International balance

Under the international balance means a balanced trade policy. World demand = world supply applies. In the literature this connection is also discussed under the name of the world equilibrium.

General explanation of terms and introduction

The general balance

In order to deal with the international equilibrium, the concept of market economy equilibrium should first be clarified. In macroeconomics there are 3 equilibria: goods market balance, money market balance and labor market balance. Market equilibria are focal points in the real economic sector, especially the links between supply and demand. By definition , a market is in equilibrium when the quantity of a product offered and demanded - each at a certain price - match. With every shift in the supply or demand curve, i. H. With every change in supply and demand, the equilibrium also changes and a new one sets in, with different prices.

Basically there are two revitalizing approaches - the "Classical" and the "Keynesian" approach.

In an open economy, which means that there is trade with foreign countries, the equilibrium depends heavily on developments in the exchange rate. The effects and actions of rising and falling exchange rates on imports and exports, and thus also on overall economic demand, are explained in more detail in the section "Determining the international balance". Shifting the demand function Z up or down causes the so-called multiplier process to turn on again To achieve equilibrium in the market. For example: When exchange rates rise and market conditions otherwise remain the same, the overall economic demand function is shifted upwards and production is expanded at the same time. This also happens the other way round when exchange rate developments fall. This always creates a new market equilibrium (Y (supply ) = Z (demand)).

Composition of the goods market equilibrium

Y = Z

Y = determined by production and income (the prerequisite for this is that there are no existing stocks, otherwise there will be no match between supply and demand)

Z = C + I + G - IM + X (imports and exports only take place in an open economy)

C = consumption

dependent on "disposable income" = Y (income) - T (plus taxes - transfer payments), which is linearly related to consumption.

C = C 0 + C 1 * (Y - T)

C 0 = marginal consumption quota Share of income Y that private households invest or consume in the next possible Y unit and do not save.

C 1 = autonomous consumption (consumption that is needed, even without disposable income Y - a kind of "livelihood consumption")

I = investment

depending on production (Y) and real interest rate (r)

The higher r, the less is invested. The interest rate r represents the cost of borrowing, which is one of the most important sources of investment financing.

The higher the production, the higher the income. Accordingly, more is invested.

G = government expenditure

given exogenously (purchases of goods and services by the state sector such as municipalities, states and the federal government)

IM = imports

The domestic demand for foreign goods is dependent on Y and W (exchange rate). Convert imports into domestic units (= total imports * exchange rate). Imports depend positively on Y and negatively on the exchange rate. If Y increases, both domestic demand and demand from abroad increase. If W rises, domestic demand rises, but not foreign demand, which means that less is imported.

X = exports

Foreign demand for domestic goods. Depending on production abroad, income abroad (Y) and the exchange rate. If production increases abroad, income also increases, which means that more is invested and thus the demand from abroad. This means that in addition to domestic goods, there is also demand for domestic goods from abroad, which increases exports. If the exchange rate rises, domestic German goods are cheaper than foreign goods. That means that abroad imports more (Germany exports more).

Z = C0 + C1 * (Y- T) + I (Y, r) + G- IM (Y, W) + X (Y *, W)

Summary

The goods market equilibrium forms the reference point for the multiplier process analysis (shifting the supply and demand function) demand overhang (seller's market) = increase production and this results in an increase in supply. Excess supply (buyer's market) = lower production and reduce supply. After the process is complete, supply and demand are back in balance.

For more detailed information see under goods market equilibrium .

The prerequisite for this is free pricing and a large number of providers.

Export and import in relation to the international balance

Export refers to the delivery of domestic products abroad. Typically, a country exports when there is a surplus of production and the domestic market is saturated. The prerequisite for this is profitable sales.

Under Import means the import of foreign products into the country. A country imports a product when there is a production shortage in its own economy and there is domestic demand.

Thus the international balance is maintained.

The international balance

Model assumptions

To illustrate this, let us first assume that there are only two countries: the domestic and the foreign. They both consume and produce the product wheat , which means that this product can be transported from one country to another free of charge. In both countries, domestically and abroad, there is complete competition in the wheat industry. Furthermore, in our model there should be a difference between the prices of the product wheat at home and abroad, since foreign trade can only come about in such situations. It is also assumed that the exchange rate in this market remains unaffected by foreign trade policy and that the prices for both markets are therefore given in domestic currency.

Determination of the international balance

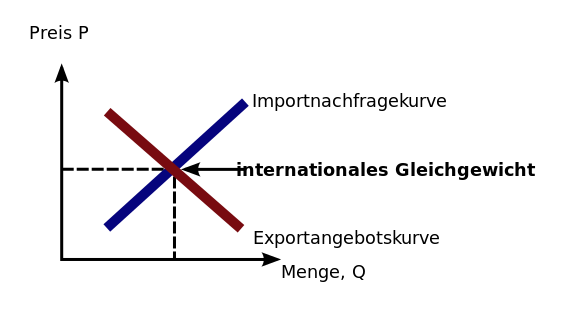

In order to determine and represent the international equilibrium between these two countries, the first step is to define two curves:

- 1. The import demand curve is the amount of demand by domestic consumers that exceeds the supply made available.

