Warrant

Warrants ( English warrants ) are securitized (d. E. As securities designed) options .

In contrast to options traded on the stock exchange or OTC options, warrants are also suitable for sale on the retail market because they can be traded in smaller lot sizes. Buy and sell orders for warrants can - just as with shares - be placed in an order system by specifying the security identification number. Access to a futures exchange is not required.

history

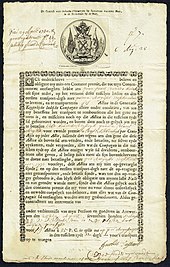

The first known warrants in financial history were issued by the Ostender company from 1728 . These warrants entitle the holder to purchase shares in the Ostenender company within a certain period of time at a predetermined price.

In Germany, it was Karstadt AG that issued a warrant along with an option bond on the US stock exchange in New York in 1925 . The first warrant that could be traded in Germany came in 1926 from Vereinigte Stahlwerke AG Düsseldorf. After the German ban on futures transactions in 1929, Deutsche Lufthansa entered the German market for the first time in 1967 with an option bond . In 1989 the banks Citibank AG and Trinkaus & Burkhardt then introduced the covered warrant, which was not linked to an option bond. The first issue of such a warrant was made by Trinkaus & Burkhardt (today: HSBC Trinkaus & Burkhardt AG) in January 1989. The base value at that time was JPY / DEM, i.e. the yen to German mark currency pair. The warrant had the security identification number 811 521 and was sold from 10th to 12th January offered for subscription at DM 11.30 per warrant. Citi made the second issue with a call warrant on the USD / DM exchange rate (US dollar / German mark) with the securities identification number 803119 and a strike price of 1.84 DM. In the following period, the number of warrants increased: Except in Germany Citi also issued warrants in Austria, Switzerland, France, Portugal and Spain.

functionality

Usually, warrants represent the right

- a particular underlying ( english underlying , for example a share , bond , currency or index )

- according to a certain subscription ratio

- at a pre-determined exercise price

- within a specified subscription period (American option) or at the end of a subscription period (European option)

- to buy ( call option ) or sell ( put option ).

With such classic warrants, the issuer is always the writer of the option.

Since warrants are derivatives and are therefore viewed as a particularly risky form of investment, the distributing banks have special information obligations towards their customers (see derivatives in the German legal system ).

Warrants are several ways emitted :

- On the one hand, warrants can be part of bonds with warrants (the so-called “traditional warrants”). Here the warrants usually relate to shares of the company that also issues the warrant bond. Such warrants are therefore related to a (possibly conditional) capital increase . The term can be up to 10 years.

- On the other hand, they can be issued independently as so-called "bare warrants". Bare warrants usually have terms of up to 2 years. This class also includes warrants issued for the retail market.

- A special form of "naked warrant" is the "covered warrant" (English covered warrant ). This is a purchase warrant in which the writer has the underlying asset , usually shares, in his custody account and thus serves the warrant if exercised. In contrast to warrants from option bonds, there is no capital increase. Warrants that are not hedged with the underlying asset but with futures or other options are not referred to as covered warrants.

Most of the warrants available on the market are bare warrants issued by various issuers (usually banks and other financial institutions).

Exotic warrants

In addition to the classic warrants, there is also a not very clear group of so-called exotic warrants . With the warrants, you have the common characteristics of a leveraged performance, a total risk of loss when a certain threshold is reached and a time value. In some cases, there are constructions made up of several options, but (in contrast to certificates) without the inclusion of a cash component or the underlying itself.

See also

Individual evidence

- ↑ HP magazine 10/1991, page 13

- ↑ Explanation: How long have warrants been around?

- ↑ Focus Money: "The year when the turbo came". Retrieved February 25, 2019 .

- ↑ Citigroup | History. Retrieved October 10, 2019 .

swell

- Jürgen Krumnow (Ed.): Gabler Bank Lexicon. 13th, completely revised and expanded edition. Gabler, Wiesbaden 2002, ISBN 3-409-46116-7 .

- Antonie Klotz, Jürgen Philipp: The world of warrants. Finanzbuch Verlag, 2000, ISBN 3-932114-33-7 .