Balanced Scorecard

This article was the basis of content and / or formal deficiencies in the quality assurance side of the portal economy entered.

You can help by eliminating the shortcomings mentioned there or by participating in the discussion .

Balanced Scorecard ( BSC , English for balanced report sheet ) is a concept for measuring, documenting and controlling the activities of a company or organization in relation to its vision and strategy .

overview

history

In the industrial age , companies developed control systems that promoted the efficient use of financial and material resources. The focus was on financial key figures such as the Du Pont key figure system . The upheavals from the industrial age to the information age went hand in hand with a new, tougher competition. Intangible assets made more and more of a company's value.

To meet this new challenge, a study by several companies was commissioned by the Nolan Norton Institute in 1990. The aim was to support the financial indicators ( ROCE , ROI ) , which were widely used at the time , with other, non-monetary indicators. David P. Norton led the study and academic advice was provided by Robert S. Kaplan . Representatives from 12 companies ( AMD , American Standard , Apple , Bell South, CIGNA, Conner Periphals, Cray Research, DuPont , Electronic Data Systems, General Electric, Hewlett-Packard and Shell Canada) then met every 2 months and developed a new performance -Measurement model. At the beginning case studies of existing performance measurement systems were examined. An approach from Analog Devices was discovered . This has been using a company scorecard since 1987 , which supports financial indicators with non-monetary ones. The then Vice President Arthur M. Schneiderman attended a meeting and laid the foundation for the scorecard. During this time, the scorecard was expanded to a balanced scorecard when it was recognized that a balance between different key figures is required. These were, for example, result and performance-oriented indicators. The key performance indicators were almost exclusively monetary indicators, while the newly added indicators were of a non-monetary nature. These are also known as performance drivers. Internal and external goals should also be in balance , which is represented by the four different perspectives. The customer and financial perspective are to be seen in balance with the process and development perspective. The study was completed in December 1990. A summary of the study was published two years later in the Harvard Business Review entitled The Balanced Scorecard - Measures that Drive Performance .

When several companies reached out to help with implementation after the release, R. Kaplan and D. Norton realized that a second round was necessary. The reasons lay in the key figures used by the companies. These were too operationally oriented and not linked to the corporate strategy. Then an attempt was made to determine the relevant key measurements from the corporate strategy. To achieve this, the strategy was broken down to key success factors (top-down reflection). The study leaders published the results in a second article, Putting the Balanced Scorecard to Work in the HBR.

This strategic performance measurement (BSC) now had to be embedded in a performance measurement system. The BSC should express the strategy of the company or an SGE (Strategic Business Unit) in order to create transparency and clarity company-wide. This formed the basis for aligning the SGE with the existing vision and strategy and should be an essential feature for its success.

A 1998 study by the Gartner Group found that by the year 2000 at least 40% of Fortune 1000 companies would like to use a BSC. This management tool continues to be number one for the EMEA economic region .

concept

The basic concept is based on the idea of a logical or physical object or system that absorbs information and matter from its environment, processes it, transfers it to its environment in a modified form and experiences a material and / or immaterial effect as a reaction to it. This is done according to the scheme input → processing → output → result / effect or input → process → output → return / outcome / impact / result. The logic of the BSC in the sense of Kanban or a pull-push principle asks first about the desired effect (goal, intention, end, purpose) in order to get backwards to the necessary input, i.e.: return / outcome / impact / Result ← Output ← Process ← Input. Since the design of a BSC corresponds in principle to programming, programming aids such as control structures (structograms, flow diagrams), control flow plans, Petri nets , object orientation, etc. are also suitable tools. In addition to general work aids such as those listed below, there are of course also commercial and free software that was explicitly developed for balanced scorecards, e.g. B. from Oracle, IBM and numerous smaller providers.

