Du Pont scheme

The DuPont scheme or DuPont key figure system (in the original: DuPont System of Financial Control ) is the oldest key figure system in the world and one of the best known to this day. The system of corporate key figures for balance sheet analysis and corporate management , based on purely monetary values, was developed in 1919 by the American chemical company DuPont . The system is also used in other companies in various versions and supplements as a management or planning and control instrument.

The focus of the indicator system which is return on assets (including return on investment or short ROI), so the rate of return on capital employed. The primary goal of corporate management is therefore not to maximize profit, but to maximize the result per unit of capital employed. The orientation of the key size to ROI in terms of performance management is a value-oriented corporate management allow. All today's key figure systems (e.g. ZVEI key figure system ) are based on the basic idea of the Du Pont scheme.

The motivation for developing the key figure system was the desire for a closed model of mutually dependent target values. This should make it possible to analyze dependencies and interactions. The formal system turned away from mere collections of isolated key figures, as these often lead to inconsistencies in the analysis results .

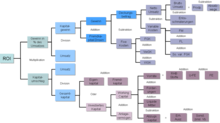

The Du-Pont key figure system has the formal structure of a computing system in the form of a key figure pyramid. The ROI is determined from the product of the key figures return on sales and capital turnover .

The top key figure ROI is initially divided into return on sales and the turnover rate of the capital required for operations. In the following stages, the values that go into the numerator and denominator of these ratios are broken down into their absolute expense and income components and asset components. The return on sales is profit through sales, the capital turnover is calculated from the sales through the average invested capital (operating assets). This split can be carried on almost indefinitely. The various influencing factors on the company's success are clearly displayed through the mathematical decomposition of the higher-level target variable.

The advantage of the DuPont system is that the indicators used are mainly drawn from the business accounting and also to other companies' comparable are. A major disadvantage lies in the exclusively retrospective consideration of monetary values (in contrast to this see Balanced Scorecard ). The orientation towards the short-term profitability target does not take into account long-term aspects of increasing company value. Nor can direct conclusions be drawn about the productivity of the company, since accounting policy can also be decisive. In addition, the mono-goal orientation is criticized and it is pointed out that area-oriented ROI goals can lead to suboptima.

literature

- Hans-Jürgen Probst, Key Figures Made Easy , 2004 ISBN 3-8323-1049-5

- Volkmar Botta, KPI systems as management tools , 1997 ISBN 3-503-04033-1

- Wolfgang H. Staehle , key figures and key figure systems as a means of organizing and managing companies , 1969 ISBN 3-409-31642-6