Cash advance

The term cash credit (including liquidity credit or cash gain credit ) comes from the local government law and refers to the borrowing in the municipal operating budget or from other community organizations ( equity , publicly owned enterprises , institutions / public bodies ).

Legal definition of the municipal code

A legal definition of the term cash credit is provided, for example, by § 105 Hessische Gemeindeordnung (HGO), similar regulations can also be found in the other municipal codes . According to this, the municipality can "take out cash advances up to the maximum amount stipulated in the budget charter in order to pay its expenses in good time, provided no other funds are available for the cash office". What is interesting under local law is that despite the designation as a "cash loan", this borrowing is not regarded as a loan because the cash loan must be shown in the administrative budget (in this case, borrowing is prohibited in reverse from Section 86 (1) GemO NRW). Unlike the general borrowing of municipalities, cash advances may only be shown in the administrative budget, i.e. where the obligation to pay comes from. Cash loans represent outside funds which serve to compensate for short-term fluctuations in liquidity and thus to maintain proper cash management.

Since cash loans do not fall under the budgetary credit term of § 86 GemO (NRW), they also do not affect the credit line for loans for investments to be determined in the budget statute according to § 79 Paragraph 2 No. 1 c GemO NRW, but require a separate credit authorization . In the budget charter, however, the planned cash borrowing is not shown, but a maximum amount that the sum of current cash advances may not exceed at any time during the budget year (Section 78 Paragraph 2 Sentence 1 No. 3 GemO NRW).

Classification under banking law

The municipalities regularly take out cash loans from banks . The classification under civil and banking law does not follow this local law perspective. The cash loan is a loan to § 488 para. 1 BGB, falls to § 19 para. 1 no. 4 KWG among general credit term (loans to customers) and is therefore notifiable and as a normal regulatory Kommunalkredit classified. Section 21, Paragraph 2, No. 1 of the KWG, along with an exemption from disclosure obligations, contains simplifications in terms of reporting law for all municipal loans.

Cash loans are possible at all levels and can be granted by credit institutions. Only the Deutsche Bundesbank no longer has the authority to grant cash advances under Section 20 (1) of the German Bundesbank Act (BBankG). It may only conduct the banking business with public authorities described in Section 19 No. 2 to 7 BBankG, whereby only “ account overdrafts in the course of one day” are permitted.

Usage

The inclusion of cash advances in the administrative budget also indicates their narrow purpose. They finance ongoing administrative expenses that are due, provided that the planned income has not (yet) been received. Cash credits therefore represent a kind of pre-financing of the budgeted income. The maximum amount for cash credits stipulated in the budget charter is, in contrast to other credits, not usually subject to notification / approval by the local authority . In municipalities with deficient administrative budgets, cash loans have developed into a permanent financing instrument for current expenses. They are repaid when the receipts are received.

The municipality itself may only - in strict compliance with EU state aid law - own operations , special assets according to § 97 GemO or companies in which it has a stake of more than 50%, and municipal companies according to § 106 a GemO and other institutions of which it is the sponsor - Grant cash credit.

meaning

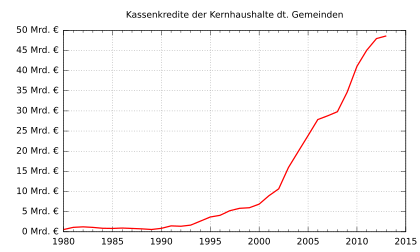

Due to the decline in municipal income between 1992 and 2006, as the German Association of Cities emphasizes, cash loans literally exploded during this period. They rose from around 1.2 billion euros in 1992 to 28.4 billion euros in 2007 and now account for 26.4% of all municipal debt; The main reasons for this were the sharp decline in trade tax revenue with a simultaneous increase in social spending - both items are included in the administrative budget. In 2012, cash advances reached a new negative record of 48 billion euros.

The difficult situation has led some federal states to impose extensive and restrictive regulations on cash advances. According to Section 87 (1) GemO Schleswig-Holstein, a municipality can take out cash advances up to the maximum amount specified in the budget statute in order to pay its expenses in good time, provided the cash office has no other funds. However, cash advances are not considered a means of financing. Rather, they are intended to ensure the constant solvency of the community.

In recent years, the communal situation has even meant that cash loans could no longer be completely reduced in the same budget year, so that when new cash loans were taken out, an unredeemed deposit remained. This factual situation was made the content of a circular in Schleswig-Holstein. According to this, the decision to take out a cash loan, the term of which exceeds the budget year, is to be regarded as an important decision according to § 27 GemO, for which a fundamental decision of the municipal council is to be made.

Individual evidence

- ↑ Hamburg Constitutional Court 1/84, judgment of May 30, 1984, DÖV 1985, p. 456

- ↑ cf. Section 18, Paragraph 2, No. 2 of the Hamburg State Budget Code, where these loans are referred to as “cash boosting loans”

- ^ S. on the further procedure: Jan Stemplewski, Die communal borrowing in North Rhine-Westphalia, Kovac Verlag 2015, p. 119

- ↑ the city day 05/2007. Municipal financial report 2007: Rise in municipal taxes - but not for everyone ( Memento from March 9, 2010 in the Internet Archive )

- ↑ President Ude: No experiments on the municipal business tax deficit rises by two billion euros ( Memento of February 23, 2008 in the Internet Archive ) September 29, 2005

- ↑ German Association of Cities: Many cities urgently need help

- ^ Jan Stemplewski, The municipal borrowing in North Rhine-Westphalia, Kovac Verlag 2015, p. 112 ff.

- ↑ VÖB, with circular (PDF)