The main features of the BSC are:

| ID | Function (work step) | comment | Object (work aid or tool) |

|---|---|---|---|

| 1 | Delimiting a system | z. B. SYSMOD / SysML / UML | |

| 2 | Mapping the control structure of the system, d. H. its end-means or cause-effect logic | Topic: Form, structure, structure; Question: “Are we doing the right thing?”> Strategy / Validation | z. B. Petri net |

| 2.1 | Capturing the ideal and material elements | Objects or nodes | |

| 2.2 | Capture the relationships between the elements | Functions or edges | |

| 2.3 | Assess the relationships between the elements | Type, direction, strength or weight | |

| 2.4 | Select the most important objects and functions | Strategy instead of hygiene | |

| 3 | Establishing controllability | Topic: behavior, procedure, process; Question: “Are we doing it right?”> Controlling / verification | z. B. Spreadsheet programs such as Excel or Open Office |

| 3.1 | Determination of measurands | Attributes or edge or node weights (type) for the selected objects and functions | |

| 3.2 | Formation of target values for the measured variables | Setpoint | |

| 3.3 | Collecting measured values for the measured variables | actual value | |

| 3.4 | Deriving forecast values | Expectation | |

| 4th | Handling of exceptions or deviations, d. H. Management of actions | z. B. To-do list, action management tool, spreadsheet program | |

| 4.1 | Deriving measures in the event of deviations between target and actual | ||

| 4.2 | Implementation of the measures |

In this way, both the argumentative and logical foundations of the (business) system (strategy or validation ) and their operational and practical implementation ( controlling or verification ) can be mapped and controlled. As with other management methods, the core of the approach is to use graphs, trees, lists and matrices to structure and process a problem, in this case organizational design.

target

The term BSC is mistakenly used for different types of KPI-based systems. However, the BSC, which requires a cause-and-effect analysis, is originally a different management method than descriptive process costing or the classic monetary key figure system (see e.g. Du Pont scheme ). Due to its flexible and thus comprehensive design options, the balanced scorecard is an instrument for setting up an integrated management system . The key numbers for the functions and attributes of the objects under consideration in the BSC make it possible to follow the development of the business vision. In this way, the BSC enables management not only to consider the financial aspects, but also to control structural early indicators for business success. With the methods of the BSC, the management's field of vision is to be steered from a traditional company view, characterized by financial aspects, to all relevant parts and thus lead to a balanced picture. The more comprehensive view then enables more concrete measures to align the organization to the specified goals.

Action

Structure of the BSC

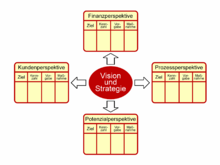

The dimensions of the BSC are determined individually for the specific application. However, they practically always include the financial perspective (return) and the customer perspective (output), mostly also the process perspective (process) and the potential or employee perspective (input). Based on a strategy that takes into account other stakeholders (e.g. employees and suppliers) in addition to the shareholders , critical success factors (KEF) are determined and a key performance indicator (KPI ) is used to create a key figure system (scorecard) . The measured variables represent the degree of fulfillment of the strategic goals. In a continuous process, goals and achievement of goals are checked and controlled by corrective measures.

The constitutive element of a balanced scorecard is the cause and effect diagram . Through the cause-and-effect relationships, the corporate strategy is linked to the customer's point of view, this to the process logic and that again to measures at the employee level. The logic of the dependencies leads almost automatically through all four desired perspectives.

The dependencies can be easily determined by entering all the affected goals and success drivers (objects) in a (cross) table (matrix) both in columns and in rows, and then the respective dependencies and relationships (functions) with regard to their significance, relevance or also Validity can be assessed as part of the validation . After the dependencies have been worked out, the BSC diagram is formulated into a BSC story , for example: In order to achieve a better financial result, more premium customers have to be addressed, who in turn expect a sophisticated support process that can only be ensured by well-trained employees can. Then actual and expected values of the measured variables (attributes) are mapped and compared in a target / actual comparison or verification . Then possible and necessary measures, both for the business system and for the scorecard itself, are discussed, defined and implemented. Finally, an overall assessment is made. The process is repeated regularly.

