Price control

The price control under the competition policy , which on price stability is aligned state is a market engagement . This intervention directly restricts market prices by prohibiting market participants from offering goods and services at certain prices.

Price controls are often used to avoid market outcomes that are perceived as unfair. They temporarily override the market allocation and are among the last means to maintain largely free competition and to protect consumers from exploitation. They are used in the case of monopoly forms that cannot be avoided or other forms of the market that are not in full competition. They are also used when a significant part of the price formation on the markets is no longer formed according to the competitive price theorem, but is influenced by the market power of the providers. The aim of these imposed prices is to influence market prices in order to bring the allocation function of the price system back closer to the optimal model. The price control controls, among other things, the price level through credit policy. It is not always clear whether it is only used to protect competition (institutional protection) or as an independent protective purpose for consumer interests (individual protection). Intervention is necessary when a company with a dominant position restricts the competitive freedom of other economic entities. The aim should be to keep the markets open and to protect the upstream and downstream economic stages.

The competitive function must be inoperative. In order to determine the competitive price, as it would arise in the event of functioning competition, the comparison market concept can be used, in which the market results of the dominant companies are compared with the behavior of other companies that offer similar goods under the conditions of substantial competition.

Price control in accordance with Section 19 (4) No. 2 may only be used in extreme emergencies, in which an ongoing monopoly is abusing its market power. In all other cases, official price controls prove to be a disruptive interference in the competitive process.

The aim of price control is to bring the actual market equilibrium closer to the equilibrium in a perfectly functioning market.

Explanation

The main function of price control is to protect free competition and weaken the economic power of individual companies. The market price regulates the amount of goods exchanged and the amount of the profits of the exchange partners. If the markets worked perfectly, then they would bring the optimal result for all market participants together. Furthermore, in a functioning competition, the price gives signals about supply and demand and is a measure of scarcity. In the case of a non-functioning competition where z. For example, if there is only a monopoly that uses its power, the price no longer works as a scarcity meter, because the high price did not arise because of a shortage of goods. With the price control it could be restricted. This is primarily intended to protect competition as an institution and not the consumer, which is a desirable side effect. Furthermore, the price controls also serve, among other things, as an instrument to combat inflation. It is particularly useful when it comes to managing temporary inflationary tensions. It is also used to combat the flanked measures and demand inflation.

Factors for Imposing Price Control

The Federal Cartel Office (BKartA) and the Higher Regional Court (KG) decide whether a price control is applied . This requires a price abuse order. This comes about when there is abuse. Various forms of abuse are listed below.

Disability abuse

In 1998 there was an adaptation to the EU as a direct effective and fine-proven ban with the focus on the abuse of disabilities. This is needed because there are companies that, by the size they have taken, can evade competition. There is always a disability abuse when there is a company with a dominant position. By taking advantage of this position, competitors or the opposite side of the market have noticeable restrictions in their options for action without an objectively justified reason.

You can roughly distinguish between 5 anti-competitive behaviors:

Competitive price undercutting

- This is the systematic undercutting of the prices of certain competitors of a company in order to force them out of the market. In the case of combat travel undercutting, low prices are used as compensation for the destruction of remaining competitors. These prices are below the market clearing price, so that there is excess demand . Accordingly, consumers only buy from this company. This means that the latter also accepts losses so that other companies cannot survive in this market or do not even enter the market. After the competition is out of the competition, they return to the original prices.

Competitor lock

- It is primarily used in the form of delivery and purchase blocks. Blocking purchases or blocking patents hardly play a role. The block is a measure that is practiced so that the person concerned is excluded from normal business dealings in whole or in part, even temporarily. This is done through agreements between companies, decisions by business associations and concerted practices designed to prevent, restrict or distort competition within the internal market. The delivery block serves as an example. Here, deliveries from a competing but also dependent company are blocked by the respective supplier so that the other company can assume a dominant position.

Exclusivity

- Exclusivity commitment means the exclusive use, purchase and distribution commitment, which restricts the freedom of action of the market partner and contractually stipulates how the buyer of a product or service must deal with this product. These contractual agreements are not permitted.