- 2. The export supply curve is the surplus that foreign countries have produced and that foreign consumers no longer demand.

In the second step , these respective curves must be determined.

This is obtained by determining the respective price-volume ratios of the supplier and customer in a graph.

If the market is in equilibrium, this means that no quantities of the product are imported. There is no excess demand in Germany. If the domestic supply were now greater than the demand, the producers would curb their import behavior.

The import demand curve is therefore characterized by a downward trend . Because if z. For example, if the price of the product wheat rises, the amount demanded decreases and domestic producers no longer import wheat. You are now producing in stock.

In contrast to this, the export supply curve shows a rising trend , since with rising prices the demand of foreign consumers falls and so more can be exported.

If the market is in equilibrium, this means that - analogous to import demand behavior - no quantities of the product are exported because there is no excess supply. The export supply curve rising beyond equilibrium, on the other hand, means that more quantities of the product are produced than are in demand. There is an excess supply. The country can now export more.

See Figure 2b.

In the third and decisive step , the domestic demand for imports is to be compared with the export supply from abroad. The following applies:

- Import demand = export supply

This also means:

- Domestic Demand - Domestic Supply = Foreign Supply - Foreign Demand

By changing it you get:

- Domestic demand + foreign demand = domestic supply + international supply

And finally worded differently:

Impact of a tariff on the international balance

From the supplier's point of view, customs duties represent transport costs. The suppliers are therefore only ready to export when the price difference between home and abroad is at least as high as the amount of customs duties charged.

A customs-free state is first assumed, as described in the previous section. If customs are now introduced, suppliers abroad are no longer willing to export goods. Since no goods are traded between Germany and abroad, there is an excess demand in Germany and an excess supply abroad.

Domestic prices are rising, at the same time more providers will offer higher prices. Prices are falling abroad, so there is more demand.

Trading starts again when the price difference between the domestic and foreign countries is equal to the amount of duty. Due to the temporary surplus of supply abroad and the consequent drop in prices, the providers cannot completely pass the duty on to the consumers. Part of the duty is therefore borne by suppliers and part by customers. Furthermore, the trading volume is falling.

Relationship between external balance and international balance

In order to achieve an external balance , the partial balances, foreign exchange and current account of a state should be balanced. This means that the sum of exports should be equal to the sum of imports. An external balance is an important requirement that enables brisk trade with other nations.

If a state succeeds in combining a stable monetary policy with full employment, it will also promote international equilibrium.

Current account

The current account shows the changes in net foreign claims. A current account surplus is desirable. A current account deficit can create financing problems. In order to be able to finance a long-term current account deficit, it must be balanced through foreign trade, so there must be more exports and fewer imports. Exemplary measures are: export subsidies, import restrictions.

Foreign exchange balance

The foreign exchange balance is automatically balanced through free market price formation, through supply and demand. Such exchange rate adjustments lead to an appreciation or depreciation of the currency. In times of growth, the prices of goods rise and with them the real exchange rate. A rising exchange rate leads to an increasing demand for imports of goods, as foreign goods become cheaper when viewed in domestic currency. At the same time, however, the demand for exports is falling as domestic goods become more expensive for foreigners. An appreciation of the currency worsens the trade balance and thus also the current account. Conversely, a devaluation of the real exchange rate leads to a rising demand for exports and a falling demand for imports and consequently improves the current account.

J curve

The J-curve is characterized by a delayed improvement in the trade balance, despite the devaluation of the domestic currency. The J-curve effect only leads to a short-term deterioration in the trade balance, since neither exports nor imports react to a devaluation. In the medium to long term, the volume reaction of exports and imports takes place according to the elasticity condition. With the trade balance, the current account balance also rises.

swell

- Doubt, Heller: Internationaler Handel , 3rd edition, 1997, Heidelberg

- Krugman, Obstfeld: Internationale Wirtschaft: Theory and Politics of Foreign Trade , 7th edition, 2006, Munich

- Konrad Anton: Balance of payments theory and balance of payments policy , Verlag Vahlen, 1979, Munich

- Bernhard Beck: Understanding Economics , 3rd revised edition, Vdf Hochschulverlag, 2004, Zurich

- Katrin Alisch, Ute Arentzen, Dr. Eggert Winter: Gabler Wirtschaftslexikon , 16th edition, Gabler Verlag, 2004, Wiesbaden

- Blanchard, Olivier; Illing, Gerhard: Macroeconomics 3rd updated edition. Pearson Education Deutschland GmbH, Munich 2003, page 89