Involvement of those involved and affected

In order to develop the BSC diagram in a meaningful way, stakeholders from all areas of the company as well as customers, suppliers and other third parties should ideally be involved. Thus, the BSC may have a role in a process of change ( change management , English "change management") play. If many affected persons are involved in the development of the BSC, the strategy will be better accepted and the planned measures can be implemented more easily.

Typically, the strategic goals are viewed from different perspectives: finances, customers, processes (internal procedures) and employees (growth and maturation). Other perspectives make sense if the company attaches great importance to them (for example partner management or supplier BSC). For each of the perspectives, key figures are selected that measure the approach to the strategic goals. The challenge lies in the selection of fewer and at the same time relevant key figures, which ideally also influence each other directly in the various perspectives. For example, a customer indicator should be selected in such a way that its achievement has a positive contribution to the higher-level financial indicator (sales, profit, return or payment range).

Complexity reduction

In the BSC, the goals should be pursued in a balanced way. To achieve this, the effects of the measures on all objectives are repeatedly assessed. From a psychological point of view, this requires the smallest possible number of key figures to be considered at the same time, typically one or two per perspective. In total, a BSC should not have more than 20 key figures. Many BSCs fail because of the consistent selection and reduction to a few key figures. The aim should therefore be to use a scorecard to create the entire arc from the overarching story to the few really decisive success factors, metrics and measures at the lowest level, so that the corporate concept in its USP can be understood at a glance.

In order to map the size and diversity of organizations, BSCs can also be derived from the group BSC for individual company areas (for example a purchasing BSC or a human resources BSC). The goals of the corporate divisions are thus linked to the corporate goals.

introduction

For the implementation and integration with strategy discussion and classic controlling, Deming circle and continuous improvement process from quality management or explicit introduction or implementation / implementation concepts can be used. The following general steps are essential (see also the characteristics of the BSC above):

Prepare for introduction

- Define the area of investigation and action

- Determine ideas and maxims for action

- Carry out environment , situation and potential analyzes, e.g. B. Industry structure analysis , SWOT

- Check the structure and details of the structure and process of the BSC

Develop key messages (strategy / validation part)

- Clarify core problems, requirements and options

- Derive qualitative goals ( effects / purposes ) and success drivers ( causes / means ) (strategy map)

- Assess cause-effect relationships, e.g. B. with the help of a matrix or crosstab

- Summarize leitmotifs and statements ( vision / mission )

Break down goals (controlling / verification part)

- Develop metrics and key figures for goals and drivers

- Determine target and actual values as well as time series and deviations from key figures

- Define measures, persons responsible, deadlines and budgets

- Formulate the action plan ( story / strategy )

Introduce scorecard

- Incorporate key figures into controlling, reporting and forecasting

- Communicate the contents of the scorecard

- Check the environment regularly

- Regularly adjust perspectives, goals, drivers, measured variables, key figures, measures, deadlines, budgets and those responsible

The first two blocks tend to be outwards towards the environment, the latter two towards the organization inwards. The necessary regular revision of the BSC is made possible by defined work packages of a standard implementation concept. Individual work steps can be repeated if the input parameters change or if there are contradictions or a lack of self-commitment by employees. The BSC can thus be continuously developed in the organization over time.

Typical perspectives

As a rule, four perspectives are used, each with around one or two goals as well as corresponding measures and the associated key figures. What is important here is that this system, unlike almost all other controlling systems, is free to determine the dimensions (the number of perspectives can be larger or smaller). Often the perspectives described in the literature and below are used. The strength of the BSC, however, lies in the fact that, for example, environmental factors or a life cycle assessment can be included, as well as stakeholder considerations or industry-specific factors.

The following are the perspectives according to Robert S. Kaplan and David P. Norton:

Financial perspective: key figures for achieving financial goals.