Coupling agreements

- Coupling is defined as the obligation to purchase another product in addition to a certain (desired) product. It is often viewed as a special case of exclusivity.

Example: MS Office

Price discrimination

- Price discrimination is the generic term for all measures of all types that include price-relevant different treatment. It is characteristic that the market partners have to pay different prices for the same service.

Exploitation / price abuse

Exploitation or misuse of prices occurs when a company demands excessive prices due to its market power. It is all about the appropriateness of performance and consideration. However, price abuse also occurs when a company, without an objective justification, charges less favorable prices than it demands on other markets.

Der Preis den ein marktbeherrschendes Unternehmen setzt, darf weder den Wettbewerb beschränken noch die Entwicklung des Wettbewerbs behindern noch in seiner Höhe „missbräuchlich“ sein.

In order to determine whether a dominant company is abusing its market position by asking for prices, you need a benchmark. This yardstick is a price that would arise with effective (functioning) competition. This represents the central assessment criterion. It is also known as the as-if competition award. Depending on the determination method, a distinction is made between a competitive price and a fictitious competitive price. However, a price is only abusive if it is significantly above the so-called as-if competition price and if there is no economic or objective justification for the pricing. The problem is that there is no clear answer to whether and from when there is price abuse.

Another type of abuse of exploitation is when the market partner of the powerful company is taken advantage of by inappropriate purchase or sales prices. However, this occurs almost exclusively only with electricity and gas companies. The focus here is on the protection of the consumer, which is to be guaranteed by price control.

Recently, the question of how one can investigate this form of exploitation abuse on online trading platforms in relation to the small providers advertising there has also been investigated. The price control authority in Switzerland began z. B. in September 2017 a corresponding procedure against the travel booking platform booking.com.

Cartel formation

Cartels means the contractual amalgamation of companies of the same production or trade level, which remain legally independent, but give up their economic independence in whole or in part in order to achieve a competitive advantage. The companies involved in the cartel generally undertake to act jointly and to pay contractual penalties if the provisions of the cartel agreement are violated.

Price control instruments

The main instrument of price control is state price fixing. This can occur in the form of maximum price limits or in the form of minimum price limits. Both price limits represent state intervention in free pricing and partially override them.

Maximum price control

The maximum price control is the state-set upper price limit, which is below the equilibrium price for a good shown on the market. The aim is either to correct possible market errors or to protect the consumer from exploitation through excessive prices by making the goods in question available at the lowest possible price. But this happens especially in times of economic shortage, such as B. in times of war or in natural disasters. The population should be supplied with essential goods.

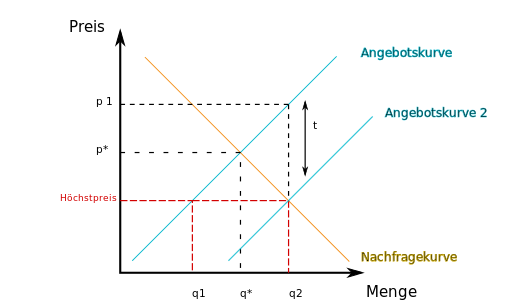

The optimum should be a market clearance . This is the point on the graph where the demand curve and the supply curve intersect . At this point there is just as much demand as there is. If the maximum price control is now above the market price that occurs with free pricing, this is not of great importance, since the equilibrium price is realized in the long run.

If the maximum price ceiling is below the equilibrium, as shown in the graphic, this leads to excess demand. At the low price, consumers will increase their demand for the good , while suppliers reduce their production to quantity . The excess demand can no longer be reduced on its own. This means that fewer goods are offered than needed. Due to the high demand, black markets often form where goods are traded at prices that are above the maximum price. The state must intervene when it comes to vital goods, e.g. B. extends the supply by obliging companies to produce essential goods. This can also be in the form of vouchers or food stamps .

An alternative to reduce the excess demand would be to subsidize the supply, but this is associated with costs for the state. This means that the state pays a subsidy of a certain amount for each unit of the produced good to the supplier. This would then lead to a shift of the supply curve to the right to supply curve 2, and thus to the new equilibrium . The consumers could continue to buy the good at the maximum price and the providers could sell these good at the price . The state pays the company t monetary units for each unit.

