Laffer curve

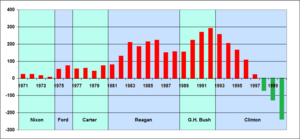

The Laffer curve is a hypothetical financial scientific relationship named after the US economist Arthur B. Laffer , according to which tax revenues only rise with increasing tax rate, then fall again after reaching a maximum, i.e. assume the shape of an inverted "U". In particular, this means that if tax rates are high, a reduction in income tax can increase income tax revenue . The Reagan administration appealed to the thesis as part of its economic policy, the so-called Reaganomics , and reduced income taxes. In the years that followed, government revenues fell and budget deficits rose.

Even before Laffer, philosophers and economists advocated the idea, such as Jonathan Swift in his Steuereinmaleins (1728) or Ibn Chaldūn (14th century). Laffer took up the thesis in the first half of the 1970s. The journalist Jude Wanniski reported in an article Taxes, revenues, and the “Laffer curve” in 1978 about how Laffer is said to have sketched the curve and hypothesis on a serviette at a dinner in 1974, which was also attended by Donald Rumsfeld and Dick Cheney . After this article appeared, the hypothesis became popular under Laffer's name.

Derivation

If the tax rate is gradually increased, starting from a rate of zero, the tax revenue will initially also increase . Although there is tax resistance and the taxpayers try to evade the tax, the falling tax base is overcompensated by the increase in the tax rate.

With a tax rate of 100%, the tax base is zero and thus the tax revenue is also zero. If the tax rate is lowered, the tax base increases and with it the tax revenue.

From this analysis of the two theoretical extreme tax rates of 0% and 100%, it can be shown that the tax revenue-maximizing tax rate cannot be one of the two extreme values, but must lie somewhere between the extreme tax rates.

From these considerations one could assume a roughly parabolic course of the relationship between tax rate and tax revenue. In this case there is an apex up to which increasing the tax rate increases tax revenue. A further increase then lowers the tax revenue.

criticism

In fact, two statements can only be made about the point at 0%. The curve is at 0% at 0 and rising. There is only an upper limit on income taxes, but consumption taxes on luxury goods are often used as evidence.

If one accepts the hypothesis of a basically parabola-like course of the curve, the problem remains that the hypothesis gives no clue as to which side of the vertex a control system is on and how much the actual curve deviates from a symmetrical parabola, since there is no mathematical formula behind it of the curve and the course must be estimated.

Some economists see the thesis as refuted by the budget deficits that occurred as a result of tax cuts . When the Reagan administration cut taxes in 1981, citing the Laffer Curve, revenues plummeted. As a countermeasure after the increase in debt, a number of tax loopholes were removed from 1982 onwards, which offset part of the falling income. Some economists consider the construction of the Laffer curve to be fundamentally correct and even consider the budget deficits to be evidence of the thesis. The curve is correct. One would only have been wrong about the location of the vertex.

Since both rising and falling tax revenues can be explained with the same theory, the Laffer curve has been criticized for its lack of falsifiability.

literature

- Jochen Schumann u. a .: Basics of microeconomic theory . Springer, Berlin 1999. ISBN 3-540-66081-X .

- Gustav Dieckheuer: Macroeconomics. Theory and politics . 5th edition. Springer, Berlin 2003. ISBN 3-540-00564-1 .

- E. Görgens; K. Ruckriegel; F. Seitz: European Monetary Policy . 4th edition Lucius & Lucius Verlagsgesellschaft mbH, Stuttgart 2004. ISBN 3-8282-0286-1

- Gudehus, Timm, Dynamic Markets, Practice, Strategies and Benefits for Business and Society , Springer, Berlin-Heidelberg-New York, 2007, ISBN 978-3-540-72597-8 (see p. 277ff and Fig. 15.13)

- Laffer, Arthur B. (1981): Government Exactions and Revenue Deficiencies (PDF; 739 kB) , In: The Cato Journal, Vol. 1, No. 1, 1–21.

- Laffer, Arthur B. (2004): The Laffer Curve - Past, Present, and Future .

- Henderson, David (1981): Limitations of the Laffer Curve as a Justification for Tax Cuts (PDF; 256 kB) , The Cato Journal, Vol. 1, No. 1, 45-52.

