Cantonal referendum "Fines for tax discounts!"

The cantonal referendum "Fines for tax discounts!" was a referendum in the Swiss canton of Lucerne that took place on May 17, 2009. The content of the vote was to credit the income from future fines from road traffic to the Lucerne population as a tax discount.

Background and content

The referendum was triggered by a popular initiative submitted by a majority of SVP members on September 28, 2007 , with the following content:

“The Canton of Lucerne is setting up a special fund for 'fines for tax discounts'. All administrative fines levied by the Canton of Lucerne and the municipalities in accordance with the Road Traffic Act are paid into this special fund. At the end of each year, the total amount in the special fund is divided by the number of all natural taxpayers in the canton of Lucerne and the resulting amount per capita is credited to each natural taxable person in the canton of Lucerne as a one-off tax discount. The “Fines for Tax Discounts” special fund may not be misused. The costs for collecting the administrative fines may not be charged to the tax fund ‹fines for tax discounts›. "

On January 26, 2009, the Lucerne Cantonal Council voted 86:18 against the initiative. According to the legal basis, the popular initiative was therefore subject to a referendum.

Reasons of the initiative committee

The initiative committee was of the opinion that the traffic controls carried out in the canton would no longer serve the actual purpose of road safety, but would be used as a means to improve the canton's coffers with the money earned from the fines. The police should concentrate more on medium and severe traffic violations such as frenzy, instead of enriching themselves with numerous fines. The sharp increase in fines in 2004 contributed to this view. This year, 145,150 buses at CHF 25.80 were issued, which were collected by fines for minor offenses, which can hardly be described as a traffic safety measure.

Counter arguments from the Cantonal Council

To reproach the traffic controls would no longer serve the purpose of traffic safety, but to improve the cantonal treasury:

- They are not only necessary, but are even a task of the canton under federal law.

- They take place according to clear criteria, such as the frequency or the danger of the corresponding points at which they are carried out. Special times or circumstances such as the start of school are also reasons for traffic controls.

- The aim of the traffic controls is to atone for excesses in traffic such as frenzy, but inevitably smaller offenses are also noticed in the controls. Failure to consistently atone for these would lead to arbitrariness and would not correspond to the principle of equality.

- The costs of the traffic controls are higher than the income from the regulatory fines. In 2004, for example, the canton police had service costs of around 20 million francs compared to proceeds of only 12 million.

On the high increase in fines as of 2004:

- This was a reaction to the increasing number of traffic accidents as a result of speeding violations with fatal consequences until 2003, whereupon the number of traffic controls increased in 2004.

- At the same time, the measurement technology was modernized in 2004, which enabled more precise speed measurement.

- The controls also had been public calls for greater speed monitoring.

- Since 2004 the revenue from fines has stagnated, although more and more motor vehicles are on the road.

On the popular initiative itself:

- An acceptance of the initiative would have no effect on the traffic controls per se. It would also continue to be the task of the federal government to carry out traffic checks for the purpose of traffic safety.

- The tax rebate would only correspond to a modest amount of around 40 francs per taxpayer. On the other hand there is an increased administrative effort for the credit, the adjustment and the change of the tax software. For the reimbursement of the tax discount, one reckons with an increased personnel expense of a 50% position.

- With the equal tax rebate benefit among the entire population, those who had to pay a fine would also benefit. The buses could thus lose their effectiveness and purpose.

- The population would be granted a tax rebate, but at the same time a necessary increase in taxes is likely. With the adoption of the initiative, the most important source of funding for traffic controls would cease to exist, as the text of the initiative stipulates that “the collection of administrative fines may not be charged to the tax fund“ fines for tax discounts ”” . Since the traffic controls continue to take place, however, the costs will have to be financed through taxes in the future. Thus, there would only be a redistribution of funds that would also bring little or nothing to the taxpayer.

Voting result

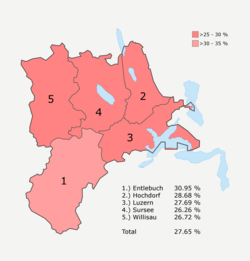

The turnout was between 32% in the Willisau office and 42% in the Lucerne office . The initiative was rejected with values between 69% in the Entlebuch office and 74% in the Sursee office . In the cantonal total, it was rejected with an average of 72% and a voter turnout of 39%.

| Office | Voting participation | Yes (number) | No (number) | Yes (percent) | No (percent) | adoption |

|---|---|---|---|---|---|---|

| Entlebuch | 34.12% | 1,374 | 3,066 | 30.95% | 69.05% | No |

| Hochdorf | 38.91% | 4,561 | 11,344 | 28.68% | 71.32% | No |

| Lucerne | 42.42% | 12,987 | 33,908 | 27.69% | 72.31% | No |

| Sursee | 36.19% | 4,362 | 12,248 | 26.26% | 73.74% | No |

| Willisau | 31.70% | 2,751 | 7,546 | 26.72% | 73.28% | No |

| Total (5) | 38.78% | 26,035 | 68,112 | 27.65% | 72.35% | No |