- Revenue per Sales Representative: Supports business growth, not necessarily profitability .

- Costs per piece: Supports cost awareness, high volumes - but goes against quality .

From the customer perspective , the focus is on identifying the customer and market segments on which you want to be competitive. The identified customer and market segments are then the source for the financial goals.

According to Kaplan, earnings indicators, also known as the core indicator group, are the same for all companies: market share, customer loyalty, customer acquisition, customer satisfaction and customer profitability.

Performance drivers are the company's value proposition. Since these differ from company to company, only property classes are listed.

- Product and service characteristics

- Customer relationships

- Image and reputation

Internal process perspective to achieve internal process and production goals

- Process quality: Supports the delivered quality, not necessarily an effective and efficient production process.

- Process lead time: Supports fast lead times , low capital commitment and little intermediate storage. Can be evaluated in detail and continuously using Process Performance Management .

Employee , potential or learning and growth perspective: key figures for achieving the (long-term) survival goals of the organization

- Sales ratio of new products to old products: Supports rapid new and further development of products.

- Fluctuation of high performers from within the organization: Supports the long-term employment of high performers in the organization, promotes performance differentiation, can block lateral thinkers.

example

In a company, customer orientation should be improved as an essential sub-goal . So the perspective here is that of the customer. Very good adherence to deadlines , few reasons for complaints and fast service or short repair times are seen as critical factors . At the same time, the costs must not be increased significantly.

This means that the following key figures can be used:

- Share of deadlines not met,

- Share of rejected products after delivery,

- Average length of stay for customer service and repairs,

- Cost per product.

These are first determined, around 20 percent of deadlines not met, ten percent of complaints and four weeks of stay. In the next year, only less than ten percent of the appointments are to be missed, the number of complaints is to be reduced to seven percent and the length of stay is only three weeks on average. Measures that can be taken are improvement of scheduling (adherence to deadlines), improvement of quality management and increasing the number of employees in the service and repair department (length of stay). Since the last measure would significantly increase the costs, an attempt can also or additionally be made to improve the efficiency of the department. A high level of sick leave suggests low employee satisfaction . Training measures have also not been carried out in recent years. The following are therefore used as further key figures:

- Average number of sick days

- Average training days per employee

Further developments and applications

The balanced scorecard as a procedural concept cannot only be applied to a company and its management. Other areas of application are, for example, cross-company projects. For this purpose, the perspectives of the balanced scorecard have been adapted and given the term project scorecard .

The focus of the balanced scorecard is on internal company factors that influence the success of a company. Based on the public value concept, Timo Meynhardt and Peter Gomez have developed a public value scorecard that supplements the balanced scorecard with an external perspective. This instrument focuses on value creation in various dimensions as well as the areas of tension that exist in between, and thus enables a structured recording of social opportunities and risks in the corporate environment. An extension to environmental aspects results, for example, from the Sustainability Balanced Scorecard with the connection to the company environmental information system (BUIS). Environmental aspects can be integrated into the four standard perspectives of a BSC by adding the relevant ecological performance indicators, target values and measures there. The classic BSC can also be expanded to include one or more additional perspectives that summarize the relevant environmental aspects. As a rule, the preferred option is to merely supplement the sustainability or environmental perspective.

A further development of the process concept of the balanced scorecard and adaptation to interactive Internet applications is the collaborative balanced scorecard . The result corresponds to that of a balanced scorecard. When creating the collaborative balanced scorecard , not only managers but also many experts from the organization are involved. The development procedure is based on the peer production procedure in software development. The first applications of a collaborative approach have been successfully implemented within Xerox, for example. There are also numerous programs available for creating balanced scorecards. Key figure cockpits are often used to visualize key figures .

