Isoelastic utility function

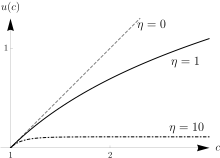

In microeconomics , the isoelastic utility function , also called CRRA utility function ( CRRA : English for Constant Relative Risk Aversion ), is a utility function that is mostly used to express utility in relation to consumption. In modern financial economics , it represents the standard utility function.

definition

The isoelastic utility function has the form

where is the Arrow-Pratt measure of risk aversion . The case is the classic case ("Bernoulli case"). It results from the application of de l'Hospital's rule .

properties

- It belongs to the class of HARA utility functions ( English Hyperbolic Absolute Risk Aversion ).

- The fact that it is also called the CRRA utility function is due to the fact that it is the only function with constant relative risk aversion. Because it is the only solution of the non-linear ODE of the second order , i. H. the general formulation of the CRRA property using the Arrow-Pratt measure.

- An isoelastic utility function has the property of constant elasticity of substitution .

literature

- Stiglitz, Joseph E .: Economics for an imperfect world: Essays in honor of Joseph E. Stiglitz. MIT Press, 2003. p. 431 Isoelastic Utility Functions

- Mossin, Jan. Optimal multiperiod portfolio policies. The Journal of Business 41.2 (1968): 215-229. P. 224

Individual evidence

- ^ Jack Clark Francis and Dongcheol Kim: "Modern Portfolio Theory: Foundations, Analysis, and New Developments, + Website." (2013).