Minimum price control

The minimum price control is the state-set lower price limit. Above all, minimum prices are intended to protect manufacturers in certain sectors of the economy such as agriculture or mining from sharp price drops and ruinous competition (itemization and undercutting) by securing them high revenues and incomes. Example: minimum wage

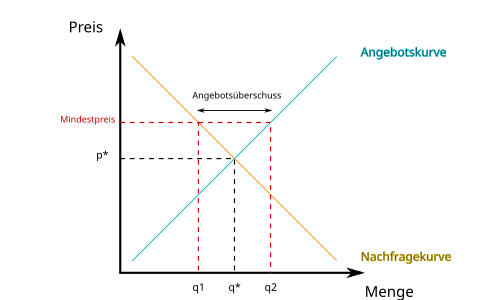

From an economic point of view, it is also desirable to clear the market for the minimum price. If the minimum price is below the equilibrium price shown on the market , there is no impairment of supply and demand.

However, if the minimum price is above the equilibrium, as in the graphic, there is an excess supply (in the amount of ), i.e. the supply is higher than the demand. The amount of consumer demand for this price has fallen to. The producers then react by expanding their range . However, consumers still only ask for the quantity . The excess supply can no longer be reduced due to price controls. This can lead to the emergence of gray markets where the goods in question are resold at lower prices. The state must now take further measures in various forms. One of them would be the state purchase guarantee. In order to secure the minimum prices for agricultural products, among other things, slaughter premiums for cattle, maximum purchase quantities for milk, ... were set. Certain products were also bought and stored by the state in advance at minimum prices, such as B. Butterberg. These stocks were reduced from time to time by certain measures, including the sale of agricultural products abroad at the lowest prices, the processing of grain into fodder or even the destruction of agricultural products. Another alternative to prevent excess production would be to subdivide the quantity demanded into production quotas for this purpose, which set the upper limit of production for the supplier.

Another alternative would be to subsidize consumers. The state pays the consumer a price subsidy for each unit of the good purchased. So the demand curve shifts to demand curve 2. The demanders can now purchase the quantity at the minimum price, only pay because they get it back from the state. For the state, however, there are immense follow-up costs.

If the price fixing were fixed exactly at the level of the equilibrium price, there would be no stability problem in the case of delayed adjustment price reactions . However, this would require precise knowledge of the course of supply and demand functions.

There is also a monopoly commission , which the German federal government in other questions of competition regulation, so z. B. advises measures against the blocking of competitors. It is an independent advisory body of experts that deals with disability abuses that are not immediately apparent.

Problems

There are several reasons why price controls are problematic. The possibility of asking excessive prices implies that competition is not fully functional. In these cases, competition does not do justice to its economic steering function in terms of price, because the price is a signal of scarcity. This means that price controls do not tackle the causes, only the symptoms. It should be noted that symptoms can themselves become causes.

For example, in the sense of the signal effect emanating from the price increase with the consequence of accelerating inflation. If price controls are in place, competition can slow down as companies quickly understand that all you have to do is cooperate with antitrust authorities early enough to get approved prices.

Another problem with price control is often the duration of the measure. Fixed prices that could be justified at a certain point in time by the existence of market errors often still exist when the market failure no longer exists. This applies above all to the price regulations to stabilize the markets. With an expansion of the number of suppliers and buyers through international integration of the markets and through innovation to improve the storability of goods, better and better conditions for the stability of the market equilibrium arise over time. The fixing of government fixed prices then loses its justification, but if it is maintained it causes economic problems of its own.

There is also the risk of taking advantage of the consumer. Competition policy is of central importance for the maintenance and further development of a free and social economic and social order . The market economy system promises not only the best possible economic result, but also inexpensive supply for consumers. It has also been shown that the market process controlled by competition protects the interests of consumers far better than consumer protection legislation with direct powers of the state to intervene in economic processes.