Furthermore, a modified model is used that uses the Balanced Innovation Card key figure system (BIC) to plan and control projects in innovation management . This model represents a modification of the Balanced Scorecard (BSC), which supports the implementation of strategies and the achievement of company goals. The use of a BIC leads to a holistic view of the innovation management and aims at the efficient design of the entire innovation management. The framework for this model is set by the innovation or corporate strategy determined by management. Similar to the balanced scorecard approach, the cause-effect relationships also determine the BIC model. The BIC is especially designed for the innovation management of medium-sized companies.

Since the balanced scorecard is ultimately based on a positive model, it can make epistemological sense in the sense of a falsification to focus the scorecard consistently on potential damage, hygiene, risks and avoidance of errors instead of on benefits, strategy, opportunities and correct action. Correspondingly, the possible errors with the greatest risk of damage would have to be taken into account throughout and the BSC would have to be consistently supplemented or integrated with an error-possibility and influence analysis (FMEA) or replaced by this. In this case, the FMEA, which is also based on a cause-and-effect model, would have to be extended to all perspectives. The relationship between rule (object / function) and exception (measure) would thereby be reversed and regular action would basically be understood as avoiding and eliminating defects, exceptions and errors (harm instead of benefit orientation). In practice, however, it will most likely come down to a mixture of both approaches or, as with the SWOT, to all 4, namely strengths / opportunities (benefit side) and weaknesses / risks (damage side).

rating

opportunities

- Balanced scorecards make it possible to represent, operationalize and communicate strategies.

- The vision or strategy can be broken down into operational action (measures).

- The inclusion of lead (leading / causes) and lag indicators (subsequent / effects) conveys a balanced picture and enables forward-looking planning and management. The business model can hopefully be managed successfully using structural early indicators.

- It enables the linking of several or all other controlling instruments (glue function)

- In particular, it enables the simple connection of the functions of Quality Function Deployment (QFD) for benefit or opportunity aspects and failure-possibility and influence analysis (FMEA) for damage or risk aspects for the entire system (organization, company Etc.).

- It reveals deficits and important tasks.

- The interdependencies between the individual corporate goals become clear.

- The simple structure enables a complexity reduction in the control.

- Measures and responsibilities can be justified.

- Employees are strengthened: They get their own perspective. Your work makes a measurable contribution to the implementation of the company's overall strategy.

- In addition to monetary targets, the balanced scorecard also includes non-monetary targets, which makes it a holistic management process .

- There is the possibility of inclusion or alignment with the idea of shareholder value or discounted cash flow / company value .

Risks

- A balanced scorecard, like any key figure system, carries the risk of implementing wrong or unrealistic goals. Incorrect assumptions and ideas or hypotheses about the cause-effect or end-means relationships underlying your own BSC or your own organization / company ultimately also lead to a wrong scorecard and wrong action via modeling and operationalization. Bad strategies are also implemented through the professional process.

- There is a risk of overloading the balanced scorecards with too many and too complex goals.

- A superficial examination of the balanced scorecard can wrongly lead to a one-sided focus on the key figures, especially those based on the past. In this case, the actual intention of the balanced scorecard is lost, the alignment of actions with strategic goals and the sustainable, future-oriented development of potential (= options for action for the future).

- The fixation on key figures can lead to deliberate manipulation or one-sided optimization of the key figures - especially if employee remuneration is linked to the fulfillment of key figures. Therefore, the principle of balance (balance between the individual goals) must be observed in order to avoid incorrect management.

- The unreflective application of the results of process costing without the support of a balanced scorecard management can lead to serious wrong decisions and thus jeopardize the company's success.

- Operationalization can tempt people to rely on paper instead of what is actually given, and thus inadequately perceive and react to rapidly changing environmental conditions. This may have to be intercepted by an independent or special opportunity-risk sensor system / seismograph (perspectives, objects, measured variables, key figures) within the framework of the BSC , as well as strengths / weaknesses , sales / costs or innovation / tradition aspects .

