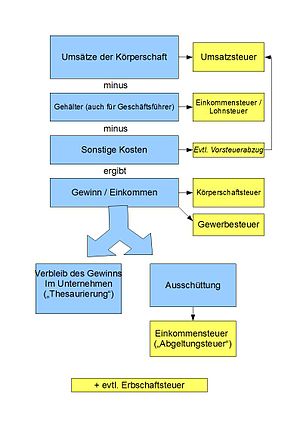

Actual tax charge on the profit of corporations

The tax burden on the profits of corporations consists not only of corporation tax and trade tax. The profit distributed is also taxed at the shareholder's.

| Profit before tax | 100 |

| Trade tax (100 * 3.5% * 400%) | 14th |

| Corporation tax (100 * 15%) | 15th |

| Solidarity surcharge (15 * 5.5%) | 0.83 |

| Total tax burden in the company | 29.83 |

| Capital Gains Tax ((100-29.83) * 25%) | 17.54 |

| Solidarity surcharge (17.54 * 5.5%) | 0.96 |

| Actual tax burden | 48.33 |

|---|

literature

- Dieter Birk : Tax Law. 12th edition. CF Müller Verlag, Heidelberg 2009, ISBN 978-3-8114-9703-0 , Rn. 1231 ff.

- Bernd Erle, Thomas Sauter (Ed.): Heidelberg Commentary on the Corporate Income Tax Act. The taxation of the corporation and its shareholders. 3. Edition. CF Müller Verlag, Heidelberg 2010, ISBN 978-3-8114-3646-6 .

- Wolfram Scheffler : Taxation of companies I. Income, property and transaction taxes. 11th edition. CF Müller Verlag, Heidelberg 2009, ISBN 978-3-8114-9606-4 , p. 177 ff.

Web links

- Text of the corporate tax law

- Text of the corporation tax implementing regulation

- Corporate income tax in the Gabler Business Dictionary

Individual evidence

- ↑ See federal and state tax revenues in November 2009 . Federal Ministry of Finance . Retrieved November 19, 2010.

- ↑ Axel Schrinner, Donata Riedel: Financial equalization angered Bavaria . In: Handelsblatt . No. 13 , January 18, 2013, ISSN 0017-7296 , p. 9 .

- ↑ Corporate Income Tax Guidelines 2004. General administrative regulation on corporate income tax of December 13, 2004 (Federal Tax Gazette I; special number 2, p. 2). ( PDF file; 213 kB ).

- ↑ In detail Thomas Sauter, Torsten Altrichter-Herzberg, in: Bernd Erle, Thomas Sauter (eds.): Heidelberg Commentary on the Corporate Income Tax Act. The taxation of the corporation and its shareholders. 3. Edition. CF Müller Verlag, Heidelberg 2010, § 2 KStG Rn. 15 ff.

- ↑ Thomas Sauter, in: Bernd Erle, Thomas Sauter (ed.): Heidelberg Commentary on the Corporate Income Tax Act. The taxation of the corporation and its shareholders. 3. Edition. CF Müller Verlag, Heidelberg 2010, § 1 KStG Rn. 80 mwN

- ↑ Cf. Florian Haase : International and European Tax Law. 2nd Edition. CF Müller Verlag, Heidelberg 2009, ISBN 978-3-8114-9736-8 , Rn. 156.

- ↑ Cf. Dieter Birk: Tax Law. 12th edition. CF Müller Verlag, Heidelberg 2009, ISBN 978-3-8114-9703-0 , Rn. 1215.

- ↑ See Part 3 of the EEA Agreement , atrecht-in.de. Retrieved February 3, 2011

- ↑ Cf. Norbert Dautzenberg, Birgitta Dennerlein: Organschaft . In: Gabler Verlag (Ed.): Gabler Wirtschaftslexikon. Retrieved November 19, 2010.

- ↑ Cf. Dieter Birk: Tax Law. 12th edition. CF Müller Verlag, Heidelberg 2009, ISBN 978-3-8114-9703-0 , Rn. 1258.

- ↑ See Thorsten Wagner: Corporation tax simply explained , buchhaltung-einfach-sicherheit.de.

- ↑ Wilfried Schulte, in: Bernd Erle, Thomas Sauter (Ed.): Heidelberg Commentary on the Corporate Income Tax Act. The taxation of the corporation and its shareholders. 3. Edition. CF Müller Verlag, Heidelberg 2010, § 9 KStG Rn. 56 f.

- ^ Green paper of the Franco-German cooperation on points of convergence in corporate taxation . Website of the Federal Ministry of Finance. Retrieved March 17, 2012.

- ↑ BVerfG, decision of March 29, 2017, Az. 2 BvL 6/11, full text

- ↑ Restructuring clause of the regulation on loss offsetting restrictions for corporations ( § 8c KStG), initiation of a formal investigation procedure by the European Commission - State aid - C 7/2010 - BMF letter of April 30, 2010.

- ↑ ECJ rulings on the German restructuring clause. In: juris. Retrieved July 3, 2018 .

- ↑ How is the tax rate of 29.83% calculated