Free pricing is no longer available on the market. From a neoliberal perspective, however, this is the basis of a market economy system. If the economy no longer has competition, one should not compensate for this with price control orders, but one should remove the barriers to competition oneself. Restricting competition affects the economic freedom of action of the competitors of the dominant companies. Even if the price of an individual dominant company is inappropriately high, neither the existing, cheaper competitors nor the economic levels (through which the product reaches the consumer) are impaired in their economic freedom of action . The main problem, however, is that it is not always possible to say with certainty when we have an abuse. Such statements are fraught with errors and uncertainty and usually cannot be established or understood. It is also incomprehensible how the company determines the price, whether it is due to the capital employed, the individual product or the entire company. It is impossible to say with certainty how much has been spent on research. Determining this for each company individually is associated with immense costs and personnel. No analysis of the relevant market can show when the expensive price of a product is justified and when the abuse begins. It is also not always possible to find comparable markets with which the products could be compared or that would be informative, and discrimination cannot be avoided either.

Alternatives

- An alternative would be to only act against those behavioral strategies in price strategy which aim at or have the effect of restricting competition. This type of abuse is not difficult to detect and can therefore be legally remedied by mere prohibition.

- Since any further interpretation of the term “price abuse” forces the courts to determine the “appropriate” maximum price for a particular market, the BKartA would have to conduct a review in which certain price reductions are ordered and assigned to the responsible minister.

This alternative has already established itself abroad and has proven to be sufficiently practicable.

Example: rent brake

One example of price control is the rent brake. This applies from June 1, 2015 and is intended to control rent in the metropolitan areas. In metropolitan areas such as Berlin or Munich the prices are well above the market equilibrium price, and in order to regulate these and also to help the poor, the rent brake was introduced due to abuse of exploitation. In the case of a new rental, the rent must not be higher than 10% above the upper local comparative rent. There are exceptions for new buildings or basic renovations.

An attempt is being made here to create an upper price limit in order to offer affordable housing in metropolitan areas even to the poor. However, it should be noted that it is not a basic right to live in a metropolitan area. The function of the price as a scarcity signal is overridden by the rental price brake in the form of a maximum price ceiling. The apartments are expensive due to excess demand. The supply of apartments is much lower than the demand. However, the maximum price moves further away from the market equilibrium, and market clearance is now even less likely as the excess demand becomes even greater. The oversupply that there is meanwhile in the neighboring cities is even greater because a larger group of customers now wants to move to metropolitan areas instead of the surrounding area due to the lower prices. The imbalance caused by price control is now widening and the market itself is no longer functioning as it should.

In other countries, including Spain, the rent brake has failed. The price control did not work as expected. The affordable apartments were not rented to low-income tenants, but to the high-income. As a result, they got bigger and bigger apartments, even though they didn't need them.

Price controls abroad

Great Britain

In Great Britain there is the British Monopoly Commission, which is made up of lawyers, economists, entrepreneurs, representatives of trade associations, trade unionists and business administrators and, as is well known, has the task of examining the activities of dominant companies for their compatibility with the public interest, reporting on them and the the competent minister to propose any measure which the Commission believes would be appropriate to remedy any maladministration. For example in the color film case, in which the Commission recommended that the minister lower prices.

The most important element is the fact that the Minister is in no way bound by the recommendations of the Commission. There are many cases in which the Minister ignored or modified the proposals.

literature

- Ludwig Einhellig: Abuse of prices in the field of energy supply . BOD, 2017, ISBN 978-3-8482-5295-4 , pp. 396} .

- NG Mankiw: Principles of Economics . 1998, p. 120 .

- Erich Hoppmann: Market dominance and price abuse . Nomos, 1983, ISBN 3-7890-0921-0 .

- Siegfried Gabriel: Price control in the context of competition policy . 1976.

- Ulrich Vorderwülbecke: Abuse catches up on pharmaceutical companies . 1979.

- Paul Reuter: Maximum price control according to § 22 Para. 4 and 5 GWB? 1981.

- Karl Georg Zinn: Price System and State Interventionism . 1978.

- Rudi Kurz, Lothar Rall: Disability abuse . 1983.

Web links

- grin.com - Abuse control against dominant companies

- vwl.uni-freiburg.de (PDF) - As- if competition

- jstor.org - alternatives to price control

- sachverstaendigenrat-wirtschaft.de (PDF) - Rent brake