- Caution should be exercised when programs allow employees to monitor their performance and behavior . If employees affected in this way were unable to have a sufficient say in the implementation process, there is a risk of a lack of acceptance. Furthermore, in companies in Germany with a works council, such use is subject to codetermination under the Works Constitution Act .

- Studies show that the greatest successes in implementation are ultimately achieved by focusing on the target-measure links ( relevance , plausibility or significance criterion) or the measure management instead of the key figure orientation.

criticism

For the implementation of the corporate strategy with the instrument of the balanced scorecard, it is necessary to consult the person responsible for the corresponding key figure for every deviation from the plan in order to ensure long-term acceptance. It should be noted that the person responsible for the key figures cannot be held responsible for every deviations from the plan that have occurred. Especially in the case of exogenous disturbances (e.g. economy , raw material prices, etc.), the reason for the deviations from the plan is not to be found with the person responsible for the key figures. It is therefore of fundamental importance that a clear distinction is made between deviations from the plan that are responsible and those that are not responsible. The best way to achieve this is to indicate the risks to be assigned to a key figure when developing a balanced scorecard, because precisely these risks describe an irresponsible deviation from a planned or expected value. This procedure enables the integration of strategic management (balanced scorecard) and risk management , which promotes the efficiency and logical consistency of both systems.

Risks currently hardly play a role in the balanced scorecards, which may be due to the fact that Kaplan and Norton have given almost no space to this topic in their description of the balanced scorecard. Therefore, a further development of the traditional balanced scorecard with the assignment of risks to the key figures is a logical consequence in order to promote the implementation of a value-oriented corporate strategy.

See also

Individual evidence

- ^ Robert S. Kaplan, David P. Norton, Brigitte Hilgner: The effective strategy process: Successful with the 6-phase system. ISBN 978-3-593-38795-6 .

- ^ AD Chandler Jr .: The Visible Hand: The Managerial Revolution in American Business. ISBN 978-0-674-94052-9 .

- ^ Margaret M. Blair: Ownership and Control. rethinking corporate governance for the twenty-first century. ISBN 0-8157-0948-X .

- ^ Schneiderman: The First Balanced Scorecard?

- ^ Robert S. Kaplan, David P. Norton: The Balanced Scorecard - Measures that Drive Performance. (PDF) In: Harvard Business Review. , January / February 1992

- ^ Robert S. Kaplan, David P. Norton: Putting the Balanced Scorecard to Work. ( Memento of February 2, 2014 in the Internet Archive ) (PDF) In: Harvard Business Review. September / October 1993

- ^ Robert S. Kaplan, David P. Norton: Balanced Scorecard. ISBN 978-3-7910-1203-2 .

- ^ Robert S. Kaplan, David P. Norton: Using the Balanced Scorecard as a Strategic Management System. In: Harvard Business Review (January – February 1996)

- ↑ energy.gov ( memento of August 24, 2014 in the Internet Archive ) (PDF).

- ^ Bain & Company: Management Tools & Trends Report . (PDF, 2013).

- ↑ Balanced Scorecard explained in a simple and understandable way - Balanced Scorecard (BSC). Retrieved January 5, 2020 .

- ^ Robert S. Kaplan, David P. Norton: Balanced Scorecard. Implement strategies successfully. , Stuttgart 1997, pp. 62-82.

- ^ T. Meynhardt: Tool box: 37th Public Value Scorecard (PVSC). In: Organizational Development, 2013 (4), pp. 79–83.

- ↑ Andreas Möller, Stefan Schaltegger: The Sustainability Balanced Scorecard as an integration framework for BUIS , in: Integrated environmental controlling. From material flow analysis to an evaluation and information system. Springer Gabler, 2011; Edited by Martin Tschandl, Alfred Posch, pp. 293-317.

- ^ G. Weinberg: The Psychology of Computer Programming. ISBN 0-932633-42-0 .

