Kelly formula

The Kelly formula , also known as the Kelly criterion , is used to maximize profit from bets with positive profit expectations . It goes on the scientist John Larry Kelly Jr. back who published it in 1956.

In this context, a bet means risking an amount of money (stake) which, in the event of a win, is rewarded with a fixed multiple of the stake (fixed rate). In the event of a loss, the stake is given up

The formula

The Kelly formula is the calculation rule for the Kelly share, the proportion of the game capital that is used in the bet to maximize the profit taking into account the repayment rate and the probability of winning. The calculation rule is

- .

Are there

- the repayment rate, d. H. in the event of a win, you get back -fold the stake ( ) and

- the probability of winning ( ).

The numerator can be interpreted as the chance , more precisely as the expected value of the return when betting 1.

The denominator is the win rate, i.e. the repayment rate minus the stake.

Thus, a memorable variant of the Kelly formula is:

- .

Bets with a positive profit expectation are bets with an advantage (value) for the player, so-called " value bets " ( value ). A bet with a probability of winning and a payback rate is a value bet or has a positive expectation of profit if

applies. In this case it is always positive.

An idealized example

If we play many bets of the same type in a row, each with the same amount as stake, we win about -fold the total money staked.

Let us assume that we are playing 1000 similar bets with a 40% probability of winning , i.e. and odds of , i.e. H. the stake is tripled in the event of a win (the net profit is twice the stake). If we now place the same amount in all 1000 bets, say € 1, we will win about 400 of these bets and lose 600.

So we get

back and have for it

expended. We won a total of € 200, i.e. 0.2 times our total stake:

- .

This is the expected value. In reality, it can come out a little more or a little less than 0.2x the stake.

If the Kelly formula had been applied, we would have risked times the amount of gambling capital available. So each

So one tenth of the existing playing capital.

With a starting capital of € 1000 that would be € 100 for the first bet. If we won the first bet, we would have a total of € 1200 afterwards, so we would risk € 120 on the second bet. However, if we lost the first bet we would only have € 900 left, so we would only risk € 90 in the second bet, etc.

We'll win about 400 and lose 600 out of 1,000 bets. In the event of a win, a credit turns into a credit of

- .

In the event of a loss, a credit becomes a credit of

- .

With a profit of 400 bets and a loss of 600 bets, our starting capital is multiplied 400 times by 1.2 and 600 times by 0.9. After 1000 bets this results in a capital of

- .

The order in which the profits or losses occur does not matter.

In reality, however, we will hardly find such a series of bets.

Larger or smaller stakes

What effects does it have if we always set a larger or smaller portion instead of the Kelly portion?

Let's stay with our example for now. Let's assume we bet double, so instead of 0.1 we bet 0.2 of the existing balance. So we would start with a starting credit of 1000 € with a stake of 200, and so on. With every bet that we won, we would have a credit of

achieved, with every lost bet a credit would be converted into a credit of

become. So after 1000 bets we would have

- .

Although we would have risked a lot more, the profit would be significantly less than with the simple Kelly bet. It becomes even clearer with the triple Kelly bet (0.3). We'd have bets after 1000

- .

Since you cannot divide the cent, that would be a total loss.

If we had used smaller stakes, there would always have been a profit. This would not be as high as with the Kelly stake, but we would have risked less. For example, with half a Kelly bet (0.05) after 1000 bets, that would be a credit of

- .

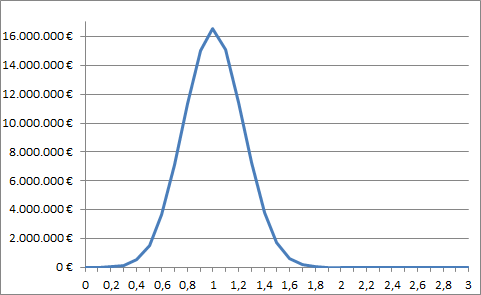

For our example, the following figure shows the final result after 1000 bets with different multiples of the Kelly stake. It is assumed that the number of bets won corresponds to the probability of winning.

The maximum profit is achieved if exactly the Kelly bet (1 on the X-axis) is always placed. Stakes that are too small mean that less profit is achieved, but stakes that are too large carry the risk of total loss. In the following illustration, the significant sections are shown enlarged.

Even with other values for the probability of winning and the repayment rate than in the example above, the curve will have the same shape, i.e. H. the maximum is reached with the Kelly bet, after which the profit curve drops relatively quickly. The prerequisite for this is that it applies.

For a similar example see also.

Incorrect probability information

In reality, the probability is often not known, but only estimated. In the worst case scenario, it is not a value bet , so no wager at all would be appropriate.

Sticking to the previously considered example and assume that the probability of winning would not be 40%, but only 36%, that is . With odds of , it would still be a bet with a positive profit expectation, because

- .

The Kelly portion would be, however

- .

If we had applied the Kelly bet that was previously calculated with the wrong probability of 0.4, that would be more than double the correct Kelly bet. With a starting capital of 1000 € we would have a credit of after 1000 bets

- .

That would be a loss. If we had only risked half the Kelly stake, which we calculated with the probability that was a little too high, our stakes would have been just a little too high. That wouldn't have had such a bad impact. In this case, the balance would be after 1000 bets

- .

In comparison, the result would be using the actual Kelly stake

- .

Because of possible errors in the estimation of probabilities, it is advisable to only play those bets that would still have a positive profit expectation with a slightly lower probability and then only part of the Kelly stake, e.g. B. to use half.

Fluctuations

Even if we know for sure the probability of winning a bet and thus the correct Kelly share, the fluctuations in the balance when placing the corresponding bets are enormous and increase with the balance. The following figure illustrates this. The values from the idealized example are used, i.e. a probability of and a repayment rate of . The course of 1000 bets can look like this.

The balance development of only the first 200 bets from this example is as follows:

One idea to alleviate the fluctuations would be to divide the credit on paper into several virtual accounts and to play with each account separately. This can be aptly described with the word diversification .

literature

- William Poundstone: The Formula of Happiness. How math triumphed over Las Vegas and Wall Street. Börsenmedien AG, Kulmbach 2007, ISBN 978-3-938350-20-1 .

- Petra Wolff: Win money with sports betting. A tennis value bet strategy. Books on Demand GmbH, Norderstedt 2010, ISBN 978-3-8391-6190-6 .

Individual evidence

- ↑ JL Kelly, Jr .: A New Interpretation of Information Rate in Bell System Technical Journal vol. 35, Issue 4, 1956, pp. 917-926

- ^ William Poundstone: The Formula of Happiness. 2007, p. 115ff.

- ^ William Poundstone: The Formula of Happiness. 2007, p. 338ff.

- ^ William Poundstone: The Formula of Happiness. 2007, p. 142.