- Trabandt, Mathias / Uhlig, Harald (2006): How Far Are We From The Slippery Slope? The Laffer Curve Revisited (PDF; 964 kB) , Discussion Paper SFB 649, Humboldt University Berlin.

- Dalamagas, Basil (1998): Endogenous growth and the dynamic Laffer curve , Applied Economics Vol. 30, No. 1: 63-75.

- Agell, Jonas / Persson, Mats (2001): On the analytics of the dynamic Laffer curve , Journal of Monetary Economics Vol. 48, No. 2, 397-414.

- Heijman, WJM / van Ophem, JAC (2005), Willingness to pay tax - The Laffer curve revisited for 12 OECD countries , The Journal of Socio-Economics Vol. 34, No. 5, 714-723.

- Becsi, Zsolt (2000): The Shifty Laffer Curve (PDF; 254 kB) , Economic Review - Federal Reserve Bank of Atlanta Vol. 85, No. 3, 53-64.

- Becsi, Zsolt (2002): Public Spending, Transfers and the Laffer Curve (PDF; 276 kB) , Working Paper Louisiana State University.

- Claessens, Stijn (1990): The Debt Laffer Curve: Some Estimates , World Development Vol. 18, No. 12, 1671-1677.

- Sander, H. (1990): The “Debt Relief Laffer Curve”, On the Economics of Voluntary Debt Buybacks in the Framework of the Brady Plan , WiSt, Sept. 1990, 463–466.

- Mirowski, Philip (1982): What's Wrong With the Laffer Curve? , Journal of Economic Issues Vol., No. 3, 815-828.

- Mathias Trabandt, Harald Uhlig: How Far Are We From The Slippery Slope? The Laffer Curve Revisited , NBER Working Paper No. 15343, September 2009.

Web links

- The Austrian politician and university professor and today's Federal President of Austria, Alexander Van der Bellen explains the Laffer curve in the Austrian Parliament in the speech of the 19th National Council meeting on April 21, 2009

Individual evidence

- ↑ Bruce Bartlet: Jonathan Swift: Father of Supply-side Economics? In: History of Political Economy 24: 3 . Duke University Press, 1992 ( sfu.ca [PDF; 237 kB ]).

- ↑ Laffer Curve. (No longer available online.) The Laffer Center at the Pacific Research Institute, archived from the original on April 29, 2011 ; accessed on January 10, 2017 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. See also: Timothy Taylor: Narrative Economics and the Laffer Curve. In: Conversable Economist. January 9, 2017, accessed January 10, 2017 .

- ^ Jude Wanniski: Taxes, revenues, and the “Laffer curve” . In: National Affairs . No. 50 , 1978 ( nationalaffairs.com [PDF; 723 kB ]). Taxes, revenues, and the “Laffer curve” ( Memento of the original from May 8, 2011 on WebCite ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice.

- ^ Robert J. Shiller : Narrative Economics . January 4, 2017 ( aeaweb.org [PDF; 675 kB ] Manuscript for a lecture on the occasion of the AEA Awards Ceremony and Presidential Address ).

- ^ Peter Bohley: Public Finance: Taxes, Fees, and Public Borrowing. Oldenbourg Wissenschaftsverlag 2003, ISBN 3-486-27374-4 , p. 127

- ^ Udo H. Raab, Public Transaction Costs and Efficiency of the State Income System , ISBN 3-428-08248-6 , pp. 119–220

- ^ N. Gregory Mankiw, Principles of Economics , ISBN 978-0-538-45305-9 , p. 165

- ↑ Olivier Blanchard, Gerhard Illing: Macroeconomics. 2009. p. 604

- ^ A b Office of Tax Analysis: Revenue effects of mayor tax bills , 2013

- ^ Joseph J. Thorndike: Historical Perspective: The Reagan Legacy. In: taxhistory.org Tax History Project. June 14, 2004, accessed March 4, 2019 .

- ^ Udo H. Raab, Public Transaction Costs and Efficiency of the State Income System , ISBN 3-428-08248-6 , p. 222

- ^ N. Gregory Mankiw, Principles of Economics , ISBN 978-0-538-45305-9 , p. 165