Midijob

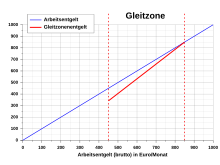

As Midi job is called in Germany an employment relationship with a salary in the range of 450.01 to 1300 euros a month. Since July 1, 2019, this area is no longer called a sliding zone , but a " transition area ". In the case of several employment relationships, the total wage earned is decisive. In the transition area is employee contributions to statutory social insurance from the gross wage dependent, while the employer's contribution is constant.

Switching from an insurance-free mini job to an activity subject to compulsory insurance should be attractive. Employees should not suddenly be burdened with high social security contributions if their wages exceed the mini-job limit.

In contrast to mini-jobs, mid-jobs are not tax-deductible. In a marriage with an earning spouse and a mid-job spouse, the total income is used to calculate the tax.

aims

The goals are

- To make jobs attractive, the wages of which are just above the wage threshold for mini jobs (€ 450.00),

- to secure legal employment socially (especially health insurance protection ; defusing the " working poor " problem),

- Increase incentives to take up employment in order to bring the unemployed into the labor market,

- the social to develop additional sources of contribution.

Since before April 1, 2003, when changing from a mini job to better paid work, the social security obligation increased the tax burden from 0% to around 21% of gross earnings, a sliding zone was introduced. Since then, the employee's social security contribution has risen steadily from around 11% to around 21% ( Section 20 (2) SGB IV ). The regulation was part of the Hartz concept (Hartz II) for reforming the labor market.

application

A mid-job exists if

- an employment relationship subject to compulsory insurance is taken up,

- the employment is not short-time work, gradual reintegration or partial retirement or is for vocational training (and some internships), and

- the regular monthly wage is between € 450.01 and € 1300.

Regular remuneration also includes one-off payments to which there is a legal entitlement. If wages are not consistently paid in the same amount, the average is calculated.

If there are several jobs that are subject to social security contributions, the gross wages must be in the transition area, otherwise the normal contribution calculation is used. Mini-jobs and civil servant salaries are not included. If the wages subject to pension insurance exceeded € 800 at the end of 2012, for wages up to € 850 in accordance with Section 276b (2) SGB VI, for reasons of grandfathering, the sliding zone regulation was only applied in the pension insurance from 2013 if employees declared the application of the sliding zone regulation to the employer in writing. This was possible until the end of 2014 and only applies to the future. There is no grandfathering protection in health, long-term care and unemployment insurance.

Calculation of social security contributions

The contributions are calculated separately for health insurance , long-term care insurance , pension insurance and unemployment insurance .

The total contribution of the reduced employee's share and the employer's share is calculated as follows:

- Total contribution = sliding zone fee × total contribution rate

- Employer's share = actual wage × contribution rate (employer)

- Employee share = total contribution - employer's share,

Determination of the sliding zone fee

From 2013, the sliding zone fee was calculated using the following formula:

AE: actual gross earnings

With the reform that came into force on July 1, 2019, this formula is no longer up-to-date, as the sliding zone / transition area has been expanded to 1,300 euros. For AE = 450 euros, the formula results in a sliding zone fee of F × 450 euros, for AE = 850 euros this results in a sliding zone fee of 850 euros, for AE values from 450 to 850 euros the sliding zone fee was interpolated linearly. A simplified representation of the formula is:

| Period | from | Factor F | calculation |

|---|---|---|---|

| 2003 | April 1st | 0.5995 | F = 25% / 41.7% |

| 2004 and 2005 | 0.5952 | F = 25% / 42.0% | |

| 2006 | January 1st | 0.5967 | F = 25% / 41.9% |

| 2006 | July 1 | 0.7160 | F = 30% / 41.9% |

| 2007 | 0.7673 | F = 30% / 39.1% | |

| 2008 | 0.7732 | F = 30% / 38.8% | |

| 2009 | 0.7472 | F = 30% / 40.15% | |

| 2010 | 0.7585 | F = 30% / 39.55% | |

| 2011 | 0.7435 | F = 30% / 40.35% | |

| 2012 | 0.7491 | F = 30% / 40.05% | |

| 2013 and 2014 | 0.7605 | F = 30% / 39.45% | |

| 2015 | 0.7585 | F = 30% / 39.55% | |

| 2016 | 0.7547 | F = 30% / 39.75% | |

| 2017 | 0.7509 | F = 30% / 39.95% | |

| 2018 | 0.7547 | F = 30% / 39.75% | |

| 1.1. – 30.6.2019 | 0.7566 | F = 30% / 39.65% |

The factor F is determined by the Federal Ministry of Health and the Federal Ministry of Labor and Social Affairs. The calculation procedure is specified in Section 163 (10) of the Book VI of the Social Code . The formula for this is:

- in the period from July 1, 2006 to ...:

- Factor F = 30% divided by the average total social security contribution rate

- in the period from April 1, 2003 to June 30, 2006:

- Factor F = 25% divided by the average total social security contribution rate

Additional contributions

Members of the statutory health insurances must pay an additional contribution of 0.9% of the assessment remuneration, members of the statutory long-term care insurance who are childless and older than 23 years must pay an additional contribution of 0.25% of the assessment remuneration. When calculating the additional contributions, the sliding zone fee is multiplied by the additional contribution rate (0.9% or 0.25%).

