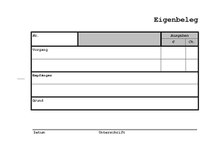

Own receipt

A personal receipt is a substitute for an invoice or receipt .

In principle, professional or operational expenses must be proven in tax law ( Section 97 of the Tax Code ). No deduction is made without receipts in the form of invoices and receipts. This obligation to provide evidence does not apply to flat rates. Therefore, a principle of proper bookkeeping is : “No booking without receipt”. In cases in which there is no receipt for a business transaction or the receipt has been lost, a so-called own receipt must be created as a replacement. Provided that the expenses are operationally or professionally necessary and the amount is credible, the tax office must recognize these own receipts.

If the receipts are lost, the personal receipt is only an emergency solution. If the issue is to be recognized by the tax office, this must remain an exception. In the case of smaller expenses in daily life and the use of (coin) machines (telephone, photocopier , parking meter , postage ) or tips , however, it is a common and permitted business practice.

A correct self-receipt must contain the following information:

- Payee with full address,

- Type of expenditure, e.g. E.g .: "Tip, see restaurant receipt" or "Color cartridge XY",

- Date of expenditure,

- Costs (total price, if applicable unit price per piece),

- Proof of the amount of the price (if possible, for example by means of a price list)

- Reason for the self-receipt (e.g. loss, theft or "unacknowledged tip", "use of a machine that does not issue a receipt"),

- Date and own signature .

A deduction of input tax is not possible for own receipts. According to § 15 of the Sales Tax Act (UStG), a proper invoice in accordance with § 14 of the Sales Tax Act is essential.

Requirements for the recognition of a personal receipt

A self-receipt must meet the following requirements in order to be recognized by the responsible tax office :

- A business transaction must exist for the expenditure to be documented.

- The operating expense must be understandable in terms of the amount.

Web links

- Bundesfinanzhof , judgment of April 18, 2012, Az.XR 57/09, full text ( obligation to provide evidence for entertainment expenses for entertainment in a restaurant)