- ↑ D. Tapscott, AD Williams; Wikinomics How Mass Collaboration Changes Everything. ISBN 978-1-59184-138-8 .

- ↑ Martin Kaschny, Matthias Nolden, Siegfried Schreuder: Innovation management in medium-sized companies: strategies, implementation, practical examples. Gabler, Wiesbaden 2015, ISBN 978-3-658-02544-1 .

literature

English

- Robert S. Kaplan, David P. Norton: The Balanced Scorecard - Measures that Drive Performance . In: Harvard Business Review . (January – February), 1992, pp. 71-79 .

- Robert S. Kaplan, David P. Norton: Putting the Balanced Scorecard to work . In: Harvard Business Review . (September – October), 1993, pp. 134-147 .

German

- Robert S. Kaplan, David P. Norton: Balanced Scorecard. Implement strategies successfully . Stuttgart 1997, ISBN 3-7910-1203-7 .

- Robert S. Kaplan, David P. Norton: Strategy Maps. The path from immaterial values to material success . Verlag Schäffer-Poeschel, Stuttgart 2004, ISBN 3-7910-2239-3 .

- Frank Barthélemy, Heinz-Dieter Knöll, André Salfeld, Christoph Schulz-Sacharow, Dorothee Vögele: Balanced Scorecard - Successful IT selection, implementation and application: companies report . 2009, ISBN 978-3-8348-0686-4 .

- Roland Abel: The balanced scorecard in the work area of works councils . Düsseldorf 2001 ( boeckler.de [PDF; 483 kB ] Study on behalf of the Hans Böckler Foundation ).

- H. Friedag, W. Schmidt: Balanced Scorecard. More than a key figure system . 4th edition. Haufe Verlag, Freiburg im Breisgau 1999, ISBN 3-448-04979-4 .

- H. Friedag, W. Schmidt: Pocket Guide Balanced Scorecard . 3. Edition. Haufe Verlag, Freiburg im Breisgau 2007, ISBN 978-3-448-07976-0 ( scorecard.de [PDF; 969 kB ]).

- Hans-Jörg Vohl: Balanced Scorecard in SMEs. Mastering change processes in medium-sized companies (SMEs) with the Balanced Scorecard (BSC) . 2nd Edition. Murmann Verlag, Hamburg 2015, ISBN 3-86774-428-9 .

- Horváth & Partners (ed.): Implementing a balanced scorecard . 4th edition. Schäffer-Poeschel publishing house, Stuttgart 2007.

- J. Weber, U. Schäffer: Balanced Scorecard and Controlling . Gabler Verlag, 1999, ISBN 3-409-11518-8 .

- CW Gerberich: Integrated Lean Balanced Scorecard: Methods, Instruments, Case Studies . Gabler Verlag, 2006, ISBN 3-8349-0222-5 .

- Stefan Schaltegger, Thomas Dyllick (ed.): Managing sustainably with the balanced scorecard. Concepts and case studies . Gabler, Wiesbaden 2002, ISBN 3-409-12080-7 ( leuphana.de [PDF; 3.7 MB ]).

- M. Griga, R. Krauleidis: Balanced Scorecard for Dummies . Wiley-VCH Verlag, 2009, ISBN 978-3-527-70466-8 .

- Internationaler Controller Verein (ed.): Balanced Scorecard . Controller Statements Instruments. ( Balanced Scorecard . ( Memento from October 26, 2006 in the Internet Archive ) controllerverein.com [PDF]).

- D. Matusiewicz, C. Dante, J. Wasem: The importance of the balanced scorecard for statutory health insurance - an inventory . In: BH Mühlbauer, F. Kellerhoff, D. Matusiewicz (ed.): Future perspectives of the health economy, series: Health economics: Politics and management . 2nd Edition. tape 10 . LIT-Verlag, 2014, p. 319-340 .

- Balanced scorecard for the healthy company . ( Article in the Fraunhofer IAO Wiki [accessed December 23, 2013]).