Contributions to the equalization procedure

Contribution contributions to be borne by the employer for the equalization procedure according to the Expenditure Equalization Act are to be calculated according to the assessment remuneration according to which the pension insurance contribution is to be calculated. Between 450.01 and 1300 euros, the allocation is not paid on the full gross wage, but on the sliding zone remuneration (see above for calculation).

Example for 2015

The following calculation example relates to the year 2015.

- The gross wage of the midi job is € 650.00 per month.

- The employee has no children. The employer takes part in the compensation procedure in the event of illness.

- There is compulsory health, long-term care, pension and unemployment insurance

Contribution rates:

- Health insurance: 14.6% + 0.9% (average additional contribution rate) = 15.5%

- Pension insurance: 18.7%

- Unemployment insurance: 3.0%

- Long-term care insurance: 2.35% + 0.25% (additional contribution rate for childless)

Contribution rates:

- Contribution U1 (compensation procedure in the event of illness): 2.0%

- Contribution U2 (equalization procedure maternity allowance): 0.38%

- Allocation U3 (compensation procedure for insolvency money): 0.15%

Calculation:

Gleitzonenentgelt (Bemessungsentgelt) = 0,7585 × 450 € + (2,125 − 1,125 × 0,7585) × (650 € − 450 €) = 341,325 € + 1,2716875 × 200 € = 595,67 €

Health insurance:

- Total contribution with additional contribution: 595.67 € × 15.5% = 92.33 €

- Employer's contribution: € 650.00 × 7.3% = € 47.45

- Employee share with additional contribution: € 92.33 - € 47.45 = € 44.88

Pension insurance:

- Total contribution: € 595.67 × 18.7% = € 111.39

- Employer's contribution: € 650.00 × 9.35% = € 60.78

- Employee share: € 111.39 - € 60.78 = € 50.62

Unemployment insurance:

- Total contribution: € 595.67 × 3.0% = € 17.87

- Employer's contribution: € 650.00 × 1.5% = € 9.75

- Employee share: € 17.87 - € 9.75 = € 8.12

Care insurance:

- Total contribution without additional contribution: 595.67 € × 2.35% = 14.00 €

- Employer's contribution: € 650.00 × 1.175% = € 7.64

- Employee share without additional contribution: € 14.00 - € 7.64 = € 6.36

- Additional contribution: € 595.67 × 0.25% = € 1.49

- Employee's share with additional contribution: € 6.36 + € 1.49 = € 7.85

Employers only:

Allocation U1 for the compensation procedure in the event of illness:

- Total contribution: € 595.67 × 2.0% = € 11.91

Allocation U2 for the maternity allowance compensation procedure:

- Total contribution: € 595.67 × 0.38% = € 2.26

Allocation U3 for the compensation procedure for insolvency money:

- Total contribution: € 595.67 × 0.15% = € 0.89

Effects

In the case of compensation benefits such as sickness benefits or transitional benefits calculated on the basis of standard pay, these benefits must not exceed 90% of a fictitious net wage . The fictitious net wage is the net wage that would apply without the application of the sliding zone rule.

Legal references

The definition of the sliding zone (mid-job) can be found in § 20 SGB IV. The calculation rule is noted in the respective insurance system, in the case of pension insurance z. B. in Section 163 (10) SGB VI.

historical development

From April 1, 2003 to December 31, 2012, the sliding zone was between 400.01 and 800 euros.

Thereafter, the sliding zone was in the range of 450.01 to 850 euros.

The transition range from 450.01 to 1300 euros has been in effect since July 1, 2019.

See also

- Job opportunity

- student job

- Marginal employment

- Work opportunity with additional expense allowance , so-called "1 euro job"

- Precariat

Web links

- BMAS: "Marginal employment and employment in the sliding zone" , brochure, PDF

- In addition to the legal provisions that came into force in 2003, this joint circular also contains details on the sliding zone regulations and examples. Among other things, this circular comes from the central associations of the health insurance funds (collection agencies) as well as from the pension insurance carriers that carry out the company audits.

- BfA information on "mini jobs" and "low wage jobs", brochure for PDF download .

- Mid-job calculator / sliding zone calculator - calculates online the social security contributions and AG surcharges for remuneration within the transition area or for periods up to 30.06.2019 in the sliding zone (free of charge)

- Minor employment in a new guise - short report of the IAB (PDF file; 296 kB)

- Legal text of §§ 20 ff. SGB IV

Individual evidence

- ↑ DeutscheHandwerksZeitung finances + money - November 15 , 2018 : Earning more in mid-job: This applies from 2019. Accessed on December 24, 2018 .

- ↑ See the speech of the Bundestag member Thea Dücker, Bündnis 90 / Die Grünen, at the session of the German Bundestag on December 19, 2002, plenary minutes 15/16, p. 1237.

- ↑ Formula as PDF according to Section 163 (10) SGB VI

- ↑ Information on the sliding zone at lohn-info.de, accessed on January 4, 2015

- ↑ a b depending on health insurance (example DAK-Gesundheit, reimbursement rate 70% , PDF accessed on January 15, 2015)

- ^ German pension insurance - sliding zone. Retrieved January 11, 2019 .